Vehicle Tracking Device Market Size, Share, Growth & Industry Analysis, By Product Type (Standalone Tracker, OBD Device, Advance Tracker with AI/ML Capabilities) By Application (Fleet Management, Asset Tracking, Driver Behavior Monitoring, Theft Prevention) By Connectivity (2G, 3G, 4G/LTE, 5G, NB-IoT, Satellite) By End-User (Logistics, Transportation, Construction, Personal Vehicles, Government), and Regional Analysis, 2024-2031

Vehicle Tracking Device Market: Global Share and Growth Trajectory

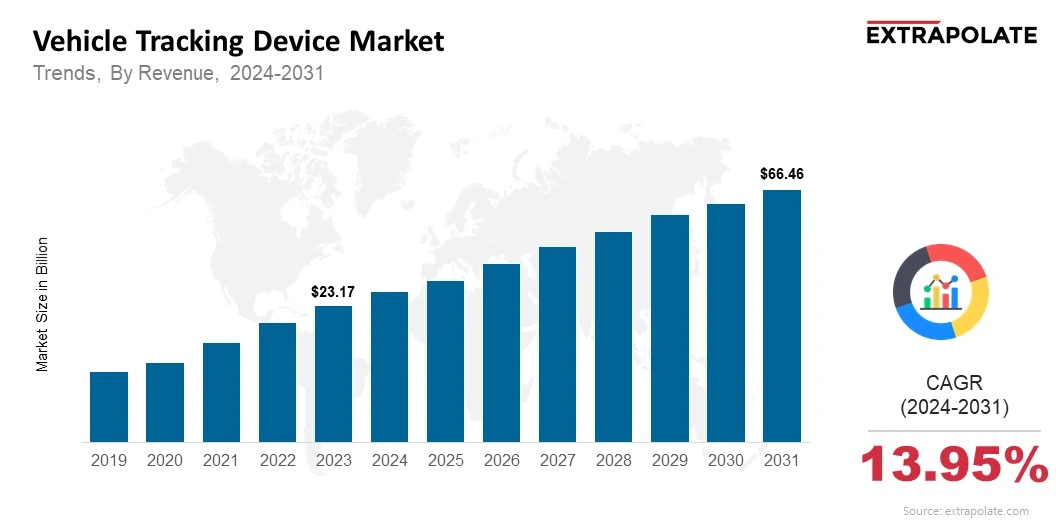

The global Vehicle Tracking Device Market size was valued at USD 23.17 Billion in 2023 and is projected to grow from USD 26.63 Billion in 2024 to USD 66.46 Billion by 2031, exhibiting a CAGR of 13.95% during the forecast period.

The vehicle tracking device market is growing rapidly as the need for real time vehicle monitoring, enhanced fleet management and increasing vehicle security concerns is increasing. Businesses, transportation services, logistics operators and even private vehicle owners are integrating vehicle tracking technologies in their operations and daily life.

These systems embedded with GPS (Global Positioning System), GSM (Global System for Mobile Communication) and IoT (Internet of Things) are designed to provide accurate real time location data, improve route optimization, ensure fuel efficiency and boost overall safety.

This growth is driven by a combination of advanced telematics, stringent regulatory mandates for vehicle tracking and growing emphasis on operational efficiency and driver behavior analytics. As technology continues to evolve with artificial intelligence, 5G connectivity and cloud based platforms, vehicle tracking systems are becoming more intelligent, versatile and indispensable in a connected transportation ecosystem.

Applications are diverse – from tracking commercial fleets and ride sharing vehicles to ensuring security in private vehicles and public transportation systems. As the global automotive industry is undergoing digital transformation, the vehicle tracking device market is poised for big and sustained growth.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Fleet Management Solutions

One of the biggest trend is the surge in demand for comprehensive fleet management solutions. Companies operating large fleets especially in logistics, e-commerce and public transportation sectors are increasingly relying on vehicle tracking systems to boost productivity. These solutions provide real time route tracking, optimize delivery schedules, monitor driver behavior and help with predictive maintenance. The results are fuel savings, reduced idle times and better customer service.

IoT and AI

IoT and AI is redefining the vehicle tracking landscape. IoT sensors in tracking devices collect multiple data points which AI algorithms process to generate insights. These innovations are enabling predictive analytics, driver scoring, fuel efficiency alerts and even real time route adjustments. The outcome is smarter decision making, reduced operational costs and increased vehicular uptime.

Government Regulations for Safety and Compliance

Governments across various regions are mandating vehicle tracking systems especially in commercial vehicles to promote road safety, track emissions and ensure compliance with transportation norms. For example, India’s AIS 140 regulation mandates GPS tracking devices and emergency buttons in all public transport vehicles. Such regulations are driving growth.

Vehicle Theft Concerns

Vehicle theft is a big concern. Vehicle tracking devices with geofencing and immobilization are becoming popular anti-theft solution. Consumers and businesses are buying these devices for extra security and peace of mind.

Major Players and their Competitive Positioning

The vehicle tracking device market is competitive, with companies striving to innovate and offer integrated, intelligent, and scalable tracking solutions. The key players dominating the landscape include: - Verizon Connect, Geotab Inc., TomTom Telematics (acquired by Bridgestone), CalAmp Corp., Continental AG, Robert Bosch GmbH, Trimble Inc., Teltonika, Orbcomm Inc., Trackimo

These companies are heavily investing in R&D, forming strategic alliances, acquiring niche players, and rolling out cloud-based fleet management platforms. They aim to provide end-to-end solutions that go beyond tracking—encompassing route optimization, driver behavior analytics, compliance reporting, and fuel management.

Consumer Behavior Analysis

Shift Toward Real-Time Monitoring

Consumers, both individual vehicle owners and fleet operators, are increasingly seeking real-time tracking capabilities. The demand for 24/7 access to vehicle data, notifications on deviations, and emergency support has made live GPS monitoring an essential feature in modern vehicle tracking systems.

Preference for User-Friendly Interfaces

There is a noticeable preference for tracking devices that are easy to install, intuitive to operate, and accessible via mobile apps. Consumers are also demanding dashboards that offer consolidated views, customizable alerts, and integration with third-party platforms like ride-sharing or delivery management systems.

Cost-Conscious Adoption

Although high-end tracking devices come with an array of features, cost continues to be a deciding factor for many consumers. Subscription-based pricing models, bundled services, and hardware-as-a-service options are becoming popular, particularly among SMEs that require robust tracking but have limited capital expenditure budgets.

Emphasis on Data Privacy

As systems grow in power and detail, they collect more personal data. Users are more aware of how that data is stored and shared. Strong encryption and open data policies help build customer trust. Compliance with GDPR and other laws gives firms an edge.

Pricing Trends

Price varies by tech and size. More functions mean higher cost. Low-cost GPS devices range from $20 to $50 and offer simple tracking. High-end systems with smart features like AI and fuel monitoring go beyond $200.

Monthly software costs vary by features. Each vehicle may cost $10 to $50. Cloud-based SaaS is on the rise. Many tracking systems now follow this model. Leasing gear and bundling upkeep helps firms. They get more while spending less.

Growth Factors

Technological Advancements

New tech like GPS, 5G, and AI is changing tracking. These tools make systems faster and smarter. Tech upgrades improve accuracy. They also speed up data and add new functions.

Booming E-Commerce and Logistics Sector

On-demand services are on the rise. They need strong fleet tracking to stay efficient. Last-mile and long-haul fleets use trackers. This helps cut costs and adds clear oversight.

Urbanization and Smart City Initiatives

Modern cities face growing traffic jams. Pollution levels are also becoming a major concern. Many cities are going smart with transport. Tracking tech plays a key role in this shift. Smart tracking systems guide traffic better. They track jams and improve bus and train routes.

Increasing Commercial Vehicle Production

More commercial vehicles are being made and used globally. As a result, tracking systems are seeing strong market growth. OEMs are even beginning to integrate tracking capabilities into vehicles during manufacturing stages.

Regulatory Landscape

Vehicle tracking is shaped by strict rules. These vary across areas and types of vehicles. Key regulatory highlights include:

- AIS 140 (India): Public vehicles must have GPS trackers by law. A panic button is also needed to handle emergencies.

- ELD Mandate (USA): Under FMCSA rules, trucks must use e-logs with GPS tracking. This helps monitor work hours and improve road safety.

- EU Regulations: New cars in Europe must follow eCall rules. They need built-in tracking for fast crash response.

- ISO/TS 16949: Global rules help manage quality for auto suppliers. This also covers makers of tracking devices.

Policies are forcing changes in tracking tech. Firms need systems that work well and follow rules.

Recent Developments

Recent developments reflect growing innovation and consolidation within the market:

- Verizon Connect launched AI Dashcams that integrate vehicle tracking with driver behavior analysis, and enable real-time coaching and accident analysis.

- Geotab surpassed 3 million connected vehicles on its platform, cementing its status as a global leader in telematics solutions.

- Teltonika introduced LTE Cat M1/NB-IoT vehicle trackers, optimized for low-power, wide-area networks, ideal for large-scale fleet operations.

- Trackimo introduced universal tracking solutions with global SIM card support, allowing seamless international tracking for logistics companies.

- M&A Activity: Bridgestone and Trimble made key moves in tracking. These show a shift toward full supply chain integration.

These milestones highlight constant change. They reflect strong funding for smarter tracking.

Current and Potential Growth Implications

Demand-Supply Analysis

Rising demand pushes higher production. Makers are also adding advanced functions to devices. The main challenge is mixing low cost with smart features. This helps serve both small fleets and big logistics firms.

Gap Analysis

Vehicle tracking is common in advanced markets. Emerging areas face high costs and poor digital support. This challenge brings new market chances. Simple and flexible tools can meet local needs. Companies target underserved areas with budget models. These come with only key features.

Top Companies in the Vehicle Tracking Device Market

- Verizon Connect

- Geotab Inc.

- TomTom Telematics

- CalAmp Corp.

- Continental AG

- Robert Bosch GmbH

- Trimble Inc.

- Teltonika

- Orbcomm Inc.

- Trackimo

Vehicle Tracking Device Market: Report Snapshot

Segmentation | Details |

By Product Type | Standalone Tracker, OBD Device, Advance Tracker with AI/ML Capabilities |

By Application | Fleet Management, Asset Tracking, Driver Behavior Monitoring, Theft Prevention |

By Connectivity | 2G, 3G, 4G/LTE, 5G, NB-IoT, Satellite |

By End-User | Logistics, Transportation, Construction, Personal Vehicles, Government |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Vehicle Tracking Device Market: High-Growth Segments

- AI-Enabled Trackers: -AI helps systems watch driver habits and spot problems early. This supports fast and smart decisions.

- 5G-Connected Systems: - Low delay and high speed make 5G ideal for tracking. These devices work well in dense zones.

- Fleet Management in E-Commerce: - E-commerce growth fuels the need for smart delivery tools. Tracking systems now include routing and real-time updates.

Major Innovations

- Driver Scorecards and Dashcams: Tracking location, behavior, and video gives key insights. These tools improve driver habits and reduce risks.

- Remote Immobilization: If a car is stolen or used without permission, it can be shut down remotely. This is done through linked mobile apps.

- Smart Geofencing: With set zones, users get alerts on movement. It shows if a vehicle enters or exits key areas.

Vehicle Tracking Device Market: Potential Growth Opportunities

- Emerging Markets Expansion: As digital access grows in these regions, new markets open. Companies can offer tracking tools for transport at lower costs.

- Electric Vehicle Integration: As EVs rise, so does the need for smart tools. Systems that track and monitor power add real value.

- Connected Mobility Solutions: Linking with MaaS, smart parking, and live traffic tools adds value. These features open up new market growth.

Extrapolate Says:

More people and firms are using tracking tools. The market will grow sharply in the forecast period. Security concerns and fleet use are on the rise. These, along with rules, keep the market expanding. New tech like AI, cloud, and better links is changing tracking tools. They now support smart and connected travel.

Businesses aim to work safer and faster. Governments also push for clear and trusted tracking systems. Offering value and user-friendly tools sets brands apart. It keeps them strong in a changing market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Vehicle Tracking Device Market Size

- July-2025

- 140

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021