Automotive Camera Sensor Market Size, Share, Growth & Industry Analysis, By Type (Mono Camera, Stereo Camera, Rear-View Camera, Surround-View Camera) By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) By Application (ADAS, Autonomous Driving, Parking Assistance, Night Vision), and Regional Analysis, 2024-2031

Automotive Camera Sensor Market: Global Share and Growth Trajectory

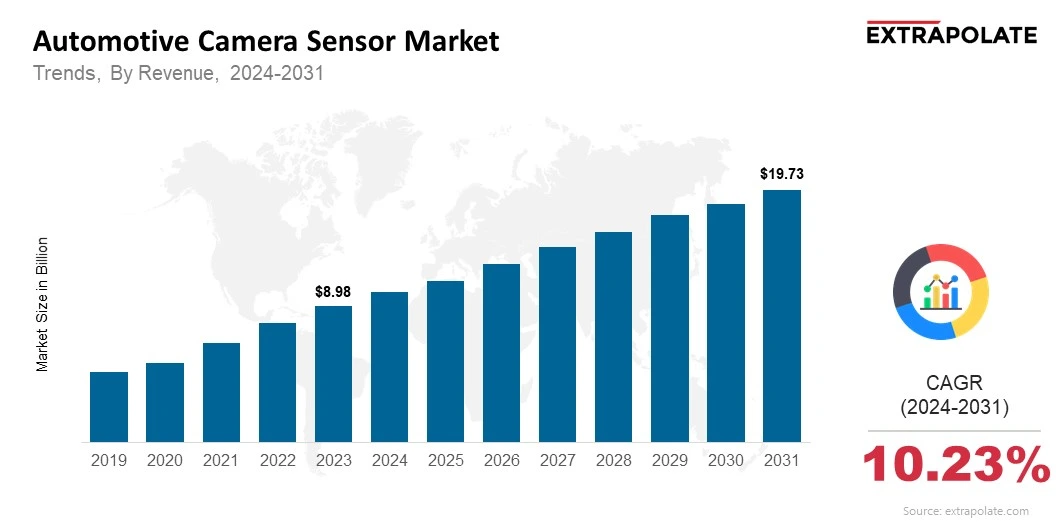

Global Automotive Camera Sensor Market size was recorded at USD 8.98 billion in 2023, which is estimated to be valued at USD 9.97 billion in 2024 and reach USD 19.73 billion by 2031, growing at a CAGR of 10.23% during the forecast period.

The global automotive camera sensor market is witnessing remarkable growth, driven by a surge in demand for advanced driver assistance systems (ADAS), autonomous vehicles, and road safety initiatives. These compact yet powerful sensors serve as the eyes of modern vehicles, offering vital input for various functions such as lane keeping, object detection, blind spot monitoring, parking assistance, and collision avoidance. As the automobile industry embraces technological evolution, automotive camera sensors are becoming indispensable for enhancing vehicle safety, performance, and user experience.

Fueled by the convergence of stringent government regulations, rising safety awareness among consumers, and escalating integration of AI-powered systems, automotive camera sensors are paving the way toward smarter and safer transportation. Their ability to deliver real-time, high-resolution imaging supports the growing complexity of onboard vehicle systems, making them vital components of next-generation mobility.

With the shift towards fully autonomous vehicles, the importance of camera sensors has reached new heights. These sensors provide essential visual data to help vehicles interpret their surroundings and make accurate driving decisions. From adaptive cruise control to pedestrian recognition, the applications of automotive camera sensors are expanding rapidly. As the automotive ecosystem evolves, the market is poised for significant expansion, driven by a strong foundation of innovation and demand for safer mobility solutions.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Rising Demand for ADAS Features

Automotive camera sensors are central to the functionality of advanced driver assistance systems. These systems are increasingly being adopted by automakers to meet safety standards and offer value-added features to consumers. Governments around the world are mandating the inclusion of basic ADAS technologies such as automatic emergency braking, lane departure warnings, and backup cameras in new vehicles. This regulatory pressure is creating a strong impetus for automotive manufacturers to integrate high-quality camera sensors across various vehicle segments.

Autonomous Vehicles Accelerating Sensor Integration

The vision of fully autonomous vehicles relies heavily on sophisticated sensor suites. Camera sensors work in tandem with LiDAR, radar, and ultrasonic systems to create a comprehensive perception platform. Their ability to capture color and texture data makes them crucial for interpreting traffic signs, road conditions, and pedestrian gestures. With significant investments being made in autonomous driving technology by key players like Tesla, Waymo, and NVIDIA, the role of camera sensors is becoming more entrenched in the mobility value chain. For example, in October 2024, Sony Semiconductor Solutions announced its ISX038 CMOS image sensor for automotive cameras. It’s the industry’s first sensor capable of simultaneously processing and outputting both RAW (for ADAS and autonomous driving) and YUV (for infotainment applications), streamlining camera systems and saving space, cost, and power components.

Technological Advancements in Image Processing

New technologies like HDR imaging, 360-degree view systems, and low-light sensors are changing vehicle camera systems. CMOS image sensors now offer higher resolution and faster frame rates. These improvements boost vision clarity and response time. Such advancements are making driver assistance systems more effective. They are also shaping consumer expectations for vehicle safety.

Consumer Focus on Safety and Convenience

Drivers today want safer and more convenient vehicles. Camera sensors support features that reduce accidents and improve comfort. Functions like surround-view, automatic parking, and driver monitoring are becoming standard in many vehicles. This shift is pushing OEMs to add more sensors. It helps them stand out in a competitive market.

Major Players and Their Competitive Positioning

The automotive camera sensor market is highly competitive and fragmented, featuring established players and emerging innovators vying for market dominance. The top players are investing heavily in R&D, strategic partnerships, and mergers and acquisitions to enhance their technological capabilities and broaden their product portfolios.

Key players in the market include: Robert Bosch GmbH, Continental AG, Sony Corporation, OmniVision Technologies, Inc., Aptiv PLC, Magna International Inc., ON Semiconductor Corporation, Valeo SA, STMicroelectronics, ZF Friedrichshafen AG.

These companies are leveraging their expertise in sensor manufacturing, semiconductor design, and automotive electronics to cater to evolving OEM requirements. Collaborations with vehicle manufacturers and autonomous driving startups are also shaping their strategic direction.

Consumer Behavior Analysis

Safety First

Consumers prioritize safety when buying a car. Automotive camera sensors are key to many safety features so they’re in high demand. Buyers are looking for cars with parking assist, lane-keeping and collision warning, all of which are supported by camera sensors.

Connected and Smart Cars

The connected car revolution has raised consumer expectations for in-car tech. Consumers want cars that connect to their smartphones and have intelligent features like auto-braking and pedestrian detection. Automotive camera sensors enable many of these features so they’re a big selling point.

Willing to Pay for Safety

Even in price-sensitive markets consumers are willing to pay a premium for safety and driver-assist features. This growing willingness to invest in safety tech is good news for sensor deployment across all vehicle segments from entry-level to luxury.

Educated Buyers Fueling Adoption

As consumers become more aware of automotive safety technologies through advertising, test drives, and reviews, their willingness to adopt vehicles equipped with multiple sensors has grown. Buyers are now more informed and likely to compare sensor features when making purchasing decisions.

Pricing Trends

Pricing of automotive camera sensors is dependent on resolution, frame rate, size and integration complexity. Basic rear view and surround view camera modules have become more affordable due to mass production and economies of scale. High performance sensors with AI based vision processing or thermal imaging cost more.

Integration of camera sensors into vehicle systems also includes software and electronic control units (ECUs) which adds to the overall cost. OEMs manage this cost through modular architecture and partnerships with Tier 1 suppliers. As competition increases and production scales up, pricing pressure will push down costs especially for high resolution sensors making them accessible to mid segment vehicles.

Growth Factors

Tough Government Regulations on Vehicle Safety

EU’s General Safety Regulation (GSR) and US NHTSA mandates have made safety features mandatory in all new vehicles. These regulations are forcing OEMs to adopt camera based systems and hence the market is growing.

Rapid Urbanization and Smart Mobility

With urban population growing and traffic congestion worsening, demand for intelligent transportation solutions is increasing. Automotive camera sensors enable features like adaptive traffic sign recognition and pedestrian detection which is essential for urban driving. This trend is driving demand for sensor equipped vehicles.

Electrification and Platform Modularity

Electric vehicles (EVs) and modular vehicle platforms are incorporating sensors as part of the design. EV makers especially new entrants like Rivian and Lucid Motors are focusing on ADAS features powered by advanced sensor systems. This is a big boost to the automotive camera sensor market.

Technological Collaboration and Integration

Joint ventures and technological partnerships between sensor companies, software developers and automakers are driving innovation. Collaboration reduces time to market and enhances the capability of camera sensors especially in autonomous driving use cases.

Regulatory Landscape

The regulatory framework surrounding automotive camera sensors is designed to ensure that safety technologies meet stringent performance and reliability standards. In major automotive markets, regulatory compliance is a critical factor for market entry and adoption.

- United States (NHTSA): The agency has outlined specific guidelines for camera-based systems in vehicles, including mandatory backup cameras in passenger vehicles.

- European Union (GSR 2022): The EU now mandates the inclusion of features such as lane-keeping assist and pedestrian detection systems, driving the use of automotive camera sensors.

- Asia-Pacific (China and Japan): China and Japan have enacted safety and emissions regulations that require camera-based ADAS systems for new vehicle certifications.

ISO standards such as ISO 26262 for functional safety and ISO 21448 (SOTIF – Safety of the Intended Functionality) guide the development and testing of automotive camera sensors to ensure they perform reliably in varied conditions.

Recent Developments

- Sony releases CMOS Sensor with LED Flicker Mitigation: Sony has launched a new CMOS image sensor for automotive use that can reduce flicker under LED lighting – a common problem in urban driving.

- Continental launches AI-based Monocular Camera System: Continental has released a scalable camera system for driver monitoring and object detection with AI image processing.

- Mobileye and Geely partner: Mobileye, an Intel company, has partnered with Chinese automaker Geely to deploy its EyeQ camera sensor chips in autonomous vehicle platforms.

- ON Semiconductor releases AR0820AT Image Sensor: Designed for automotive ADAS, the sensor can capture high resolution images in any lighting condition.

All this shows the high pace of innovation in the camera sensor space.

Current and Potential Growth Implications

Demand-Supply Analysis

Automotive OEMs and Tier 1 suppliers are increasing sensor production. This is to meet rising demand for vision-based systems. The supply chain is currently stable. However, integrating sensors and calibrating software remains complex. This creates entry barriers for new players.

Gap Analysis

Despite strong demand, gaps still exist. One major gap is affordability. Many low-cost vehicles, especially in developing countries, cannot easily adopt these sensors. Another gap is performance in harsh weather. Sensor redundancy and reliability still need improvement. Innovation in these areas is crucial for future growth.

Top Companies in the Automotive Camera Sensor Market

- Robert Bosch GmbH

- Continental AG

- Sony Corporation

- OmniVision Technologies, Inc.

- Aptiv PLC

- Magna International Inc.

- ON Semiconductor Corporation

- Valeo SA

- STMicroelectronics

- ZF Friedrichshafen AG

Automotive Camera Sensor Market: Report Snapshot

Segmentation | Details |

By Type | Mono Camera, Stereo Camera, Rear-View Camera, Surround-View Camera |

By Vehicle Type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

By Application | ADAS, Autonomous Driving, Parking Assistance, Night Vision |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Automotive Camera Sensor Market: High-Growth Segments

- Surround-View Cameras: As 360-degree awareness becomes more important, surround-view systems will see big growth, especially in mid- and high-end vehicles.

- Night Vision and Driver Monitoring Systems: Luxury and autonomous segments are driving demand for night vision and infrared camera sensors to improve low-light driving.

Key Innovations

- AI-Embedded Imaging Systems: Camera sensors with AI built-in are improving decision-making for ADAS and autonomous functions.

- Module Miniaturization: Smaller sensors are giving more design flexibility and integration across vehicle lines.

- Thermal and Infrared Camera Integration: These enable better visibility in fog, nighttime, and extreme weather conditions, overall safety.

Automotive Camera Sensor Market: Growth Opportunities

- Emerging Markets: As car ownership grows in India, Brazil and Southeast Asia, there will be plenty of opportunities for camera sensor suppliers.

- V2X and AI Integration: As V2X and edge AI come along, camera sensors will get smarter, interacting in real-time with the environment to provide more safety and autonomy.

Extrapolate says:

The automotive camera sensor market will grow fast. Cars are getting more connected, autonomous and safety focused. Sensor adoption is driven by new tech, regulations and need for safety features. Every vehicle segment is affected by this trend.

Automakers are trying to enable autonomous functions and comply with new safety regulations. Camera sensors are key to this change. They are part of the car’s digital nervous system. The market will be shaped by the convergence of AI, sensor innovation and smart systems. In the next few years’ growth will be immense.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Automotive Camera Sensor Market Size

- August-2025

- 140

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021