Low-Powered Electric Motorcycle and Scooter Market Size, Share, Growth & Industry Analysis, By Vehicle Type (Electric Scooter, Electric Motorcycle), By Battery Type (Sealed Lead Acid, Lithium-Ion, Others), By Voltage (36V, 48V, 60V, 72V and Above), By Application (Personal, Commercial (Delivery, Sharing)), and Regional Analysis, 2024-2031

Low-powered Electric Motorcycle and Scooter Market: Global Share and Growth Trajectory

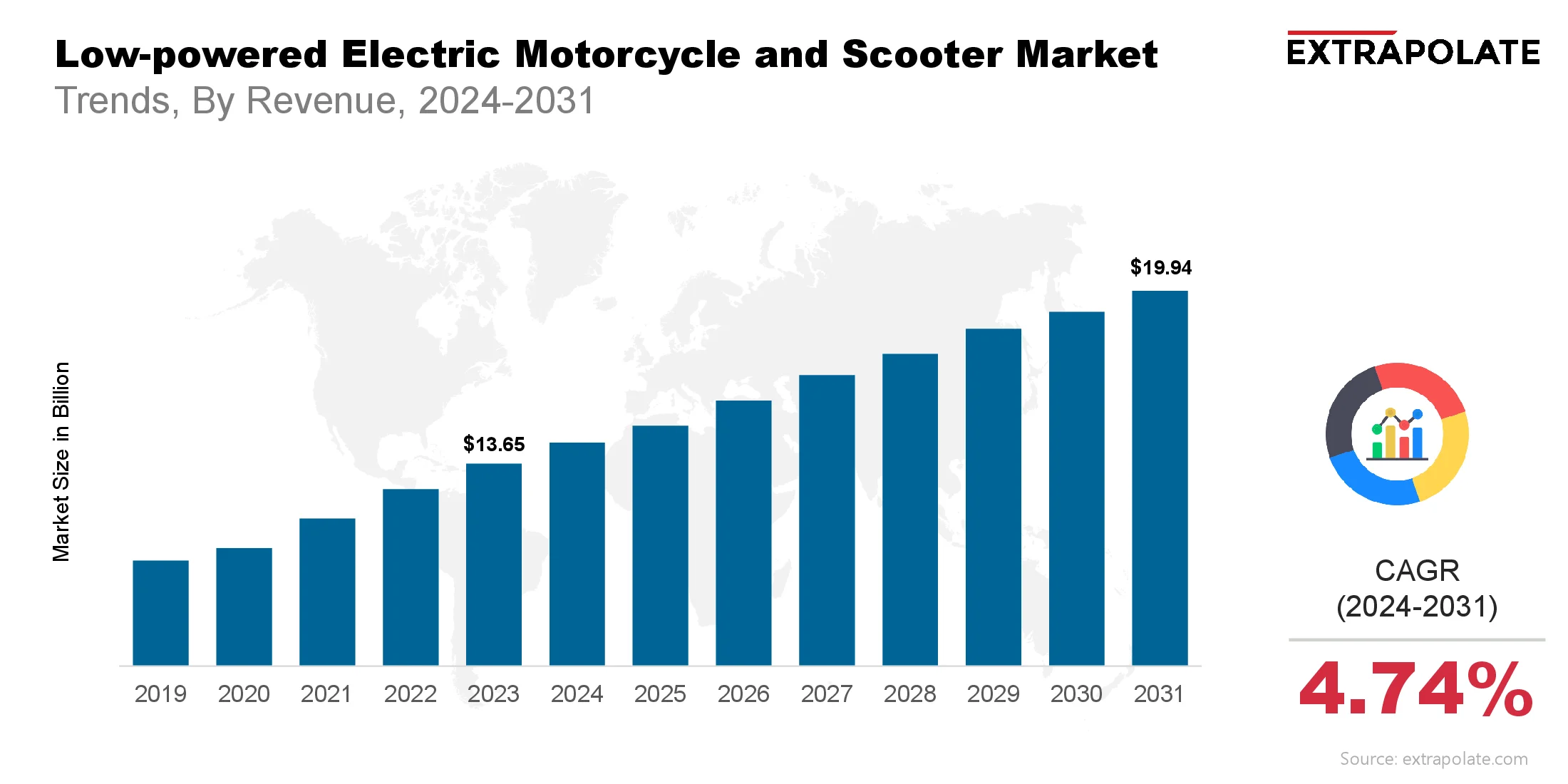

The global Low-Powered Electric Motorcycle and Scooter Market size was valued at USD 13.65 billion in 2023 and is projected to grow from USD 14.42 billion in 2024 to USD 19.94 billion by 2031, exhibiting a CAGR of 4.74% during the forecast period.

The global low-powered electric motorcycle and scooter market is experiencing a significant surge in growth. With urbanization intensifying and environmental concerns mounting, governments, consumers, and manufacturers alike are turning toward cleaner, more sustainable modes of transportation. Low-powered electric two-wheelers—especially those with motor capacities below 4 kW—have emerged as pivotal alternatives to traditional internal combustion engine (ICE) vehicles. These electric vehicles (EVs) are ideal for short-distance commuting, offering users a cost-effective and environmentally friendly transportation solution.

This transformation is being accelerated by technological advancements, favorable government incentives, and shifting consumer preferences. As lithium-ion battery technologies improve and charging infrastructure expands, low-powered electric motorcycles and scooters are increasingly being adopted across urban centers globally. The market is expected to expand at a robust rate, driven by rising fuel prices, regulatory pressures to reduce carbon emissions, and increasing demand for energy-efficient mobility.

Moreover, the integration of smart features—such as GPS navigation, Bluetooth connectivity, mobile app integration, and anti-theft technologies—is redefining user experience. As these innovative solutions continue to evolve, the low-powered electric motorcycle and scooter market is poised for sustained, exponential growth.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several pivotal trends are propelling the widespread adoption of low-powered electric motorcycles and scooters:

- Urbanization and Last-Mile Mobility: Rapid urban development has led to increased congestion, especially in emerging economies. This has created a strong demand for compact, agile, and efficient personal transportation options. Low-powered electric scooters and motorcycles are becoming essential tools for last-mile connectivity, helping users avoid traffic bottlenecks while reducing environmental impact.

- Government Policies and Incentives: Policymakers worldwide are offering substantial subsidies, tax breaks, and purchase incentives to promote the adoption of electric vehicles. In countries like China, India, and various EU nations, regulatory mandates for emissions reductions and bans on ICE two-wheelers in urban zones are accelerating the transition to electric alternatives.

- Advances in Battery Technology: The development of high-density, longer-lasting lithium-ion batteries has significantly improved vehicle range, charging speed, and performance. Innovations in battery management systems and swappable battery technologies are increasing the appeal and practicality of low-powered electric two-wheelers.

- Smart Mobility and IoT Integration: New models now feature connectivity-enhancing features such as remote diagnostics, ride analytics, GPS tracking, and integration with smartphones. This not only improves user convenience but also strengthens fleet management for ride-sharing and delivery services.

Major Players and Their Competitive Positioning

The low-powered electric motorcycle and scooter market is highly competitive, with numerous established players and new entrants vying for market share. Key manufacturers are focusing on product innovation, strategic partnerships, and international expansion to strengthen their market position.

Prominent companies in this market included are NIU Technologies, Yadea Group Holdings Ltd., Hero Electric, Okinawa Autotech Pvt. Ltd., Ather Energy, Ampere Vehicles (Greaves Cotton Ltd.), Terra Motors Corporation, VMoto Limited, Gogoro Inc., Energica Motor Company and others. These companies are prioritizing innovation in design, range, battery performance, and digital capabilities. Many are expanding their charging networks, entering strategic collaborations with battery suppliers, and targeting untapped markets in Southeast Asia, Latin America, and Africa.

Consumer Behavior Analysis

Consumer behavior in this market is influenced by a blend of environmental awareness, cost-efficiency considerations, and growing acceptance of electric mobility:

- Affordability and Cost Savings: While initial purchase prices may still be higher than ICE equivalents, the long-term cost of ownership is significantly lower. Consumers are increasingly attracted by reduced fuel costs, lower maintenance expenses, and available government subsidies.

- Environmental Consciousness: Climate concerns are influencing consumer decisions, particularly among younger urban commuters. Many are deliberately choosing electric scooters and motorcycles as a greener alternative to gasoline vehicles.

- Convenience and Accessibility: As charging infrastructure improves and battery swapping becomes more available, consumer confidence in electric mobility solutions is rising. Brands offering portable battery options and doorstep servicing are gaining preference.

- Style and Customization: Visual appeal drives interest. Aesthetic value often influences buying decisions. Modern looks and personalization attract young users. Demand is strong in dense urban zones.

Pricing Trends

Prices vary by battery size, motor power, and brand. Added tech features also raise the cost. Models range from affordable entry-level scooters starting at $500 to premium versions equipped with advanced electronics that can exceed $2,500.

attery costs are falling due to better tech and scale. This will make EVs more affordable. Subsidies and tax breaks make EVs more affordable. Special loans also help more people buy them. Rental and subscription models are growing in cities. They let users ride without high upfront costs.

Growth Factors

Numerous dynamic forces are fueling the growth of the low-powered electric motorcycle and scooter market:

- Environmental Regulations and Emissions Targets: Tighter emissions rules are driving change. Buyers and makers are shifting to cleaner tech. Many big cities are banning gas-powered vehicles. This is speeding up the move to electric two-wheelers.

- Urban Mobility Solutions: As cities pack in more people and cars, traffic slows. Light, quick vehicles offer a smart way forward. For short commutes, light electric vehicles are ideal. Many city users prefer them for speed and savings.

- Technological Advancements: Tech upgrades are improving motor power and battery life. This makes e-scooters and bikes more user-friendly. Integration with digital platforms is enhancing customer experiences and operational efficiency for fleet operators.

- Expanding Charging Infrastructure: Charging infrastructure is growing fast. Private firms and governments are backing the shift. Swapping stations are rising in Asia’s EV scene. They let users trade batteries and avoid wait times.

Regulatory Landscape

These vehicles face different laws around the world. Local rules shape design, speed, and access. Governments are increasingly aligning their regulations to support sustainable transportation, with key policies including:

- Subsidy Programs: EV buyers get support through rebates or grants. India’s FAME-II helps lower costs for users.

- Emissions Standards: Agencies in the U.S. and Europe are enforcing clean-air goals. This shift is helping EVs gain ground.

- Licensing and Classification: License-free use in many regions helps adoption. Light e-scooters are open to a broader group.

- Import/Export Regulations: Governments are easing tariffs on EV components. It helps make local manufacturing stronger and trade smoother.

Recent Developments

The following developments are reshaping the low-powered electric motorcycle and scooter market:

- Battery Swapping Partnerships: Firms like Gogoro are building more swap stations. Taiwan is the base, but growth is going global. User experience is smoother with swap networks. They help ease range anxiety.

- Smart Fleet Integration: Fleet operators now use more e-scooters. Delivery and ride-sharing firms are driving adoption. Makers and gig firms are working together. This creates fresh roles for small EVs in urban jobs.

- In June 2025, Nissan launched its third-generation e-POWER technology in Europe, debuting in the updated Qashqai. The new system offers better fuel efficiency, lower CO₂ emissions, quieter operation, and enhanced performance with a 151 kW motor and modular 5-in-1 powertrain design.a

- Global Expansion: Leaders are scaling fast across borders. Southeast Asia and Europe lead the expansion. Hero Electric is tapping global demand. Exports to Africa and Latin America are on the rise.

- Sustainability Initiatives: To lower their footprint, companies use clean tech and recyclable batteries. This helps build a more sustainable supply chain.

Current and Potential Growth Implications

a. Demand-Supply Analysis: Production is scaling up to meet growing demand. However, shortages in key battery materials could pose a challenge. This could disrupt production in the near term.

b. Gap Analysis: Growth is strong in Asian and European cities. But some rural and North American regions lag behind. To boost adoption, firms must cut costs and expand reach. This will help underserved areas catch up.

Top Companies in the Low-powered Electric Motorcycle and Scooter Market

- NIU Technologies

- Yadea Group Holdings Ltd.

- Hero Electric

- Ather Energy

- Gogoro Inc.

- Ampere Vehicles

- VMoto Limited

- Okinawa Autotech Pvt. Ltd.

- Terra Motors Corporation

- Energica Motor Company

Low-powered Electric Motorcycle and Scooter Market: Report Snapshot

Segmentation | Details |

By Vehicle Type | Electric Scooter, Electric Motorcycle |

By Battery Type | Sealed Lead Acid, Lithium-Ion, Others |

By Voltage | 36V, 48V, 60V, 72V and Above |

By Application | Personal, Commercial (Delivery, Sharing) |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Electric Scooters: Easy use and good pricing drive their success. City commuters prefer them widely.

- Lithium-Ion Battery Segment: Light design, fast charge, and long use time make it a top pick. These traits boost its value.

- Commercial Applications: Shared mobility and last-mile fleets are expanding quickly. These segments now drive major fleet growth.

Major Innovations

- Battery Swapping Technology: Time-saving tools improve how fleets are managed. They enhance both productivity and user experience.

- AI-based Telematics: Smart systems now offer real-time checks and early fixes. Geofencing adds control and safety.

- Connected Mobility Platforms: Smart apps support better rides. They offer tracking, charging help, and system checks.

Potential Growth Opportunities

- Emerging Markets Expansion: These regions offer fresh chances for expansion. Urban trends and policy support drive the opportunity.

- Ride-sharing Integration: With more shared transport options, e-scooters lead the way. They fit well into fleet-based models.

- Development of Compact Urban EV Models: Foldable and modular vehicles are in demand. Companies who offer them can grow fast.

Extrapolate Research Says:

The market for low-power e-motorcycles and scooters is set to grow fast. Sustainability trends, tech gains, and new travel needs drive this shift. Clean transport rules and improved batteries drive demand. This trend spans developed and emerging regions. Firms that focus on low cost, better range, and smart tech will stay ahead. These features matter most to buyers. Urban mobility and last-mile needs are growing fast. The market is ripe for bold new players.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Low-Powered Electric Motorcycle and Scooter Market

- August-2025

- 140

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021