Semiconductor Timing IC Market Size, Share, Growth & Industry Analysis, By Product Type (Oscillators, Clock Generators, Jitter Attenuators, Clock Buffers, Frequency Synthesizers) By Application (Telecommunications, Consumer Electronics, Automotive, Industrial, Data Centers) By End-User (OEMs, Contract Manufacturers, Telecom Operators, Cloud Providers, Automotive Suppliers), and Regional Analysis, 2024-2031

Semiconductor Timing IC Market: Global Share and Growth Trajectory

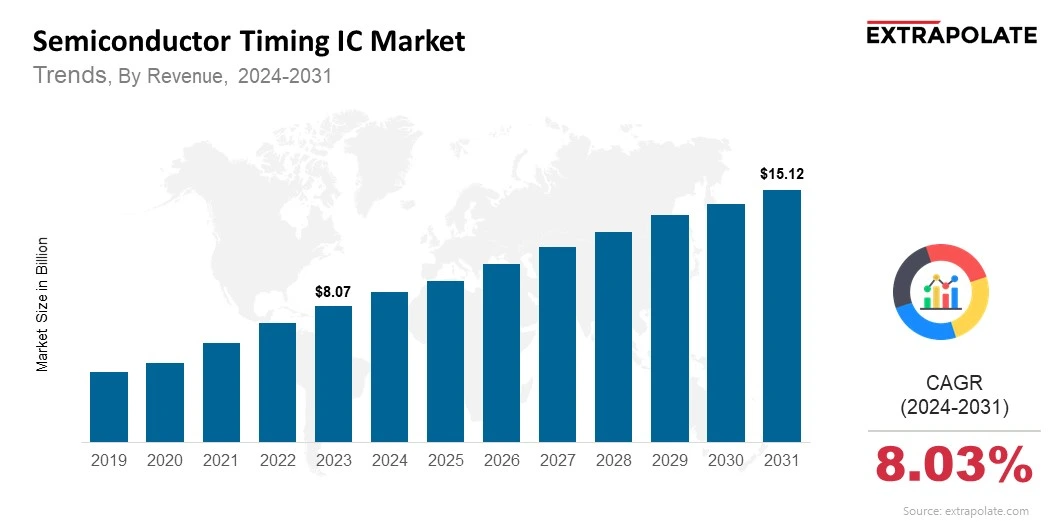

The global Semiconductor Timing IC Market size was valued at USD 8.07 billion in 2023 and is projected to grow from USD 8.80 billion in 2024 to USD 15.12 billion by 2031, exhibiting a CAGR of 8.03% during the forecast period.

The global semiconductor timing IC market is experiencing a strong upward trajectory, driven by the growing complexity of electronic systems across multiple industries. These integrated circuits are essential for generating, distributing, and managing clock signals that synchronize operations in digital devices. From data centers and telecommunications infrastructure to automotive electronics and consumer devices, timing ICs ensure system stability, reduce latency, and enhance performance.

A key factor fueling market growth is the rapid adoption of next-generation technologies such as 5G networks, autonomous vehicles, Internet of Things (IoT) devices, and high-performance computing systems. These technologies require ultra-precise, low-jitter timing solutions to enable fast data transfer and seamless device communication. As a result, demand for advanced timing ICs—including clock generators, oscillators, buffers, and jitter attenuators—is growing exponentially.

North America and Asia-Pacific lead the global market, with the United States, China, Japan, and South Korea being major contributors due to their strong presence in semiconductor manufacturing and telecom development. Meanwhile, Europe is witnessing a surge in demand driven by the expansion of automotive electronics and industrial automation sectors.

The market is also seeing a shift toward highly integrated and programmable timing solutions that reduce component count and support miniaturized electronic designs. Moreover, MEMS-based timing ICs are gaining traction for their superior shock resistance, stability, and reliability compared to traditional quartz components.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several trends are propelling the growth and adoption of semiconductor timing ICs:

- Surging 5G and Data Center Deployments: The roll-out of 5G networks and the expansion of hyperscale data centers demand ultra-precise timing components to support low-latency and high-bandwidth applications. Timing ICs play a vital role in synchronizing complex networking hardware and ensuring seamless data communication, thereby fueling demand.

- Automotive Electrification and ADAS Growth: Modern vehicles are becoming data-driven machines. The rise in electric vehicles (EVs) and advanced driver-assistance systems (ADAS) requires accurate timing for sensor fusion, real-time data processing, and safe autonomous driving. Timing ICs ensure reliable communication between sensors, ECUs, and infotainment systems.

- Miniaturization and Integration Trends: With the ongoing push for miniaturized and power-efficient electronics, manufacturers are integrating multiple timing functions into single-chip solutions. These integrated timing devices help reduce footprint, cost, and power consumption, making them ideal for consumer electronics and wearables.

- Transition to High-Speed Interfaces: As interfaces like PCIe Gen5, USB4, and DDR5 become mainstream, the need for low-jitter, high-accuracy timing ICs grows. These interfaces require precise clocking to operate at high speeds without data errors, driving adoption in computing and server markets.

Major Players and their Competitive Positioning

The semiconductor timing IC market is highly competitive and innovation-driven, with key players focusing on high-performance solutions, strategic partnerships, and acquisition-led expansion. Prominent market participants include- Texas Instruments Inc., Analog Devices Inc., Renesas Electronics Corporation, Microchip Technology Inc., Skyworks Solutions Inc., Integrated Device Technology (IDT), a Renesas Company, ON Semiconductor, Maxim Integrated (now part of Analog Devices), SiTime Corporation, NXP Semiconductors, Abracon LLC, Murata Manufacturing Co., Ltd., IQD Frequency Products, TXC Corporation, Epson Electronics America, Inc.

These companies are enhancing their product portfolios with high-precision, ultra-low-jitter, and low-power timing solutions tailored for emerging applications. Their efforts are aimed at capturing a larger share in data-intensive sectors such as automotive, telecom, and consumer electronics.

Consumer Behavior Analysis

Consumer trends in the semiconductor timing IC market are being shaped by application-specific requirements and preferences:

- Growing Demand for Power Efficiency: End-users, particularly in the mobile and wearable electronics segments, prioritize low-power timing ICs to extend battery life. Designers now seek timing components that offer the right balance of performance and energy efficiency.

- Preference for Integrated Solutions: As device complexity increases, customers lean toward highly integrated timing solutions to simplify board design and lower total BOM (bill of materials) costs. This behavior is pushing suppliers to develop multi-function timing chips with programmable capabilities.

- Customization and Flexibility: OEMs increasingly request customizable timing ICs with programmable output frequencies, voltage levels, and phase alignment. The ability to tailor timing functions to unique hardware requirements is becoming a key differentiator for manufacturers.

- Reliability and Long-Term Support: In mission-critical applications such as aerospace, defense, and industrial automation, customers emphasize long-term component availability and operational reliability. Vendors offering extended lifecycle support and robust quality assurance see higher brand loyalty.

Pricing Trends

The pricing of semiconductor timing ICs varies widely based on specifications, accuracy, integration level, and application domain. Low-end clock buffers and oscillators used in consumer electronics may be priced under $1 per unit, whereas high-performance jitter attenuators and network synchronizers for telecom or data center equipment can command prices upwards of $10–$50 per unit.

The market is witnessing a gradual price decline in commoditized segments due to manufacturing efficiency and competition. However, pricing in niche high-performance segments remains stable or slightly premium, as customers prioritize reliability and precision over cost. Additionally, fabless business models and advancements in MEMS-based timing technologies are helping lower production costs, thereby impacting end-user pricing trends positively.

Growth Factors

Several structural and technological factors are driving growth in the semiconductor timing IC market:

- Proliferation of 5G Infrastructure: As telecom operators build out 5G base stations and core networks, timing ICs with ultra-low jitter and high precision are critical for synchronizing multiple nodes. The demand for advanced clocking solutions that support IEEE 1588 and SyncE protocols is on the rise.

- Cloud and Edge Computing Expansion: The rise of cloud-based services, edge devices, and AI inference workloads is fueling the need for timing circuits that can ensure synchronized data processing across distributed systems.

- Automotive Innovation: Modern vehicles integrate dozens of ECUs, cameras, sensors, and infotainment modules—all of which require accurate timing. The market is benefiting from regulatory pushes for EVs and vehicle autonomy, expanding timing IC usage in transportation.

- Emergence of MEMS Timing Devices: MEMS-based oscillators and clocks are challenging quartz technology by offering better reliability, smaller size, and lower power consumption. As MEMS timing gains traction in automotive and industrial sectors, market dynamics are shifting in favor of newer entrants.

Regulatory Landscape

Though timing ICs are not as heavily regulated as medical or pharmaceutical products, there are compliance and certification standards that manufacturers must meet depending on the end-use sector:

- Automotive Grade Requirements (AEC-Q100): For automotive applications, timing ICs must meet strict temperature, vibration, and reliability criteria defined by the AEC-Q100 standard. This ensures they perform reliably in harsh vehicle environments.

- Telecom Synchronization Standards: In telecom, precision timing ICs must comply with ITU-T synchronization standards such as G.826x and G.827x. This includes support for IEEE 1588 PTP and Synchronous Ethernet (SyncE).

- Electromagnetic Compatibility (EMC): Timing ICs must meet EMC and EMI standards for use in sensitive electronics, particularly in industrial and medical environments.

- RoHS and REACH Compliance: As with most electronics components, timing ICs must be compliant with global environmental regulations like RoHS (Restriction of Hazardous Substances) and REACH, ensuring they are safe and sustainable.

Recent Developments

Several recent trends and strategic moves are shaping the semiconductor timing IC market:

- SiTime Launches High-Precision MEMS Oscillators: SiTime Corporation introduced its “Elite X Super-TCXO” series tailored for 5G infrastructure, edge computing, and aerospace. These devices offer unmatched stability under vibration and temperature extremes, marking a leap in MEMS timing.

- Renesas Expands Wireless Clocking Portfolio: Renesas Electronics recently launched programmable wireless timing chips designed to simplify synchronization in small cell and Open RAN base stations. These innovations are helping accelerate 5G adoption.

- Strategic Acquisitions: Renesas' acquisition of Integrated Device Technology and Analog Devices' acquisition of Maxim Integrated have greatly changed the competitive landscape of the semiconductor market. These strategic acquisitions combined complementary clocking technologies, further enhancing product diversity and boost R&D.

- AI-Driven Network Synchronization: AI and ML help fine-tune network timing instantly. They boost accuracy by adjusting parameters in real time. It improves synchronization in changing traffic and environments. This is key for cloud-native setups.

Current and Potential Growth Implications

Demand-Supply Analysis: The demand for timing ICs is outpacing supply, especially in high-growth sectors like automotive and telecom. Semiconductor fabs and foundries are under pressure to scale production, and supply chain constraints—especially in legacy nodes—continue to affect delivery timelines.

Gap Analysis: A key challenge remains the reliance on quartz-based timing devices, which have limitations in rugged and miniaturized environments. There is a growing gap between demand for compact, programmable, and robust timing solutions and current legacy supply, paving the way for MEMS-based ICs and integrated timing modules.

Top Companies in the Semiconductor Timing IC Market

- Texas Instruments Inc.

- Analog Devices Inc.

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Skyworks Solutions Inc.

- Integrated Device Technology (IDT)

- SiTime Corporation

- NXP Semiconductors

- ON Semiconductor

- Maxim Integrated

- Abracon LLC

- Murata Manufacturing Co., Ltd.

- IQD Frequency Products

- TXC Corporation

- Epson Electronics America, Inc.

Semiconductor Timing IC Market: Report Snapshot

Segmentation | Details |

By Product Type | Oscillators, Clock Generators, Jitter Attenuators, Clock Buffers, Frequency Synthesizers |

By Application | Telecommunications, Consumer Electronics, Automotive, Industrial, Data Centers |

By End-User | OEMs, Contract Manufacturers, Telecom Operators, Cloud Providers, Automotive Suppliers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Semiconductor Timing IC Market: High-Growth Segments

The following segments are expected to experience notable growth:

- Oscillators and MEMS Timing Devices: MEMS-based oscillators are gradually becoming a must in the automotive, aerospace, and industrial automation sectors.

- Telecom and Data Center Applications: 5G and big data centers are growing fast. This drives demand for timing ICs using IEEE 1588 and Synchronous Ethernet.

Major Innovations

- Programmable Timing ICs: Being the next generation of timing ICs, these devices allow real-time tuning of the frequency and configuration through digital interfaces. Such flexibility eases the design and inventory management tasks for manufacturers.

- AI-Enhanced Timing Systems: Some advanced timing ICs now integrate self-calibration and predictive analytics to compensate for thermal drift and voltage variation—improving accuracy and uptime.

- MEMS-Based Clocks: MEMS oscillators are revolutionizing the market with superior shock resistance, better reliability, and programmable features, challenging the century-old dominance of quartz timing.

Semiconductor Timing IC Market: Potential Growth Opportunities

Opportunities for market players include:

- Penetration into Emerging Markets: With the growth of electronics manufacturing in Asia-Pacific and Latin America, there’s strong demand for cost-effective, scalable timing solutions suited to local market needs.

- Integration with AI, IoT, and Edge Devices: In the AIoT and edge computing ecosystem, timing ICs that are capable of functioning under power-constrained budgets and provide real-time synchronization will be vital.

- Expansion of Automotive Applications: With the accelerated transition going on in the field of electric and autonomous vehicles, there lies an opportunity for vendors in automotive-grade ICs that support real-time communication and safety.

Extrapolate Research says:

The semiconductor timing IC market is set for sustained and transformative growth. Being the backbone of synchronization in modern electronics, ICs are growing more and more sophisticated, efficient, and application-specific. This integration, together with 5G, EVs, AI, and cloud infrastructure, is fueling this massive growth.

Vendors that innovate in low-power, ultra-precise, and programmable timing solutions are best positioned to lead the next wave. With MEMS technology disrupting traditional quartz devices and AI boosting performance adaptability, the semiconductor timing IC market is entering an exciting new era of evolution.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Semiconductor Timing IC Market Size

- June-2025

- 148

- Global

- Semiconductor-Electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020