Polylactic Acid Market Size, Share, Growth & Industry Analysis, By Raw Material (Corn Starch, Sugarcane & Sugar Beet, Cassava, Other Raw Materials), By Form (Films & Sheets, Coatings, Fiber, Pellets, Other Forms), By End-User Industry (Packaging (Food Packaging, Non-Food Packaging), Textiles (Apparel, Nonwovens), Agriculture, Automotive & Transportation, Electronics, Consumer Goods, Biomedical, Other Industries), By Application (Rigid Thermoforms, Flexible Films, Bottles, Fibers, 3D Printing Filaments, Medical Devices, Mulch Films, Other Applications), and Regional Analysis, 2025-2032

Market Definition

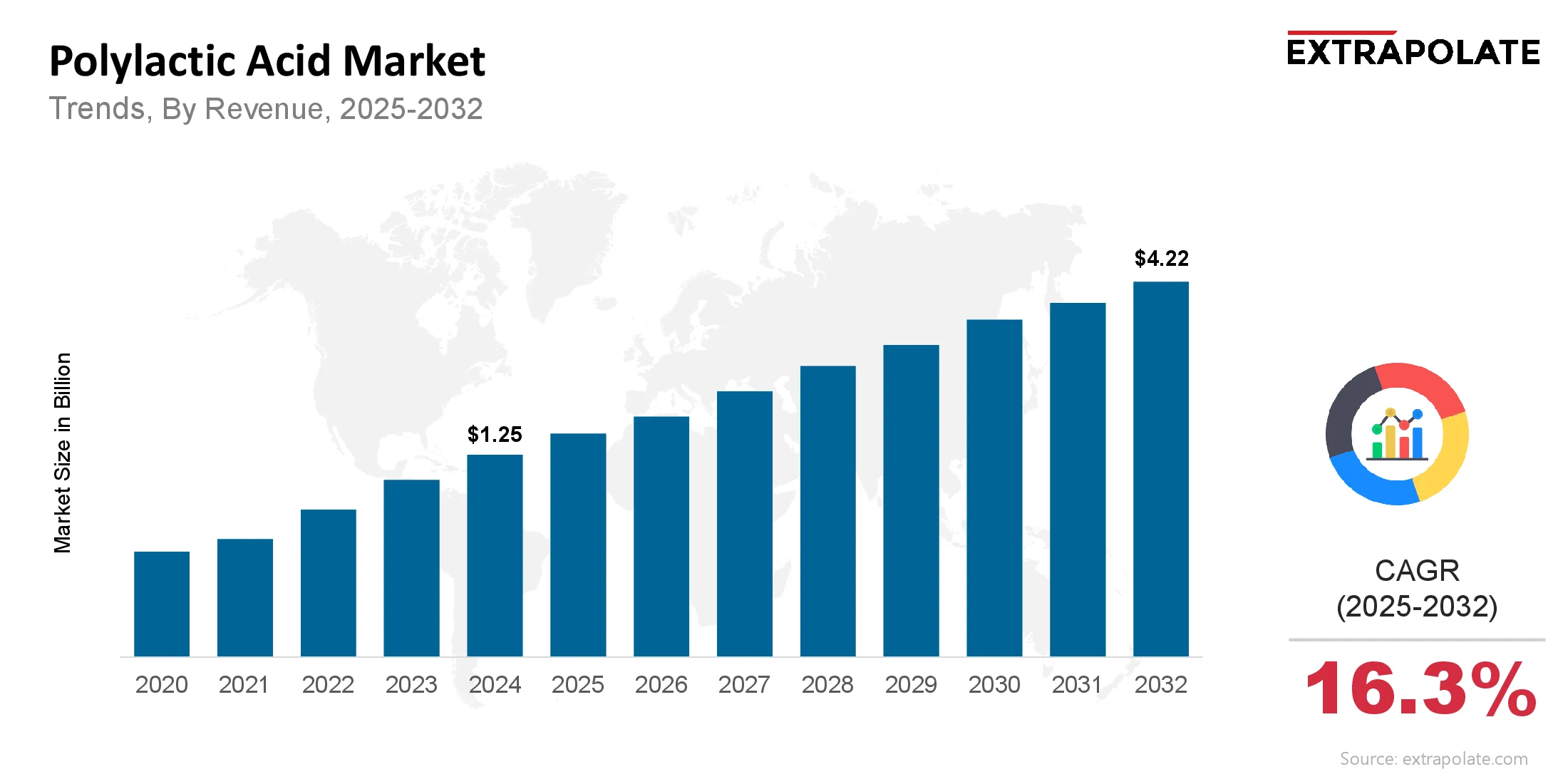

The global Polylactic Acid Market size was valued at USD 1.07 billion in 2023 and is projected to grow from USD 1.25 billion in 2024 to USD 4.22 billion by 2032, exhibiting a CAGR of 16.3% during the forecast period.

Production, distribution, and sales of one of the most widely used bio-based and biodegradable polymers worldwide are all part of the global polylactic acid (PLA) market. PLA is an environmentally friendly substitute for conventional polymers derived from petroleum since it is made from renewable resources including maize starch, sugarcane, and cassava. Because of its minimal carbon impact and adaptability, it is a crucial component of the worldwide movement toward a circular economy.

Packaging, textiles, consumer goods, and biomedical devices are just a few of the industries where the industry is growing quickly. Its special qualities, like transparency, biocompatibility, and compostability, provide substantial practical and environmental advantages. Innovation in PLA's end-of-life alternatives, material qualities, and production scaling to satisfy rising global demand are driving the market.

Key Insights

Key Insights

The polylactic acid market is booming and it’s all because of consumer and regulatory pressure for sustainable alternatives to traditional plastics.

- The global polylactic acid market was $1.25 billion in 2024.

- It will be $4.22 billion by 2032, that’s a major boost in demand and supply.

- The CAGR is around 3% from 2025 to 2032 driven by bio-based materials and advanced manufacturing.

- Asia-Pacific will be the fastest growing market and will hold the largest market share by 2032, driven by huge production capacity investments and industrialization.

- By end-use, packaging is the largest and most dominant market segment, driven by global ban on single-use plastics.

- Biomedical segment which includes medical implants to drug delivery systems will have the highest growth rate as PLA is biocompatible and biodegradable.

- The major driver is government led regulatory pressure which includes ban on single-use plastics and push for certified compostable materials, making bioplastics like PLA a necessity. One of the trend in the industry is improving PLA’s thermal and mechanical properties through advanced blending and compounding so it can be used in more demanding applications like automotive parts and electronics.

Market Summary Financials

The polylactic acid market is growing exponentially as the world moves away from fossil based materials. In 2023 the market was valued at $1.07 billion, that’s early days of a trend. By 2024 this will have grown to $1.25 billion as the market drivers and production rises. Looking forward the market will continue to grow aggressively with a projected value of $4.22 billion by 2032. This growth is backed by a projected CAGR of 16.3% from 2025 to 2032 which is a clear indication of the market health and the confidence in it.

Detailed Analysis Content

Key Trends

The polylactic acid market is undergoing a fundamental shift, several key trends are shaping its future. One of the biggest is the move to a circular economy where PLA is seen as a material that can be recycled, reused or industrially composted to reduce waste and close the material loop. Companies are investing heavily in advanced enzymatic and chemical recycling technologies to recover lactic acid monomers, so virgin quality PLA can be made from post consumer waste. This trend addresses the end of life challenges and strengthens PLA’s position as a sustainable solution.

Another big trend is the diversification of raw material sources. Corn starch is the primary feedstock but there is a growing shift towards using non food based biomass like sugarcane, cassava and sugar beet to alleviate the “food vs fuel” debate. This diversification ensures a more stable and sustainable supply chain and supports the local economies of agricultural regions.

Major Players

- NatureWorks LLC

- TotalEnergies Corbion

- BASF SE

- Futerro

- COFCO

- JIANGSU SUPLA BIOPLASTICS CO., LTD.

- Jiangxi Keyuan Biopharm Co., Ltd.

- Shanghai Tong-jie-liang Biomaterials Co., LTD.

- Zhejiang Hisun Biomaterials Co., Ltd.

- Wuhan Huali Environmental Technology Co., Ltd.

Consumer Behavior Insights

Consumer behavior is the key driver of the polylactic acid market. More and more consumers are demanding products that match their values. This is not a trend, it’s a fundamental shift in behavior. Consumers are getting educated about the environmental impact of traditional plastics and are actively looking for sustainable, eco-friendly alternatives. This is creating a strong demand for bioplastics, including PLA.

But consumer decisions are not just driven by environmental awareness. Price sensitivity is still a big factor; consumers will pay a premium for sustainable products but the premium has to be perceived as reasonable. The price difference between a PLA based product and a petroleum based product is a key consideration. Additionally, consumers expect bioplastics to perform at the same level or better than conventional plastics. This means durability, strength and functionality. And there is a big knowledge gap around the disposal of bioplastics. Many consumers are confused by vague labeling and think PLA will biodegrade in a home compost pile and are disposing of it in the wrong way. Educating consumers through clear labeling and accessible information is key to overcoming this challenge and to fully realize the environmental benefits of PLA.

Pricing Trends

The price of polylactic acid is influenced by many factors, mainly raw material costs and economies of scale. Since PLA is made from agricultural feedstocks like corn and sugarcane, the price is tied to the commodity market. Any changes in global crop yields or agricultural policies can impact PLA production costs. Energy costs also play a big role since fermentation and polymerization are energy intensive.

But as the market grows and new facilities being established, a trend of price deflation is emerging. The influx of new capacity, especially from the big players in Asia, is making the market more competitive and driving down the cost per unit. This efficiency with the ongoing technological advancements that reduce processing costs is making PLA more competitive with petroleum based plastics. Over time as PLA penetrates more into the market and production becomes more optimized, the price will stabilize and will further accelerate its adoption across industries.

Growth Factors

The polylactic acid market is growing fast and is driven by a combination of factors. The biggest one is the global push against single-use plastics. Governments and regulatory bodies around the world are banning and taxing petroleum-based plastics, so companies are being forced to switch to biodegradable alternatives like PLA. This top-down pressure is forcing industries to innovate and find new compliant materials.

At the same time, there’s a huge increase in consumer demand for sustainable and eco-friendly products fueling the market. As awareness grows, consumers are inclining toward brands that show their commitment to sustainability and adopting bioplastics.

And finally, PLA is expanding into new high-growth applications. The biomedical and 3D printing sectors are key areas. In biomedical, PLA’s biocompatibility and ability to be absorbed by the body makes it suitable for sutures, implants and drug delivery systems. In 3D printing, its ease of use and low toxicity has made it the preferred filament for a wide range of applications from hobbyist projects to industrial prototypes. The growth in these niche sectors is contributing to the overall market growth.

Regulatory Landscape

The regulatory landscape is key to the future of the polylactic acid market. More and more countries and regions are introducing legislation to combat plastic waste and pollution. The European Union has been leading the way with its Single-Use Plastics Directive which has put strict limits on certain plastic products and is pushing companies towards certified compostable alternatives. Several U.S. states and cities have also introduced local bans on single-use items like plastic straws and bags.

These regulations create a good environment for PLA by providing a clear legal and commercial path for adoption. But the landscape is not without its complexities. There is still no global standard for “biodegradable” and “compostable” labelling which can confuse both consumers and businesses. For the market to reach its full potential a more harmonized and global regulatory framework is needed to ensure clear communication and proper end-of-life management for PLA products.

Recent Developments

The polylactic acid market is booming with innovation and strategic development. In the last few years several big events have shaped its growth. The most notable are the new production facilities investments. Big players like NatureWorks and TotalEnergies Corbion have announced or are building large scale PLA plants in Thailand and the U.S. This surge in capacity is a response to the growing global demand and is key to bring down costs and ensure supply.

There has also been a wave of strategic partnerships between PLA producers and companies in end-use industries. For example, partnerships between biopolymer companies and big food and beverage brands are accelerating the shift to PLA packaging. And PLA recycling is another recent development. New enzymatic depolymerization technologies are being developed that can break down PLA into its original monomers and create new PLA products from recycled material. This is a big step towards a circular economy for bioplastics.

Demand-Supply Analysis

The demand-supply of polylactic acid is in expansion mode. Demand is outpacing supply in some regions, reflecting strong growth. The driving factors of consumer preference and push factors of government regulation are aiding this imbalance. The packaging industry is the biggest driver of demand as companies rush to meet new sustainability requirements and consumer expectations.

On the supply side, the industry is scaling up production. New plants are being built especially in Asia. This is helping to close the gap but the supply chain for PLA is still maturing. Challenges remain in securing a stable and cost effective supply of raw materials and optimizing logistics of distribution. As these supply side challenges are addressed through continued investment and innovation the market will witness a more balanced and sustainable equilibrium, which will lead to wider adoption of PLA.

Gap Analysis

Despite the rapid growth of the polylactic acid market there are still challenges and unmet needs. The biggest gap is lack of industrial composting infrastructure in many parts of the world. While PLA is industrially compostable the facilities to process it are not yet widespread. So a lot of PLA waste ends up in landfills where it degrades slowly and contributes to the very problem it was designed to solve. This gap between material design and end of life infrastructure is a major barrier to the market’s full potential.

Another big gap is high cost and complexity of recycling PLA. Current recycling methods mechanical and chemical are often more expensive than producing virgin PLA. This economic hurdle discourages investment in recycling programs and limits the viability of a closed loop system. More cost effective and energy efficient recycling technologies is needed to make PLA recycling a commercial reality.

Segmentation and Growth Opportunities

Segmentation | Details |

By Raw Material | Corn Starch, Sugarcane & Sugar Beet, Cassava, Other Raw Materials |

By Form | Films & Sheets, Coatings, Fiber, Pellets, Other Forms |

By End-User Industry | Packaging (Food Packaging, Non-Food Packaging), Textiles (Apparel, Nonwovens), Agriculture, Automotive & Transportation, Electronics, Consumer Goods, Biomedical, Other Industries |

By Application | Rigid Thermoforms, Flexible Films, Bottles, Fibers, 3D Printing Filaments, Medical Devices, Mulch Films, Other Applications |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

While the whole market is growing fast, some areas are growing even faster due to specific drivers and innovations.

- Biomedical: With an ageing population, expansion of healthcare infrastructure and need for biocompatible materials, biomedical is a high growth area. PLA is being used in resorbable sutures, bone fixation devices and drug delivery systems.

- Textiles: The fashion and apparel industry’s push for sustainable fibers is driving growth of PLA in textiles. PLA fiber is known for its moisture wicking properties and silk like feel, it’s becoming popular for sportswear and eco friendly clothing.

- Rigid Thermoforms: This segment, a subset of packaging, is seeing significant growth due to the demand for single-use food service products and blister packs. As regulations against traditional plastics tighten, PLA-based trays, cups, and containers are becoming a standard choice for both environmental and functional reasons.

Major Innovations

Innovation is the lifeblood of the PLA market, with new technologies continuously pushing the boundaries of what the material can achieve.

- High-Heat PLA: One of the most significant innovations is the development of high-heat resistant PLA, often achieved through stereocomplexation or blending with other biopolymers. This innovation addresses one of PLA's primary limitations and allows it to be used in applications requiring thermal stability, such as automotive interiors and electronics.

- 3D Printing Filaments: The development of a wide range of PLA-based 3D printing filaments has transformed the additive manufacturing industry. Innovations in filament composition have improved layer adhesion, reduced warping, and enabled a broader palette of colors and textures, making PLA the most popular material for hobbyists and professionals alike.

- Advanced Recycling: The development of advanced chemical and enzymatic recycling processes is a major innovation. These technologies, still in their early stages, have the potential to make PLA a truly circular material by breaking it down into its original monomers, which can be re-polymerized into high-quality PLA.

Potential Growth Opportunities

For companies in the polylactic acid market, a number of significant growth opportunities exist beyond the current market drivers.

- Advanced Composites: There is a substantial opportunity in developing high-performance PLA-based composites for the automotive and aerospace industries. These composites can be used to produce lightweight parts that improve fuel efficiency and reduce carbon emissions.

- Emerging Economies: As rapidly industrializing regions in Asia, Latin America, and Africa address their growing plastic waste problem, there will be immense demand for sustainable alternatives. Investing in local production and distribution capabilities in these regions will allow companies to capitalize on this booming demand.

- Food Waste Conversion: A promising future opportunity lies in developing technologies to produce PLA directly from food waste, thereby solving two major environmental problems at once: plastic pollution and food waste. This would create an even more sustainable and circular supply chain for PLA.

Extrapolate says

The Polylactic Acid market is likely to become a major player in the materials industry as the world goes green. Our research shows that while packaging and consumer goods are the foundation of the market today, the future is in specialized high performance segments like biomedical devices, textiles and advanced composites.

Due to the conflicting demands of economic sustainability and environmental responsibility, the sector is at a turning point. Businesses that can be creative in this area and create circular, bio-based goods that not only perform as well as, but better than, conventional plastics will ultimately prevail.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Polylactic Acid Market Size

- September-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021