Psyllium Market Size, Share, Growth & Industry Analysis, By Product Type (Psyllium Husk, Psyllium Seed, Psyllium Husk Powder, Psyllium Industrial Powder), By Application (Dietary Supplements, Pharmaceuticals, Animal Feed, Personal Care, Food & Beverages), By End User (Individual Consumers, Healthcare Institutions, Food Industry, Animal Nutrition, Personal Care Manufacturers), and Regional Analysis, 2024-2031

Psyllium Market: Global Share and Growth Trajectory

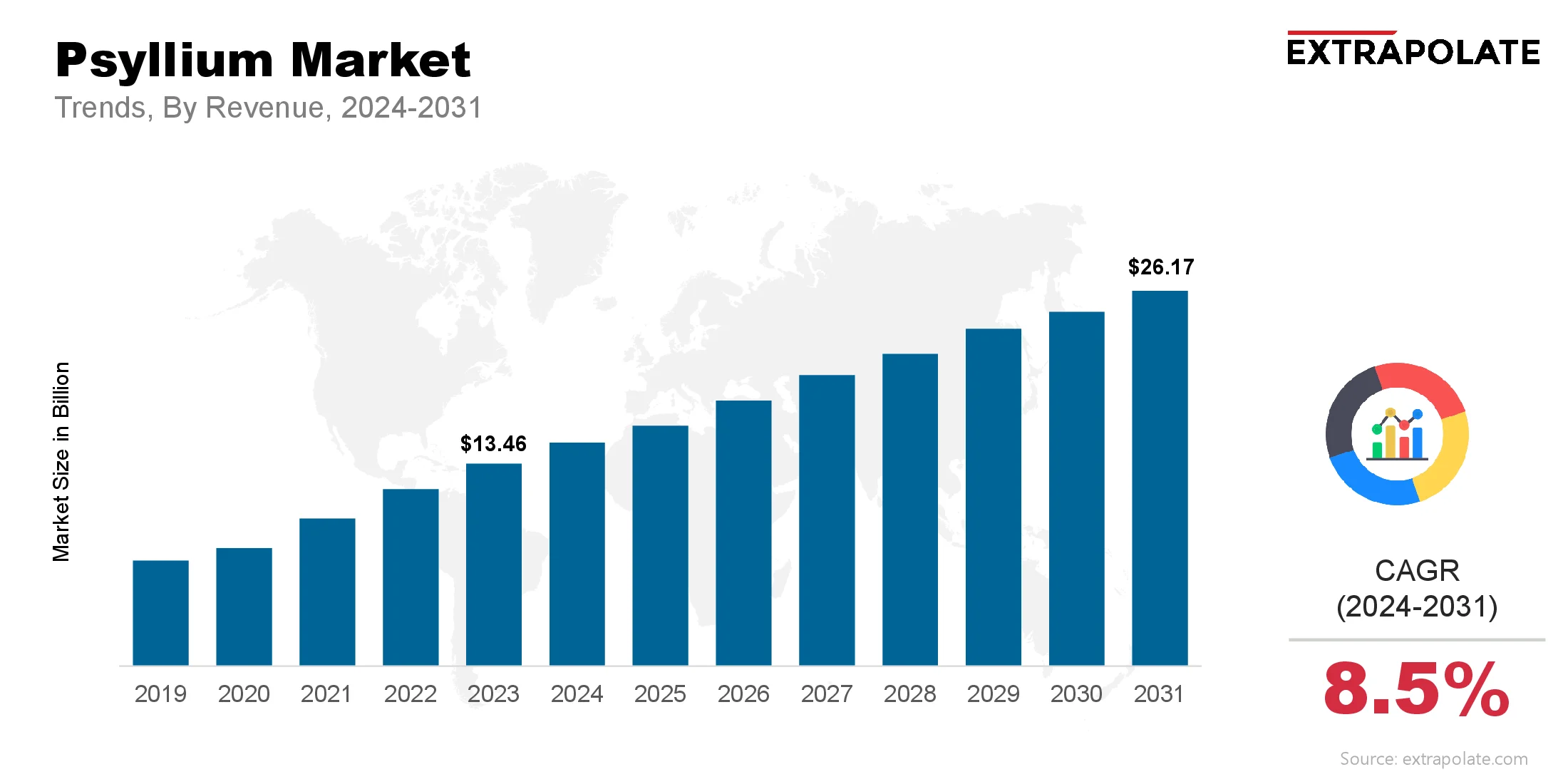

The global Psyllium Market size was valued at USD 13.46 billion in 2023 and is projected to grow from USD 14.73 billion in 2024 to USD 26.17 billion by 2031, exhibiting a CAGR of 8.5% during the forecast period.

The global psyllium market is experiencing significant growth, driven by increasing consumer awareness regarding digestive health, a growing preference for natural and plant-based products, and the expanding utilization of psyllium in various industries such as food and beverages, pharmaceuticals, and personal care.

Psyllium, primarily sourced from the seeds and husks of Plantago ovata, is rich in soluble dietary fiber and is widely recognized for its ability to promote gastrointestinal wellness, manage cholesterol levels, and support weight loss.

With the rising incidence of lifestyle-related disorders such as obesity, diabetes, and cardiovascular diseases, consumers are increasingly turning toward functional foods and supplements that offer health benefits beyond basic nutrition. Psyllium has garnered substantial attention as a functional ingredient owing to its effectiveness in improving digestion, reducing constipation, and regulating blood sugar levels.

This growing demand for gut-friendly and heart-healthy products has propelled the adoption of psyllium across multiple product categories, including dietary supplements, breakfast cereals, baked goods, nutrition bars, and beverages.

In the pharmaceutical industry, psyllium is widely used in the formulation of laxatives and bulk-forming fiber supplements. The growing popularity of over-the-counter fiber supplements and increasing prescription of psyllium-based drugs by healthcare professionals have significantly contributed to market growth. Furthermore, its non-toxic, natural profile makes psyllium an attractive option for inclusion in various pharmaceutical formulations aimed at addressing gastrointestinal issues and metabolic disorders.

The food and beverage segment is witnessing a rising demand for psyllium as a gluten-free and clean-label ingredient. As more consumers adopt gluten-free, vegan, and allergen-free diets, food manufacturers are incorporating psyllium into a broad range of products to enhance texture, retain moisture, and boost fiber content. Psyllium is increasingly used in bread, muffins, tortillas, and pasta as a binding and bulking agent, offering a functional alternative to synthetic additives and allergens.

The personal care and cosmetics industries are exploring psyllium’s potential. Its natural thickening, emulsifying, and soothing properties are ideal for skincare and haircare formulations. The trend for natural and organic beauty products is growing. This is encouraging the use of psyllium-based ingredients. These ingredients are being added to face masks, shampoos, conditioners, and moisturizers.

Asia-Pacific leads the global psyllium market. India is the largest producer and exporter. This includes both psyllium husk and seeds. North America and Europe are key markets. High consumer demand for functional foods drives growth. Dietary supplements also contribute to the demand. Ongoing research is improving extraction and processing techniques. This enhances the quality and versatility of psyllium products. It opens new opportunities for manufacturers and suppliers.

Key Market Trends Driving Product Adoption

The psyllium market is shaped by changing diets, consumer demands, and growing support for plant-based ingredients. Key trends include:

- Rising Demand for Dietary Fiber: Digestive issues and lifestyle diseases are rising. Psyllium is a popular natural fiber supplement, aiding gut health and cholesterol management.

- Growth in Vegan and Gluten-Free Products: As a binding and bulking agent, psyllium is ideal for vegan and gluten-free recipes. It's increasingly used in alternative bakery and snack products.

- Clean Label Movement: Consumers want natural, chemical-free, and recognizable ingredients. Psyllium is plant-based and minimally processed. It fits well with clean label requirements.

- Ayurvedic and Herbal Supplement Integration: The popularity of traditional and herbal medicine systems, like Ayurveda, is rising. This is increasing the demand for psyllium. It is in higher demand for nutraceutical and therapeutic applications.

- Sustainable Farming Practices: Psyllium cultivation is growing, mainly in India. It is recognized for its low environmental impact. This appeals to environmentally conscious consumers and businesses.

Major Players and their Competitive Positioning

The psyllium market is moderately consolidated, with key players such as Jyotindra International, Shree Mahalaxmi Psyllium Industries, Satnam Psyllium Industries, and Abhyuday Indutries dominating the supply chain. These companies are investing in quality certifications. They are expanding production capacity. Targeting international markets helps them maintain a competitive edge.

Consumer Behavior Analysis

Consumer interest in psyllium is driven by various health and lifestyle factors, including:

- Digestive Health: Psyllium helps relieve constipation and promotes gut health. This is driving adoption among health-conscious individuals.

- Weight Management: Psyllium increases satiety and regulates blood sugar. This is attracting fitness-focused consumers.

- Preventive Healthcare: There is a growing focus on preventive health. This is leading to increased consumption of fiber-rich supplements .

- Natural Lifestyle Choices: Consumers are moving away from synthetic ingredients. Psyllium is gaining popularity in natural remedy markets.

Pricing Trends

Psyllium pricing is affected by seasonal crop yields. It is also influenced by quality certifications and processing standards. Premium psyllium husk products have higher prices in developed markets. Cost-effective raw materials from India help keep global prices competitive.

According to Kings Research, the global psyllium market is projected to grow at a CAGR of 6.3% from 2023 to 2028, with the market expected to exceed USD 725 million by 2028, driven by rising demand from North America, Europe, and Asia-Pacific regions.

Growth Factors

Several factors are propelling the expansion of the psyllium market:

- Health and Wellness Trends: There is an increasing focus on digestive health. Fiber-rich diets are gaining attention across all age groups.

- Expansion in Functional Foods: The use of psyllium in bakery products is accelerating. It is also expanding in cereals and meal replacement products.

- Aging Population: The rising geriatric demographic is increasing. This leads to higher demand for easy-to-consume, gut-friendly supplements.

- Pharmaceutical Formulations: Psyllium is playing a role in drug delivery systems and laxatives. This is driving growth in the pharmaceutical sector.

Regulatory Landscape

The regulatory framework for psyllium varies worldwide. It includes food safety, organic certification, and labeling requirements. Compliance with FDA, EFSA, and other national guidelines is crucial. It ensures global trade and maintains consumer trust.

Recent Developments

The psyllium market is evolving, with ongoing innovations and industry developments:

- Product Innovation: Certified organic psyllium production is increasing. It is aimed at meeting growing Western demand.

- Organic Certification: Certified organic psyllium production is surging. This is to meet growing Western demand.

- Strategic Partnerships: Companies are forming alliances. This helps expand global distribution and sourcing capabilities.

- Enhanced Processing Technology: Milling and packaging solutions are improving. This ensures better shelf life and purity.

Current and Potential Growth Implications

- Demand Supply Analysis

Demand for psyllium is rising globally, particularly in developed markets. However, supply is primarily concentrated in India, which may create bottlenecks during poor harvests or export constraints. - Gap Analysis

Despite steady progress, several market gaps exist:

- Limited Awareness: Psyllium's benefits are not well-known. They are mainly recognized by health-conscious consumers.

- Standardization Challenges: Smaller suppliers lack consistency in processing. This affects their quality control.

- Product Diversification: Psyllium-based products are limited. Their availability goes beyond just supplements.

- Supply Chain Vulnerability: Heavy dependence on a single geographic source (India).

Top Companies in the Psyllium Market

Some of the leading players in the global psyllium industry include:

- Jyotindra International

- Abhyuday Industries

- Shree Mahalaxmi Psyllium Industries

- Satnam Psyllium Industries

- Keyur Industries

- Altrafine Gums

- Rajganga Agro Product Pvt. Ltd.

- Gujarat Agro Processors

- Virdhara International

- Nexcel Natural Ingredients

Psyllium Market: Report Snapshot

Segmentation | Details |

By Product Type | Psyllium Husk, Psyllium Seed, Psyllium Husk Powder, Psyllium Industrial Powder |

By Application | Dietary Supplements, Pharmaceuticals, Animal Feed, Personal Care, Food & Beverages |

By End User | Individual Consumers, Healthcare Institutions, Food Industry, Animal Nutrition, Personal Care Manufacturers |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

Growth Segments

The following segments are poised for notable expansion:

- Dietary Supplements: Driven by increased awareness of gut health and fiber intake.

- Pharmaceutical Applications: Use in OTC laxatives and therapeutic products.

- Food and Beverages: Emerging use in gluten-free baking and functional foods.

Major Innovations

Innovation remains vital in capturing new markets and maintaining relevance:

- Effervescent Psyllium Powders: For better solubility and taste.

- Flavored Fiber Supplements: Catering to younger demographics.

- Eco-Friendly Packaging: Meeting sustainability demands.

- Encapsulated Fiber Forms: For easy incorporation into food and beverage products.

Potential Growth Opportunities

Companies in the psyllium market must address several challenges and leverage key opportunities:

- Consumer Education Campaigns: Boosting knowledge about psyllium’s benefits helps increase consumer awareness. It encourages adoption in various health and wellness applications.

- Innovative Product Development: Innovative product development caters to more dietary preferences. It meets the demand for diverse options.

- Vertical Integration: Vertical integration enhances supply chain control. It improves product quality.

- Sustainability Certification: Attracting eco-conscious consumers and retailers is key. This strategy enhances market appeal and drives demand.

Extrapolate Research says:

The global psyllium market is poised for sustainable growth over the coming years, driven by increasing health consciousness, expanding applications across industries, and a growing preference for plant-based ingredients. Companies that focus on innovation, quality, and global outreach will thrive in this evolving landscape.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Psyllium Market Size

- May-2025

- 148

- Global

- agritech

Related Research

Agricultural Biologicals Market Size, Share, and COVID-19 Impact Analysis, By Function Type (Biopest

July-2022

Agricultural Supply Chain Service Market Size, Share, Growth & Industry Analysis, By Service Type (P

June-2025

Agrigenomics Market Size, Share, Growth & Industry Analysis, By Technology (Gene Editing, Genetic Se

March-2025

Agritourism Market Size, Share, Growth & Industry Analysis, By Activity Type (Farm Stays, Direct Mar

May-2025

Feed Grade Vitamin and Mineral Premixes Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Global Acid And Nutrient In Animal Nutrition Market Research Report 2022 (Status and Outlook)

June-2022

Global Advanced Herbicides Market Research Report 2022

December-2022