AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Based, Space-Based), By Application (Surveillance & Reconnaissance, Fire Control, Air Defense, Electronic Warfare), By Component (Transmit/Receive Modules, Antenna Array, Power Supply, Signal Processor), and Regional Analysis, 2024-2031

AESA Radar Market: Global Share and Growth Trajectory

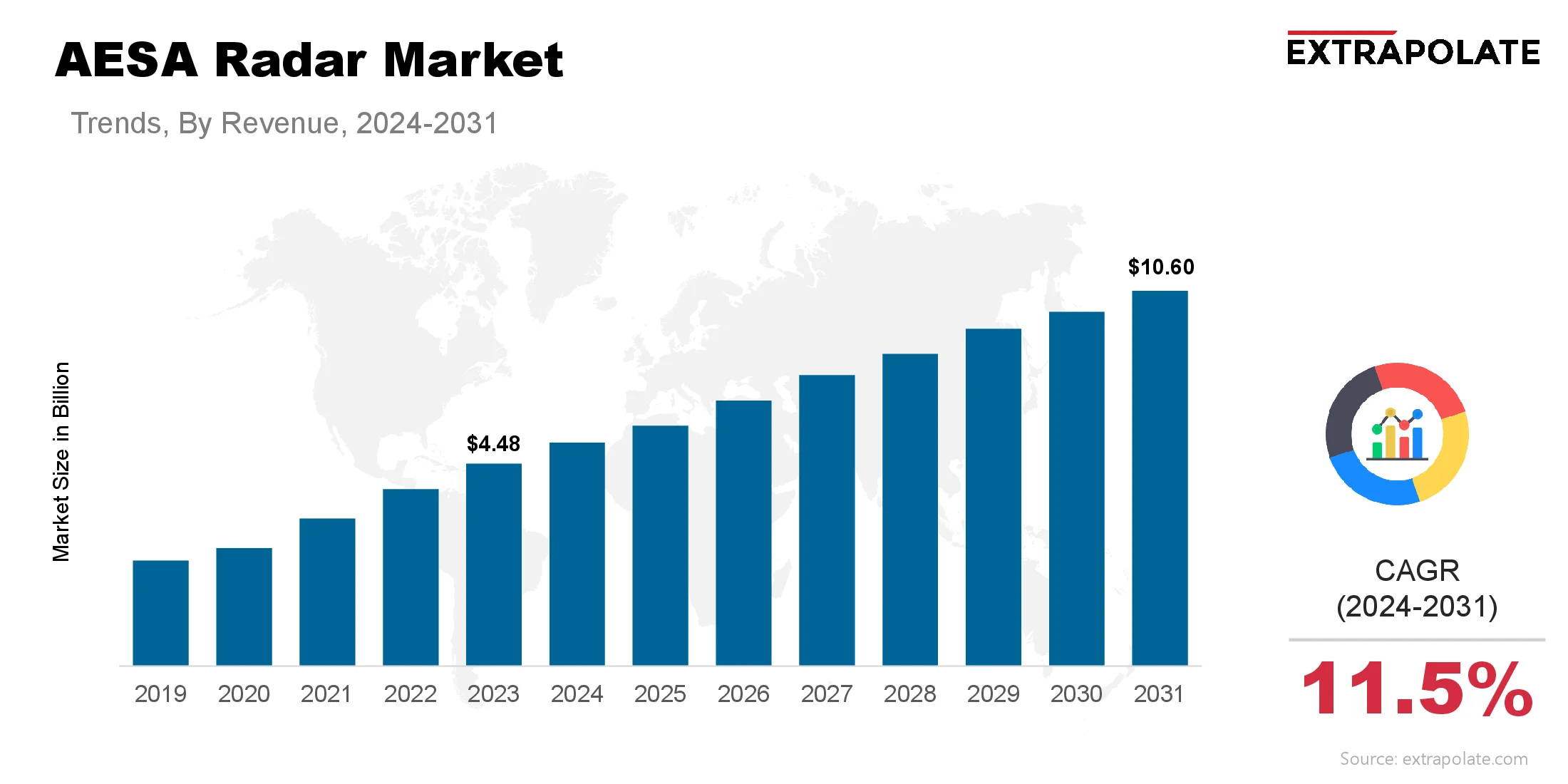

The Active Electronically Scanned Array (AESA) radar market size was valued at USD 4.48 billion in 2023 and is projected to grow from USD 4.94 billion in 2024 to USD 10.60 billion by 2031, exhibiting a CAGR of 11.5% during the forecast period.

The global Active Electronically Scanned Array (AESA) radar market is witnessing strong growth, driven by escalating demand across military, aerospace, and select commercial applications. Governments and defense organizations are prioritizing advanced radar systems to enhance situational awareness, targeting accuracy, and electronic warfare capabilities. AESA radars are increasingly replacing legacy mechanically scanned arrays (MSAs) due to their agility, multi-target tracking, higher detection accuracy, and resilience to electronic countermeasures.

Market expansion is supported by rising geopolitical tensions, sustained growth in global defense budgets, and ongoing military modernization programs. AESA radar platforms are being integrated across next-generation aircraft, naval vessels, and land-based systems. Their adoption is further propelled by continuous advancements in signal processing, GaN-based transmit/receive modules, and the integration of AI for adaptive tracking and threat identification.

Military aviation remains the dominant application segment for AESA radar. Modern fighter aircraft utilize AESA systems to support precision targeting, simultaneous air-to-air and air-to-ground operations, and superior threat response. Naval forces are deploying AESA radars for missile defense and maritime surveillance, while ground-based systems are central to integrated air defense networks. These applications underline the strategic importance of AESA technology across evolving multi-domain operations.

Key Market Trends Driving Product Adoption

Several key trends are driving AESA radar adoption:

Defense Modernization Programs

Nations worldwide are modernizing their defense, replacing old radar systems with AESA technology. Governments recognize the strategic advantage AESA radars provide, especially in contested environments with sophisticated electronic warfare threats. This has led to a wave of new procurement programs, from fighter jets to naval vessels and ground based air defense systems.

GaN Advancements

Gallium Nitride (GaN) semiconductors have revolutionized radar system design. GaN based transmit/receive modules deliver higher power output, better thermal management and improved reliability over older Gallium Arsenide (GaAs) components. These improvements translate to longer detection ranges and better resistance to electronic countermeasures, making AESA radars more effective in high threat environments.

Artificial Intelligence and Data Fusion

AESA radar systems are being designed with AI and advanced signal processing. AI enables real time threat identification, clutter reduction and adaptive waveform generation. Data fusion with other sensors (infrared, optical, SIGINT) gives operators complete situational awareness and better decision making in complex operational environments.

Multi-Functionality

Military forces want radar systems that can do multiple things at once – track aircraft, guide weapons, conduct electronic attacks and support communications. AESA radars are perfect for these requirements with electronic beam steering, rapid mode switching and wide operational bandwidth.

Commercial and Space Applications Rising

Beyond defense, AESA radar technology is finding new markets in civil aviation, weather forecasting and space based remote sensing. Commercial aircraft use AESA radars for weather detection and collision avoidance, while satellite based AESA payloads support Earth observation missions with high resolution imaging capabilities.

Major Players and their Competitive Positioning

AESA radar market is highly competitive driven by technology and defense contracts. Leading companies are developing advanced radar solutions to meet evolving mission requirements. Key players are Northrop Grumman Corporation,Raytheon Technologies Corporation,Lockheed Martin Corporation,Leonardo S.p.A.,Thales Group,BAE Systems plc,Israel Aerospace Industries Ltd.,Saab AB,HENSOLDT AG,Elbit Systems Ltd. and others.

These companies invest heavily in R&D to stay ahead of the technology curve. Many have multiyear government contracts to supply AESA radars for fighter programs, naval platforms and air defense systems. Strategic partnerships, joint ventures and acquisitions are common to expand geographic reach and product portfolio.

Consumer Behavior Analysis

Consumer behavior in AESA radar market is driven by:

- Operational Superiority: Military procurement agencies prioritize radar systems that deliver operational advantages on the modern battlefield. AESA radars are valued for their speed, precision, and ability to operate in contested electronic warfare environments, prompting steady adoption across defense forces.

- Lifecycle Cost : AESA radars have higher upfront cost compared to older systems but have lower lifecycle cost. Solid state components reduce maintenance needs, improve reliability and enable software based upgrades, making them attractive long term investment for defense budgets.

- Customization and Localization : Many countries want localized production or customization to ensure sovereignty and operational security. Suppliers are offering modular designs that can be tailored to specific platform requirements or integrated with indigenous systems.

- Training and Support : Defense agencies require comprehensive training and support to operate and maintain AESA radar systems. Vendors often provide lifecycle support packages including operator training, maintenance and software updates as part of procurement contracts.

Pricing

AESA radar systems are the most advanced and expensive radar solutions on the market. Pricing depends on system complexity, platform integration and production volume:

- High-End Military Systems: Fighter aircraft radars or advanced naval systems can cost tens of millions per unit, including R&D, integration and testing.

- Ground-Based Air Defense Radars: While still expensive, these may have lower unit costs when bought in volume.

- Commercial and Civil Aviation Systems: AESA radars for commercial use have lower price points, benefiting from economies of scale and less stringent performance requirements.

Long term affordability comes from modularity, software defined architecture and the ability to upgrade via software rather than hardware. Some vendors offer flexible payment structures, including leasing and long term service agreements to help governments manage their budgets.

Growth Factors

Several factors are driving the growth of the AESA radar market:

- Technological Advancements: Breakthroughs in semiconductor technology (GaN) and signal processing have improved radar performance. Higher power output, higher reliability and smaller/ lighter requirements enable deployment on drones to satellites.

- Rising Defense Budgets: Many countries are increasing defense spending due to geopolitical tensions, terrorism and regional rivalries. This supports large scale procurement of advanced radar systems with AESA technology being specified as a requirement.

- Modernization of Legacy Systems: Armed forces are replacing aging radar inventory to counter emerging threats, including stealth aircraft and electronic warfare systems. AESA radars offer significant improvement in detection, tracking and survivability.

- Multi-Mission Capabilities: Defense planners are looking for systems that can do multiple tasks without sacrificing performance. AESA radars can switch between surveillance, tracking, targeting and electronic warfare functions.

- Space-Based Radar Programs: With the emergence of satellite constellations for Earth observation, weather monitoring and defense surveillance, demand for compact high performance AESA payloads is growing.

Regulatory Environment

The AESA radar market operates in a complex regulatory landscape to control the export, deployment and use of advanced defense technologies:

- Export Controls: AESA radars fall under International Traffic in Arms Regulations (ITAR) in the US and similar export control regimes elsewhere. These controls restrict sales to certain countries and require government approval for transfers.

- Defense Procurement Standards: AESA radar systems must meet military specs for reliability, electromagnetic compatibility and resistance to electronic warfare threats.

- Certification Requirements: Civil aviation AESA systems must comply with regional aviation authorities (e.g. FAA, EASA) to operate in commercial airspace.

- Environmental and Safety Standards: Manufacturing and deployed systems must comply with environmental regulations and safety protocols to minimize environmental impact and operator safety.

Recent Developments

Recent developments in the AESA radar market show the industry is moving fast:

- GaN-Based Modules: Leading companies are adopting GaN to boost power efficiency, detection range and reliability.

- Electronic Warfare Capabilities: New AESA systems have electronic attack modes to jam or deceive enemy radars while maintaining surveillance.

- Miniaturization for UAVs and Satellites: Vendors are developing AESA radars for drones and small satellites to increase operational flexibility.

- Industry Partnerships: Companies are partnering to develop next-gen radar solutions, including multinational fighter jet programs and naval modernization.

- Software-Defined Radar: The shift to software-defined architectures allows for rapid updates, customization and longer life of radar systems.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Demand for advanced radar is driving production volume and investment in manufacturing capacity. But high costs and complex supply chains (including GaN semiconductor production) will constrain rapid scaling, especially for high-end military systems.

b. Gap Analysis

Mature markets in North America and Europe are driving most of the demand, but emerging markets face barriers due to high procurement costs and export restrictions. This affordability and access gap is an area of focus for vendors offering scaled-down, cost-effective AESA solutions.

Top Companies in the AESA Radar Market

Leading companies include:

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Leonardo S.p.A.

- Thales Group

- BAE Systems plc

- Israel Aerospace Industries Ltd.

- Saab AB

- HENSOLDT AG

- Elbit Systems Ltd.

AESA Radar Market: Report Snapshot

Segmentation | Details |

By Platform | Airborne, Naval, Ground-Based, Space-Based |

By Application | Surveillance & Reconnaissance, Fire Control, Air Defense, Electronic Warfare |

By Component | Transmit/Receive Modules, Antenna Array, Power Supply, Signal Processor |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to see significant growth:

- Airborne Platform: Airborne AESA radars are in high demand for fighter jets, surveillance aircraft and UAVs. They can detect stealth aircraft, resist jamming and track multiple targets at the same time.

- Naval Platform: Airborne AESA radars are in high demand for fighter jets, surveillance aircraft and UAVs. They can detect stealth aircraft, resist jamming and track multiple targets at the same time.

- Transmit/Receive Modules: The core of AESA systems, these modules are evolving rapidly with GaN based designs that improve performance and reduce maintenance.

Innovations

- GaN-Based Electronics:GaN is revolutionizing AESA radar design with higher power density, better thermal management and higher reliability.

- Software-Defined Radar : Modular, software defined designs allow for rapid upgrades, mission customization and extended lifecycle value.

- Miniaturized AESA : Advances in miniaturization are enabling AESA radars for small UAVs and satellite payloads, opening new markets and mission profiles.

Potential Growth Opportunities

- Emerging Markets: As defense budgets grow in Asia-Pacific, Latin America and Middle East, demand for advanced radar systems will increase. Vendors see opportunities in offering scaled, cost effective AESA solutions.

- Integration with Electronic Warfare and AI; The fusion of AESA radar with EW and AI enabled decision support will be game changing on the battlefield.

- Commercial Aviation and Space Applications: Growth in civil aviation safety systems and Earth observation satellites is creating new demand for AESA technology.

Extrapolate Research says:

AESA radar market will see strong and sustained growth over the next decade. As nations modernize their military and prepare for contested environments, demand for advanced radar systems will surge. GaN electronics, AI enabled signal processing and software defined architecture will keep AESA radar at the forefront.

With military, commercial and space sectors all recognizing AESA technology’s advantages, growth is inevitable. Leading players will meet this demand through innovation, partnerships and solutions for diverse operational needs.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

AESA Radar Market Size

- July-2025

- 140

- Global

- aerospace-and-defence

Related Research

Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots

June-2025

AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Base

July-2025

Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermop

June-2025

Dog Automatic Feeder-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

Drone Market Size, Share, Growth & Industry Analysis, By Type (Consumer Drones, Commercial Drones, M

March-2025

Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Carg

April-2025

Global Military Radar Market Size, Share, and COVID-19 Impact Analysis, By Component (Digital Signal

July-2022

Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles),

June-2025

Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Che

June-2025

Small Satellite Market Size, Share, Growth & Industry Analysis, By Satellite Type (CubeSat, MiniSat,

April-2025