Probiotics Market Size, Share, Growth & Industry Analysis, By Product Type (Probiotic Supplements, Probiotic-Enriched Foods, Probiotic Beverages, Others), By Application (Digestive Health, Immune Health, Mental Health, Skin Health, Others), By End-User (Individual Consumers, Healthcare Providers, Food & Beverage Manufacturers), and Regional Analysis, 2024-2031

Probiotics Market: Global Share and Growth Trajectory

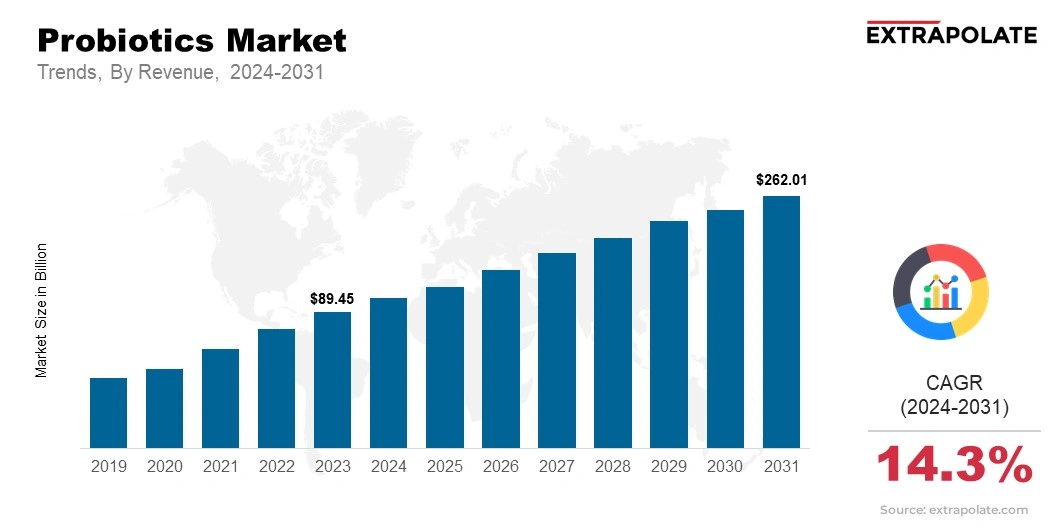

The global Probiotics Market size was valued at USD 89.45 billion in 2023 and is projected to grow from USD 103.07 billion in 2024 to USD 262.01 billion by 2031, exhibiting a CAGR of 14.3% during the forecast period.

The global market is experiencing robust growth, fueled by increasing consumer awareness of gut health, advancements in probiotics research, and rising demand for functional food and dietary supplements.

Probiotics, which include live beneficial microorganisms that provide health benefits, are becoming an essential part of consumers' daily routines due to their proven positive effects on digestive health, immune system function, and overall well-being.

As the demand for natural health solutions rises, probiotics are being integrated into a variety of product categories. These include dairy-based probiotics, dietary supplements, fermented foods, beverages, and even non-dairy options such as plant-based yogurts and drinks.

The growing trend of health-conscious consumers seeking natural and functional foods has further propelled the popularity of probiotics across different age groups and demographics.

Technological innovations in probiotic strain development, as well as advancements in product formulation and delivery mechanisms, are enhancing the effectiveness and stability of probiotics, leading to improved consumer satisfaction.

Companies are also increasingly investing in research to develop targeted probiotics that address specific health concerns such as gut dysbiosis, irritable bowel syndrome (IBS), and skin conditions.

The expanding applications of probiotics are driving market growth and creating new opportunities in the functional food and beverage sectors.

Regionally, North America and Europe are the largest markets for probiotics, supported by advanced healthcare systems and growing awareness of the importance of gut health. Meanwhile, the Asia-Pacific region is witnessing significant growth, driven by rising disposable incomes, greater adoption of probiotic-rich foods, and increased awareness of the link between gut health and overall wellness.

Key Market Trends Driving Product Adoption

Several factors are fueling the demand for probiotics, including:

- Health and Wellness Focus: Growing consumer awareness of the importance of gut health and its connection to overall well-being is propelling the adoption of probiotics as part of daily health routines.

- Rise in Digestive Disorders: With an increasing prevalence of digestive issues like irritable bowel syndrome (IBS), constipation, and bloating, consumers are turning to probiotics to alleviate symptoms and support digestive health.

- Personalized Nutrition: People want food and supplements made just for them, and this is helping probiotics grow in popularity in healthy foods, supplements, and drinks.

- Increasing Popularity of Plant-Based Probiotics: With plant-based eating on the rise, plant-based probiotics are in high demand, giving people more choices.

- Probiotics in Beauty and Skincare Products: Probiotics are popping up in beauty products too, boosting their popularity beyond just food and supplements, and creating more demand in cosmetics.

Major Players and their Competitive Positioning

The probiotics market is highly competitive, with numerous players offering a range of products across various categories. Key players like Danone, Nestlé, Yakult, and Chr. Hansen dominate the market, offering probiotic-enriched food, beverage, and supplement products. Smaller companies and startups are developing niche probiotics. Players are switching to plant-based choices and good bacteria for tummy health. The market is seeing a lot of deals and new ideas for probiotic products and how they're used.

Consumer Behavior Analysis

Consumers are increasingly incorporating probiotics into their daily routines due to:

- Gut Health Awareness: As gut health info spreads, more people are choosing probiotics. They aid digestion, improve immunity, and relieve digestive issues.

- Holistic Health Focus: The rise in natural health is driving more people to probiotics. They’re viewed as natural alternatives to medicine, part of a broader wellness plan.

- Convenience and Accessibility: Probiotics come in all sorts of forms now capsules, powders, drinks, snacks. Consumers are choosing these easy, probiotic-packed options to match their busy lives.

- Beauty and Skin Health: Probiotics go beyond digestion. Consumers are now picking skincare products with probiotics to boost skin health and calm inflammation.

Pricing Trends

Probiotic prices depend on things like the bacteria strain, product form and the brand name. Premium products, especially those with multiple strains or targeting specific health issues, come with a higher price tag. More probiotics are popping up in regular supermarkets and online stores. This is driving prices down and making them easier to grab for more people. Competition in the probiotics world will push prices lower. This will likely lead to cheaper options, especially for products aimed at the mass market.

The probiotics market is set to grow with a CAGR of 7.8% each year from 2023 to 2031. This growth is fueled by more gut health awareness, a rise in functional foods and supplements, and a stronger demand for natural, plant-based health products.

Growth Factors

The market is fueled by several key growth drivers:

- Rising Consumer Awareness of Gut Health: As people understand more about gut health and its impact on well-being, the demand for probiotics is increasing.

- Increased Focus on Digestive Health: The rise in digestive issues like IBS, bloating, and constipation is pushing consumers to use probiotics for support.

- Expanding Product Applications: Probiotics are now added to more products. This includes functional foods, drinks, and beauty items.

- Adoption of Probiotics in Emerging Markets: Awareness of probiotics' health benefits is growing in emerging markets like Asia-Pacific and Latin America. This is driving market expansion.

Regulatory Landscape

Regulations for probiotics differ by region. They control product claims, quality, and safety standards. In many regions, probiotics are seen as food or supplements, with different regulation levels. Regulatory bodies like the FDA, EFSA, and regional authorities check the safety and effectiveness of probiotics, ensuring products meet standards for consumption.

Recent Developments

Key developments in the market include:

- Scientific Advancements in Probiotic Research: Specific probiotics strains are being developed to target specific health issues.

- Probiotics in Functional Beverages: Probiotics are also introduces into different functional beverages. This includes drinks like kombucha or other smoothies

- Plant-Based Probiotic Products: Dairy-free or vegan probiotics are getting more popular among consumers. This is forcing manufactures to develop plant based probiotics.

- Innovation in Probiotic Strain Development: Manufactures in the markets are aggressively investing in research and development of new probiotics strains. This new strains are developed to support mental and skin health along with immunity.

Current and Potential Growth Implications

Demand-Supply Analysis

Emerging countries are showing a constant demand of probiotics. Nonetheless, high-quality probiotics faces supply constraints as they require advance production techniques. High quality probiotics also require strain-specific formulations to maintain the stability and efficacy of live bacteria.

Gap Analysis

The market faces a few challenges:

- Quality Control Issues: Ensuring potency and stability is vital for probiotic manufacturers. Meticulous quality control and testing are crucial obstacles.

- Lack of Consumer Awareness: Probiotics are becoming more popular. But low consumer awareness about their specific health perks and different strains slow market progress.

- High Costs for Premium Products: The premium market is developing. But the high cost of special strains limits wider reach, particularly in budget-conscious areas.

Top Companies in the Probiotics Market

- Danone (Activia, DanActive)

- Nestlé (Nestlé Health Science)

- Yakult Honsha Co.

- Chr. Hansen

- Probi AB

- DuPont (Danisco)

- Kerry Group

- Amway (Nutrilite)

- Lallemand

- BioGaia

Probiotics Market: Report Snapshot

Segmentation | Details |

By Product Type | Probiotic Supplements, Probiotic-Enriched Foods, Probiotic Beverages, Others |

By Application | Digestive Health, Immune Health, Mental Health, Skin Health, Others |

By End-User | Individual Consumers, Healthcare Providers, Food & Beverage Manufacturers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to experience significant growth:

- Probiotics for Digestive Health: Probiotics for gut health, digestion, and a healthy microbiome will stay popular. This part of the market will keep growing.

- Probiotics for Immune Support: Probiotic supplements and immune-boosting foods are getting more popular. This is more relevant among health-conscious shoppers.

- Plant-Based Probiotics: As plant-based diets grow, plant-powered probiotics are ready to shoot up. Think vegan supplements and dairy-free options.

Major Innovations

Innovation is key to the growth of the market, with major innovations including:

- Advanced Probiotic Strain Development: Labs are creating new probiotics. They help with mental health, skin, and immunity.

- Probiotics in Functional Foods and Beverages: Probiotics in drinks like kombucha and kefir are becoming more prevalent. People want fast health fixes.

- Probiotics for Skin Health: Probiotics are infiltrating the skincare business. They diminish inflammation and encourage the skin health.

Potential Growth Opportunities

The market presents significant growth opportunities, particularly in the following areas:

- Emerging Markets: Awareness and use of probiotics are growing in new markets, especially in Asia-Pacific. This opens up a big chance for growth.

- Probiotics for Mental and Skin Health: Holistic health is getting more attention. Probiotics that help mental health, fight stress, and boost skin health are full of exciting growth possibilities.

- Functional Foods and Beverages: Mixing probiotics into foods, drinks, and snacks opens big chances for growth. Shoppers are chasing healthier, easy choices more and more.

Extrapolate Research says:

The probiotics market is primed for extensive progression. People are getting more aware of gut health. Digestive problems are rising, and there’s more buzz around functional foods and nutrition tailored to the individual. Companies innovating with new probiotic strains will thrive. Those integrating probiotics into diverse products and meeting the demand for plant-based, functional items are well-positioned for success.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Probiotics Market Size

- March-2025

- 148

- Global

- agritech

Related Research

Agricultural Biologicals Market Size, Share, and COVID-19 Impact Analysis, By Function Type (Biopest

July-2022

Agricultural Supply Chain Service Market Size, Share, Growth & Industry Analysis, By Service Type (P

June-2025

Agrigenomics Market Size, Share, Growth & Industry Analysis, By Technology (Gene Editing, Genetic Se

March-2025

Agritourism Market Size, Share, Growth & Industry Analysis, By Activity Type (Farm Stays, Direct Mar

May-2025

Feed Grade Vitamin and Mineral Premixes Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Global Acid And Nutrient In Animal Nutrition Market Research Report 2022 (Status and Outlook)

June-2022

Global Advanced Herbicides Market Research Report 2022

December-2022