Oilfield Chemicals Market Size, Share, Growth & Industry Analysis, By Product Type (Inhibitors, Demulsifiers, Rheology Modifiers, Biocides, Surfactants, Gelling Agents, Friction Reducers, Specialty Polymers), By Application (Drilling Fluids, Cementing, Enhanced Oil Recovery, Well Stimulation, Production Chemicals), By End-User (Onshore, Offshore), and Regional Analysis, 2024-2031

Oilfield Chemicals Market: Global Share and Growth Trajectory

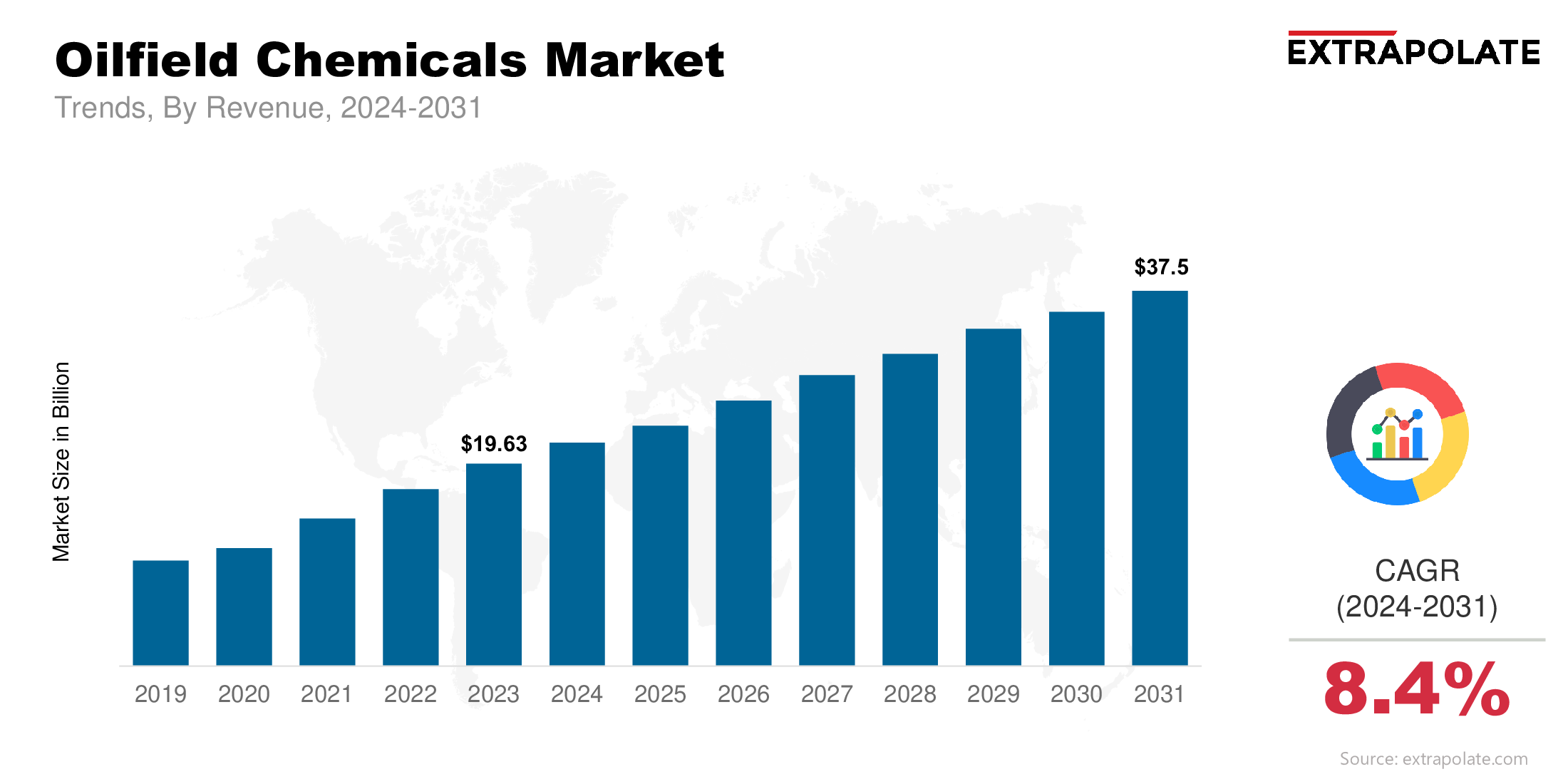

The global oilfield chemicals market size was valued at USD 19.63 billion in 2023 and is projected to grow from USD 21.21 billion in 2024 to USD 37.5 billion by 2031, exhibiting a CAGR of 8.4% during the forecast period.

The global oilfield chemicals market is steadily expanding as the energy industry faces mounting challenges in exploration, production, and enhanced oil recovery. Oilfield chemicals play a crucial role in improving the efficiency and safety of drilling and extraction processes. These chemicals are employed throughout upstream oilfield operations, including drilling, cementing, production, well stimulation, and enhanced oil recovery (EOR). Their use ensures optimal well performance, reduces downtime, and mitigates environmental and equipment-related risks.

This growth is supported by rising global energy demand, the exploration of unconventional reserves such as shale gas and tight oil, and the increasing complexity of drilling operations. Technological innovations and a greater emphasis on operational safety and environmental protection are further propelling market growth. As the world transitions to more sophisticated and environmentally compliant extraction technologies, the demand for advanced oilfield chemicals is expected to soar.

Oilfield chemicals offer specialized solutions for controlling corrosion, preventing scale buildup, maintaining fluid viscosity, and improving overall production efficiency. Their critical role in upstream activities is attracting continued investments, positioning the oilfield chemicals market as an essential component in global oil and gas infrastructure.

Key Market Trends Driving Product Adoption

Several key trends are driving the increased adoption of oilfield chemicals:

- Unconventional Oil and Gas Exploration: The surge in unconventional energy resources, particularly shale formations in North America and deepwater reserves globally, is creating new opportunities for oilfield chemicals. These reserves require complex hydraulic fracturing and horizontal drilling techniques. As a result, specialty chemicals like friction reducers, gelling agents, and biocides are in high demand to optimize performance and ensure well integrity.

- Focus on Enhanced Oil Recovery (EOR): With oil fields aging, producers are using EOR to boost extraction and extend output. EOR methods like chemical flooding with surfactants and polymers rely on various oilfield chemicals. The increasing emphasis on EOR strategies is expanding the scope for chemical applications in older reservoirs.

- Digitalization and Smart Formulation: Advanced data analytics and real-time monitoring have enabled companies to develop smarter oilfield chemical formulations. These chemicals are tailored to specific well conditions, improving efficacy and reducing wastage. Digital oilfield initiatives also help operators make more informed decisions on chemical dosing and deployment, enhancing operational efficiency.

- Sustainability and Green Chemistry: Environmental concerns are steering the industry toward the adoption of eco-friendly oilfield chemicals. Regulatory bodies and ESG (Environmental, Social, and Governance) frameworks are pushing for low-toxicity, biodegradable, and non-hazardous chemical solutions. This is encouraging innovation in green chemistry, which is gradually becoming a defining trend in product development and procurement practices.

Major Players and Their Competitive Positioning

The oilfield chemicals market is fiercely competitive and highly fragmented, with numerous global and regional players offering a broad range of solutions. The major players are leveraging partnerships, acquisitions, and innovation to strengthen their market positions. Notable names include Baker Hughes Company, Schlumberger Limited, Halliburton Company, BASF SE, Clariant AG, Dow Inc., Solvay S.A., Croda International Plc, Kemira Oyj, Huntsman Corporation , Ashland Global Holdings Inc., Albemarle Corporation, Stepan Company, Innospec Inc. , Lubrizol Corporation and others.

These companies are investing in R&D to develop advanced and environmentally compliant chemical formulations. They are also expanding their geographic presence and supply chains to cater to regional demands in North America, the Middle East, Asia-Pacific, and Africa.

Consumer Behavior Analysis

Consumer behavior in the oilfield chemicals market is influenced by operational needs, performance metrics, and regulatory pressures:

- Performance-Centric Procurement:

Oil and gas operators prioritize chemical performance over cost when selecting products. Efficacy in high-pressure and high-temperature (HPHT) environments, compatibility with other downhole materials, and long-term reliability are key selection criteria. - Demand for Customized Solutions:

Operators increasingly demand customized chemical solutions tailored to specific reservoir conditions. This has led to collaborative product development between suppliers and energy companies, enabling better alignment with unique well characteristics. - Environmental Compliance:

End-users are becoming more cautious of environmental regulations and stakeholder scrutiny. There is a growing preference for low-impact chemicals that comply with national and international safety and environmental standards. - Lifecycle Cost Considerations:

Buyers assess the total cost of ownership, factoring in product efficiency, reduced downtime, and extended asset lifespan. Chemicals that contribute to lower maintenance costs and improved well productivity over time are favored despite higher upfront costs.

Pricing Trends

Pricing in the oilfield chemicals market is influenced by raw material availability, oil price volatility, global demand patterns, and transportation costs. Key pricing trends include:

- Raw Material Sensitivity:

Most oilfield chemicals are derived from petrochemicals. Fluctuations in crude oil prices directly impact feedstock costs, affecting the pricing structure of chemical products. - Regional Pricing Variations:

Price points vary across regions depending on the maturity of the oilfield services sector, local production capabilities, and import/export tariffs. North America generally offers more competitive pricing due to robust domestic manufacturing. - Sustainability Premium:

Eco-friendly chemicals often carry a higher price tag due to the cost of R&D and alternative raw materials. However, operators are increasingly willing to pay a premium for products that meet regulatory and ESG goals. - Long-Term Contracts and Bundled Services:

Oilfield service providers often enter into long-term contracts with chemical suppliers. Bundled service offerings, which combine product supply with on-site technical services, help stabilize prices over time.

Growth Factors

Multiple factors are accelerating the growth of the oilfield chemicals market:

- Rising Global Energy Demand:

As the world economy continues to grow, energy consumption remains strong, especially in emerging markets. Oil and gas production must increase to meet this demand, which in turn drives the need for oilfield chemicals to support exploration and extraction. - Technological Innovations:

New technologies such as nanotechnology and microemulsion formulations are being incorporated into oilfield chemical products. These advancements improve product stability, enhance performance, and reduce dosage requirements. - Expansion of Shale and Tight Oil Reserves:

The development of shale oil and gas, particularly in the U.S., Canada, Argentina, and China, is creating a surge in demand for fracturing fluids, corrosion inhibitors, and other specialty chemicals. - Aging Oilfields and Complex Operations:

As more fields reach maturity, challenges such as scaling, corrosion, and declining pressure become prevalent. Oilfield chemicals are essential in managing these issues and ensuring continued production from aging reservoirs. - Increased Drilling Activity in Harsh Environments:

Deepwater and arctic drilling operations require robust chemical solutions that can withstand extreme conditions. This creates demand for high-performance additives and protective agents.

Regulatory Landscape

The oilfield chemicals industry is subject to stringent environmental and safety regulations designed to minimize the ecological impact of oil and gas operations:

- REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals):

In Europe, manufacturers must comply with REACH regulations, ensuring all chemicals used are registered and evaluated for their environmental and health impact. - Environmental Protection Agency (EPA):

In the United States, the EPA regulates the use and disposal of oilfield chemicals to minimize groundwater and surface water contamination. - OSHA and Safety Standards:

Chemical suppliers must also adhere to workplace safety regulations established by the Occupational Safety and Health Administration (OSHA), focusing on labeling, handling, and storage protocols. - Industry Certifications:

ISO and API standards guide best practices in quality control, chemical formulation, and supply chain management. These certifications are often prerequisites for vendor approval in large-scale oilfield projects.

Recent Developments

Recent developments in the oilfield chemicals market include:

- Eco-Friendly Product Launches:

Companies like Clariant and BASF have introduced green surfactants and biodegradable corrosion inhibitors in response to rising environmental concerns and regulatory demands. - Strategic Acquisitions and Partnerships:

Halliburton’s acquisition of Multichem and Schlumberger’s collaboration with independent chemical labs are aimed at expanding product portfolios and advancing R&D efforts. - Digital Integration in Chemical Monitoring:

Service providers now offer digital platforms that integrate chemical dosage management with real-time reservoir monitoring. These platforms optimize chemical usage and reduce waste. - Regional Expansion:

Major players are establishing manufacturing and distribution centers in high-growth regions such as the Middle East and Asia-Pacific to reduce logistical costs and enhance responsiveness.

Current and Potential Growth Implications

a. Demand-Supply Analysis:

A growing number of upstream projects is increasing demand for oilfield chemicals. However, supply chain disruptions and raw material shortages occasionally cause volatility. Balanced inventory management and local sourcing are emerging as strategies to mitigate risks.

b. Gap Analysis:

While innovation is flourishing, there remains a gap in product accessibility in emerging markets. High product costs and lack of infrastructure limit the use of advanced chemicals in low-income oil-producing countries.

Top Companies in the Oilfield Chemicals Market

Prominent companies in the oilfield chemicals market include:

- Baker Hughes Company

- Schlumberger Limited

- Halliburton Company

- BASF SE

- Clariant AG

- Dow Inc.

- Solvay S.A.

- Croda International Plc

- Kemira Oyj

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Albemarle Corporation

- Stepan Company

- Innospec Inc.

- Lubrizol Corporation

Oilfield Chemicals Market: Report Snapshot

Segmentation | Details |

By Product Type | Inhibitors, Demulsifiers, Rheology Modifiers, Biocides, Surfactants, Gelling Agents, Friction Reducers, Specialty Polymers |

By Application | Drilling Fluids, Cementing, Enhanced Oil Recovery, Well Stimulation, Production Chemicals |

By End-User | Onshore, Offshore |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Friction Reducers and Surfactants:

As hydraulic fracturing operations expand, the demand for efficient and cost-effective friction reducers and surfactants continues to climb. - Biocides and Corrosion Inhibitors:

In offshore and HPHT environments, the need for biocides and corrosion inhibitors to protect infrastructure and maintain productivity is increasing sharply.

Major Innovations

- Nano-Based Additives: Nanotechnology is being used to improve chemical dispersion and performance under extreme well conditions.

- Intelligent Chemical Systems: AI-driven chemical monitoring systems enable real-time optimization of chemical usage, reducing costs and environmental risks.

Potential Growth Opportunities

- Geographic Expansion in Emerging Markets: Drilling is increasing in Latin America, Southeast Asia, and Sub-Saharan Africa. Policy shifts and foreign investment boost their untapped potential.

- Eco-Friendly Chemical Development: Green chemical R&D brings long-term gains. It's most valuable in regions with strict environmental rules.

- Integration with Digital Oilfields: Digital oilfields now use smart chemicals for better control. This cuts waste and supports smarter field management.

Kings Research says:

The oilfield chemicals market is undergoing a seismic change with the introduction of newer technology and changing environmental standards. The extraction processes become more complicated, where specialty chemicals find application across drilling and well maintenance. Innovating and integrating digital tools continue to define the system amidst pressures on costs and sustainability. Companies focusing on green chemistry, R&D, and high-growth regions will be in the better position to lead.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Oilfield Chemicals Market Size

- June-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021