Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Chemical Propulsion, Electric Propulsion, Hybrid Propulsion, Green Propulsion) By Satellite Type (Small Satellites, Medium Satellites, Large Satellites) By Application (Earth Observation, Navigation, Communication, Scientific Exploration, Defense) By End-User (Commercial, Government & Defense, Research Organizations), and Regional Analysis, 2024-2031

Satellite Propulsion Systems Market: Global Share and Growth Trajectory

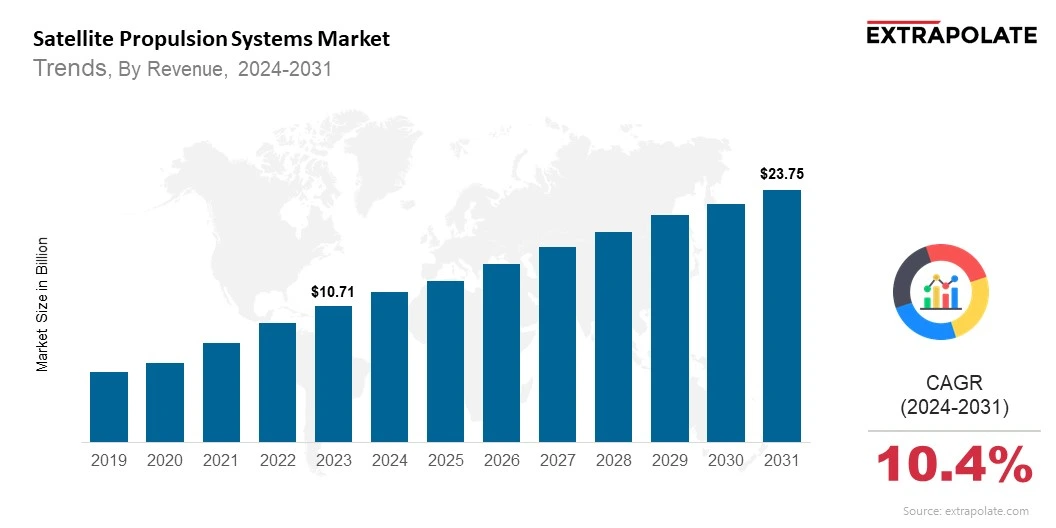

The global Satellite Propulsion Systems Market size was valued at USD 10.71 Billion in 2023 and is projected to grow from USD 11.92 Billion in 2024 to USD 23.75 Billion by 2031, exhibiting a CAGR of 10.4% during the forecast period.

The satellite propulsion systems market is experiencing dynamic growth, driven by the increasing frequency of satellite launches and the evolution of space missions across commercial, governmental, and defense sectors. Propulsion systems are vital for satellite maneuvering, orbit insertion, station keeping, and end-of-life deorbiting—functions that are critical for mission success and asset longevity.

As satellite constellations expand and low Earth orbit (LEO) becomes increasingly populated, the demand for reliable, efficient, and scalable propulsion technologies has never been greater. Traditionally dominated by chemical propulsion systems, the market is undergoing a transformative shift toward electric and green propulsion solutions.

Electric propulsion offers significant advantages in fuel efficiency, reduced mass, and extended mission duration, making it a preferred choice for both small satellites (smallsats) and geostationary platforms. The adoption of green propellants, such as iodine- or water-based alternatives, reflects a broader push toward environmental sustainability and operational safety in space missions.

The rise of mega-constellation projects—such as SpaceX’s Starlink, Amazon’s Project Kuiper, and OneWeb—has created unprecedented demand for high-performance propulsion systems tailored to mass deployments. Moreover, the global emphasis on satellite-enabled connectivity, Earth observation, defense surveillance, and interplanetary exploration is broadening the application spectrum.

North America and Europe currently hold dominant market shares due to the presence of major aerospace firms and government-backed space programs. However, the Asia-Pacific region is emerging rapidly, led by growing investments from countries like China, India, and Japan. As nations and private enterprises increase their presence in space, the global satellite propulsion systems market is set to grow exponentially in the coming years.

With innovation at the core, propulsion technology is transitioning from a supporting role to a central pillar of satellite design, enabling new capabilities and defining the future of space mobility.

Key Market Trends Driving Product Adoption

- Electric Propulsion Systems:

Electric propulsion systems are preferred over chemical propulsion due to efficiency and reduced fuel mass. Geostationary and LEO missions are where electric propulsion is most popular. Airbus and Northrop Grumman are investing heavily in electric propulsion which allows satellites to carry more payload and stay operational for longer. - Small Satellites and CubeSats:

The market has seen a huge surge in CubeSats and small satellite deployments for Earth observation, communication and scientific missions. These small satellites need lightweight and efficient propulsion systems which is driving innovation in micro-propulsion technologies. - Commercial Space Exploration:

Private companies like SpaceX, Blue Origin and Rocket Lab have entered the space industry and is driving demand for advanced propulsion systems. These companies need reliable propulsion technologies to deploy satellite mega-constellations, deep space missions and maintain space assets. - Government Space Programs Expanding:

National agencies like NASA, ESA and ISRO are increasing investment in satellite technologies. Their focus on deep space exploration, defense applications and scientific research is driving development and procurement of high performance propulsion systems.

Major Players and their Positioning

The satellite propulsion systems market is highly competitive with established players competing with new entrants. These companies are focusing on technology, partnerships and product diversification to strengthen their position. Major players: Airbus Defence and Space, Northrop Grumman Corporation, OHB SE, Safran S.A., Thales Alenia Space, Aerojet Rocketdyne (a L3Harris Technologies company), IHI Aerospace Co., Ltd., Moog Inc., Busek Co. Inc., Exotrail, Phase Four

These organizations are expanding their portfolios with electric, chemical, hybrid, and green propulsion systems tailored to smallsats, large geostationary satellites, and deep-space missions. Mergers, acquisitions, and R&D investments remain central to their growth strategies.

Consumer Behavior Analysis

- Cost vs. Performance:

Satellite operators—governmental and commercial—want propulsion systems that offer high thrust-to-weight ratio, reliability and efficiency. While traditional chemical systems offer high thrust, electric systems offer longevity and cost advantages for low thrust applications. - Sustainable Technologies:

As sustainability becomes a global priority, satellite developers and space agencies are moving to green propulsion systems that minimize toxic propellants and space debris. Water and iodine based propulsion are gaining interest due to their eco-friendly profiles. - Customization from Commercial Operators:

Commercial customers are asking for propulsion systems tailored to their mission requirements—be it for high precision orbit insertion, station keeping or interplanetary travel. This has forced propulsion system manufacturers to offer more modular and customizable solutions. - More Risk Tolerance from Startups:

Space startups unlike traditional government agencies have more risk appetite. This has led to faster adoption of new propulsion technologies especially in small satellite segment and hence faster market innovation.

Pricing Trends

Pricing of propulsion systems varies greatly depending on type (chemical, electric, hybrid), scale and application. Chemical propulsion systems though dominant historically are expensive due to fuel requirements and complexity. Electric propulsion systems reduce fuel costs and launch weight and provide long term savings.

New entrants and advancements in 3D printing, miniaturization and manufacturing efficiency are reducing overall costs. Government backed grants and international collaboration initiatives are helping emerging companies to introduce competitive and affordable solutions to the market.

Subscription models, leasing and propulsion as a service platforms are emerging—allowing satellite operators to manage capital expenditure and streamline operations.

Growth Factors

- Increasing Number of Satellite Launches: Over 100 satellite launches per year and satellite constellations like Starlink, OneWeb and Kuiper are increasing the demand for reliable propulsion systems.

- Innovation in Propulsion Technologies: Breakthroughs in electric propulsion (Hall effect thrusters, ion engines), green propellants and hybrid systems are redefining propulsion efficiency, scalability and safety. These innovations are compatible with newer satellite platforms and evolving mission requirements.

- Strategic Government Investments: Many governments are increasing their national space programs with more funding and international collaboration. These investments not only support space missions but also local manufacturing of propulsion components and systems.

- Emerging Use Cases: Beyond telecommunications and Earth observation, propulsion systems are now critical in in-space servicing, debris mitigation, on-orbit manufacturing and lunar gateway missions. This is expanding the market size.

Regulatory Landscape

Satellite propulsion systems market operates in a complex regulatory environment to ensure safety, sustainability and international compliance. Key regulations are:

- ITAR and EAR Compliance (U.S.): Export regulations like International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) govern technology transfer and licensing, impacting global supply chain.

- UN COPUOS Guidelines: The United Nations’ Committee on the Peaceful Uses of Outer Space (COPUOS) sets global frameworks for space activity, including responsible disposal and propulsion safety standards.

- Environmental Safety Guidelines: As propulsion systems deal with hazardous propellants and orbital mechanics, stringent environmental and safety rules from agencies such as the EPA and ESA dictate system design and deployment.

- Licensing and Launch Permits: Space agencies require proper certifications for propulsion-enabled satellites, including propulsion modeling, contamination control, and end-of-life deorbiting strategies.

Recent Developments

- Exotrail’s Modular Electric Propulsion: Exotrail recently launched its modular Hall-effect thruster solutions designed for smallsats, offering a scalable approach to electric propulsion in low Earth orbit.

- NASA’s Green Propellant Infusion Mission (GPIM): This successful demonstration of a non-toxic propellant alternative (AF-M315E) is pushing the adoption of green chemical propulsion systems in future missions.

- Busek's Iodine Thruster Test in Space: The first in-space test of iodine-based propulsion technology, conducted by Busek and ThrustMe, showed promising results for sustainable propulsion in compact satellites.

- Increased SpaceX and OneWeb Launches: With hundreds of satellites launched via reusable rockets, propulsion systems are critical for constellation maintenance, orbital adjustments, and deorbiting protocols.

Current and Potential Growth Implications

Demand-Supply Analysis:

The accelerating frequency of satellite deployments has put pressure on propulsion system manufacturers to scale up production without compromising on quality. Companies are responding with automated production lines, modular designs, and strategic outsourcing.

Gap Analysis:

Despite growth, access to advanced propulsion remains limited in developing countries due to cost, licensing hurdles, and limited infrastructure. There’s also a technology gap between propulsion options for small satellites and those for larger or interplanetary missions.

This opens opportunities for affordable micropropulsion solutions and public-private collaborations to democratize access to advanced space capabilities.

Top Companies in the Satellite Propulsion Systems Market

- Airbus Defence and Space

- Northrop Grumman Corporation

- OHB SE

- Safran S.A.

- Thales Alenia Space

- Aerojet Rocketdyne

- Moog Inc.

- Busek Co. Inc.

- IHI Aerospace Co., Ltd.

- Exotrail

- Phase Four

Satellite Propulsion Systems Market: Report Snapshot

Segmentation | Details |

By Propulsion Type | Chemical Propulsion, Electric Propulsion, Hybrid Propulsion, Green Propulsion |

By Satellite Type | Small Satellites, Medium Satellites, Large Satellites |

By Application | Earth Observation, Navigation, Communication, Scientific Exploration, Defense |

By End-User | Commercial, Government & Defense, Research Organizations |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Satellite Propulsion Systems Market: High-Growth Segments

- Electric Propulsion: With efficiency and weight advantages, electric is going to dominate especially in LEO satellite constellations and long duration missions.

- Small Satellite Propulsion: The smallsat boom is driving demand for low-cost, lightweight, and compact propulsion technologies, making this a prime growth area.

- Green Propulsion Solutions: As sustainability concerns rise, eco-friendly alternatives to hydrazine and other toxic fuels are getting attention in regulatory and R&D circles.

Major Innovations

- Hall-Effect and Ion Thrusters: These advanced electric propulsion systems are redefining satellite maneuverability and longevity in LEO and deep space.

- Additive Manufacturing for Thruster Components: 3D printing is enabling faster production cycles, design optimization and cost reduction across the propulsion supply chain.

- Water and Iodine Propulsion: Alternatives like water based steam thrusters and iodine fuel systems are opening up sustainable and low cost propulsion options for small spacecraft..

Satellite Propulsion Systems Market: Potential Growth Opportunities

- Emerging Markets: Governments in Asia, Latin America and Africa are investing in space research, new markets for modular and cost effective propulsion technologies.

- On-Orbit Servicing and Debris Mitigation: Propulsion systems are critical for satellite servicing, repositioning and safe deorbiting, new niches for growth.

- Interplanetary Missions and Space Tourism: As deep space exploration and space tourism evolves, there will be growing demand for high thrust, long endurance propulsion systems for human and robotic missions.

Extrapolate Research says:

The satellite propulsion systems market is on a growth path, driven by increasing satellite deployments, private space investments and government support. As technology advances, the market is moving away from traditional chemical systems to advanced electric and green propulsion solutions.

Electric and hybrid systems will dominate the propulsion landscape due to efficiency, adaptability and small satellite compatibility. Modularity, cost effectiveness and sustainability is redefining propulsion technology adoption across commercial and defense sectors.

With new frontiers like in-space manufacturing, lunar missions and orbital servicing emerging, propulsion systems are becoming mission critical. The long term outlook is very positive and stakeholders are investing heavily to capitalize on the huge opportunity.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Satellite Propulsion Systems Market Size

- June-2025

- 148

- Global

- aerospace-and-defence

Related Research

Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots

June-2025

AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Base

July-2025

Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermop

June-2025

Dog Automatic Feeder-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

Drone Market Size, Share, Growth & Industry Analysis, By Type (Consumer Drones, Commercial Drones, M

March-2025

Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Carg

April-2025

Global Military Radar Market Size, Share, and COVID-19 Impact Analysis, By Component (Digital Signal

July-2022

Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles),

June-2025

Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Che

June-2025

Small Satellite Market Size, Share, Growth & Industry Analysis, By Satellite Type (CubeSat, MiniSat,

April-2025