Lamp Lenses Market Size, Share, Growth & Industry Analysis, By Product Type (Glass Lenses, Plastic Lenses, Fresnel Lenses, Micro-Optic Lenses), By Application (Automotive Lighting, General Illumination, Industrial Lighting, Architectural Lighting, Specialty Lighting), By End-User (Residential, Commercial, Automotive, Municipal, Industrial), and Regional Analysis, 2024-2031

Lamp Lenses Market: Global Share and Growth Trajectory

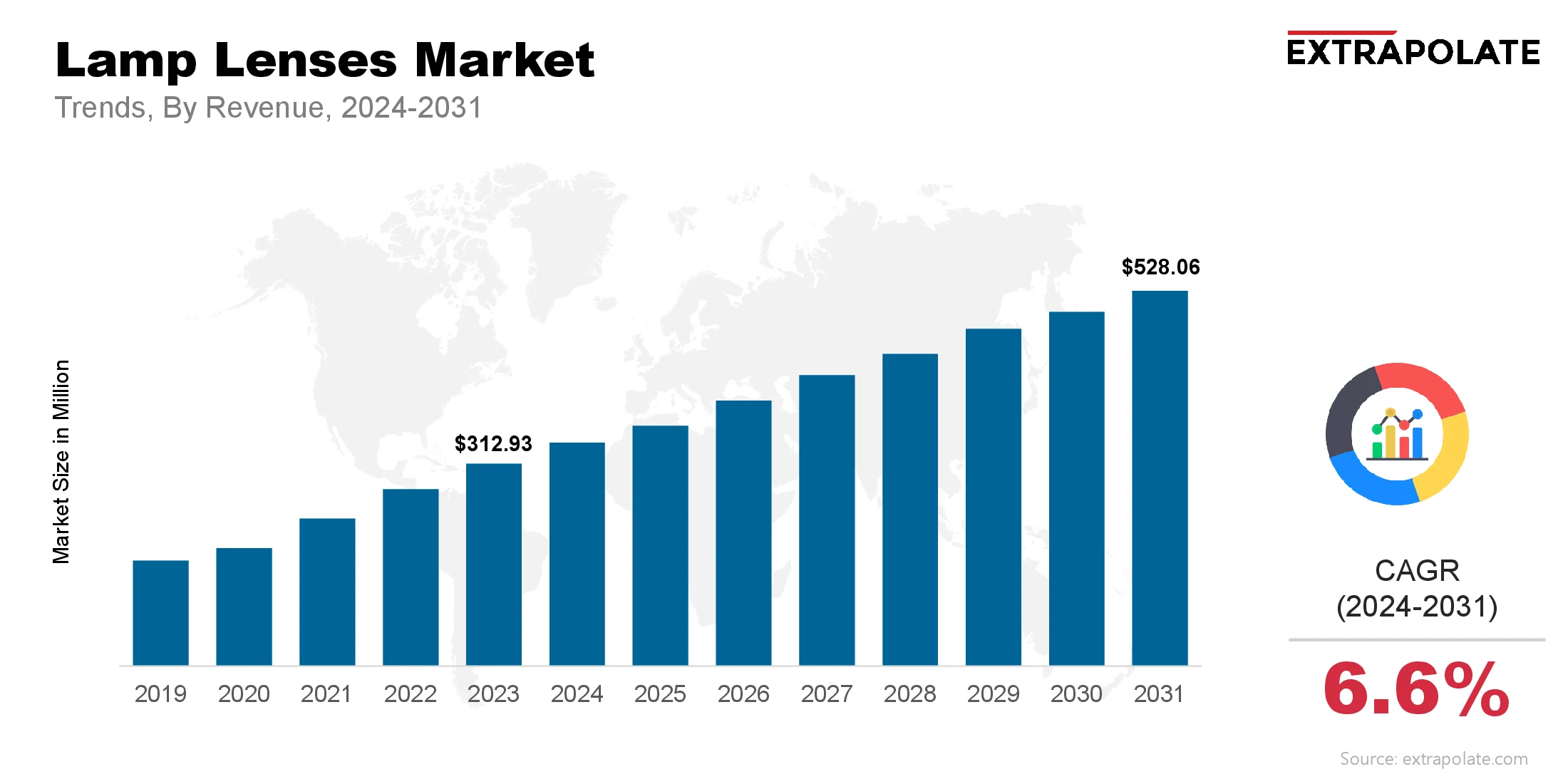

The global Lamp Lenses Market size was valued at USD 312.93 million in 2023 and is projected to grow from USD 336.54 million in 2024 to USD 528.06 million by 2031, exhibiting a CAGR of 6.6% during the forecast period.

The market is growing steadily as demand increases across various end use industries such as automotive, commercial lighting, residential lighting, street and industrial illumination and specialty lighting. Lamp lenses – critical optical components that control light dispersion, beam shape and intensity – are becoming more important in modern lighting systems. With the rapid advancement of LED technology, smart lighting and energy efficient solutions, lamp lenses are playing a key role in improving light quality, aesthetics and performance.

The global shift to LED lighting which now dominates the lighting industry due to its energy efficiency and long life has further emphasized the importance of precision optical components like lamp lenses. As lighting systems become more customized and application specific, lamp lenses are being designed more complex to meet the evolving technical requirements. The market is also seeing a surge in demand from automotive manufacturers for high performance headlamp lenses and interior lighting optics for electric and autonomous vehicles.

Regulatory pressure for energy efficient lighting products and environmental concerns are driving manufacturers to innovate with better materials and optical designs. As smart cities and connected lighting infrastructure is taking center stage globally, lamp lenses are becoming the enablers of functional and aesthetic lighting. So the lamp lenses market will continue to grow strongly in the coming years.

Key Market Trends Driving Product Adoption

LED Spread and Optical Precision

LEDs are spreading fast and one of the main drivers of the lamp lenses market. LEDs are efficient but need optical control to get the desired beam and minimize glare. Lamp lenses solve these problems, delivering better light control, focus and diffusion. As LED penetrates deeper into street lighting, commercial interiors and automotive systems, so does the need for high performance lamp lenses.

Smart Lighting and IoT

Smart lighting is being adopted in homes, offices and public infrastructure. Smart lighting demands dynamic beam control and adaptable optics which are achieved through advanced lens configurations. With IoT enabled lighting becoming part of smart building designs, lamp lenses that offer beam tuning and improved lux uniformity are in high demand. Also tunable white lighting and color changing fixtures often rely on specialized lenses to maintain color consistency.

Automotive Lighting

Automotive companies are investing heavily in next gen headlamp technologies like adaptive beam systems, matrix LED lighting and laser headlamps. These innovations need precision lamp lenses to deliver tailored beam patterns, improve road visibility and meet stringent safety regulations. Also the aesthetic design of vehicle lighting, both interior and exterior is being elevated by styled lens components that offer optical clarity and visual appeal. For example, in June 2025 Asahi Optics unveiled a new series of automotive lighting optical lenses designed specifically for modern LED and adaptive beam vehicle systems. These include high‑low beam, ambient, turn‑signal, warning light, and reading light lenses with up to 93% light transmittance and engineered for safety, clarity, and glare reduction.

Major Players and their Competitive Positioning

The lamp lenses industry is highly competitive and characterized by the presence of several key global players that offer a wide range of optical components for lighting systems. These companies are actively engaged in innovation, partnerships, and geographical expansion to strengthen their market position. Notable players in the lamp lenses industry include are Signify N.V. (Philips Lighting), SCHOTT AG, General Electric (GE), Seoul Semiconductor Co., Ltd., Ledil Oy, Carclo Optics, Fraen Corporation, Bicom Optics, Luminit LLC, Stanley Electric Co., Ltd. And other.

These companies are focused on developing new lens geometries, material formulations, and customizable optics to cater to a wide array of lighting applications. They also leverage global distribution networks and OEM relationships to maintain a competitive edge. In February 2025 LirOptic (a spin‑out from University College Dublin) unveiled a shape‑shifting, electronically tunable lens that adjusts focal length without moving parts—ideal for compact camera modules in smartphones and AR/VR devices

Consumer Behavior Analysis

- Energy Efficiency and Sustainability: End-users in the commercial and industrial sectors are looking for energy efficiency and lower carbon footprint. This is reflected in the demand for high performance lamp lenses that deliver more light with less energy. Consumers are also looking for recyclable lens materials to make lighting products more sustainable.

- Aesthetic and Functional Integration: Modern consumers want lighting solutions that are both beautiful and functional. Lamp lenses play a big role in fixture aesthetics by allowing designers to control beam angles, brightness and glare. As architectural and ambient lighting becomes more design led, consumer expectations for lens quality and customisation increase.

- DIY and Consumer Lighting: In the residential sector, DIY smart lighting kits and customisable fixtures are gaining popularity. Consumers are looking for lenses that can be easily swapped or adjusted to fit different room layouts and lighting preferences. This has created a niche for modular lens systems that are easy to install and adaptable.

- Technical Awareness and Brand Loyalty: As consumers become more tech savvy, they are looking for lighting products with better optics and innovation. Brand reputation, product certifications (like ENERGY STAR or RoHS) and technical support influence purchasing decisions. Manufacturers of lamp lenses that have proven performance and long term reliability enjoy higher consumer loyalty.

Pricing Trends

Lamp lenses are priced by material type, complexity of manufacture, size, optical performance and application. Standard plastic lenses made from polycarbonate or PMMA are the most affordable and are used in general lighting. Glass lenses are more expensive but are used in high heat applications or where optical clarity is critical.

Advanced lens designs (Fresnel, aspheric, beam shaping microstructures) are more expensive due to the tooling and fabrication required. Automotive and architectural lenses are more expensive due to the performance and design specifications.

Bulk manufacturing especially in LED lighting has brought down the cost per unit. But customization, small batch production and high optical tolerances still cost more. The trend toward integrated lens-reflector assemblies is also influencing pricing models by shifting costs from discrete optics to system-level solutions.

Growth Factors

- LED Lighting Systems Expansion: The growth of LED lighting is the biggest driver for lamp lenses. LEDs need optics to shape and distribute light, unlike traditional incandescent or fluorescent sources. The shift to LEDs in residential, commercial, industrial and outdoor applications is driving demand for custom lenses.

- Optical Design and Simulation Innovations: Advances in ray-tracing software and optical simulation tools are allowing for more precise and efficient lens designs. Manufacturers are using these tools to create lenses that improve optical efficiency, reduce light loss and achieve the desired beam shape. These innovations are shortening product development time and expanding design capabilities.

- Infrastructure Development: Urbanization and infrastructure projects, especially in emerging markets, are driving demand for streetlights, tunnel lighting, airport lighting and public facility lighting. These applications require rugged, weatherproof lamp lenses that deliver optimal light distribution and performance in various environmental conditions.

- Lighting Regulations: Government regulations on energy consumption and light pollution are forcing manufacturers to adopt lens technologies that meet compliance standards. Lenses that reduce glare, control upward light output and ensure uniform illumination are now part of meeting regulations like the European Ecodesign Directive or the US Department of Energy’s lighting mandates.

Regulatory Landscape

The lamp lenses market is governed by a multitude of regulatory standards for lighting performance, environmental compliance and product safety. Some of the key standards that impact the industry are:

- RoHS (Restriction of Hazardous Substances Directive): Lamp lenses and associated materials must not contain harmful substances like lead, mercury or cadmium.

- REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals): Material usage and chemical composition of lenses must be transparent.

- IEC Standards: Define light transmission, thermal stability and optical distortion performance metrics.

- UL and CE Certifications: Required for North America and Europe respectively. These standards validate the optical components used in electrical lighting systems.

Compliance to these standards ensures product acceptance in global market and end user confidence in quality and safety.

Recent Developments

- Micro-Optic Lens Designs: Micro-structured lens surfaces allow for highly directional beam shaping and thinner material. Perfect for compact lighting applications like wearables and automotive interior lighting.

- Automotive Headlamp Innovations: Hella and Stanley Electric have released LED matrix lenses that work with adaptive beam systems for high-end vehicles, for safety and comfort.

- 3D Printed Optical Prototypes: 3D printing allows for quicker and more cost effective prototyping of lens designs, reducing development time and tooling costs.

- Sustainable Materials: Biopolymer based lenses with improved UV resistance and biodegradability are being researched to reduce the environmental impact of lighting products.

Current and Potential Growth Implications

Demand-Supply Analysis

The global demand for lamp lenses is outpacing traditional supply capabilities, especially in high-growth segments such as automotive and smart street lighting. Supply chain resilience and material availability (particularly for specialty polymers and coated optics) have become focal points for manufacturers striving to meet global demand while maintaining lead times.

Gap Analysis

Despite strong market growth, there remains a gap in the availability of affordable, high-performance lenses for small and medium lighting manufacturers. Customization services are often cost-prohibitive for smaller players. As a result, the market is ripe for modular, plug-and-play lens solutions that reduce design complexity while maintaining optical quality.

Top Companies in the Lamp Lenses Market

- Signify N.V.

- SCHOTT AG

- General Electric

- Seoul Semiconductor

- Ledil Oy

- Carclo Optics

- Fraen Corporation

- Bicom Optics

- Luminit LLC

- Stanley Electric Co., Ltd.

Lenses Market: Report Snapshot

Segmentation | Details |

By Product Type | Glass Lenses, Plastic Lenses, Fresnel Lenses, Micro-Optic Lenses |

By Application | Automotive Lighting, General Illumination, Industrial Lighting, Architectural Lighting, Specialty Lighting |

By End-User | Residential, Commercial, Automotive, Municipal, Industrial |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Automotive Lighting Lenses: Precision headlamp and taillight lenses are in demand due to autonomous vehicle lighting and aesthetics.

- Architectural and Decorative Lighting: Premium designs require custom optics for ambience and beam aesthetics.

- Street and Industrial Lighting: Cities upgrading to smart and energy efficient lighting are driving demand for high lumen lenses.

Innovations

- Beam Tunable Optics: Lenses that can go from narrow to wide beam are popular for dynamic lighting.

- Anti-Glare and Diffusion Coatings: Surface treated lenses are improving user comfort and energy efficiency.

- Hybrid Optical Systems: Lenses with reflectors or light guides for system level beam control.

Potential Growth Opportunities

- Emerging Markets: Urbanization and electrification in Asia, Africa and Latin America is a big opportunity for lamp lens suppliers.

- Customized Lighting: As unique lighting effects are in demand, custom lens design services for niche applications are on the rise.

- Integration with Sensors and Controls: Lenses with integrated light sensors or diffusers compatible with motion or ambient sensors is opening up new smart lighting applications.

Extrapolate says

The lamp lenses market is set to grow as global lighting moves towards more efficiency, precision and adaptability. With LED based systems, smart infrastructure and design led lighting, the demand for high performance lenses is increasing across automotive, architectural, industrial and residential sectors. Technological innovations like beam tunable optics, micro structured surfaces and sustainable materials are changing the competitive landscape and regulatory mandates and energy efficiency targets are fuelling adoption. Companies that invest in advanced optical engineering, scalable manufacturing and customised solutions will be well placed to grab the market share. As lighting gets intelligent and connected, lamp lenses will be at the heart of this transformation, so it’s a key area of focus for everyone in the lighting value chain.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Lamp Lenses Market Size

- August-2025

- 140

- Global

- Semiconductor-Electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020