Smart Power Distribution Systems Market Size, Share, Growth & Industry Analysis, By Component (Hardware (Switchgear, Smart Transformers, Sensors), Software (Analytics, Grid Management), Services (Installation, Maintenance)) By Application (Residential, Commercial, Industrial, Utility) By Technology (Advanced Metering Infrastructure (AMI), Distribution Automation, SCADA, Energy Management Systems) and Regional Analysis, 2024-2031

Smart Power Distribution Systems Market: Global Share and Growth Trajectory

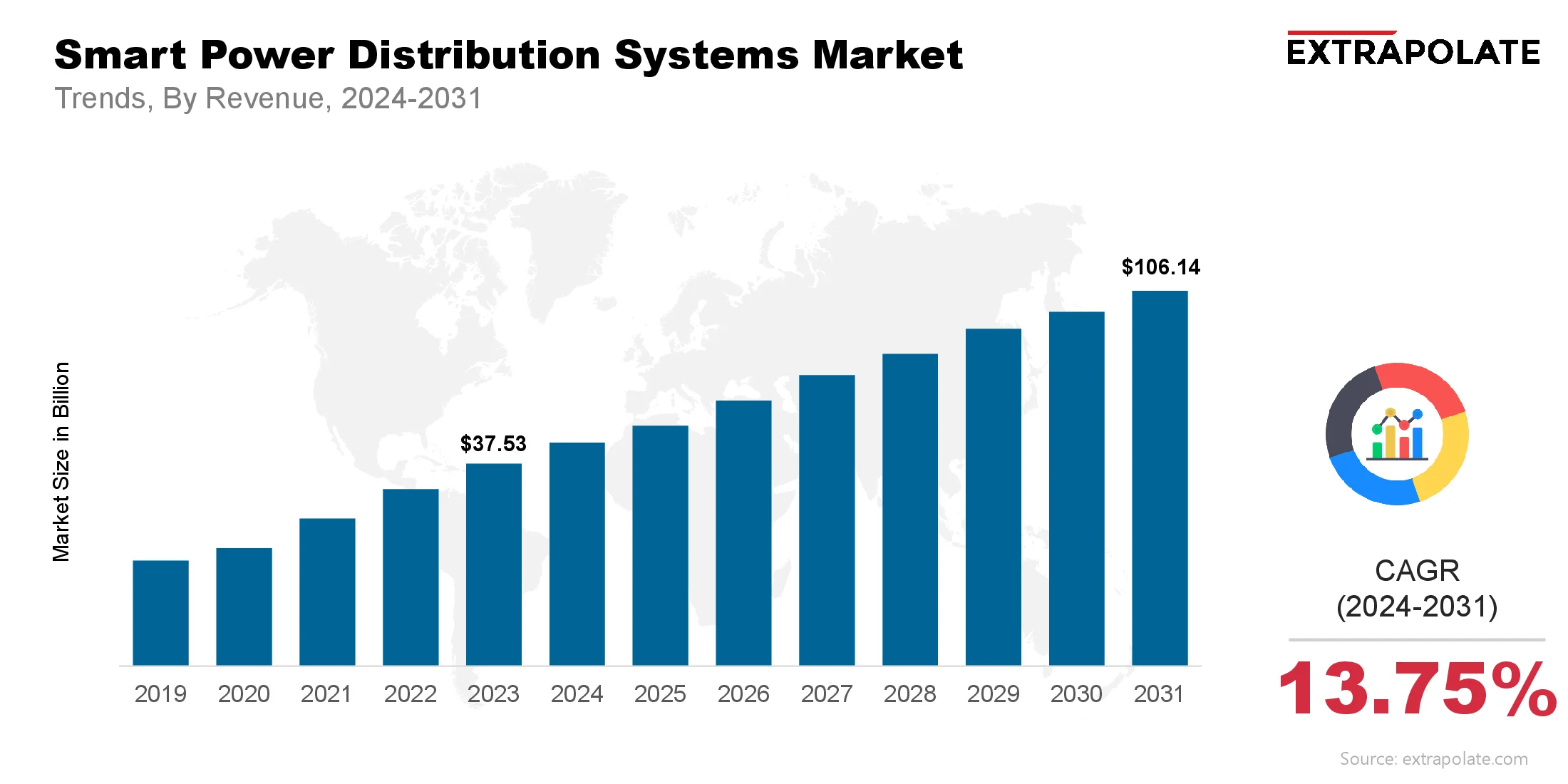

The global Smart Power Distribution Systems Market size was valued at USD 37.53 billion in 2023 and is projected to grow from USD 43.05 billion in 2024 to USD 106.14 billion by 2031, exhibiting a CAGR of 13.75% during the forecast period.

The market is changing. Utilities and governments around the world are modernising their electrical grids to make them smarter, more efficient and more resilient. At the heart of this change are smart power distribution systems which combine digital communication, automation and advanced sensors to deliver real-time monitoring, dynamic load balancing and fault detection.

Global energy demand is rising and the need to reduce energy losses and integrate renewable energy sources is driving this market. Power grids are moving from being passive delivery systems to intelligent networks. These systems allow utilities to optimise electricity distribution, improve reliability and empower consumers with data driven insights. With ongoing technology innovation and increasing policy support the market is on a path of long term growth.

The move from traditional grid systems to two way communication networks is unlocking new capabilities – decentralised generation, remote diagnostics and predictive maintenance. These are not just technical milestones – they are the foundation of the energy transition and grid stability in a distributed energy world.

Key Market Trends Driving Product Adoption

Several critical trends are accelerating the adoption of smart power distribution systems:

- Increasing Integration of Renewable Energy: As renewable energy penetration increases globally, there is a growing need for intelligent systems capable of managing variable supply and decentralized generation. Solar and wind power introduce intermittency and complexity to grid operations. Smart power distribution systems facilitate real-time energy balancing, allowing for smoother integration of distributed energy resources (DERs). These systems also support bidirectional electricity flow, enhancing the grid’s ability to adapt to fluctuations in renewable generation.

- Digitization and Advanced Communication Technologies: The integration of IoT, cloud computing, and edge analytics is redefining energy distribution. Smart distribution systems use real-time data to detect faults, monitor consumption, and optimize energy flow. Utilities are deploying smart sensors, automated switches, and grid-monitoring devices that enable predictive maintenance and reduce downtime. These digital systems not only improve operational efficiency but also provide granular insights for informed decision-making.

- Emphasis on Energy Efficiency and Loss Reduction: One of the major challenges in power distribution is transmission and distribution losses. Smart distribution systems minimize these losses through real-time monitoring, load forecasting, and automated control mechanisms. Governments and utilities are adopting these systems to meet carbon reduction goals and enhance energy efficiency, particularly in densely populated urban areas and industrial hubs.

- Rising Demand for Resilient Grid Infrastructure: Climate change, increasing frequency of extreme weather events, and aging infrastructure are pushing utilities to invest in more resilient power grids. Smart power distribution systems enable faster fault detection and isolation, improving outage response times. Automated grid reconfiguration helps maintain service continuity during disruptions, which is critical in disaster-prone and high-demand areas.

Major Players and their Competitive Positioning

The smart power distribution systems industry is highly competitive and innovation-driven. Leading global technology and energy companies are actively developing and deploying next-generation solutions. Key market players include: Siemens AG, Schneider Electric SE, General Electric Company, ABB Ltd., Eaton Corporation, Cisco Systems Inc., Honeywell International Inc., Hitachi Energy Ltd., Itron Inc., Landis+Gyr Group AG.

These companies are engaged in strategic partnerships, R&D investments, and acquisitions to strengthen their technological portfolios. For instance, Siemens is integrating AI into its grid software to enhance self-healing capabilities, while ABB is leveraging cloud-based platforms for remote monitoring and management of distribution assets.

Consumer Behavior Analysis

Consumer behavior in the smart power distribution systems market is influenced by various practical, economic, and environmental factors:

- Demand for Cost Savings and Energy Efficiency: Commercial, industrial, and residential users are increasingly aware of the economic benefits of smart energy systems. These systems enable demand response programs, reduce peak load charges, and optimize energy consumption. As utility bills rise, both businesses and homeowners are looking for ways to lower their energy expenditures through intelligent distribution systems.

- Awareness of Environmental Impact: Consumers are becoming more environmentally conscious, pushing for greener energy solutions. Smart power systems support sustainability by enabling better integration of renewable energy, reducing losses, and lowering carbon emissions. Green building certifications and government-backed incentives further motivate users to adopt these technologies.

- Increasing Adoption of Smart Meters and Home Automation: The rise in smart meter installations is shifting consumer expectations toward greater control and visibility over energy use. Coupled with home automation systems, smart power distribution allows users to monitor consumption patterns, schedule appliance use, and interact with utilities in real time.

- Trust in Technology and Cybersecurity Concerns: While adoption is rising, consumers—especially in developed markets—also demand robust cybersecurity. Utilities are addressing these concerns by incorporating secure communication protocols, encrypted data storage, and advanced identity management to protect smart grid infrastructure and consumer data.

Pricing Trends

- Smart grid costs change based on how big the system is, what it includes, and where it's built. Each region has different needs and prices. Upfront costs for smart power systems are high. They include hardware like sensors and RTUs, software tools, and services such as setup and training. The return on smart grid investment grows over time. This is due to fewer service failures, lower repair costs, and higher energy savings.

- Smart grid pilots, funding plans, and teamwork with private firms are growing. They reduce the money needed to build new systems. Scalable and modular systems are now widely used. They help reduce upfront costs by allowing phased deployment.

Growth Factors

Many forces are pushing the smart grid market forward quickly. These include tech growth, policy support, and rising power needs:

- Urbanization and Infrastructure Modernization: Growing cities need smarter power networks. Smart distribution systems support smart cities by improving grid control and saving energy. Infrastructure upgrades are now key to digital plans. Governments are investing to modernize systems and boost tech growth.

- Rising Electricity Demand: Rising population, urban areas, and electric transport are boosting power demand. Smart systems help by cutting grid congestion and making delivery more efficient.

- Government Policy and Regulatory Support: Smart grid rollout is getting a boost from global policies. Many governments are using both mandates and financial support. Major policies in the U.S. and EU are funding grid upgrades. These efforts are pushing the smart grid market forward faster than before.

- Integration with Distributed Energy Resources (DERs): DERs such as solar panels, battery storage, and EVs are complex to handle. They require smart tools for proper control and balance. Smart grids give real-time updates, adjust loads as needed, and support two-way communication. These features are vital for connecting DERs like solar and storage.

Regulatory Landscape

This market is guided by strong regulations. They focus on keeping the grid stable, securing data, and allowing systems to connect. Key regulatory needs include:

- NERC and FERC Standards (U.S.): These bodies set key rules for safety and uptime. Grid operators and tech firms must follow them to meet system needs.

- IEC 61850: The standard guides communication in substation systems. It supports easy data exchange and system compatibility worldwide.

- GDPR and Cybersecurity Regulations (EU): Smart grid setups must guard user data. At the same time, they need strong security to protect the system.

- ISO/IEC 27001: The standard gives clear steps for managing data safety in energy networks. It helps build strong security systems.

System vendors and utilities must follow these rules closely. Privacy and cyber risks are growing, making compliance more critical.

Recent Developments

Several advancements are reshaping the smart power distribution systems market:

- AI and Machine Learning Integration: Utilities are using AI analytics to spot equipment problems early, control voltage, and detect faults. This cuts costs and makes the grid more reliable.

- Rise of Edge Computing: Edge systems are rising in use, processing data right at the distribution level. This improves speed and makes grid actions more responsive.

- Strategic Alliances and Mergers: Firms are building alliances to blend their strengths. One example is GE Digital and AWS, that are improving cloud tools for grid data.

- For Example- In March 2025, Schneider Electric launched the One Digital Grid Platform, an AI-powered solution for grid modernization. It offers real-time analytics, predictive maintenance, and streamlined DER integration. The platform aims to reduce outages by up to 40% and accelerate DER connection and software deployment.

- EV Charging Infrastructure Integration: With EV use rising, grids need to change. Smart systems help support quick charging and manage changing power demand.

The developments highlight a big shift in how power is managed. Digital tools, stronger systems, and local control are now key goals.

Current and Potential Growth Implications

- Demand-Supply Analysis: Smart systems are in high demand, but supply can’t keep up in some places. This often happens where the grid is outdated or demand is soaring. To speed up smart grid rollout, vendors are making more products. They partner with local utilities to deliver full service packages. Key components like semiconductors and communication units are in short supply. This challenge limits how fast smart systems can expand.

- Gap Analysis: Despite major tech progress, smart systems are not used equally everywhere. High costs and limited grid readiness slow deployment in many regions. Smart systems are hard to scale in developing areas. Low funds and poor policy support hold back progress. Fixing these gaps needs local solutions that fit each region. It also requires strong funding plans and training programs.

Top Companies in the Smart Power Distribution Systems Market

- Siemens AG

- Schneider Electric SE

- General Electric Company

- ABB Ltd.

- Eaton Corporation

- Cisco Systems Inc.

- Honeywell International Inc.

- Hitachi Energy Ltd.

- Itron Inc.

- Landis+Gyr Group AG

Smart Power Distribution Systems Market: Report Snapshot

Segmentation | Details |

By Component | Hardware (Switchgear, Smart Transformers, Sensors), Software (Analytics, Grid Management), Services (Installation, Maintenance) |

By Application | Residential, Commercial, Industrial, Utility |

By Technology | Advanced Metering Infrastructure (AMI), Distribution Automation, SCADA, Energy Management Systems |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Distribution Automation: This segment is poised for strong growth as power systems go digital. It aids smart decisions, finds faults instantly, and drives networks that fix themselves to keep the lights on.

- Advanced Metering Infrastructure (AMI): AMI systems are spreading across the energy sector. They enable two-way communication, time-based pricing, usage tracking, and remote power cuts.

Major Innovations

- Self-Healing Grids: These are automated fault detection and isolation systems that reconfigure the grid in real time.

- Digital Twins: Digital twins copy the real grid in virtual form. They are used to test systems, find problems, and guide planning.

- AI-Enhanced Voltage Optimization: AI-powered systems adjust voltage based on demand. This cuts power loss and helps equipment last longer.

Potential Growth Opportunities

- Emerging Markets: Africa, Southeast Asia, and Latin America offer strong growth chances. With faster electrification, smart grids are key to reliable power.

- Electric Vehicle Infrastructure: Electric transport is growing fast, creating new power needs. Smart grids are needed to balance loads and link with Electric transport is growing fast, creating new power needs. Smart grids are needed to balance loads and link with V2G systems (V2G) systems.

- Decentralized Energy Systems: Microgrids, prosumer energy setups, and peer-to-peer trading depend on smart grids. These systems provide live control and help optimize power flow.

Extrapolate Research Says:

The smart power systems market is set to grow fast. This comes as energy moves toward digital, local, and sustainable setups. Smart tech, quick data checks, and renewables are changing the grid. They improve how power is shared, saved, and managed. Strong policies, high power needs, and weak old systems push change. Smart distribution tech is now key to modern power grids. As investment rises in smart systems and power networks, new markets will grow. These gains will spread across rich and emerging countries. From smart cities to electric cars, these systems play a big role. They form the base of future energy networks. Kings Research says growth will stay strong in this market. Key drivers include new tech, global plans, and joint efforts.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Smart Power Distribution Systems Market Size

- July-2025

- 148

- Global

- Semiconductor-Electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020