Lubricant and Fuel Additives Market Size, Share, Growth & Industry Analysis, By Product Type (Dispersants, Detergents, Anti-Oxidants, Friction Modifiers, Corrosion Inhibitors, Anti-Wear Agents, Pour Point Depressants, Viscosity Index Improvers), By Fuel Additives (Cetane Improvers, Deposit Control Additives, Lubricity Enhancers, Antioxidants, Cold Flow Improvers), By Application (Automotive, Industrial, Marine, Aviation, Power Generation), and Regional Analysis, 2024-2031

Lubricant and Fuel Additives Market: Global Share and Growth Trajectory

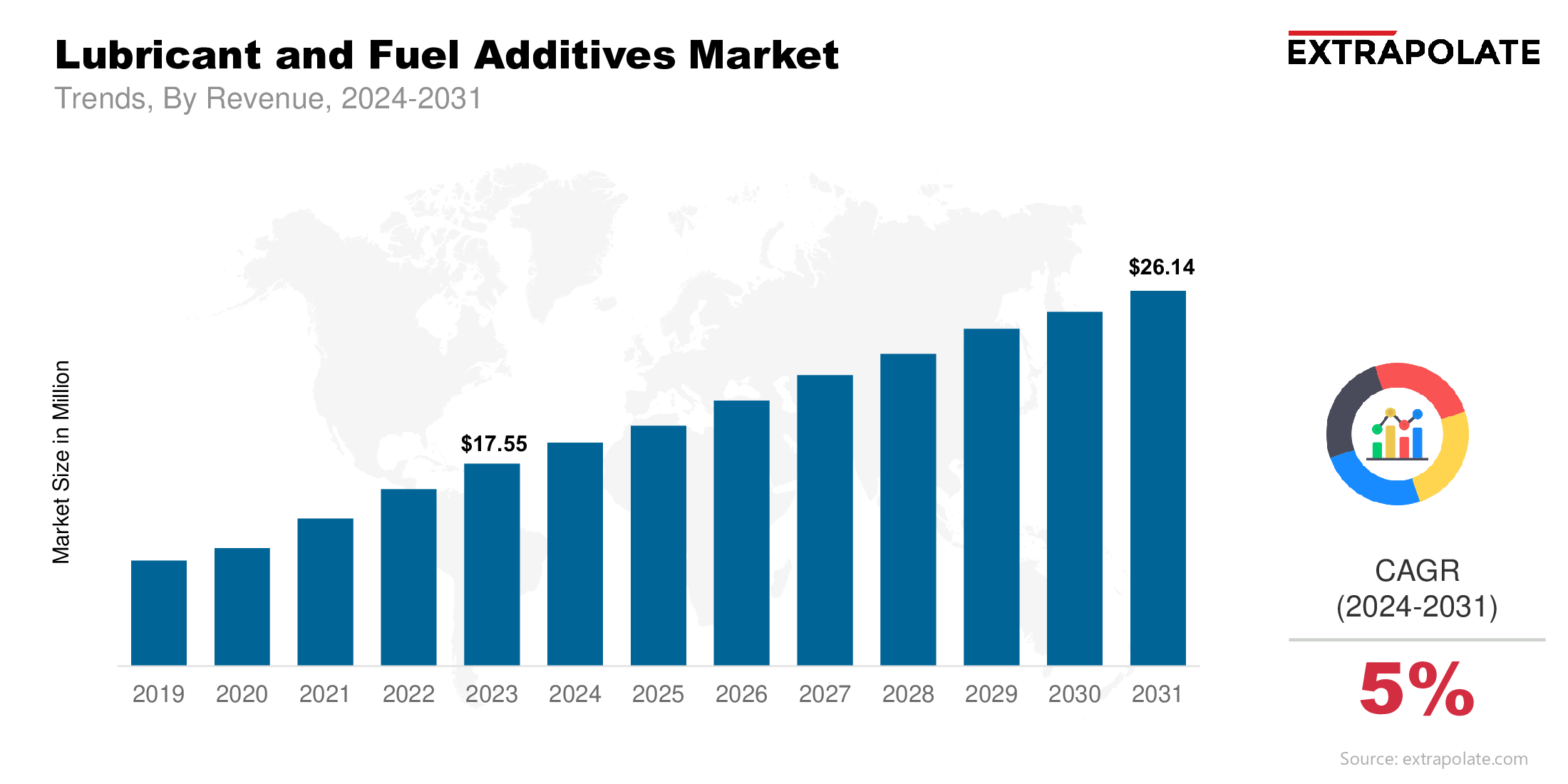

The global lubricant and fuel additives market size was valued at USD 17.55 billion in 2023 and is projected to grow from USD 18.48 billion in 2024 to USD 26.14 billion by 2031, exhibiting a CAGR of 5% during the forecast period.

The global market is on a steady upward trajectory, driven by the growing need to enhance fuel efficiency, reduce engine wear, and comply with evolving environmental regulations. These chemical compounds, which are blended with base oils and fuels, play a crucial role in improving the performance, longevity, and cleanliness of engines across automotive, marine, aerospace, and industrial sectors. Lubricant additives enhance the properties of base oils, such as reducing friction, minimizing wear, and preventing oxidation and corrosion. Meanwhile, fuel additives improve combustion efficiency, lower emissions, and ensure the smooth operation of fuel systems.

The increased adoption of high-performance vehicles, rising demand for energy-efficient engines, and stricter emission regulations globally have led to a surge in demand for high-quality lubricant and fuel additives. Furthermore, technological advancements in additive formulations, coupled with a growing focus on sustainability, are transforming the industry. Additives derived from renewable sources and those that enable engines to operate more cleanly and efficiently are gaining traction in the marketplace.

The market is also witnessing significant investment in research and development by key industry players to innovate and cater to the needs of modern engine technologies. With the continued push towards cleaner fuels and more efficient engines, the lubricant and fuel additives industry is poised for substantial growth in the coming years.

Key Market Trends Driving Product Adoption

Several key trends are fueling the adoption of lubricant and fuel additives:

- Stringent Environmental and Emission Regulations

Governments and environmental agencies are cracking down on emissions globally. Fuel and lubricant manufacturers are being forced to up the ante. Additives that reduce emissions like nitrogen oxides (NOx), particulate matter (PM), and carbon monoxide (CO), are in high demand. Especially additives that help meet Euro 6 and BS-VI norms in vehicles are gaining traction in Asia-Pacific and Europe.

- Fuel Efficiency Demand

Fuel economy is on the rise as consumers and manufacturers look to reduce costs and environmental impact. Fuel additives that improve combustion like cetane improvers for diesel and octane boosters for gasoline are getting popular. Lubricants with friction modifiers and anti-wear agents are reducing engine resistance and giving better mileage and engine performance.

- Technological Advancements in Additive Formulations

Additive chemistry innovations are enabling multifunctional products that can address multiple performance requirements in one formulation. New generation dispersants, antioxidants and anti-foam agents are optimizing engine cleanliness, thermal stability and component durability. Additives are also being developed for electric vehicles (EVs) and hybrid systems which is a growing area.

- Automotive and Industrial Growth

As automotive production is increasing globally especially in emerging markets like India, China and Southeast Asia the demand for engine oils, transmission fluids and associated additives is growing. At the same time industrial sector is dependent on heavy machinery in mining, agriculture and construction which is driving demand for high performance lubricants with anti-wear and corrosion resistant additives.

Major Players and Their Competitive Positioning

Lubricant and fuel additives industry is highly competitive and fragmented with many multinational companies holding market share. Key players are focused on R&D, strategic partnerships, mergers and capacity expansion to stay ahead. Some of the prominent companies are, Lubrizol Corporation, Afton Chemical Corporation, Chevron Oronite Company LLC, BASF SE, Infineum International Limited, Evonik Industries AG, LANXESS AG, Croda International Plc, TotalEnergies SE, Clariant AG and others.

These companies are actively engaged in the development of environment-friendly and high-performance additive technologies. Collaborations with engine manufacturers and oil companies are helping key players customize solutions for specific operating conditions and regulatory environments.

Consumer Behavior Analysis

Understanding consumer behaviour is key to understanding the market dynamics for lubricants and fuel additives:

- Shift Toward Sustainability

Consumers, especially fleet operators and industrial users, are getting more sustainable. Additives that extend oil change intervals, reduce emissions and improve recyclability are in demand. Bio-based and ashless additives are gaining traction with eco-conscious buyers.

- Preference for Premium-Grade Additives

There is a trend towards premium lubricant and fuel additives that are multifunctional and offer better engine protection. End-users are willing to pay more for additives that reduce maintenance costs, improve fuel efficiency and extend equipment life.

- Increased Awareness and Education

OEMs and lubricant manufacturers are investing in educating end-users about the benefits of high quality additives. As awareness grows, consumers are making informed purchasing decisions, prioritising quality and long term performance over cost savings.

- Cost-Performance Considerations

While cost is still important, consumers are realising the long term value of additive enhanced lubricants and fuels. Savings in maintenance, reduced downtime and better equipment life span often justify the initial investment in premium products.

Pricing Trends

Pricing of lubricant and fuel additives is influenced by raw material costs, manufacturing complexity, regulatory compliance and performance benefits. Prices vary by region, product type and application area.

- Raw Material Volatility: Prices of chemical feedstocks such as olefins, alcohols and esters fluctuate based on global supply chains and affect overall additive costs.

- High-End Products: Advanced additives for synthetic lubricants and high performance fuels command premium prices due to complex formulations and superior performance.

- Regional Disparities: North America and Europe have higher additive prices due to stricter environmental norms and higher demand for premium products.

- Bundled Services: Companies are offering packaged solutions – base oil plus additives – at competitive rates to provide value and convenience to end-users.

Growth Factors

Several key factors are driving the growth of the market:

- Electrification and Hybridization

The rise of electric and hybrid vehicles is changing the additives landscape. Although EVs use less lubricants, they still require specialized fluids for transmissions, coolants and thermal management systems. This is new opportunity for additive innovation.

- Industrial Growth in Emerging Economies

Rapid industrialization in regions like Asia-Pacific, Latin America and Africa is driving demand for machinery lubricants. Additives that improve fluid longevity and prevent component wear are in high demand to support uninterrupted operations in harsh environments.

- Innovations in Engine Design

Modern engines are built with tighter tolerances and more complex combustion systems. This evolution requires advanced lubricant and fuel additives that offer thermal stability, oxidative resistance and low volatility to support high performance engines.

- Strategic Partnerships

Leading additive manufacturers are partnering with OEMs, lubricant brands and fuel companies to co-develop custom solutions. These partnerships are helping align additive development with next generation engine technologies.

Regulatory Landscape

The regulatory landscape for lubricant and fuel additives is getting stricter across major economies. Compliance to global and regional standards is mandatory for market entry and continued operation.

- Environmental Protection Agency (EPA): In the U.S., the EPA regulates fuel additives under the Clean Air Act. Additives must be registered and proven to not contribute to air pollution.

- REACH Regulations (EU): The European Union’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) mandates strict testing and registration of chemical additives.

- API and ACEA Specifications: These industry standards set benchmarks for engine oil performance. Additives must be compatible with the latest API SN/CK-4 and ACEA C5 specifications.

- Emission Norms: Global adoption of BS-VI, Euro 6, and China VI norms demand the use of cleaner-burning fuels, which in turn require advanced additives for compliance.

Recent Developments

Recent innovations and strategic activities have shaped the market landscape:

- Bio-Based Additives: Croda and LANXESS are launching bio-based and environmentally friendly additives to replace petrochemicals.

- New Formulations for EVs: BASF and Lubrizol have developed thermal management fluids and additives for electric vehicle powertrains.

- Mergers and Acquisitions: Afton Chemical has acquired several regional additive businesses to expand its product line and global presence.

- Focus on Detergency: Chevron Oronite has launched fuel additives with enhanced detergency to clean injectors and improve fuel economy.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The demand for performance enhancing additives in automotive and industrial segments is putting pressure on the supply chain. Manufacturers are increasing production capacity and optimising logistics to meet global demand efficiently.

b. Gap Analysis

A big gap exists in affordability and accessibility of premium grade additives in developing economies. Bridging this gap through cost effective formulations, local manufacturing and customer education is top priority for market players.

Top Companies in the Lubricant and Fuel Additives Market

Leading companies shaping the global market include:

- Lubrizol Corporation

- Afton Chemical Corporation

- Chevron Oronite Company LLC

- Infineum International Limited

- BASF SE

- Evonik Industries AG

- Croda International Plc

- Clariant AG

- LANXESS AG

- TotalEnergies SE

Lubricant and Fuel Additives Market: Report Snapshot

Segmentation | Details |

By Product Type | Dispersants, Detergents, Anti-Oxidants, Friction Modifiers, Corrosion Inhibitors, Anti-Wear Agents, Pour Point Depressants, Viscosity Index Improvers |

By Fuel Additives | Cetane Improvers, Deposit Control Additives, Lubricity Enhancers, Antioxidants, Cold Flow Improvers |

By Application | Automotive, Industrial, Marine, Aviation, Power Generation |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Friction Modifiers and Dispersants

The growing need for fuel-efficient lubricants in passenger and commercial vehicles is boosting the demand for friction modifiers and dispersants.

- Cetane and Octane Enhancers

Fuel additives that boost combustion efficiency and reduce engine knocking are witnessing high demand, particularly in regions adopting clean diesel and high-octane fuels.

Major Innovations

- Multifunctional Additives: Next-gen additives with detergency, oxidation resistance and anti-wear in one.

- Nanotechnology Integration: Nanoparticle-based additives being tested for friction reduction and thermal performance.

- Smart Fluids for EVs: Thermally stable and electrically non-conductive fluids with tailored additive packages for EVs.

Potential Growth Opportunities

- Growth in Synthetic Lubricants: Shift to synthetic oils in automotive and industrial will drive demand for compatible additive systems.

- Localized Production: Manufacturing in high demand regions like Asia-Pacific and Middle East to reduce logistics and delivery time.

- Rising Focus on Aftermarket Sales: Expansion of retail distribution and consumer awareness initiatives to boost additive sales in aftermarket.

Kings Research says:

The lubricant and fuel additives market is set to grow for the long term. Performance optimisation and environmental compliance is driving additive technology to evolve fast. Manufacturers are innovating to meet the complex needs of modern engines and global emission norms. As industries focus on efficiency, longevity and sustainability the demand for advanced lubricant and fuel additives will rise across developed and developing markets.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Lubricant and Fuel Additives Market Size

- June-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021