Ferrous Sulfate Market Size, Share, Growth & Industry Analysis, By Product Type (Monohydrate, Heptahydrate, Others) By Application (Water Treatment, Agriculture, Pharmaceuticals, Pigments & Dyes, Cement Industry, Others) By End-User (Municipalities, Chemical Manufacturers, Agrochemical Companies, Healthcare Providers, Others), and Regional Analysis, 2024-2031

Ferrous Sulfate Market: Global Share and Growth Trajectory

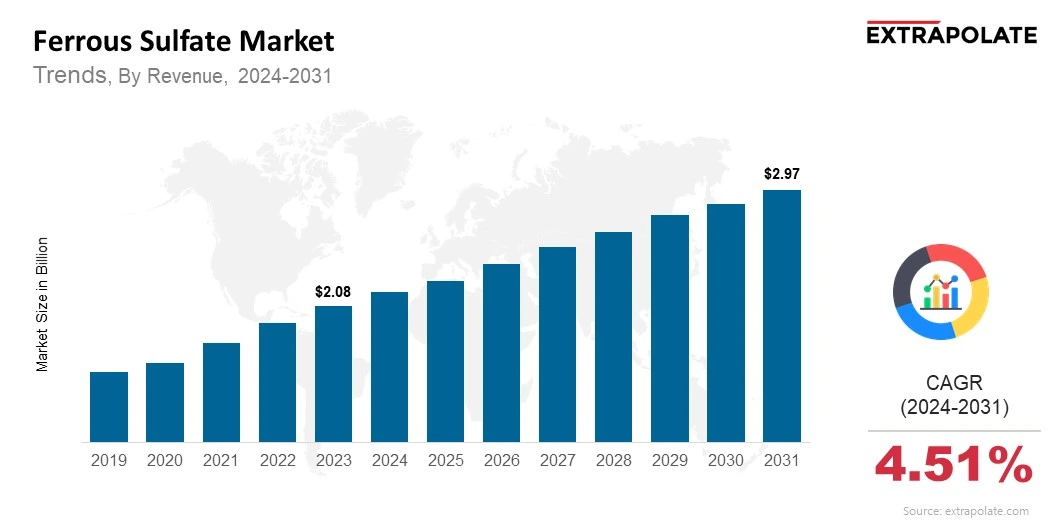

The global Ferrous Sulfate Market size was valued at USD 2.08 billion in 2023 and is projected to grow from USD 2.18 billion in 2024 to USD 2.97 billion by 2031, exhibiting a CAGR of 4.51% during the forecast period.

The global ferrous sulfate market is witnessing steady growth, driven by its widespread applications across multiple industries including water treatment, agriculture, pharmaceuticals, and chemical manufacturing. As a key iron supplement, ferrous sulfate plays a vital role in addressing iron deficiency anemia, a condition affecting millions globally. Additionally, its usage in water purification processes and as a soil amendment in agriculture further amplifies its importance across environmental and industrial domains.

Ferrous sulfate's role in enhancing crop yield and correcting iron deficiencies in alkaline soils is gaining prominence amid the global push for sustainable agriculture. Meanwhile, rising awareness about clean water access, especially in emerging economies, is propelling demand for ferrous sulfate-based coagulants in municipal and industrial water treatment facilities.

On the healthcare front, growing incidences of iron deficiency-related disorders, particularly in developing regions, are fueling demand for pharmaceutical-grade ferrous sulfate. The compound’s affordability and effectiveness make it a popular choice in both public health initiatives and over-the-counter supplements.

Regionally, Asia-Pacific leads the market in terms of production and consumption, followed by North America and Europe. The availability of raw materials, cost-effective manufacturing capabilities, and rising industrialization in countries like China and India are key factors supporting the region’s dominance.

As global demand for eco-friendly and cost-efficient solutions increases, ferrous sulfate is poised to become even more integral in essential sectors. Manufacturers are also exploring green production techniques and expanded distribution networks to maintain competitiveness and address evolving market needs.

Key Market Trends Driving Product Adoption

Several key trends are fueling the widespread adoption of ferrous sulfate:

- Expansion of Water Treatment Applications: Ferrous sulfate is extensively used in municipal and industrial water treatment plants as a coagulant to remove contaminants. Increasing environmental awareness and stringent water quality regulations, especially in developed countries, are encouraging the adoption of iron-based treatment chemicals over traditional alternatives. Additionally, rapid urbanization in Asia-Pacific and Latin America is creating a larger customer base for water treatment applications.

- Rise in Iron Deficiency-Related Health Issues: Iron deficiency anemia remains one of the most prevalent nutritional disorders worldwide, particularly in women and children. Ferrous sulfate is the most widely recommended oral iron supplement, appreciated for its effectiveness and affordability. The increasing demand for dietary supplements and iron-fortified foods is positively influencing the market.

- Sustainable Agriculture Practices: The agriculture sector is utilizing ferrous sulfate as a soil amendment and micronutrient to treat iron chlorosis in crops. With a growing emphasis on crop yield and sustainability, farmers and agribusinesses are adopting ferrous sulfate to enhance soil health and plant growth. In regions with alkaline soils such as parts of India and the Middle East, the usage is even more critical.

- Industrial Applications on the Rise: Beyond healthcare and agriculture, ferrous sulfate is gaining traction in various industrial sectors. It is used in the production of inks, pigments, and cement, as well as in electroplating and wastewater treatment. These industrial uses are expanding, thanks to the economic rebound in construction and manufacturing post-pandemic.

Major Players and their Competitive Positioning

The global ferrous sulfate market is moderately fragmented, with several players competing on price, quality, and supply capabilities. Key companies are focused on product consistency, large-scale production, and expanding their distribution networks.

Prominent players in the market include- Venator Materials PLC, Verdesian Life Sciences, Crown Technology, Inc., Coogee Chemicals Pty Ltd, Rech Chemical Co., Ltd., Cleveland Industries, Zouping County Runzi Chemical Industry Co., Ltd., Chemifloc Limited, Changsha Haolin Chemicals Co., Ltd., MM Chemical, Kemira Oyj, Baowu Clean Energy Co., Ltd., Hebei Chengxin Co., Ltd., Reagent Chemical & Research, Inc., TIB Chemicals AG

These firms are increasingly entering strategic partnerships, enhancing product quality, and expanding capacity to meet growing global demand. Regional expansion in Asia-Pacific and Latin America is a major focus to tap into new end-user industries.

Consumer Behavior Analysis

Consumer behavior in the ferrous sulfate market is shaped by economic, environmental, and health-related factors:

- Health Awareness Fuels Demand: Consumers are becoming more aware of iron deficiency and its consequences, leading to greater acceptance of supplements and fortified foods. Hospitals and healthcare providers often prescribe ferrous sulfate supplements for conditions ranging from anemia to pregnancy-related deficiencies, making them a staple in the global nutraceutical market.

- Sustainability Preferences in Agriculture: In the agriculture sector, demand is driven by environmentally conscious farmers and agribusinesses seeking micronutrients that are effective and cost-efficient. Ferrous sulfate offers both, resulting in strong market traction in organic and conventional farming systems.

- Cost-Effectiveness: Ferrous sulfate is widely used due to its low cost and availability in various forms—monohydrate and heptahydrate—making it suitable for multiple applications. This cost advantage makes it especially popular in price-sensitive markets like Africa, South Asia, and parts of Latin America.

- Regulatory Influence: Increased awareness of environmental regulations is nudging end-users in water treatment and industrial sectors toward iron-based solutions such as ferrous sulfate, replacing more harmful chemicals and creating a niche segment of environmentally responsible consumers.

Pricing Trends

The pricing of ferrous sulfate is influenced by raw material costs (mainly iron and sulfur), production technology, regional availability, and transportation. Over the past few years, the cost of raw materials has remained relatively stable, keeping ferrous sulfate prices predictable. However, fluctuations in sulfuric acid supply or iron ore prices can influence final product costs.

Monohydrate form typically commands a higher price than heptahydrate due to better stability and higher iron concentration. Prices also vary by region, with Asia-Pacific offering the most competitive rates due to local sourcing and economies of scale.

Emerging trends in bio-based and green manufacturing may slightly increase production costs but could fetch higher market value in sustainability-focused regions like the EU.

Growth Factors

Several factors are contributing to the growth of the global ferrous sulfate market:

- Rising Prevalence of Anemia: According to the World Health Organization, over 30% of the global population is anemic, with a major portion resulting from iron deficiency. This substantial burden is prompting both governments and private players to invest in supplement production and distribution.

- Water Quality Regulations: Government mandates on drinking water purification and industrial effluent management are boosting the demand for ferrous sulfate as a coagulant and flocculant. Regions like Europe and North America, with stringent wastewater discharge norms, continue to show strong consumption levels.

- Urbanization and Industrialization: Developing countries are witnessing rising demand from construction and manufacturing industries that use ferrous sulfate in pigment production, cement, and electroplating. This trend is expected to accelerate in tandem with economic growth.

- Agricultural Demand: Increased awareness about soil micronutrient deficiencies and the push for high agricultural yields are propelling demand in the agrochemical segment. Countries with iron-deficient soils are adopting ferrous sulfate to improve productivity and quality.

Regulatory Landscape

The production and use of ferrous sulfate are governed by various environmental, health, and safety regulations:

- U.S. – EPA and FDA: The Environmental Protection Agency (EPA) regulates ferrous sulfate when used in water treatment. It ensures that its use does not harm the environment or public health. The Food and Drug Administration (FDA) oversees its application in food and supplements. This ensures ferrous sulfate used in nutraceuticals meets purity and safety standards.

- European Union – REACH Regulation: REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) controls the use of ferrous sulfate across Europe. It makes sure that the substance is safe from production to disposal. This law also pushes companies to test and document the risks and handling instructions of ferrous sulfate.

- Agricultural Use – Codex and Local Guidelines: Many countries follow Codex Alimentarius or their national versions to regulate micronutrients like ferrous sulfate in fertilizers. These rules ensure safe doses are applied to crops. They help avoid overuse, contamination, or negative effects on food safety and soil quality.

- Industrial and Pharmaceutical – ISO Standards: Ferrous sulfate used in industries or pharmaceuticals must meet ISO standards. These cover quality, safety, and traceability in manufacturing processes. This ensures the final product remains consistent, reliable, and suitable for sensitive uses.

Recent Developments

- Green Manufacturing Initiatives: Companies are increasingly adopting eco-friendly production methods. This is achieved through byproducts from steel manufacturing to produce ferrous sulfate. This further reduces waste and emissions from both industries.

- Fortification Programs: Government led iron fortification programs in developing countries increasingly including Ferrous sulfate due to its cost and effectiveness.

- Product Customization: Manufacturers are introducing different ferrous sulfate grades. This include food-grade, technical-grade, and feed-grade. They cater to niche requirements to expand customer base.

- Increased Export Activity: Leading producers in China and India are boosting exports. This is due to growing demand in Africa, South America, and Southeast Asia. These regions are seeing a high rise in infrastructure and agricultural development.

Current and Potential Growth Implications

Demand-Supply Analysis:

While demand is rising consistently across applications, raw material dependence and transportation constraints may occasionally impact supply chains. Regional production hubs in China and India are stepping up to meet global needs, but regulatory pressures on emissions may pose challenges.

Gap Analysis:

One of the major limitations in the market is the limited growth potential in developed regions. Ferrous sulfate is already widely adopted there, which restrains its demand. However, emerging markets offer growth opportunities due to increased awareness and industrial activities. Opportunities also lie in the development of water-soluble and slow-release formulations for agriculture.

Top Companies in the Ferrous Sulfate Market

- Venator Materials PLC

- Crown Technology, Inc.

- Rech Chemical Co., Ltd.

- Verdesian Life Sciences

- Coogee Chemicals Pty Ltd

- Chemifloc Limited

- Changsha Haolin Chemicals Co., Ltd.

- Cleveland Industries

- MM Chemical

- Zouping County Runzi Chemical Industry Co., Ltd.

- Kemira Oyj

- Baowu Clean Energy Co., Ltd.

- Hebei Chengxin Co., Ltd.

- Reagent Chemical & Research, Inc.

- TIB Chemicals AG

Ferrous Sulfate Market: Report Snapshot

Segmentation | Details |

By Product Type | Monohydrate, Heptahydrate, Others |

By Application | Water Treatment, Agriculture, Pharmaceuticals, Pigments & Dyes, Cement Industry, Others |

By End-User | Municipalities, Chemical Manufacturers, Agrochemical Companies, Healthcare Providers, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Ferrous Sulfate Market: High-Growth Segments

- Agriculture: The segment is witnessing significant growth due to the increased demand for micronutrient fertilizers and sustainable farming practices.

- Water Treatment: Continues to dominate due to its role in purifying drinking water and treating industrial effluents.

- Pharmaceuticals: Supplement demand is growing among consumers. This boosts the need for food-grade ferrous sulfate.

Major Innovations

- Granular Formulations: Manufacturers are developing granular and microencapsulated forms for better handling and controlled release in fertilizers.

- Green Sourcing Techniques: New methods now pull out ferrous sulfate during steel making. This helps make the process cleaner and more sustainable.

Ferrous Sulfate Market: Potential Growth Opportunities

- Emerging Markets Rising investment in water and farming systems is boosting demand. Southeast Asia, Africa, and South America now show strong market potential

- R&D in Nutraceuticals: Innovations in supplement formulations are opening new opportunities. Products tailored for sensitive groups like pregnant women and children are in high demand.

- Circular Economy Models: Firms using byproduct recovery and waste reuse for ferrous sulfate production are gaining support. Regulators and green investors view these practices favorably.

Kings Research says:

The ferrous sulfate market is poised for consistent growth as global industries and public health sectors recognize its multifunctionality. Driven by healthcare needs, sustainable farming, and clean water goals, ferrous sulfate is cementing its place across core economic sectors.

With regulatory support, innovation in formulations, and demand from emerging markets, the future of the ferrous sulfate industry is both sustainable and profitable. Companies that invest in green technologies and diverse product offerings are likely to lead this growing market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Ferrous Sulfate Market Size

- June-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021