Oil & Gas Automation Market Size, Share, Growth & Industry Analysis, By Solution Type (Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), Safety Instrumented Systems (SIS), Others), By End-User (Upstream, Midstream, Downstream), By Technology (IoT, AI, Cloud Computing, Machine Learning, Big Data Analytics), and Regional Analysis, 2024-2031

Oil & Gas Automation Market: Global Share and Growth Trajectory

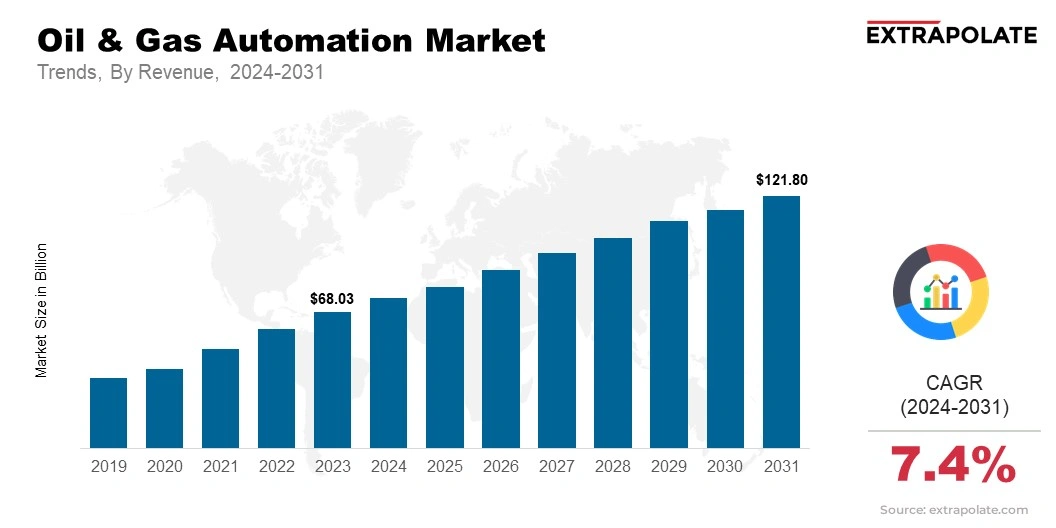

The global Oil & Gas Automation Market size was valued at USD 68.03 billion in 2023 and is projected to grow from USD 71.71 billion in 2024 to USD 121.80 billion by 2031, exhibiting a CAGR of 7.4% during the forecast period.

The global oil & gas automation market is registering significant evolution as the sector opts for digital solutions and automation technology to improve efficiency. Automation technologies serve as the need of the hour in extending the operational efficiency, cutting down on the costs, and enhancing the decision cycles at all levels of operation.

Market dynamics are influenced by growing focus on safety, eco-friendly practices and the utilization of IoT, AI and machine learning. As oil and gas companies are progressively adopting advanced automation solutions, the market is expected to grow at a fast pace in the years ahead.

Key Market Trends Driving Product Adoption

A wide range of factors are propelling the integration of automation in the oil & gas industry:

- Digital Transformation: The oil & gas sector is undergoing a major digital transformation. This transformation includes adopting automation technologies like IoT, AI, big data, and cloud computing. These technologies streamline processes, strengthen asset management, and improve safety procedures.

- Cost Optimization: Oil & gas companies face rising operational expenses. They are therefore prioritizing automation solutions. These solutions enhance efficiency, minimize downtime, and reduce maintenance costs. Automation also enables predictive maintenance, preventing disruptions and extending asset lifespan.

- Enhanced Safety and Risk Management: Automation technologies are increasingly used to improve safety in harsh environments. Automated monitoring, remote control, and AI-driven predictive models help minimize accidents. These technologies ensure safer operations.

- Sustainability and Environmental Concerns: The oil & gas industry faces increasing pressure to reduce its environmental impact. Automation solutions, such as high-efficiency equipment and advanced control systems, promote sustainability. They achieve this by reducing emissions and improving resource utilization.

Major Players and Their Competitive Positioning

This market is extremely competitive and several global as well as international players are delivering innovative automation solutions for oil & gas industry. Key Market Players Schneider Electric, Siemens, Rockwell Automation, Emerson Electric, Honeywell, ABB.

These leading firms provide integrated automation systems, pioneering control mechanisms, and total digital solutions that are transforming the market and replacing the traditional industrial models. They are also targeting towards diversifying their product portfolio through strategic collaboration, merger & acquisition and investment in R&D to meet the evolving needs of the oil & gas industry .

Consumer Behavior Analysis

The integration of automation technologies in the oil & gas industry is largely influenced by:

- Operational Efficiency: Companies are increasingly using automation. This maximizes productivity, reduces human error, and improves accuracy in complex process management.

- Cost and Time Savings: Automation optimizes labor efficiency. It also enhances productivity and reduces downtime. This leads to significant long-term cost savings.

- Safety and Compliance: Companies prioritize safety and regulatory compliance. Automation technologies enable real-time tracking of critical systems. They also allow for immediate action against emerging threats.

Pricing Trends

Automation systems pricing in the oil & gas industry is determined by a variety of parameters, including technology sophistication, deployment level, and geography. Although basic automation solutions can be efficient, advanced solutions that come merged with AI, machine learning, and cloud technologies are generally priced at a premium.

The cost of installation and maintenance forms the primary factor for pricing. At the same time, as demand for automation systems expands especially in developing markets prices are anticipated to become more aggressive, focusing toward delivering maximum value and budget-friendly solutions.

Growth Factors

Factors are facilitating the progress of the oil & gas automation market:

- Rising Energy Demand: The escalating demand on a global scale for oil and gas is motivating businesses to streamline their processes via automation to achieve increased production goals while reducing expenses.

- Technological Advancements: Advancements in automation technologies, including IoT, AI, and cloud-based solutions, are driving the expansion of the market by enhancing operational efficiency and smarter operations.

- Improved Data Analytics: The power to collect and process vast amounts of data in real-time with the help of automation systems is optimizing decision processes and fueling operational advancements in the oil & gas industry.

- Regulatory Pressure: Governments and regulatory bodies are enforcing more rigorous environmental policies, pushing oil & gas companies to integrate automation solutions that cut down emissions and strengthen sustainable operations.

Regulatory Landscape

When deploying Oil & gas automation solutions, compliance is required to be in accordance with security, environmental, operational standards as defined by international and local regulatory bodies. Commands such as the U.S. EPA’s Clean Air Act and the European Union’s environmental directives compel the implementation of old technology in enterprises, which decrease ecological footprints and enhance operational safety. Automation systems play a significant role in guaranteeing adherence by allowing constant monitoring and reporting of key performance indicators focused on safety and environmental regulations.

Recent Developments

The oil & gas automation market has experienced various remarkable changes:

- AI Integration: Top companies are incorporating AI and machine learning into their automation solutions to enhance predictive analytics, streamline drilling operations, and improve instant decision-making.

- IoT and Remote Monitoring: The implementation of IoT-enabled devices and sensors for remote monitoring and control of oil & gas assets is becoming more sidespread, enabling companies to observe equipment health, track production, and optimize utilization of resources.

- Sustainability Initiatives: Companies are progressively focusing on sustainability and are adopting automation technologies to optimize energy efficiency, minimize emissions, and meet environmental objectives.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The demand for oil & gas automation solutions is highly associated with the expansion of the oil & gas industry and the advancing intricacy of processes. Supply-side challenges involve the requirement of a skilled workforce to execute and sustain automation systems and the expenses of creating advanced technologies.

b. Gap Analysis

There are multiple possibilities in the market:

- Integration with Emerging Technologies: The integration of blockchain, AI, and machine learning with automation systems can unlock new avenues for improvement of the process and predictive maintenance.

- Expansion in Emerging Markets: The increase in demand for oil & gas in emerging markets represents potential chances for automation solution providers to offer affordable and flexible solutions.

- Remote Control and Monitoring: The growth in the implementation of remote monitoring and control systems in oil & gas operations is opening new doors for exin the automation space.

Top Companies in the Oil & Gas Automation Market

- Schneider Electric

- Siemens

- Rockwell Automation

- Emerson Electric

- Honeywell

- ABB

- Yokogawa Electric

- Mitsubishi Electric

- GE Digital

- Mitsubishi Heavy Industries

Oil & Gas Automation Market: Report Snapshot

Segmentation | Details |

By Solution Type | Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), Safety Instrumented Systems (SIS), Others |

By End-User | Upstream, Midstream, Downstream |

By Technology | IoT, AI, Cloud Computing, Machine Learning, Big Data Analytics |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following segments are projected to see substantial progress:

- Predictive Maintenance: Predictive maintenance solutions are gaining traction. These solutions use AI and machine learning. They anticipate equipment failures and optimize maintenance schedules.

- Cloud-Based Solutions: The oil & gas industry is rapidly adopting cloud computing. This is driving demand for cloud-based automation solutions. These solutions offer scalability, flexibility, and real-time data.

- Remote Monitoring and Control: Oil & gas operations increasingly require operational safety and effectiveness. This is driving the adoption of remote monitoring and control systems.

Major Innovations

Innovation in oil & gas automation is aimed at improving efficiency, security, and decision-making processes:

- AI and IoT Integration: AI is being combined with IoT-enabled devices. This improves forecasting, real-time monitoring, and decision-making in oil & gas operations.

- Blockchain for Data Security: Blockchain technology is being integrated with automation systems. This enhances data security, reduces fraud risks, and improves supply chain visibility in oil & gas.

- Advanced Data Analytics: Automation solutions offer advanced data analytics. These solutions streamline operations, minimize costs, and maximize resource utilization.

Potential Growth Opportunities

Major growth opportunities in the oil & gas automation market:

- Expansion into Emerging Markets: The oil & gas automation market is set for substantial growth in emerging markets. Rising infrastructure investments and energy demand in these regions are driving the adoption of automation technologies.

- Technological Advancements: Advanced technologies like AI, cloud computing, and IoT are constantly improving. This will create new growth opportunities in the market.

- Sustainability Initiatives: Demand for sustainable automation solutions is rising. This will create new growth opportunities. Solutions that improve sustainability and minimize environmental impact will be particularly in demand.

Extrapolate Research says:

Driven primarily on the back of technological innovations, a sheer will toward cost containment, and a heightened focus on safety and environmental sustainability, the oil & gas automation market is poised for a spectacular growth trajectory. Future of the industry will no doubt be influenced by automation solutions using tools like AI, IoT and cloud computing.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Oil Gas Automation Market Size

- February-2025

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021