Traffic Simulation Systems Market Size, Share, Growth & Industry Analysis, By Product Type (Microscopic Simulation, Macroscopic Simulation, Mesoscopic Simulation, Hybrid Simulation), By Application (Urban Planning, Traffic Management, Infrastructure Development, Emergency Response Planning, Autonomous Vehicle Testing), By End-User (Government Agencies, Transportation Consultants, Academic & Research Institutions, Private Mobility Companies), and Regional Analysis, 2024-2031

Traffic Simulation Systems Market: Global Share and Growth Trajectory

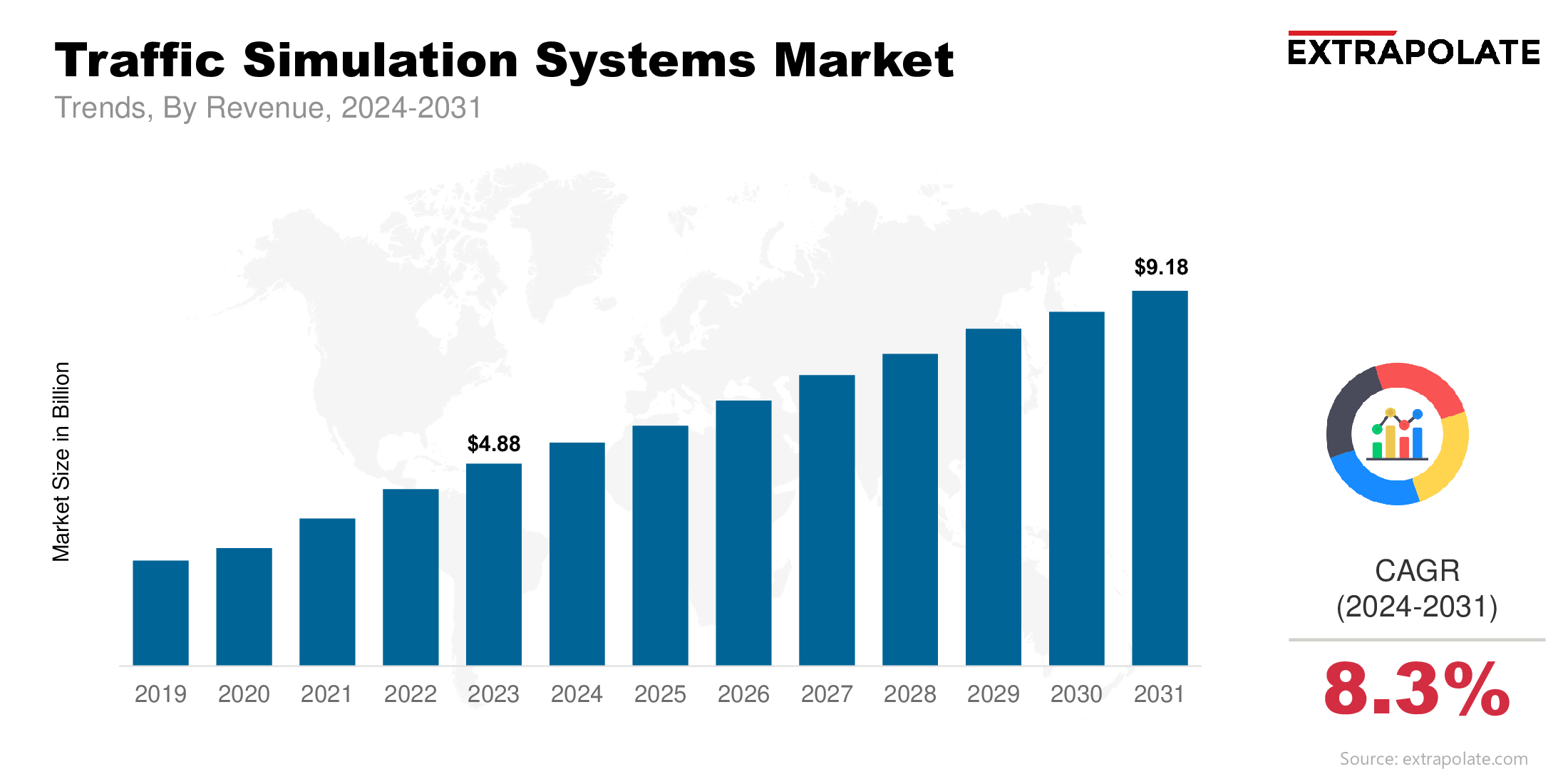

The global traffic simulation systems market size was valued at USD 4.88 billion in 2023 and is projected to grow from USD 5.25 billion in 2024 to USD 9.18 billion by 2031, exhibiting a CAGR of 8.30 % during the forecast period.

The global market is expanding quickly. This growth comes from the demand for smart transportation, the rise of smart cities, and the complex nature of urban mobility. As cities face congestion, limited infrastructure, and changing transit patterns, simulation systems are vital for traffic planning and management. These platforms create a virtual space to model, test, and optimize transportation strategies before real-world use, saving time and costs while reducing risks.

North America and Europe lead the market due to established transportation infrastructure, proactive government support, and high investments in smart mobility. However, the Asia-Pacific region is growing fast because of rapid urbanization, rising vehicle ownership, and significant infrastructure investments. Countries like China and India are using traffic simulation systems to tackle city congestion and support long-term planning.

Market players are responding to this demand with improved simulation platforms that include artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) technologies. These innovations allow for real-time data collection, predictive analytics, and adaptive modeling, improving accuracy and responsiveness. The rise of connected and autonomous vehicles (CAV) is also creating new simulation requirements, especially for testing interactions in busy urban environments.

Moreover, cloud-based simulation tools are gaining popularity. They provide scalable access and help with collaborative planning across multiple agencies. As cities prioritize sustainability, traffic simulation systems are being used to assess emissions reduction strategies and promote low-carbon transportation options.

Key Market Trends Driving Product Adoption

Several key trends are boosting the adoption of traffic simulation systems worldwide:

- Smart City Development: The growth of smart cities increases the demand for integrated traffic management solutions. City planners use simulation tools to study the effects of projects and improve urban mobility. These systems help test new policies like congestion charges before city-wide implementation.

- Advancements in AI and Predictive Analytics: Traffic simulation systems are getting smarter with AI and machine learning. These upgrades support dynamic scenario planning and real-time predictions, enabling transportation agencies to anticipate congestion and respond quickly to incidents.

- Connected and Autonomous Vehicles (CAV): As connected and autonomous vehicles enter public roads, simulation systems must adjust to model their interactions with regular traffic. Developers and regulators use these platforms to analyze CAV behavior in mixed traffic and test new technologies under various conditions.

- Sustainability Goals and Environmental Impact: Governments face pressure to meet emissions targets and enhance air quality. Traffic simulation is vital for modeling the environmental effects of transport projects and assessing the success of green mobility policies, like low-emission zones and public transport expansion.

Major Players and Their Competitive Positioning

The traffic simulation systems industry thrives on innovation and strategic partnerships. Leading technology firms, software developers, and transportation solution providers are investing heavily in research and development to gain an edge. Major players include PTV Group (a part of Umovity), Aimsun (a Siemens company), TransModeler (developed by Caliper Corporation), Paramics (by Quadstone/Siemens), TSS-Transport Simulation Systems, Citilabs (Cube), INRO (Emme, Dynameq), AnyLogic, Arcadis, Dassault Systèmes and others.

These companies are constantly improving their simulation engines, offering cloud platforms, and integrating with traffic sensors and GIS systems. Partnerships with government agencies and mobility-as-a-service (MaaS) providers are shaping the competition.

Consumer Behavior Analysis

Traffic simulation systems are mainly used by public sector entities, engineering firms, research institutions, and private mobility companies. Key factors influence purchasing and usage patterns:

- Project-Driven Demand: Users often invest in simulation tools for specific projects. Demand fluctuates based on government budgets, regulations, and urban development schedules.

- Shift Toward Cloud-Based Platforms: With digital transformation, cloud traffic simulation solutions are gaining popularity. These platforms provide scalability, remote access, and collaboration features, attracting multi-disciplinary teams.

- User Experience and Interface Intuitiveness: As more stakeholders use simulation tools, intuitive interfaces and customizable dashboards are becoming essential selection criteria.

- Data Integration Capabilities: A simulation tool's ability to pull data from various sources—like traffic sensors, GPS, and mobile apps—affects adoption rates. Users want systems that easily integrate with existing ITS infrastructure.

Pricing Trends

Pricing for traffic simulation systems varies widely based on software scope, complexity, and application. Key pricing factors include:

- Type of Software License: Solutions may be perpetual licenses or subscription-based SaaS models. The latter is popular due to its lower upfront costs and scalability.

- User Access and Features: Multi-user access, cloud deployment, and advanced simulation modules (like pedestrian modeling) come at a premium.

- Support and Customization: Vendors offer add-ons, such as technical support and training, which increase overall costs.

While initial costs for full-featured platforms may be high, the long-term benefits—better infrastructure planning and reduced congestion—make them valuable investments.

Growth Factors

The global market is expanding due to several drivers:

- Urban Population Growth and Infrastructure Strain: Rapid urbanization has stressed many cities' transportation systems. Traffic simulation helps city planners test congestion strategies before implementation.

- Rising Investments in Smart Mobility: Governments and private sectors are investing in smart mobility solutions, including real-time traffic management. Simulation tools are vital for designing these solutions.

- Emergence of Mobility-as-a-Service (MaaS): The rise of integrated, on-demand transportation services have made traffic networks more complex. Simulation systems model these dynamic flows and optimize service deployment.

- Resilience Planning Post-COVID-19: The pandemic highlighted the need for flexible transport planning. Traffic simulation systems are used to reassess transit patterns and emergency strategies, continuing to shape climate resilience planning.

Regulatory Landscape

Traffic simulation systems aren't typically regulated as standalone technologies, but they must follow broader transportation guidelines. In many areas:

- Transportation agencies require simulation models to comply with frameworks like the Highway Capacity Manual (HCM) and Federal Highway Administration (FHWA)

- In the European Union, simulation tools for public infrastructure projects must meet environmental and traffic modeling norms under EU Sustainable Urban Mobility Plans (SUMPs).

- Projects using simulations for autonomous vehicle integration or safety planning may face additional reviews by safety boards or research institutes.

Recent Developments

Several developments are influencing the market:

- Digital Twin Integration: More cities are creating digital twins of their urban areas. Traffic simulation is essential in these models, providing real-time data for decision-making.

- Open Data Ecosystems: Governments are sharing transportation datasets via open APIs. Simulation platforms are adapting to visualize this data effectively, enhancing transparency and collaboration.

- AI-Powered Scenario Testing: Vendors are adding AI modules that autonomously create and evaluate numerous traffic scenarios. This speeds up planning and boosts recommendation reliability.

- Simulation for EV Infrastructure Planning: The rise of electric vehicles requires new infrastructure. Simulation tools assist planners in finding optimal charging station locations and assessing their traffic impacts.

Current and Potential Growth Implications

a. Demand-Supply Analysis: Demand for simulation systems is outpacing traditional supply models. Cloud-based solutions and modular licensing are helping. However, a shortage of trained traffic engineers and data analysts slows full technology adoption.

b. Gap Analysis: A major challenge is the gap in adoption between developed and developing nations. North America and Europe lead in simulation use, while Asia, Africa, and Latin America lag due to budget constraints and lack of expertise. Bridging this gap needs capacity-building initiatives and localized solutions.

Top Companies in the Traffic Simulation Systems Market

- PTV Group (Umovity)

- Aimsun (Siemens)

- Caliper Corporation (TransModeler)

- Quadstone/Siemens (Paramics)

- TSS-Transport Simulation Systems

- Citilabs (Cube)

- INRO (Dynameq, Emme)

- AnyLogic

- Arcadis

- Dassault Systèmes

Traffic Simulation Systems Market: Report Snapshot

Segmentation | Details |

By Product Type | Microscopic Simulation, Macroscopic Simulation, Mesoscopic Simulation, Hybrid Simulation |

By Application | Urban Planning, Traffic Management, Infrastructure Development, Emergency Response Planning, Autonomous Vehicle Testing |

By End-User | Government Agencies, Transportation Consultants, Academic & Research Institutions, Private Mobility Companies |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Microscopic Simulation: This segment is growing quickly. It details individual vehicle movements, making it perfect for autonomous vehicles and smart cities.

- Urban Planning and Infrastructure Development: These applications generate significant revenue. Governments focus on sustainable and efficient urban growth.

Major Innovations

- AI-Driven Scenario Modeling: AI now allows simulations to adjust traffic control in real time, mimicking adaptive traffic signals.

- Cloud-Based Collaborative Platforms: New platforms enable engineers, policymakers, and developers to collaborate from different locations.

- VR and Immersive Simulation: Virtual reality lets users explore simulated environments, improving stakeholder engagement and public consultations.

Potential Growth Opportunities

- Expansion into Emerging Economies: As infrastructure investment increases in developing areas, demand for affordable simulation tools will rise.

- Integration with 5G and Edge Computing: These technologies will boost real-time traffic modeling, especially for autonomous vehicle testing and smart signal control.

- Synergy with Climate Action Initiatives: Simulation systems that assess transport carbon footprints will help cities achieve emission reduction targets.

Extrapolate Research says:

The traffic simulation systems market is set for significant growth in the coming years. Urban challenges are getting more complex, making simulation tools essential for infrastructure planning and traffic management. With technologies like AI, cloud computing, and digital twins improving their functions, these systems enable data-driven decisions in transportation.

The rise of smart cities, sustainable mobility, and the integration of connected and autonomous vehicles are speeding up market adoption. Stakeholders who invest early in strong simulation platforms will be well-positioned for the next era of intelligent transportation planning.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Traffic Simulation Systems Market Size

- June-2025

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021