Warehousing and Distribution Logistics Market Size, Share, Growth & Industry Analysis, By Service Type (Dedicated Warehousing, Shared Warehousing, Distribution and Transportation, Value-Added Services), By End-User (Retail and E-commerce, Automotive, Pharmaceuticals, Consumer Goods, Industrial Manufacturing, Food and Beverage), and Regional Analysis, 2024-2031

Warehousing and Distribution Logistics Market: Global Share and Growth Trajectory

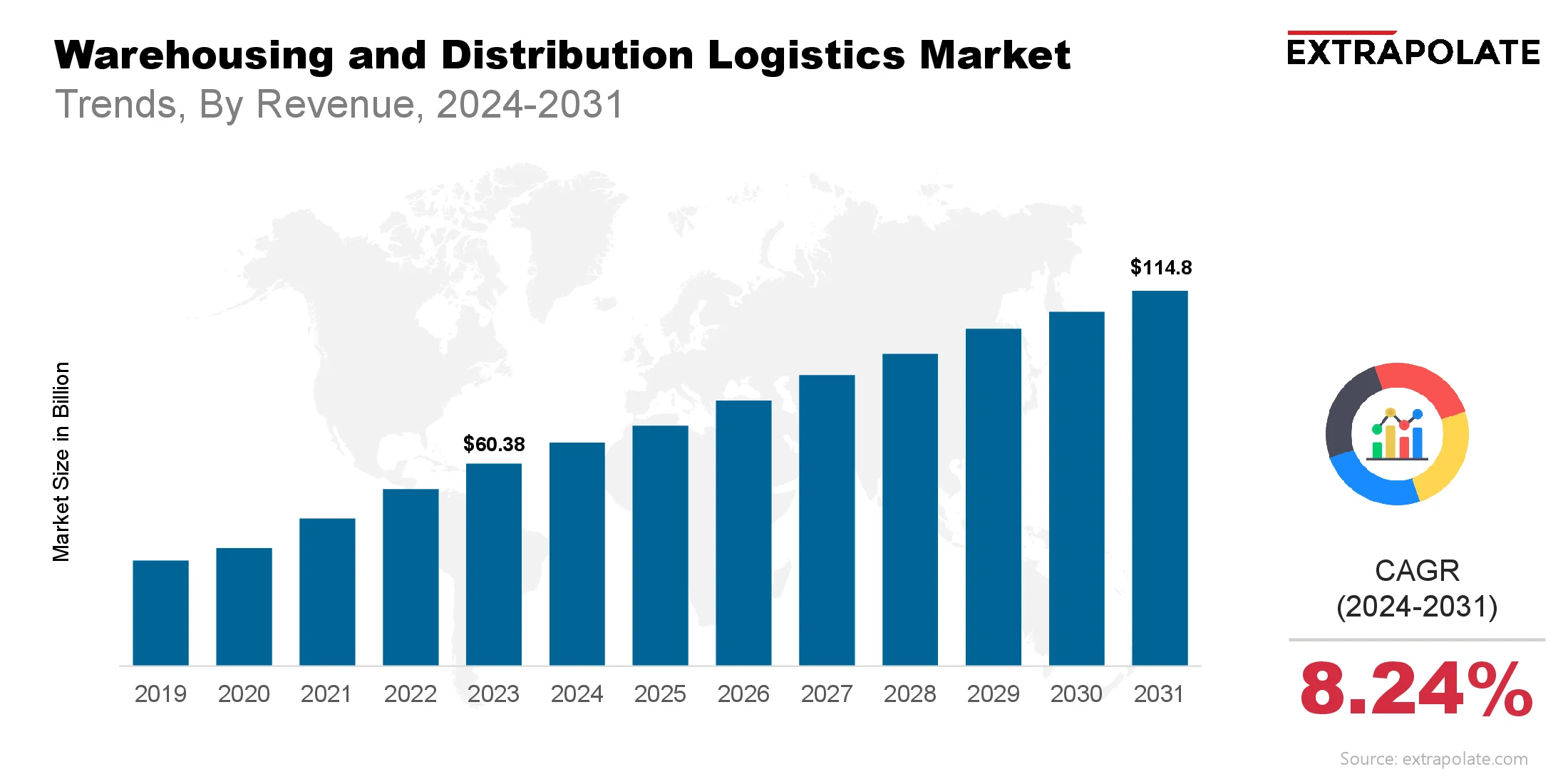

The global Warehousing and Distribution Logistics Market size was valued at USD 60.38 billion in 2023 and is projected to grow from USD 65.91 billion in 2024 to USD 114.8 billion by 2031, exhibiting a CAGR of 8.24% during the forecast period.

The global warehousing and distribution logistics market is booming driven by e-commerce, globalisation of supply chains and the need for highly efficient, technology driven storage and delivery solutions. From large regional distribution centres to last mile urban micro warehouses these facilities are the backbone of modern commerce supporting just in time inventory, rapid order fulfillment and tailored delivery strategies.

Businesses across industries from retail and consumer goods to pharma and manufacturing are investing heavily in advanced warehousing and distribution logistics. This market is evolving with automation, digital platforms and sustainability focused design to reduce costs, speed and increase visibility across the supply chain.

Technology is at the heart of this transformation. Robotics, AI driven warehouse management systems (WMS), autonomous mobile robots (AMRs) and real time tracking platforms are optimising operations and reducing errors. Green logistics is gaining momentum as companies respond to regulatory pressure and customer demand for lower carbon footprints.

Urbanisation and shifting consumer expectations are also redefining the distribution landscape. Same day and next day delivery requires highly responsive and strategically located facilities. As a result companies are rethinking network design, investing in multi tiered distribution hubs and partnering with 3PL providers for flexibility.

The market is also being shaped by global economic and geopolitical shifts. Trade volatility, supply chain disruption (COVID 19 being a great example) and evolving trade agreements are forcing companies to diversify their sourcing and rethink their warehousing strategies for resilience. This dynamic environment will ensure continued demand for advanced warehousing and distribution logistics services for years to come.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several important trends are propelling adoption and investment in warehousing and distribution logistics:

- E-commerce Boom: E-commerce is a key driver. Online shopping growth has spurred demand for sophisticated fulfillment centers that can handle high order volumes, complex inventories, and rapid delivery expectations. Companies are expanding warehouse footprints near major urban centers to shorten delivery times.

- Automation and Robotics: Automated storage and retrieval systems (AS/RS), AMRs, and robotic picking technologies are revolutionizing warehouses. These systems improve accuracy, reduce labor costs, and enable 24/7 operations. Logistics providers are rapidly adopting these solutions to remain competitive.

- Supply Chain Visibility and Digitization: Integrated WMS, transportation management systems (TMS), and advanced tracking solutions allow end-to-end supply chain transparency. Customers expect real-time updates on shipments, while companies demand precise inventory management and forecasting.

- Sustainable Logistics: Sustainability pressures are reshaping warehousing and distribution. Green building certifications, solar-powered facilities, electric delivery fleets, and waste-reduction practices are being widely implemented. Businesses seek to cut emissions while meeting stricter environmental regulations.

- Urban Warehousing: The rise of last-mile delivery has led to the development of micro-fulfillment centers within cities. These smaller facilities support ultra-fast delivery and reduce transportation costs, responding to consumer expectations for convenience.

- Resilience and Risk Management: Recent global disruptions have highlighted vulnerabilities in supply chains. Companies are investing in regional diversification, safety stock strategies, and agile warehousing solutions to mitigate risks and ensure continuity.

Major Players and their Competitive Positioning

The warehousing and distribution logistics market is highly competitive and fragmented with global giants and specialized regional players vying for market share. The major players are DHL Supply Chain, XPO Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics, UPS Supply Chain Solutions, FedEx Logistics, Ryder System Inc., Geodis, and DSV Panalpina and others.

They compete on technology adoption, geographic reach, industry expertise and value added services like reverse logistics, cold chain solutions and packaging. Many are investing in automation, AI and sustainable infrastructure to strengthen their competitive position. Strategic mergers, acquisitions and partnerships help companies to expand their network and service offerings and reinforce their market leadership.

Consumer Behavior Analysis

Consumer behaviour in the warehousing and distribution logistics market is changing rapidly:

- Faster Delivery: Consumers expect same day or next day delivery especially in e-commerce. This is forcing logistics providers to redesign their networks with more local hubs and flexible inventory positioning.

- Customization and Flexibility: Business customers want logistics partners that can offer tailored solutions. Whether it’s temperature controlled storage for pharmaceuticals or omnichannel fulfilment for retailers, providers are adapting to different requirements.

- Transparency and Tracking: End customers want real time tracking and clear delivery updates. Logistics providers are prioritizing advanced tracking systems and customer facing portals to deliver this transparency.

- Cost: Despite the demand for premium services, cost is critical. Companies evaluate logistics partners on competitive pricing and operational efficiency, balancing service quality with cost.

- Sustainability: Both B2B and B2C customers are increasingly prioritizing environmental responsibility. Providers with green credentials – like electric delivery fleets and energy efficient warehouses – get a competitive and reputational advantage.

Pricing Trends

Pricing in the warehousing and distribution logistics market is shaped by multiple factors:

- Operational Costs: Costs for staff, space, and tech shape prices. City hubs cost more but bring faster delivery.

- Value-Added Services: Firms charge based on the service level. Basic storage costs less than cold or return handling.

- Technology Costs: Automation and robotics adoption entail significant capital expenditure. Providers balance these costs through operational savings and premium service fees.

- Fuel and Transportation Costs: Fuel prices keep changing and raise delivery costs. This shifts how firms set shipping rates.

- Competitive Pressures: Competitive pressures keep prices visible and operations lean. Bigger players cut costs through scale and still stay profitable.

Pricing trends shift between rising costs and what customers will pay. Speed, reliability, and extra services often justify the price.

Growth Factors

Several drivers underpin growth in the warehousing and distribution logistics market:

- E-commerce Expansion: Online shopping is growing faster than stores. This drives need for better delivery systems.

- Technological Advancements: New tech like AI and robots makes warehouses smarter. It cuts costs and boosts service speed.

- Urbanization: More people now live in cities, raising delivery needs. Urban hubs and last-mile setups are in high demand.

- Global Trade and Supply Chain Complexity: Global trade adds more steps to supply chains. Smart storage and fast delivery help cut delays and stay strong.

- Omnichannel Retailing: Global trade makes supply chains more complex. Smarter storage and quick delivery reduce delays and boost strength.

- Government Initiatives: Some areas give perks to grow logistics setups. Free trade zones and easy customs help speed things up.

Regulatory Landscape

The warehousing and distribution logistics market is influenced by a range of regulatory factors designed to ensure safety, efficiency, and environmental responsibility:

- Occupational Safety: Warehouses must follow strong safety rules. These cover training, gear use, and work conditions.

- Environmental Regulations: Governments now push for lower emissions in logistics. Sites may need green ratings and must report pollution.

- Trade and Customs Policies: Global shippers must follow each country's trade rules. Tariffs and customs papers often differ a lot.

- Data Privacy: Digital supply chains must protect user data. Laws like GDPR set strict rules for this.

- Transportation Regulations: Transport laws cover trucks, ships, and planes. These rules affect hours, pollution, and safety.

Recent Developments

Several recent developments are shaping the warehousing and distribution logistics market:

- Rise of Micro-Fulfillment Centers: Stores and shippers now build small city hubs. These help speed up local deliveries.

- Adoption of Robotics: Robots like AMRs and AS/RS are now common in warehouses. They pick faster, work better, and need less labor.

- Sustainability Initiatives: Firms now build green warehouses and use electric vans. They also plan smart routes to cut pollution.

- Digital Platforms: WMS and TMS tools now connect supply steps. They give full control and live tracking.

- Strategic M&A Activity: Big firms are merging to grow and serve more areas. DSV bought Agility, and UPS invested in health shipping.

Current and Potential Growth Implications

a. Demand-Supply Analysis: E-commerce and globalisation is driving huge demand for warehousing and distribution services. But shortage of prime industrial space in urban areas is limiting supply and increasing costs.

b. Gap Analysis: While major markets are adopting advanced solutions, emerging markets will lag due to infrastructure challenges and investment costs. This gap is an opportunity for providers to move into underserved areas with customised solutions.

c. Labour Considerations: Labour shortages in many areas is driving automation adoption but also increasing operational costs. Providers are investing in workforce training and recruitment strategies to mitigate this challenge.

Top Companies in the Warehousing and Distribution Logistics Market

- DHL Supply Chain

- XPO Logistics

- DB Schenker

- Kuehne + Nagel

- CEVA Logistics

- UPS Supply Chain Solutions

- FedEx Logistics

- Ryder System Inc.

- Geodis

- DSV Panalpina

June 2025: Comau launches MyMR family of autonomous mobile robots (AMRs) at Automatica. Scalable intralogistics capabilities, 300kg, 500kg, 1,500kg payloads, intelligent navigation, real-time obstacle avoidance, flexible fleet management, no fixed infrastructure.

April 2025: Brightpick launches Autopicker 2.0, multi-purpose robotic picking solution with AI-driven "picking-in-motion" software. Up to 80 picks per hour. RaaS model for $1,900/month. Automation made more accessible and flexible.

Warehousing and Distribution Logistics Market: Report Snapshot

Segmentation | Details |

By Service Type | Dedicated Warehousing, Shared Warehousing, Distribution and Transportation, Value-Added Services |

By End-User | Retail and E-commerce, Automotive, Pharmaceuticals, Consumer Goods, Industrial Manufacturing, Food and Beverage |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Dedicated Warehousing: Big stores and makers want safe, custom storage. This boosts demand for dedicated warehouses.

- Distribution and Transportation Services: E-commerce and global trade need faster delivery. This grows demand for strong and flexible transport setups.

- Retail and E-commerce End-User Segment: Retail and e-commerce lead market growth. They need smart, tech-based delivery systems.

Major Innovations

- Automated Warehousing Solutions: Smart robots like AMRs and AS/RS speed up warehouse work. They cut costs and lower mistakes.

- Integrated Digital Platforms: Cloud WMS and TMS tools help track stock better. They also boost control across the supply chain.

- Sustainability-Focused Facilities: Green buildings use less power and cut waste. Solar panels and eco labels help the planet.

- Last-Mile Delivery Innovations: Electric vans and smart routes speed up final delivery. Small city hubs help reach customers faster.

Potential Growth Opportunities

- Expansion into Emerging Markets: Rising middle class boosts need for smart logistics. Asia and Latin America see fast growth as roads improve.

- Integration of AI and IoT: AI and IoT now help track and plan in real time. They boost speed and cut errors in warehouses.

- Partnerships with Retailers: Logistics firms now work closely with retailers. This helps give smooth service across all sales channels.

- Sustainability Investments: More buyers want clean and green shipping. This lets firms stand out with eco options.

Extrapolate Research Says:

The warehousing and distribution logistics market will continue to grow strongly over the next few years. As e-commerce goes from strength to strength, companies are rethinking their logistics networks to meet customer expectations for speed and reliability. Technology, particularly automation and digitisation is changing the industry’s efficiency and capability.

Meanwhile sustainability is no longer optional but a competitive imperative, driving innovation in facility design and transport. As businesses navigate global uncertainty and changing customer needs, investing in flexible, resilient and environmentally responsible warehousing and distribution will be key to success. The future of this market is in its ability to adapt, integrate the latest technology and deliver value across increasingly complex supply chains.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Warehousing and Distribution Logistics Market Size

- August-2025

- 148

- Global

- Retail

Related Research

Activewear Market Size, Share, Growth & Industry Analysis, By Product Type (Athletic Shoes, Sports B

March-2025

Agrobacterium tumefaciens Competent Cells Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Aluminium Composite Panels (ACP) Market Insights 2022, Global Analysis and Forecast to 2030

July-2021