Agricultural Supply Chain Service Market Size, Share, Growth & Industry Analysis, By Service Type (Procurement, Logistics, Warehousing, Packaging, Distribution) By Mode of Transportation (Roadways, Railways, Airways, Seaways) By End User (Farmers, Food Processing Companies, Retailers, Exporters), and Regional Analysis, 2024-2031

Agricultural Supply Chain Service Market: Global Share and Growth Trajectory

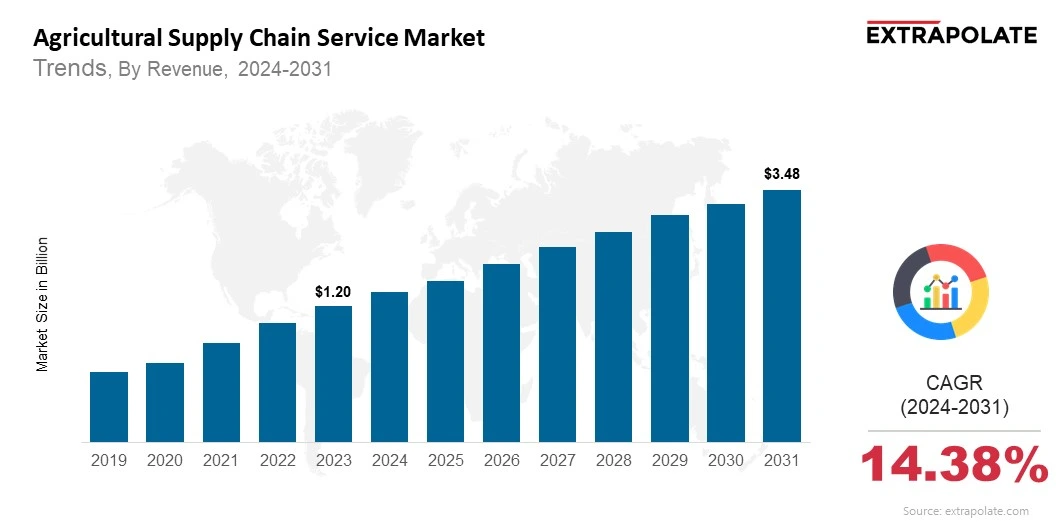

The global Agricultural Supply Chain Service Market size was valued at USD 1.20 billion in 2023 and is projected to grow from USD 1.35 billion in 2024 to USD 3.48 billion by 2031, exhibiting a CAGR of 14.38% during the forecast period.

The global Agricultural Supply Chain Service Market is changing rapidly. Digitalization, sustainability demands, and food security concerns drive this transformation. Agricultural supply chain services include sourcing, logistics, storage, quality control, packaging, and distribution of food from farm to table. These services boost productivity, cut post-harvest losses, ensure traceability, and meet consumer needs efficiently.

With a growing population and climate change risks, effective supply chain services are vital for agriculture today. Innovations like blockchain traceability, real-time tracking, data analytics, and automated storage are improving agricultural supply chains. Both governments and private investors are pouring money into agritech platforms and integrated supply networks to create sustainable food systems.

Moreover, the demand for organic produce, precision agriculture, and global food exports pushes service providers to adopt better logistics, digital procurement models, and partnerships with farmers. As rural infrastructure and digital connectivity improve in developing areas, agricultural supply chain services are set for significant growth.

Key Market Trends Driving Service Adoption

Key Market Trends Driving Service Adoption

Several key trends are speeding up the adoption of agricultural supply chain services worldwide:

Digital Transformation in Agriculture

Digitalization is changing supply chain services. IoT sensors, AI logistics, cloud-based management and satellite imaging help you make informed decisions. From monitoring crops to predicting storage needs, digitalization gives you real-time supply chain visibility. Service providers now offer complete digital solutions – from sourcing to delivery – to increase efficiency and transparency.

E-Commerce and Online Grocery Retail

E-commerce and online grocery shopping is growing and so is the investment in cold storage, last mile delivery and real-time inventory systems. This is driving the need for agile and responsive supply chain services for omnichannel delivery. Companies need scalable solutions for packaging, logistics and compliance for online grocery needs especially in urban areas.

More Focus on Food Safety and Traceability

Consumers are more aware of food quality and safety. As a result, traceability systems using blockchain, RFID and QR codes are becoming popular. Governments worldwide are enforcing stricter food safety regulations and service providers need to create transparent systems.

Climate Change and Sustainability Pressures

As environmental concerns grow, agricultural supply chain services are adapting to lower carbon footprints. Sustainable logistics, renewable energy storage, eco-friendly packaging, and reduced food miles are becoming priorities. Providers focusing on sustainability gain an advantage, especially when partnering with eco-friendly brands.

Major Players and their Competitive Positioning

The Agricultural Supply Chain Service Market features a mix of global logistics companies, regional cooperatives, agritech startups, and integrated agribusinesses. Key players include: Cargill Incorporated, Archer Daniels Midland Company (ADM), Bayer CropScience, Syngenta AG, CNH Industrial N.V., Maersk Line, DHL Supply Chain, Lineage Logistics, Olam International, CH Robinson Worldwide Inc.

These companies use AI, automation, and cloud technology to enhance their offerings. Collaborations with farmers, retailers, and governments help improve sourcing and quality. Mergers and acquisitions are common as companies seek to expand their reach and service options.

Consumer Behavior Analysis

Understanding consumer behavior is key to aligning agricultural supply chain services with market needs:

Demand for Fresh and Organic Produce

Many consumers prioritize freshness and organic certification. This trend leads service providers to ensure quick turnaround, temperature-controlled logistics, and compliance with organic standards. Investment in fast logistics and flexible warehousing is growing.

Shift Toward Local and Seasonal Products

Consumers increasingly choose locally sourced, seasonal foods for freshness. This behavior requires supply chain services to adapt sourcing routes and delivery schedules. Providers with local networks are best positioned to meet this demand.

Trust in Transparency and Brand Story

Customers want to know where their food comes from. Brands that offer transparency build customer loyalty. Supply chain services must provide real-time tracking and provenance certification. Blockchain tools for transparency are becoming more popular.

Digital Buying Behavior

The rise of mobile apps and online marketplaces for fresh produce has made supply chains more agile. Consumers expect quick delivery, easy returns, and regular updates. Agricultural supply chain services are streamlining order fulfillment and integrating ERP systems for better customer experiences.

Pricing Trends

Pricing in the Agricultural Supply Chain Service Market depends on distance, perishability, storage needs, and service type (e.g., cold chain). Costs can vary from basic warehousing to premium refrigerated services.

Despite high initial investments in digitization, economies of scale, technological efficiency, and third-party logistics are lowering long-term costs. Flexible pricing strategies like service bundling, subscription logistics, and pay-per-use warehousing are emerging. Additionally, governments are providing incentives to encourage investment in modern agri-logistics, especially in rural areas.

Growth Factors

Several driving forces are fueling growth in the Agricultural Supply Chain Service Market:

Rise in Global Food Demand

The global population may exceed 9 billion by 2050, driving food demand higher. This increase pressures supply chains to be efficient and resilient. Agricultural supply chain services help connect rural producers with urban consumers.

Expansion of Agribusiness and Export Markets

Developing countries are becoming major food exporters. This change needs advanced supply chain networks to manage documentation, quality checks, and timely logistics. Demand for export-ready supply chains is rising in Latin America, Southeast Asia, and Sub-Saharan Africa.

Increasing Investment in Rural Infrastructure

Investments in roads, cold chains, internet access, and storage are expanding supply chain services. Closing infrastructure gaps allows providers to reach remote farms and include smallholders in formal markets, broadening their service base.

Government Support and Policy Reforms

Policies like subsidies for cold storage and tax benefits for agritech help the market grow. Initiatives like India’s eNAM (National Agriculture Market) and Africa’s Alliance for a Green Revolution enhance formal supply chain engagement.

Regulatory Landscape

The agricultural supply chain industry follows regional and international regulations, especially concerning food safety and sustainability. Key frameworks include:

- GlobalG.A.P and HACCP for food safety.

- WTO’s Sanitary and Phytosanitary (SPS) Agreement for trade.

- EU Farm-to-Fork strategy for sustainable food systems.

- FDA’s Food Safety Modernization Act (FSMA) in the U.S.

Staying compliant with these regulations is crucial for market access, especially for exports. Providers must regularly update processes to ensure compliance.

Recent Developments

Key developments are shaping agricultural supply chain services:

- Blockchain Integration: Companies like IBM Food Trust collaborate with producers and retailers for traceability.

- Cold Chain Logistics Expansion: Lineage Logistics and Maersk invest heavily in cold chain infrastructure in emerging markets.

- Agritech Partnerships: Traditional companies are teaming up with startups like CropIn and DeHaat to use AI in logistics.

- Sustainable Packaging: Biodegradable packaging and reusable crates are gaining popularity due to environmental concerns.

These trends highlight the sector’s adaptability to meet regulatory and consumer demands.

Current and Potential Growth Implications

Demand-Supply Analysis

Demand for high-quality, traceable agricultural products is outpacing the supply of logistics services. Major agribusinesses have strong systems, but small and mid-sized farms struggle to access services. Closing this gap offers opportunities for third-party logistics and digital platforms.

Gap Analysis

A significant gap exists in digitization and cold storage in developing regions. Many rural farmers lack access to basic supply chain services. Addressing this divide calls for public investment and innovative models like mobile aggregation units.

Top Companies in the Agricultural Supply Chain Service Market

- Cargill Incorporated

- Archer Daniels Midland Company

- Bayer CropScience

- Syngenta AG

- DHL Supply Chain

- CNH Industrial N.V.

- Olam International

- CH Robinson Worldwide Inc.

- Maersk Line

- Lineage Logistics

Agricultural Supply Chain Service Market: Report Snapshot

Segmentation | Details |

By Service Type | Procurement, Logistics, Warehousing, Packaging, Distribution |

By Mode of Transportation | Roadways, Railways, Airways, Seaways |

By End User | Farmers, Food Processing Companies, Retailers, Exporters |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Agricultural Supply Chain Service Market: High-Growth Segments

High-growth segments include:

- Cold Chain Logistics: Rising demand for perishable goods drives this segment.

- Digital Supply Chain Platforms: Platforms that offer visibility and analytics are in high demand.

- Export-Oriented Services: Compliance-driven logistics for export markets are expanding rapidly.

Major Innovations

Recent market innovations include:

- IoT-Enabled Storage and Transportation: Real-time monitoring improves product shelf life.

- AI-Driven Route Optimization: This reduces fuel use and delivery times.

- Blockchain Traceability Systems: These ensure product safety and origin verification.

Agricultural Supply Chain Service Market: Potential Growth Opportunities

- Expansion in Emerging Markets: Untapped rural areas in Africa and Asia hold great potential.

- Integration with Smart Farming Tools: Linking with precision agriculture solutions enhances service.

- Sustainability as a Differentiator: Green logistics and eco-packaging will shape future market strategies.

Extrapolate Research says:

The Agricultural Supply Chain Service Market is at a pivotal point, driven by food demand, digitization, and sustainability needs. This market integrates farmers, retailers, and tech providers, reshaping how food moves from fields to consumers. The push for traceable and efficient supply networks is accelerating growth, especially in emerging markets. Investments in cold storage, digital platforms, and sustainable logistics will define the market’s future. Kings Research expects sustained double-digit growth as supply chain resilience becomes vital in global agriculture.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Agricultural Supply Chain Service Market Size

- June-2025

- 148

- Global

- agritech

Related Research

Agricultural Biologicals Market Size, Share, and COVID-19 Impact Analysis, By Function Type (Biopest

July-2022

Agricultural Supply Chain Service Market Size, Share, Growth & Industry Analysis, By Service Type (P

June-2025

Agrigenomics Market Size, Share, Growth & Industry Analysis, By Technology (Gene Editing, Genetic Se

March-2025

Agritourism Market Size, Share, Growth & Industry Analysis, By Activity Type (Farm Stays, Direct Mar

May-2025

Feed Grade Vitamin and Mineral Premixes Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Global Acid And Nutrient In Animal Nutrition Market Research Report 2022 (Status and Outlook)

June-2022

Global Advanced Herbicides Market Research Report 2022

December-2022