Automated Truck Market Size, Share, Growth & Industry Analysis, By Autonomy Level (Level 1, Level 2, Level 3, Level 4, Level 5), By Propulsion (Diesel, Electric, Hybrid), By Application (Logistics, Construction, Mining, Others), By End User (Retail, Manufacturing, Oil & Gas, Agriculture, Others), and Regional Analysis, 2024-2031

Automated Truck Market: Global Share and Growth Trajectory

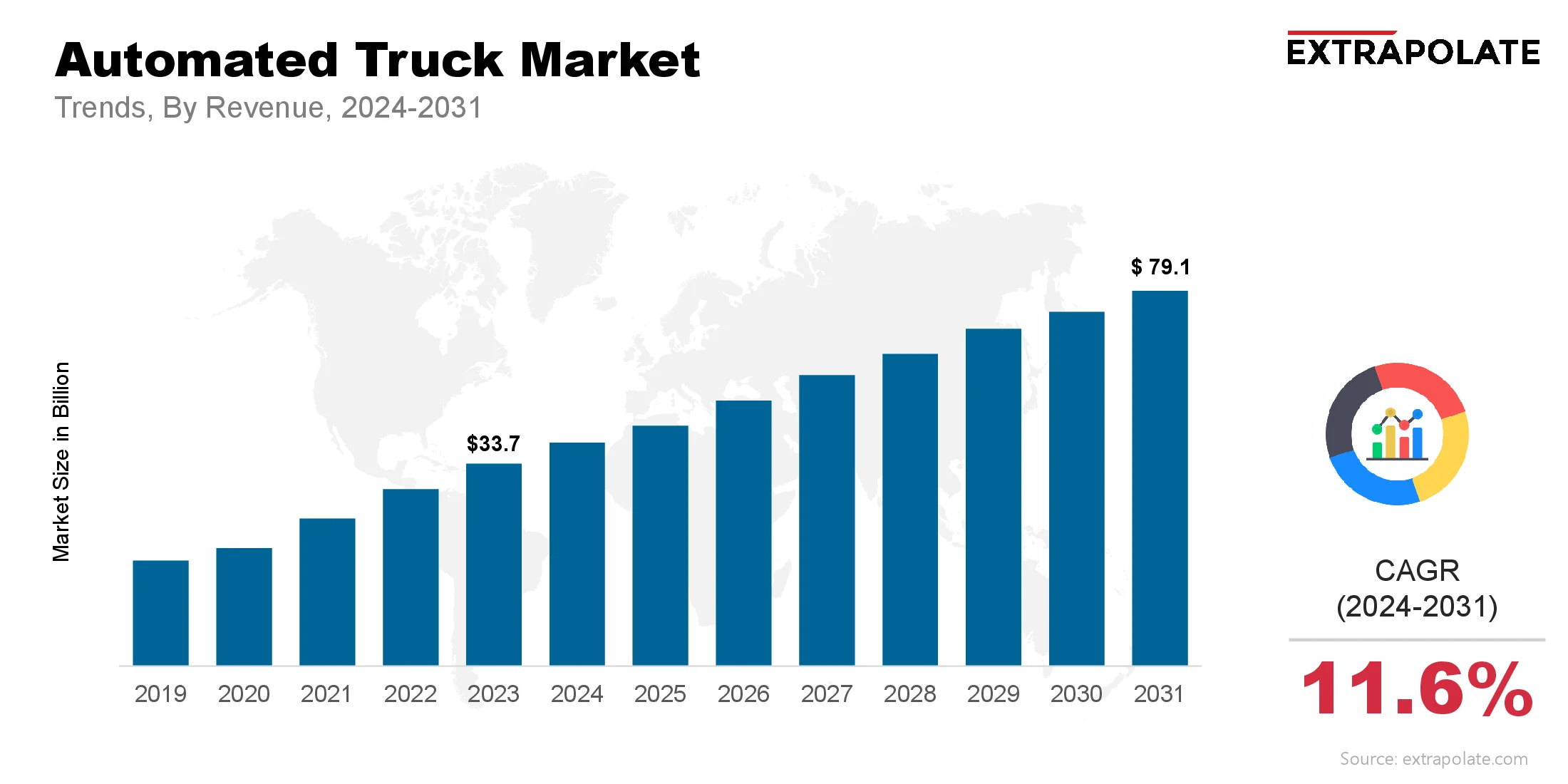

The global Automated Truck Market size was valued at USD 33.7 billion in 2023 and is projected to grow from USD 36.6 billion in 2024 to USD 79.1 billion by 2031, exhibiting a CAGR of 11.6% during the forecast period.

The global automated truck market is witnessing rapid acceleration, fueled by advancements in autonomous driving technologies, regulatory support, and increasing demand for efficient freight transportation. This market includes a wide range of automation levels, from driver-assistance systems to fully autonomous trucks.

As technology matures and infrastructure adapts, automated trucks are poised to revolutionize the logistics and transportation industries, delivering significant benefits in terms of safety, cost reduction, and efficiency.

Automated trucks leverage cutting-edge technologies such as artificial intelligence, LiDAR, radar, GPS, and advanced driver-assistance systems (ADAS) to navigate complex environments with minimal or no human intervention. These technologies enable features such as lane-keeping, adaptive cruise control, collision avoidance, and autonomous braking.

As a result, these vehicles can operate with higher precision and consistency compared to human-driven trucks, reducing the likelihood of accidents caused by human error, fatigue, or distraction. Moreover, the deployment of automated trucks promises substantial cost savings for logistics operators. Labor accounts for a significant portion of trucking expenses, and automation has the potential to dramatically reduce these costs over time.

Additionally, automated trucks can operate for longer hours without rest, thereby improving delivery speeds and fleet utilization. This increased efficiency translates to faster turnaround times, reduced fuel consumption through optimized driving patterns, and overall lower operational costs.

From a regional perspective, North America and Europe are at the forefront of the automated truck revolution, driven by supportive regulatory frameworks, high levels of technological adoption, and substantial investments by key industry players. The United States, in particular, has seen a surge in pilot projects and commercial testing by companies like Tesla, Waymo, Embark, and TuSimple.

Meanwhile, Asia-Pacific is emerging as a high-potential market due to the rapid expansion of e-commerce, growing demand for freight solutions, and increasing investments in smart infrastructure by countries like China and Japan.

Challenges such as regulatory uncertainty, high initial costs, cybersecurity concerns, and public acceptance remain barriers to full-scale deployment. However, ongoing research and development, collaborations between automakers and tech firms, and evolving standards are gradually addressing these issues. Governments are also playing a crucial role by facilitating trials, funding innovation, and setting clear guidelines for the safe deployment of autonomous vehicles.

Key Market Trends Driving Product Adoption

The automated truck market is evolving rapidly. Strategic partnerships and growing demand are shaping its future. Key trends driving market growth include:

- Advanced Driver Assistance Systems (ADAS): Lane-keeping assistance, adaptive cruise control, and automatic emergency braking are becoming standard. These features enhance safety and reduce driver fatigue.

- Full Autonomy Development: Industry leaders are investing in Level 4 and Level 5 autonomy. Their goal is fully driverless truck operations soon.

- Electrification Synergies: Many automated trucks use electric drivetrains. This supports sustainability and lowers emissions.

- Fleet Management Integration: Automated trucks now use smart fleet systems. These help optimize routes, save fuel, and predict maintenance needs.

- Platooning Technology: Automated trucks can drive in tight formations. This reduces drag and improves fuel efficiency.

Major Players and their Competitive Positioning

The automated truck market features a mix of automotive giants, tech firms, and logistics companies. Major players include Daimler AG, Volvo Group, Tesla, Waymo, TuSimple, and Embark. These companies are engaged in strategic collaborations and pilot programs, racing to achieve scalable deployment. Startups and tech disruptors are also entering the space with innovative platforms and AI-based solutions.

Consumer Behavior Analysis

Logistics firms and fleet operators are adopting automation. They seek lower costs, better efficiency, and improved safety:

- Operational Efficiency: Reducing transit times and human errors.

- Cost Reduction: Lowering long-term fuel and labor costs.

- Safety Enhancements: Reducing accidents and improving driver safety.

- Sustainability Goals: Combining automation with electrification to meet emission standards.

Pricing Trends

Prices for automated trucks vary. It depends on autonomy level, hardware, and truck type. Early prototypes cost more. Prices should drop as production scales. Lower maintenance and operating costs appeal to fleet buyers.

Growth Factors

Several key drivers are propelling the automated truck market forward:

- Technological Advancements: Innovations in sensors, AI, Lidar, and radar systems are key. They enable safe and efficient automated driving.

- Driver Shortage: A global shortage of skilled truck drivers is driving change. Companies are adopting autonomous alternatives as a solution.

- Cost Efficiency: Lower fuel consumption and longer operational hours without rest requirements improve ROI.

- Government Initiatives: Supportive regulations are helping adoption. Test programs are also facilitating broader use.

- E-commerce Expansion: Online shopping growth is driving demand. Faster, cost-effective freight delivery is becoming essential.

Regulatory Landscape

The regulatory environment is evolving. Standards for testing and deploying autonomous vehicles vary across countries. Compliance with safety protocols, cybersecurity mandates, and data privacy laws is essential. Regulatory clarity will be critical for full-scale commercialization.

Recent Developments

The automated truck industry is seeing continuous innovation and strategic activity:

- Successful Highway Pilots: Major companies have conducted successful autonomous highway tests.

- AI and Sensor Fusion: Improved AI models and sensor integration are making real-time navigation more accurate.

- OEM-Tech Partnerships: Collaborations between automakers and AI firms are accelerating commercialization.

- Teleoperation Advancements: Remote control systems for low-speed maneuvers are being developed as fallback options.

Current and Potential Growth Implications

- Demand Supply Analysis

Demand for automated trucks is rising. This trend is particularly strong in logistics and freight-heavy industries. Supply chain constraints are an issue. Semiconductor shortages and sensor availability may affect production timelines. - Gap Analysis

Key areas that still need development and focus include:

- Standardization: Lack of uniform standards for autonomous systems across regions.

- Public Infrastructure: Need for road infrastructure and smart traffic systems.

- Liability Frameworks: Defining liability in case of accidents involving autonomous trucks.

- Affordability: Reducing production costs to enable mass adoption.

Top Companies in the Automated Truck Market

Some of the top companies driving innovation and growth in the automated truck market include:

- Daimler AG

- Volvo Group

- Tesla Inc.

- Waymo (Alphabet Inc.)

- TuSimple

- Embark Trucks

- PlusAI

- PACCAR Inc.

- Navistar International

- Kodiak Robotics

Automated Truck Market: Report Snapshot

Segmentation | Details |

By Autonomy Level | Level 1, Level 2, Level 3, Level 4, Level 5 |

By Propulsion | Diesel, Electric, Hybrid |

By Application | Logistics, Construction, Mining, Others |

By End User | Retail, Manufacturing, Oil & Gas, Agriculture, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are poised for robust growth:

- Level 4 Trucks: Offering near-complete autonomy in controlled environments.

- Electric Automated Trucks: Combining the benefits of automation with sustainability.

- Last-Mile Delivery Trucks: Autonomous small trucks for urban deliveries.

Major Innovations

Innovative technologies are driving transformation in the automated truck market:

- Sensor Fusion Algorithms: For enhanced perception and decision-making.

- V2X Communication: Allowing trucks to communicate with infrastructure and other vehicles.

- Predictive Maintenance Systems: Reducing downtime through real-time diagnostics.

- HD Mapping & Localization: Providing precise data for navigation and obstacle detection.

Potential Growth Opportunities

While the outlook is promising, the market faces several challenges:

- High R&D Costs: Innovation requires significant investment.

- Cybersecurity Threats: Protecting vehicle systems from hacking.

- Public Trust: Building consumer and regulatory confidence in fully autonomous systems.

- Insurance and Liability Issues: Unclear frameworks for accident responsibility.

- Testing & Validation: Real-world testing is critical but time-intensive.

Kings Research says:

The global automated truck market is nearing a revolution. AI, sensor innovation, and operational excellence are driving this change. Companies that invest early and innovate aggressively will lead the industry. Adapting to the regulatory environment is key to future success.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Automated Truck Market Size

- May-2025

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021