Floor Coatings Market Size, Share, Growth & Industry Analysis, By Product Type (Epoxy, Polyurethane, Acrylic, Polyaspartic, Others) By Component (One-Component, Two-Component, Three-Component) By Application (Commercial, Residential, Industrial, Institutional, Others) By Flooring System (Terrazzo, Self-Leveling, Antistatic, Decorative, Mortar, Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Regional Analysis, 2024-2031

Floor Coatings Market: Global Share and Growth Trajectory

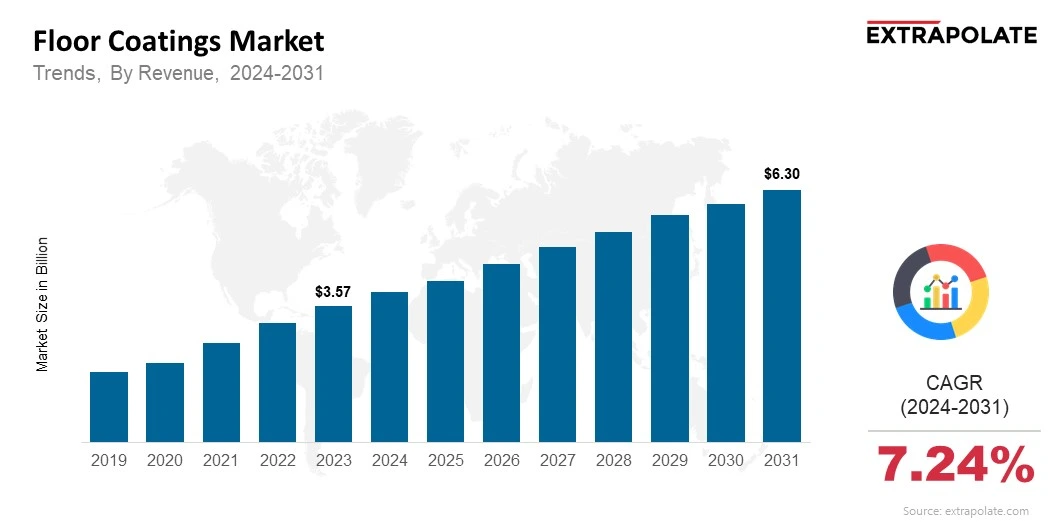

The global Floor Coatings Market size was valued at USD 3.57 billion in 2023 and is projected to grow from USD 3.86 billion in 2024 to USD 6.30 billion by 2031, exhibiting a CAGR of 7.24% during the forecast period.

The global floor coatings market is experiencing a remarkable growth trajectory, driven by rapid infrastructure development, rising urbanization, and increasing industrial activity worldwide. Floor coatings are essential for protecting surfaces from physical wear, chemical spills, and environmental damage, while also offering aesthetic enhancement and safety compliance.

As sectors like manufacturing, healthcare, logistics, and residential construction expand, so does the demand for high-performance floor coatings that offer both functionality and visual appeal. One of the key drivers of this market is the rising need for durable, resilient surfaces in high-traffic and harsh operating environments.

Industrial floors, in particular, are exposed to mechanical stress, thermal shocks, and chemical agents, making advanced coatings like epoxy and polyurethane indispensable. In commercial and residential settings, decorative and protective coatings are being adopted to enhance floor longevity and design flexibility.

Environmental regulations and sustainability goals are also shaping market dynamics. The growing preference for low-VOC and waterborne formulations reflects the industry's shift toward eco-friendly and health-conscious solutions.

These formulations not only minimize environmental impact but also ensure compliance with strict regulatory standards across regions such as North America and Europe. Technological innovations are further accelerating growth.

Advancements in fast-curing, UV-resistant, and self-leveling coatings have significantly improved application efficiency and performance. Manufacturers are also exploring smart coatings with antimicrobial and self-healing properties, especially relevant in sectors like healthcare and food processing.

Emerging economies in Asia-Pacific and Latin America are witnessing robust construction and infrastructure development, making them key growth hubs. With a surge in renovation and remodeling activities, especially post-pandemic, demand for floor coatings is expected to remain high.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several new trends are helping floor coatings become more popular.

More Use of Epoxy and Polyurethane Coatings

Epoxy and polyurethane coatings are leading the market. They are strong, long-lasting, and look good. These coatings are used in places like hospitals, warehouses, garages, and food factories. They can handle heavy loads and chemicals, and they are easy to clean.

Move Toward Eco-Friendly and Low-VOC Coatings

People care more about the environment now. So, water-based and low-VOC coatings are in demand. These coatings have less smell and are better for the planet. Some are even made from natural materials and meet green building standards like LEED.

Rise of Smart and Germ-Fighting Coatings

After COVID-19, there is more need for coatings that fight germs. These are used in hospitals, labs, and food areas. Smart coatings are also being developed. Some can heal themselves or change with temperature, making floors even more useful.

Growth in Infrastructure Projects

New buildings and government projects are growing fast, especially in developing countries. This is driving demand for floor coatings. Factories, airports, and transport hubs need strong floors that can resist wear and chemicals.

Major Players and Their Competitive Positioning

The floor coatings market is competitive and fragmented, with several global and regional players vying for market share through innovation, strategic partnerships, and acquisitions. Leading companies are focusing on eco-friendly technologies, expanding production capacity, and offering turnkey floor coating systems tailored to specific applications.

Key players include: - PPG Industries, Inc., The Sherwin-Williams Company, Akzo Nobel N.V., RPM International Inc., BASF SE, Nippon Paint Holdings Co., Ltd., Sika AG, Axalta Coating Systems, 3M Company, and Mapei S.p.A.

These companies are investing in R&D, expanding their global footprint, and introducing specialized coatings with enhanced adhesion, slip resistance, and chemical stability. Vent-E, a permeable epoxy flooring solution for heavy-duty industrial settings, was introduced by Dur-A-Flex Inc. in September 2023. It provides improved durability against harsh chemical exposure and the ability to bridge cracks. This introduction highlights the rising need for specialty coatings designed to increase the durability of infrastructure.

Consumer Behavior Analysis

Consumer preferences and buying habits in the floor coatings market are influenced by:

Performance and Durability

End-users want coatings that can handle heavy foot traffic, impact and harsh chemicals or moisture. Industrial users in manufacturing and processing plants want long lasting solutions that minimize maintenance and downtime.

Aesthetics and Customization

Color, gloss and finish are becoming more important in commercial and residential applications. Consumers want coatings that match interior design themes and functionality. Custom finishes and decorative flakes are a big plus.

Eco-Friendly Awareness

Growing environmental awareness is driving customers to low-VOC and solvent free coatings. Commercial and institutional buyers want sustainable products that contribute to green building certifications.

Application Efficiency and Cost

Consumers want coatings that are easy to apply, quick to cure and minimize downtime. While cost is a consideration, long term performance and life cycle cost savings often drive the buying decision.

Pricing Trends

Floor coating prices vary greatly depending on formulation, performance properties and application type.

High-End Coatings

Epoxy and polyurethane coatings with special features (anti-slip, anti-microbial, chemical resistance) are more expensive. These are used in pharmaceutical labs, hospitals and food processing facilities.

Water-Based and Bio-Based Options

Eco-friendly options are more expensive due to raw material costs but the long term health and sustainability benefits justify the price for many buyers.

Bulk and Custom Solutions

Manufacturers offer bulk discounts to industrial customers or custom pricing for turnkey solutions including surface preparation, application and post service maintenance.

Overall while the upfront cost is high, consumers recognize the value in longer lasting performance especially in high demand areas.

Growth Factors

The floor coatings market is being driven by a combination of growth drivers:

Construction and Industrial Growth

Global construction booms, especially in emerging markets like India, China, Brazil and Indonesia, are increasing demand. New factories, shopping malls, public infrastructure and office spaces all need floor coatings for protection and longevity.

Rising Safety and Regulatory Standards

Governments and regulatory bodies are enforcing stricter safety standards across industries. This includes anti-slip coatings in workspaces, fire retardant surfaces in public infrastructure, cleanable floors in healthcare and food production facilities.

Technological Advancements

Nanotechnology, hybrid polymer systems and 2K (two-component) curing systems are leading to high performance coatings that cure faster, last longer and adapt to different substrates.

E-Commerce and Warehousing Growth

With the growth of e-commerce and logistics networks, warehouse construction is booming. These facilities need heavy duty coatings to withstand forklifts, pallets and foot traffic, creating a steady demand base.

Regulatory Landscape

Regulations in the floor coatings market are around health, safety and environmental:

VOC Limits: Governments, especially in EU and North America, have introduced strict VOC limits to reduce air pollution and improve indoor air quality. Manufacturers are forced to innovate in water based and low-VOC solutions.

Occupational Safety Standards: Regulatory frameworks like OSHA (Occupational Safety and Health Administration) require anti-slip and chemical resistant floor surfaces in hazardous work environments.

Fire and Hygiene Compliance: Building codes increasingly mandate coatings that are flame-retardant and easy to sanitize, especially in high-risk industries like food processing and healthcare.

Certification Requirements: Compliance with certifications like GREENGUARD, LEED, and BREEAM is becoming standard for commercial buildings and institutions seeking to enhance sustainability and safety.

Recent Developments

The floor coatings market has seen some big developments recently:

Green Coatings Expansion

PPG and AkzoNobel are adding bio-based, solvent-free and low-VOC coatings to their ranges to meet the sustainability trend and tightening regulations.

Smart Coatings

Some coatings now have smart features like colour change with temperature or self-healing. Still in the early days but this is the direction of floor coatings.

Strategic Acquisitions and Partnerships

Manufacturers are buying smaller, specialist coating companies to add to their product ranges and regional presence. Sherwin-Williams and RPM have made acquisitions to boost their flooring solutions in Asia and Latin America.

COVID-19’s Impact on Demand

The pandemic has highlighted the importance of hygiene in public and institutional buildings and demand for anti-microbial and easy clean floor coatings especially in healthcare and education facilities.

Current and Future Growth Implications

Demand-Supply Analysis

Construction and refurbishment is booming globally and demand is surging. But raw material shortages, especially epoxy resins and hardeners, are causing supply chain and pricing issues in the short term.

Gap Analysis

The market is growing fast but there’s still a gap in product availability for small and medium contractors in developing regions. Many of these markets are not aware of advanced coating solutions and cost is a barrier. Manufacturers have an opportunity to offer affordable, local solutions to fill this unmet demand.

Top Companies in the Floor Coatings Market

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- RPM International Inc.

- BASF SE

- Nippon Paint Holdings Co., Ltd.

- Sika AG

- Axalta Coating Systems

- 3M Company

- Mapei S.p.A.

Floor Coatings Market: Report Snapshot

Segmentation | Details |

By Product Type | Epoxy, Polyurethane, Acrylic, Polyaspartic, Others |

By Component | One-Component, Two-Component, Three-Component |

By Application | Commercial, Residential, Industrial, Institutional, Others |

By Flooring System | Terrazzo, Self-Leveling, Antistatic, Decorative, Mortar, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Floor Coatings Market: Expanding Segments

Epoxy Coatings

Epoxy coatings will be the fastest growing segment due to their superior chemical and mechanical properties. Used in industrial settings, they are affordable and versatile.

Self-Leveling Systems

Self-leveling coatings are gaining popularity in healthcare, pharma and retail spaces. Smooth, seamless finish enhances hygiene and maintenance efficiency.

Major Innovations

Nanotechnology-Enhanced Coatings

Nanomaterials innovations offer hardness, abrasion resistance and anti-microbial protection, especially in cleanroom and sterile environments.

Fast-Cure and UV-Curable Systems

These innovations reduce downtime during application and allow for quicker project turnaround, especially in commercial renovations.

Floor Coatings Market: Growth Opportunities

Penetration into Emerging Markets

Rapid infrastructure growth in Asia, Africa and Latin America is a big opportunity. Enter these markets with affordable, region specific solutions and established players will gain market share.

Integration with Smart Infrastructure

As smart buildings evolve, so will the demand for intelligent materials, including floor coatings that can monitor wear, temperature or even pressure. R&D in smart coatings can open up new market opportunities.

Sustainability-Driven Product Lines

Companies that launch green, recyclable and carbon neutral coatings will benefit from increasing regulatory support and consumer preference.

Extrapolate Says:

The floor coatings market is going to grow big in the coming years. Demand across commercial, industrial and residential applications along with sustainability trends and technological innovation is changing the market landscape. With increasing infrastructure development and stricter safety regulations, floor coatings are no longer a luxury but a necessity in modern construction.

As manufacturers launch durable, eco-friendly and performance driven products, the market will see a big change. The future of floor coatings is innovation, sustainability and adaptability, protection and aesthetics beneath our feet.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Floor Coatings Market Size

- August-2025

- 140

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021