Car Rental Market Size, Share, Growth & Industry Analysis, By Vehicle Type (Economy Cars, Luxury Cars, SUVs, Vans, EVs) By Booking Mode (Online, Offline) By Rental Duration (Short-term, Long-term, Subscription) By End-User (Leisure, Business, Government, Local Transport), and Regional Analysis, 2024-2031

Car Rental Market: Global Share and Growth Trajectory

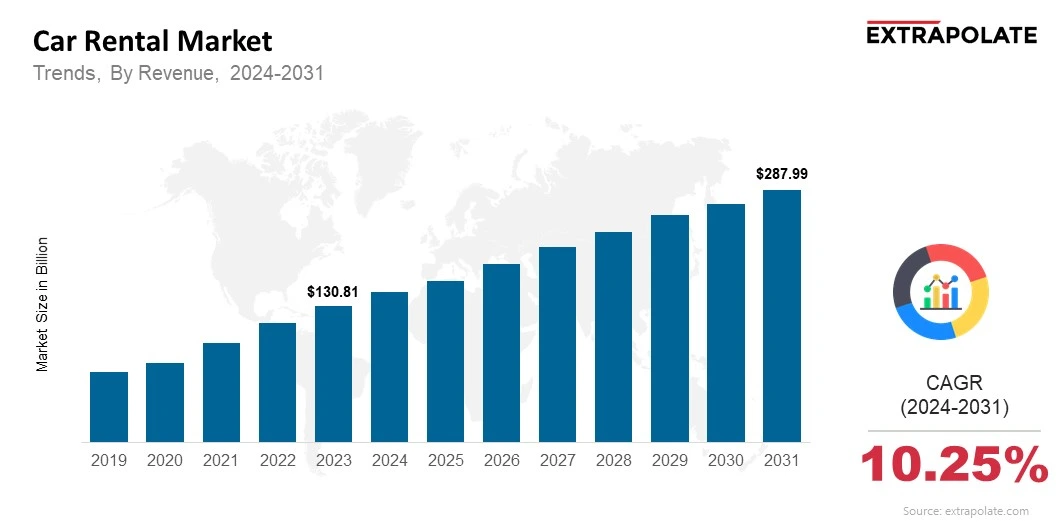

Global Car Rental Market size was recorded at USD 130.81 billion in 2023, which is estimated to be valued at USD 145.43 billion in 2024 and reach USD 287.99 billion by 2031, growing at a CAGR of 10.25% during the forecast period.

The global car rental market is experiencing a dramatic shift, fueled by shifting consumer preferences, technological innovations, and growing urbanization. From casual travellers to corporate fleets, more individuals and organizations are adopting rental vehicles as a convenient and cost-effective alternative to ownership. Car rental services are offering users increased flexibility, diverse vehicle options, and improved digital experiences, reshaping modern transportation dynamics.

Accelerated by trends like rising tourism, the popularity of ride-sharing, and the adoption of electric vehicles (EVs), the car rental industry is rapidly evolving. In developed and developing regions, digital platforms and mobile applications have simplified the rental process, providing smooth customer experiences. As operators integrate telematics, contactless services, and AI-driven fleet management, the car rental market is positioned for steady, long-term growth.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several key trends are driving the adoption and expansion of car rental services globally:

Shift Toward Digital Rental Platforms:

Digitalization is redefining how consumers interact with rental services. Mobile applications and web-based platforms now allow users to book vehicles instantly, choose flexible rental durations, and access loyalty programs. These developments reduce waiting times and enhance customer satisfaction, encouraging repeat usage.

Boom in Leisure and Business Travel:

As global travel rebounds post-pandemic, leisure and business travelers are returning to car rental services in large numbers. International tourism, business conferences, and regional travel all contribute to the rise in demand. Airports and railway hubs are once again major centers for car rental pickups, boosting revenue for operators.

Growing Popularity of Subscription-Based Models:

Subscription car rentals are becoming popular among urban consumers. These models allow customers to pay a monthly fee for access to a vehicle, which often including insurance, maintenance, and roadside assistance. This flexible and commitment-free alternative to ownership is particularly popular among younger demographics and city dwellers.

Rise of Green Mobility and Electric Fleets:

Environmental consciousness is influencing consumer behavior and corporate fleet strategies. Several rental companies are now integrating electric and hybrid vehicles into their fleets to meet growing demand and comply with environmental regulations. This sustainable shift not only reduces carbon emissions but also opens new avenues for growth and brand differentiation.

Major Players and Their Competitive Positioning

The car rental market is a dynamic and competitive landscape with multiple key players competing for market share through innovation, geographic expansion, and strategic partnerships. Major companies operating in this space include: Enterprise Holdings Inc., Hertz Global Holdings, Inc., Avis Budget Group, Inc., Europcar Mobility Group, Sixt SE, Localiza Rent a Car S.A., Fox Rent A Car, Inc., Budget Rent A Car System, Inc., Alamo Rent A Car, National Car Rental

These players utilize technology, loyalty programs, and global networks to maintain a competitive edge. Mergers, acquisitions, and collaborative ventures are common strategies employed to improve market positioning and expand service portfolios.

In December 2024, Zoomcar launched Zoomcar Cabs, a pilot chauffeur-driven car rental service in Bengaluru, offering customers the ability to choose exact car models, view vehicle ratings, and book for durations ranging from two hours to over 30 days via their existing app. This move expands beyond their traditional self-drive model, leveraging AI-powered cataloguing and transparent pricing to provide a flexible and competitively priced alternative to Ola and Uber, with plans to scale to additional cities in 2025.

Consumer Behavior Analysis

Consumer preferences in the car rental market are shaped by multiple factors:

Convenience and Accessibility:

Today’s consumers prioritize convenience, expecting frictionless booking and vehicle access. Smartphone apps, keyless entry, and contactless payment options enhance the overall experience, attracting tech-savvy renters who value time and simplicity.

Preference for Short-Term Mobility:

Urban residents and travelers prefer short-term rental options over ownership, due to the cost of maintenance, insurance, and depreciation. Flexible rental terms, which range from a few hours to several weeks, cater to this demand, promoting higher customer satisfaction and brand loyalty.

Cost-Conscious Decision Making:

Price remains a remarkable factor influencing consumer choices. Renters often compare multiple platforms to find the best deals. Promotional offers, bundled services, and loyalty programs help companies retain budget-conscious customers while differentiating from low-cost competitors.

Safety and Hygiene Concerns Post-COVID:

In the post-pandemic world, health and safety remain top-of-mind for consumers. Rental companies have responded by implementing intensified cleaning protocols and promoting contactless transactions, which have become key factors in customer decision-making.

Pricing Trends

Rental costs shift with demand, car class, and time. Extras like fuel plans also raise the price. Key pricing trends include:

- Dynamic Pricing Models: New systems help rental companies change prices. They look at demand, location, and car stock. These pricing tools make fleet use more efficient. They help companies earn more.

- Bundled Services: More rental firms now bundle extra services. These include GPS, baby seats, fuel options, and cover plans. Extra services benefit renters. They also grow company revenue per booking.

- Premium and Luxury Segment Growth: High-end car rentals are getting more popular. Wealthy tourists and business users are driving this trend. Renting premium cars brings in more money. Firms offering sedans and luxury SUVs benefit most.

- Subscription-Based Billing: People now choose monthly car access without owning a car. This trend is popular in busy urban areas.

Growth Factors

The growth of the car rental market is fueled by various growth factors that are transforming the industry:

Rapid Urbanization and Congestion:

More people are living in cities. This is raising the need for smart and low-cost travel options. In crowded cities, owning a car is hard due to space and parking issues. Rentals give people more freedom when public transport falls short.

Travel and Tourism Expansion:

Global travel is on the rise, with strong growth in Asia and Latin America. Car rentals are growing in response. Many travellers use rental cars for flexible trips. This adds to rental demand in tourist spots.

Corporate and Fleet Demand:

Businesses are renting instead of buying cars for workers. This lowers both upfront costs and admin tasks. Some fields adopt rentals faster than others. Logistics, pharma, and consulting show the highest use.

Infrastructural Growth in Developing Regions:

Road networks are expanding in developing areas. Cities there are also boosting transport options. With better infrastructure, rental companies enter new regions. These areas bring new growth potential.

Regulatory Landscape

The car rental industry is heavily regulated. The rules are not the same in every country or area. Regulations aim to protect users and reduce harm to the planet. They also support fair business practices. Key areas of regulation include:

- Driver Licensing and Age Restrictions: Many regions have age limits for rentals, often starting at 21. Drivers must also have a legal license. Drivers from other countries may need added proof. Some rental firms ask for extra paperwork.

- Insurance and Liability Requirements: By law, rental companies must include basic insurance. This covers any damage or injury costs up to a set limit. Collision damage waivers and accident insurance are often offered as extras. These options are also controlled by local laws.

- Environmental Regulations: Governments are enforcing cleaner air and emission laws. This pushes rental companies to add more eco-friendly vehicles.

- Consumer Protection Laws: Rental firms now focus on fair pricing and easy cancellations. They also offer better ways to solve disputes. Regulatory bodies check for proper conduct. Their goal is to stop unfair actions in the market.

Recent Developments

Several recent developments are shaping the car rental industry:

- Electric Vehicle Expansion: More rental firms are offering electric cars. They are responding to eco-aware customers and state incentives. Rental companies are teaming up with EV makers like Tesla and BYD. These deals help grow electric fleets faster.

- Telematics and Fleet Management: Telematics systems watch car performance and trip data. This helps rental teams save time and avoid breakdowns.

- Strategic Partnerships and Mergers: The rental industry is seeing more mergers. Europcar and Green Mobility Group combined to expand reach and digital tools.

- Automation and Smart Kiosks: Major airports and urban spots now have contactless kiosks. These allow self-service rentals and make the process faster.

Current and Potential Growth Implications

Demand-Supply Analysis:

Emerging regions and younger customers want more rental choices. Yet, high vehicle costs and limited stock make it hard to meet rising demand. Rental companies face trouble getting cars due to chip shortages. Rising and falling fuel costs also change how they manage fleets.

Gap Analysis:

Eco-friendly cars are hard to find in some regions. These areas also need better tech for rentals. Rental needs are growing in both cities and small towns. Firms must expand mobile tools and set up local support centers.

Top Companies in the Car Rental Market

- Enterprise Holdings Inc.

- Hertz Global Holdings, Inc.

- Avis Budget Group, Inc.

- Europcar Mobility Group

- Sixt SE

- Localiza Rent a Car S.A.

- Fox Rent A Car, Inc.

- Budget Rent A Car System, Inc.

- Alamo Rent A Car

- National Car Rental

Car Rental Market: Report Snapshot

Segmentation | Details |

By Vehicle Type | Economy Cars, Luxury Cars, SUVs, Vans, EVs |

By Booking Mode | Online, Offline |

By Rental Duration | Short-term, Long-term, Subscription |

By End-User | Leisure, Business, Government, Local Transport |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Car Rental Market: High Growth Segments

Certain market segments are expected to witness accelerated growth in the coming years:

- Electric Vehicle Rentals: As more cities invest in green transport and EV stations, demand is rising. EVs are growing fast in urban hubs and climate-conscious areas.

- Subscription-Based Rentals: Young people in North America and Europe like rental subscriptions. These plans offer freedom with no ownership stress.

- Corporate Leasing: More firms now use long-term rentals for work trips. Small businesses like the ease and lower cost.

Major Innovations

Recent developments that are transforming the car rental market:

- AI-Powered Fleet Optimization: Rental firms use AI to plan smart routes. It helps place cars in busy areas. It helps rental firms work better.

- Keyless Entry and Contactless Rentals: Key handovers are being replaced by mobile access. Bluetooth helps users unlock cars with phones. This makes renting quick and simple.

- Sustainability Dashboards: Real-time apps show how much fuel and carbon is used. This helps users go for cleaner rentals.

Car Rental Market: Potential Growth Opportunities

- Penetration in Emerging Markets: Growth in regions like Southeast Asia and Africa is strong. These areas now see more demand for rentals. A rising middle class and new roads make this possible.

- Integration with Mobility-as-a-Service (MaaS): By teaming with city travel apps, rental companies can do more. They reach new users and give more ways to travel.

- Electric Charging Infrastructure Partnerships: Firms are building EV charging links with help from cities and power groups. This makes renting EVs easier in more areas.

Extrapolate Research says:

The car rental market is growing due to rising travel needs. This growth will stay steady for years. Rising travel and shared rides help this sector grow. Digital tools make it move fast. People want trips that are cheap, clean, and easy. Car rental companies now use tech and offer new plans.

Emerging markets are growing fast, and EV use is rising. The future of car rentals will be sustainable and flexible. Smart tools like telematics and online booking are key now. They will shape who leads in this changing market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Car Rental Market Size

- July-2025

- 140

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021