Automotive Financing Market Size, Share, Growth & Industry Analysis, By Provider (Banks, NBFCs, OEMs, Credit Unions, Fintech Firms) By Vehicle Type (New Vehicles, Used Vehicles, Electric Vehicles) By Finance Type (Loan, Lease, Hire Purchase, Balloon Payment) By End-User (Individual Consumers, Businesses, Fleet Owners), and Regional Analysis, 2024-2031

Automotive Financing Market: Global Share and Growth Trajectory

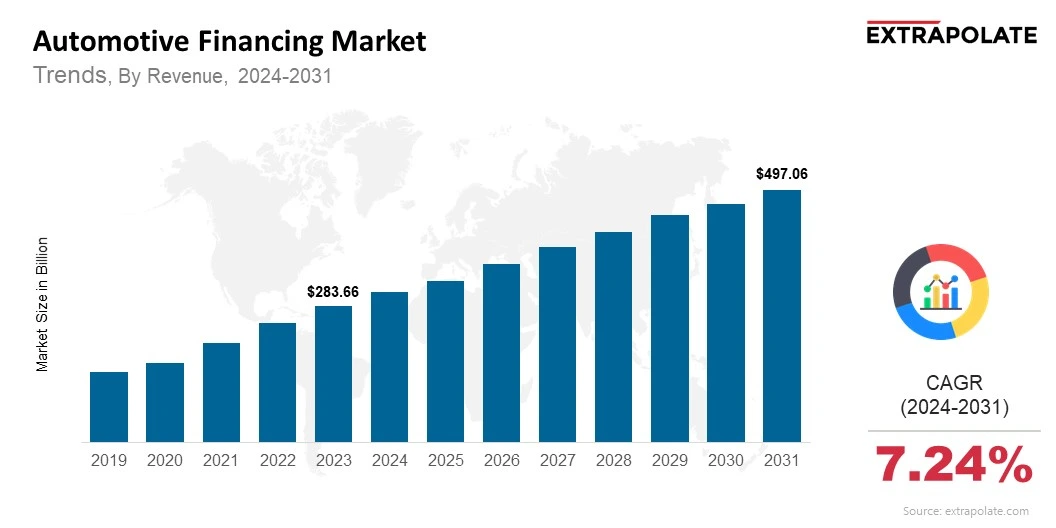

The global Automotive Financing Market size was valued at USD 283.66 billion in 2023 and is projected to grow from USD 304.57 billion in 2024 to USD 497.06 billion by 2031, exhibiting a CAGR of 7.24% during the forecast period.

The global automotive financing market is witnessing constant improvements fueled by rising vehicle ownership, changing consumer credit behavior, and widespread digitalization in financial services. Automotive financing plays a crucial role in enabling individuals and businesses to purchase new and used vehicles by offering structured repayment options. As global automotive sales rise, financing solutions continue to grow, evolving to meet the shifting needs of consumers, dealerships, and financial institutions alike.

Market growth is further supported by the increasing adoption of electric vehicles (EVs), the emergence of new ownership models, and rise in demand in emerging economies. Moreover, innovations in fintech and digital banking are simplifying the lending process, offering real-time credit approvals, and enabling smooth customer experiences. As the automotive landscape evolves, automotive financing is poised to grow in both volume and sophistication.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Multiple trends are driving the growth and adoption of automotive financing:

Digital Financing Platforms: The transition from traditional paper-based loan processes to fully digital financing platforms is transforming the automotive financing market. Fintech companies and digital-first banks are offering mobile applications and AI-driven platforms that allow customers to compare loan offers, check eligibility, and secure financing instantly. This shift is growing accessibility and improving transparency, thereby accelerating loan processing and improving customer satisfaction.

Subscription-Based and Shared Mobility Models: The rise of mobility-as-a-service (MaaS) and subscription-based vehicle ownership is encouraging financiers to design flexible and short-term loan products. Instead of conventional 5- or 7-year loans, consumers especially younger ones are looking for usage-based payment models. This trend is prompting lenders to adapt their product portfolios to support change in consumer preferences.

Rise of Electric Vehicle Financing: The expanding popularity of electric vehicles is influencing financing strategies. Since EVs often have higher upfront costs, lenders are offering innovative products like green auto loans with lower interest rates, extended repayment periods, and incentives along with sustainability goals. As governments incentivize EV adoption, financial institutions are aligning their lending policies to support eco-aware vehicle purchases.

Increased Use of Artificial Intelligence and Big Data: AI and data analytics are being largely adopted in credit risk assessment, fraud detection, and customer profiling. By analyzing large datasets on consumer behavior, income, credit scores, and vehicle resale values, lenders can better evaluate risks and personalize loan offerings. This enhances approval rates, reduces delinquencies, and strengthens overall portfolio performance.

Major Players and their Competitive Positioning

The automotive financing market is intensely competitive, comprising traditional banks, credit unions, captive finance arms of OEMs, non-banking financial companies (NBFCs), and fintech startups. Major players are focusing on improving their digital infrastructure, enhancing customer experience, and expanding their geographical footprint to gain a competitive edge. Top companies operating in the global automotive financing landscape include: Ally Financial Inc., Bank of America Corporation, Toyota Financial Services, Ford Motor Credit Company, Daimler Mobility AG, Volkswagen Financial Services AG, Honda Financial Services, Capital One Financial Corporation, JPMorgan Chase & Co., Santander Consumer USA Inc.

These companies are investing in digital transformation, AI-driven underwriting, and data analytics capabilities. They are also forming strategic alliances with automakers, dealerships, and fintech providers to widen their customer base and capture emerging opportunities.

Consumer Behavior Analysis

Consumer behavior in the automotive financing market is shaped by financial preferences, generational shifts, and broader economic factors:

Affordability and Monthly Installments: Consumers are increasingly giving priority to monthly installments over outright vehicle ownership. The option to finance allows buyers to purchase higher-end models or EVs that might otherwise be unaffordable. Competitive interest rates and extended loan terms are making auto loans more attractive to a larger number of people.

Preference for Online and Contactless Transactions: The pandemic prompted digital adoption, with consumers in favor of online applications and contactless services. Buyers now expect end-to-end online loan approval processes, digital document submission, and instant notifications. This has led lenders to enhance their digital service offerings and improve user interfaces.

Millennials and Gen Z Seek Flexibility: Younger generations often prefer leasing or subscription models that offer lower upfront costs and the freedom to change vehicles frequently. These consumers value flexibility, convenience, and eco-friendly options, prompting financial institutions to make developments with short-term, mileage-based, or usage-specific financing plans.

Credit Awareness and Financial Literacy: Increased financial awareness is motivating consumers to compare financing options, monitor credit scores, and negotiate better loan terms. As a result, lenders are placing greater focus on transparency, customer education, and responsible lending practices to build long-term relationships.

Pricing Trends

Pricing trends in the automotive financing market are affected by macroeconomic conditions, interest rates, credit risk profiles, and vehicle categories:

Interest Rate Volatility: Auto loan interest rates are tied to broader economic indicators like central bank lending rates, inflation, and credit markets. In recent years, interest rates have fluctuated due to tightening monetary policies, which impacted loan affordability and borrower sentiment. Lenders are responding with promotional rates, particularly for EVs and high-credit borrowers.

Loan Term Extensions: To keep monthly payments cost-effective, lenders are offering longer loan tenures, often up to 84 months. While this reduces monthly costs, it also increases total interest paid and the risk of negative equity. This trend is specifically prevalent in markets with high vehicle prices and low household savings.

Differentiated Pricing by Risk Tier: Risk-based pricing is often used to offer customized rates based on borrower creditworthiness. Prime customers enjoy competitive APRs, while subprime borrowers face higher interest rates due to perceived default risks. Lenders are balancing risk and revenue through tiered interest structures.

Bundled Services and Add-ons: Financial institutions are compiling auto loans with complementary services such as insurance, maintenance, extended warranties, and telematics. These packages create additional value for customers and open new revenue streams for lenders.

Growth Factors

The automotive financing market is driven by multiple growth drivers:

Rising Global Vehicle Ownership: With rising incomes and growing cities, more people in developing countries can now afford cars. Higher incomes and rapid urban growth in developing nations are making car ownership more accessible.

OEM and Dealer Integration: More automakers and dealers are merging financing with car sales to offer a smoother purchase. Brands like Toyota Financial Services and Ford Credit provide tailored point-of-sale financing that fast-tracks approval and keeps customers happy.

Supportive Government Policies: To increase electric vehicle use, many countries provide financial perks like tax relief, purchase subsidies, and EV-friendly policies. These policies enhance financing affordability and widen market access.

Technological Innovation in Fintech: New fintech platforms simplify how users apply for loans, include instant credit checks, and offer fast fund disbursal. It improves how work flows and pulls in modern, tech-smart users.

Regulatory Landscape

Laws around auto loans aim to secure user data, enforce fair lending, and uphold consumer protection standards. Key regulatory factors influencing the market include:

Consumer Protection Laws: To protect borrowers, regulators mandate clear loan terms, aiming to stop hidden fees and exploitative lending. Laws in many places demand that lenders disclose rates, fees, and repayment plans to ensure fairness and safeguard borrowers.

Credit Reporting Standards: Sticking to credit bureau guidelines and fair reporting helps lenders judge borrowers properly, make sound lending decisions, and manage risk better.

Data Privacy Regulations: Managing private financial and personal data requires digital platforms to comply with GDPR and CCPA laws, apply strong encryption, and get user consent.

Licensing and Supervision: Banks and NBFCs offering automotive loans must obtain licenses from regulatory bodies such as the Federal Reserve (U.S.), European Central Bank (EU), and Reserve Bank of India. Regular audits and disclosures are part of regulatory compliance.

Recent Developments

Remarkable advancements in the automotive financing sector include:

- Emergence of EV-specific Loan Products: With benefits like low rates and government backing, EV and green loan schemes are becoming common in the market.

- AI and Automation in Loan Underwriting: AI-based underwriting helps lenders quickly approve loans while using data to better assess credit risk.

- Strategic Acquisitions by Banks and OEMs: To lead in digital innovation, large players are acquiring fintech firms for faster tech upgrades. For instance, Santander bought Autofi, an auto finance platform, to strengthen its digital tools.

- Blockchain Pilots for Auto Loans: Financial firms are using blockchain experiments to streamline and clarify auto loan and securitization workflows.

Current and Potential Growth Implications

Demand-Supply Analysis: Rising demand for vehicles and growing credit penetration are pushing lenders to innovate and scale operations. Supply-side innovations, including digital onboarding, AI credit checks, and decentralized loan management, are enhancing scalability.

Gap Analysis: Despite market growth, credit access remains limited in rural and underbanked regions. The lending market needs to support gig and freelance workers, along with others who lack full credit profiles.

Top Companies in the Automotive Financing Market

- Ally Financial Inc.

- Bank of America Corporation

- Toyota Financial Services

- Ford Motor Credit Company

- Daimler Mobility AG

- Volkswagen Financial Services AG

- Capital One Financial Corporation

- Honda Financial Services

- JPMorgan Chase & Co.

- Santander Consumer USA Inc.

Automotive Financing Market: Report Snapshot

Segmentation | Details |

By Provider | Banks, NBFCs, OEMs, Credit Unions, Fintech Firms |

By Vehicle Type | New Vehicles, Used Vehicles, Electric Vehicles |

By Finance Type | Loan, Lease, Hire Purchase, Balloon Payment |

By End-User | Individual Consumers, Businesses, Fleet Owners |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Automotive Financing Market: High-Growth Segments

- Electric Vehicle Financing: With EV sales rising and buyers getting support through incentives, lenders are growing their EV loan products.

- Fintech-Enabled Lending: Platforms with complete digital loan services attract modern buyers by offering fast approvals and a smooth user experience.

- Used Vehicle Financing: With rising used car sales globally especially in developing regions financing options for pre-owned vehicles are also growing.

Major Innovations

- AI-Driven Credit Assessment Tools: These tools improve underwriting accuracy and expand access to financing.

- Contactless Digital Loan Platforms: Enhancing convenience, these platforms facilitate complete loan processing from application to disbursal online.

- Eco-Friendly Financing Products: Sustainable vehicle adoption is driven by custom financial instruments designed to lower upfront costs.

Automotive Financing Market: Potential Growth Opportunities

- Expansion in Emerging Economies: With vehicle penetration still low in many developing nations, there is vast potential for financing growth.

- Embedded Finance in Vehicle Sales Platforms: Adding finance options to vehicle e-commerce platforms makes buying easier and widens reach.

- Cross-Sector Collaboration: Joint efforts by banks, car makers, insurers, and ride-hailing services can drive integrated finance ecosystems.

Kings Research says:

The automotive financing market is on a path of robust growth, driven by digitization, evolving consumer expectations, and the global shift toward sustainable transportation. With varied car ownership and tech-driven personalized loans, lenders are reshaping strategies for both classic and modern buyers. The integration of AI, analytics, and digital lending is poised to transform vehicle financing in the coming years.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Automotive Financing Market Size

- June-2025

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021