Carbon Black Market Size, Share, Growth & Industry Analysis, By Type (Furnace Black, Channel Black, Acetylene Black, Thermal Black, Lamp Black), By Application (Tires, Non-Tire Rubber, Plastics, Inks & Coatings, Batteries, Electronics), By End-User (Automotive, Construction, Packaging, Industrial Manufacturing, Electronics), and Regional Analysis, 2024-2031

Carbon Black Market: Global Share and Growth Trajectory

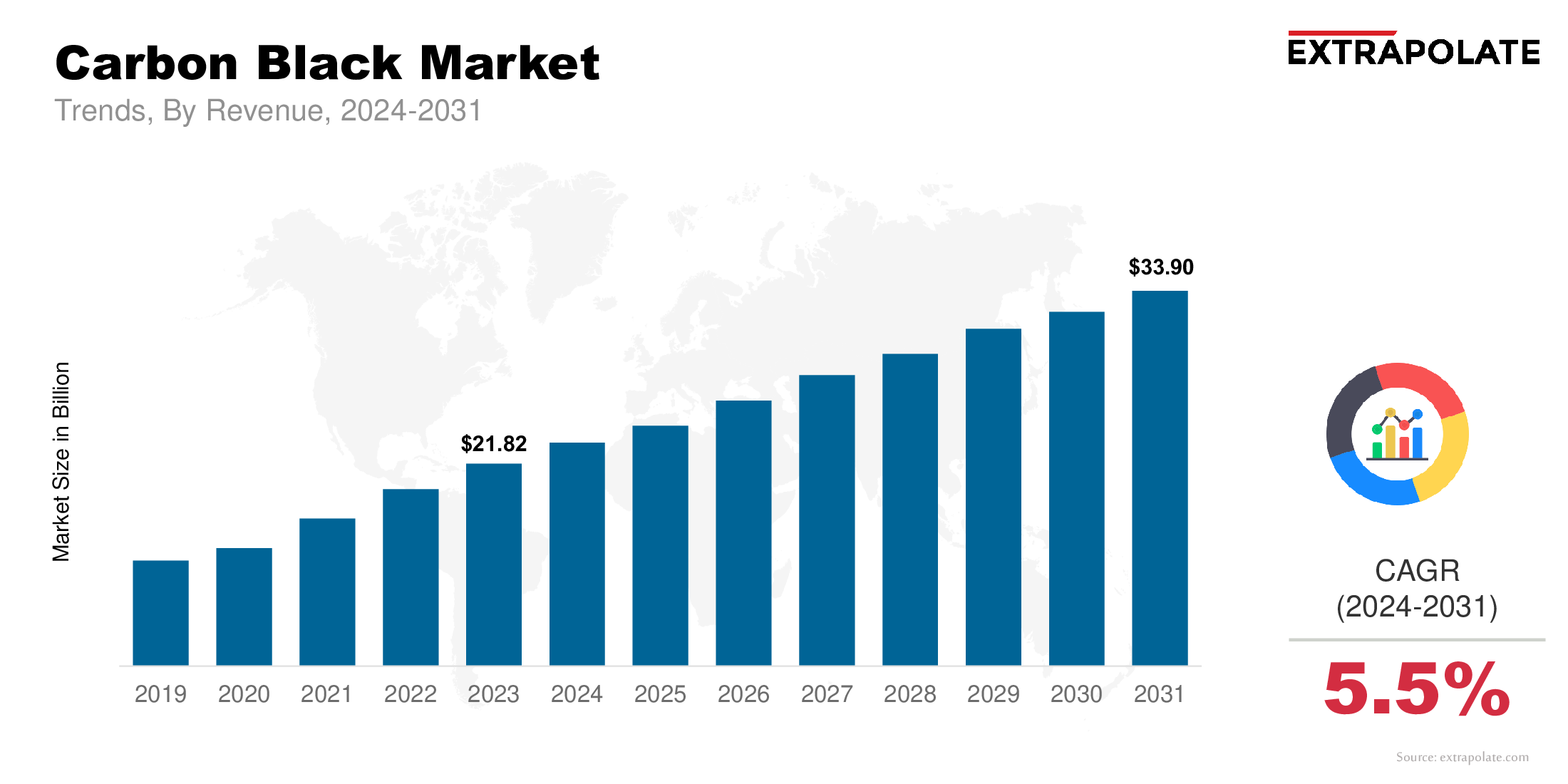

The global Carbon Black Market size was valued at USD 21.82 billion in 2023 and is projected to grow from USD 23.23 billion in 2024 to USD 33.90 billion by 2031, exhibiting a CAGR of 5.5% during the forecast period.

The global market is observing a consistent growth, fueled by significant demand from diverse end-use industries. Carbon black, a fine black powder produced through the incomplete combustion of hydrocarbons, plays a crucial role in manufacturing rubber products, plastics, coatings, and inks. As the world leans into industrial expansion, automotive production, and infrastructure development, the need for carbon black continues to rise.

Its main function as a reinforcing agent in tires and rubber goods, along with growing usage in plastic and conductive applications, has led to widespread adoption. Technological innovations in production processes and the shift toward sustainable manufacturing practices are also driving the market forward. The proliferation of electric vehicles (EVs), growing demand for high-performance materials, and innovation in nanomaterials are redefining the future of the carbon black industry.

With a large number of applications in tire manufacturing and industrial rubber goods, carbon black remains indispensable. As major economies focus on durable construction materials, enhanced automotive components, and eco-friendly alternatives, the global carbon black industry is expected to witness a strong growth trajectory in the coming years.

Key Market Trends Driving Product Adoption

- Growing Demand from the Automotive Industry

The automotive industry remains the largest consumer of carbon black, which accounts for a substantial share of the global market. Used extensively in tire manufacturing, carbon black improves durability, tensile strength, and wear resistance. As automotive sales rebound post-pandemic and electric vehicle (EV) production scales up, tire demand and by extension, carbon black consumption is set to grow. The increase in preference for high-performance and longer-lasting tires further reinforces this trend.

- Expansion in Plastics and Coatings Applications

Beyond tires, carbon black is widely used as a pigment and performance additive in plastics, paints, and coatings. It improves UV protection, conductivity, and coloring. As industries adopt polymeric materials for packaging, construction, electronics, and consumer goods, the utility of carbon black in enhancing product lifespan and appearance is being recognized. Moreover, the packaging sector's growth, driven by e-commerce and food delivery, is fueling the use of carbon black in plastic films and containers.

- Demand for Specialty Carbon Blacks

Specialty carbon blacks offer superior properties like high-purity grades, fine particle size, and electrical conductivity. These are increasingly used in applications like lithium-ion batteries, conductive polymers, and electronic components. As technologies evolve and the need for high-performance materials is surging, specialty carbon black is carving out a distinct and lucrative market segment.

- Rise of Sustainable and Bio-Based Alternatives

Amid mounting environmental concerns, carbon black manufacturers are investing in sustainable production methods. This includes the adoption of circular economy principles, utilizing bio-feedstocks, and recycling end-of-life tires to produce recovered carbon black (rCB). Regulatory pressures and increasing awareness of carbon emissions are encouraging industries to seek greener alternatives while maintaining product performance.

Major Players and their Competitive Positioning

The carbon black market is highly competitive, with both global and regional players vying for dominance. Leading companies in the carbon black industry focus on innovation, strategic acquisitions, and expanding their production capacity to strengthen their market position and meet growing demand across industries. Key players include Cabot Corporation, Orion Engineered Carbons S.A., Birla Carbon, Philips Carbon Black Limited (PCBL), Mitsubishi Chemical Corporation, Continental Carbon Company, Omsk Carbon Group, Tokai Carbon Co., Ltd., China Synthetic Rubber Corporation (CSRC), Denka Company Limited and others.

These players are heavily investing in research and development to improve product performance and change their application areas. Strategic collaborations and expansion into emerging markets are also part of their growth strategies.

Consumer Behavior Analysis

- Performance Expectations in End-Use Applications

Consumers across several industries, especially in automotive and construction, expect carbon black to enhance product performance. In tires, it must provide increased abrasion resistance, fuel efficiency, and heat dissipation. In plastics and coatings, durability, UV protection, and colour consistency are necessary factors that influence purchasing decisions.

- Preference for Sustainable Materials

Industrial consumers are becoming more aware about environmental impacts. This transition is prompting a preference for low-emission and sustainable carbon black products. Recovered carbon black and bio-based variants are attracting attention as more companies seek to align their supply chains with sustainability goals.

- Quality and Regulatory Compliance

End users demand high-quality and consistent carbon black that complies with international standards like REACH, ASTM, and ISO. Manufacturers who can meet strict quality control requirements and offer tailored grades are more likely to secure long-term partnerships with OEMs and industrial buyers.

- Cost Considerations and Supplier Reliability

Price sensitivity remains a key consideration for bulk buyers. However, value-added benefits such as technical support, logistics reliability, and supply chain transparency play a critical role in consumer decisions. Reliable delivery timelines and robust supplier-customer relationships are crucial in industries with tight production schedules.

Pricing Trends

Carbon black pricing is influenced by multiple factors, including:

- Feedstock Costs: Carbon black is traditionally produced from oil- or coal-derived feedstocks such as furnace oil or coal tar. Volatility in global crude oil prices significantly affects production costs and, consequently, carbon black prices.

- Environmental Regulations: Increasing environmental regulations around emissions and waste management are pushing up compliance costs for producers. These costs are often passed on to consumers.

- Regional Disparities: Pricing also differs by region due to transportation costs, import duties, and local supply-demand dynamics. For example, Asia Pacific benefits from cost-effective manufacturing, while prices may be higher in North America and Europe due to stricter environmental norms.

- Recovered Carbon Black: Recovered carbon black (rCB) from recycled tires is entering the market at competitive prices, offering a affordable and sustainable alternative, although still limited in availability and performance parity.

Growth Factors

- Automotive Sector Growth

As automotive production rises worldwide, particularly in emerging markets such as India, China, and Southeast Asia, the demand for carbon black in tire and rubber components is increasing. Innovations in tire technology, which include smart tires and fuel-efficient designs are further boosting the need for high-quality carbon black.

- Industrialization and Infrastructure Development

Ongoing urbanization and infrastructure development especially in emerging economies are expanding the demand for carbon black in construction materials, industrial rubber products, and piping systems. The growth of modern infrastructure calls for durable materials, propelling carbon black demand.

- Rising Demand for Conductive and High-Tech Materials

Electronics and renewable energy industries are turning to conductive carbon black. It enhances the function of batteries, cables, and protective coatings. Electric vehicles and energy storage systems are growing fast. This will drive rapid growth in demand for conductive carbon black.

- Technological Innovations

Advancements in furnace black and thermal black production methods are increasing output efficiency while reducing emissions. The development of nano-carbon black and ultrafine particles opens up new high-margin applications in electronics and aerospace.

Regulatory Landscape

A full set of regulations covers carbon black making and shipping. These laws are made for protecting the environment and public well-being. Key regulatory considerations include:

- Environmental Protection Agency (EPA) Standards (U.S.): Regulations set for emissions from carbon black plants, which include limits on particulate matter, volatile organic compounds (VOCs), and sulfur oxides.

- REACH Compliance (EU): REACH law requires carbon black to be registered and evaluated. This helps make sure it is used safely across the European Union.

- Occupational Safety and Health Regulations: Exposure limits for carbon black dust are enforced at work. These limits help avoid lung and breathing problems.

- ISO Standards: International standards for product quality and manufacturing consistency, including ISO 9001 (quality management) and ISO 14001 (environmental management), are widely adopted.

Recent Developments

- Recovered Carbon Black (rCB) Innovations: Scandinavian Enviro Systems and Pyrolyx are innovating sustainable recycled carbon black (rCB) technology from used tires, aiming to minimize landfill waste and harmful emissions.

- Capacity Expansions: New production sites are being built by Birla Carbon and Cabot Corporation in Asia and North America. These plants are meant to satisfy higher demand and improve delivery speed.

- Strategic Acquisitions: Orion acquired companies that make specialty carbon black. This expands what they can sell and strengthens their position in global markets.

- Digitalization in Manufacturing: Producers adopt digital tools to move faster. These tools improve how they handle maintenance, quality checks, and supply chains.

The market is moving toward green habits. It supports fresh ideas and aims for steady, sustainable growth.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Strong sector demand meets supply pressure in the carbon black market, restricted by feedstock limits, environmental caps, and high expansion costs. As more players invest in CB and decentralized plants, supply chain flexibility is expected to improve.

b. Gap Analysis

Although carbon black enjoys wide industrial adoption, key gaps remain:

- Sustainability: Carbon black is produced by burning fossil fuels. These emissions comprise harmful gases and particles that damage air quality and climate. Scaling up bio-based or recovered alternatives remains a challenge.

- Cost Accessibility in Emerging Markets: High capital costs and regulatory barriers limit the deployment of advanced carbon black in resource-constrained regions.

- Product Standardization: Variations in performance characteristics across suppliers can impact end-use reliability. Standardizing specialty grades can unlock broader usage.

Top Companies in the Carbon Black Market

- Cabot Corporation

- Orion Engineered Carbons

- Birla Carbon

- Philips Carbon Black Limited

- Continental Carbon Company

- Mitsubishi Chemical Corporation

- Tokai Carbon Co., Ltd.

- Omsk Carbon Group

- China Synthetic Rubber Corporation (CSRC)

- Denka Company Limited

Carbon Black Market: Report Snapshot

Segmentation | Details |

By Type | Furnace Black, Channel Black, Acetylene Black, Thermal Black, Lamp Black |

By Application | Tires, Non-Tire Rubber, Plastics, Inks & Coatings, Batteries, Electronics |

By End-User | Automotive, Construction, Packaging, Industrial Manufacturing, Electronics |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Tires and Automotive Components: The push for fuel-saving tires keeps carbon black use strong in auto production.

- Conductive Applications: Demand for conductive carbon black keeps increasing across batteries, electronics, and ESD materials.

- Recovered Carbon Black: A growing niche segment that aligns with circular economy and sustainability goals.

Major Innovations

- Nano-Carbon Black Particles: Enabling high-end electronics and conductive polymer applications.

- Sustainable Feedstock Integration: Utilizing biomass or pyrolysis oil to reduce carbon footprint.

- Smart Coatings and Pigments: Carbon black used in thermal coatings, smart windows, and anti-corrosion surfaces.

Potential Growth Opportunities

- EV and Battery Manufacturing: As EV production scales, carbon black’s role in anode materials, insulation, and coatings will grow.

- Emerging Markets Expansion: Countries in Asia, Africa, and Latin America offer untapped potential with rising industrialization.

- Innovation in Recovered Carbon Black: Enhancing rCB quality through purification and customization can open high-value applications.

- R&D Partnerships: Collaborations between chemical companies, universities, and battery manufacturers are leading to new carbon black innovations.

Extrapolate Research says:

The carbon black market is seeing steady global growth, especially in Asia-Pacific and industrial zones. Carbon black plays a key role in improving strength, life, and sustainability of materials amid industrial and scientific progress. To grow and stay compliant, businesses must align with eco-friendly production and innovate effectively.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Carbon Black Market Size

- June-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021