Metal Caps and Closures Market Size, Share, Growth & Industry Analysis, By Product Type (Screw Caps, Crown Caps, Lug Caps, ROPP Caps, Flip-Top Caps, Others), By Material (Aluminum, Steel, Tinplate, Others), By End-User (Food & Beverages, Pharmaceuticals, Personal Care, Industrial, Household, Others), and Regional Analysis, 2024-2031

Metal Caps and Closures Market: Global Share and Growth Trajectory

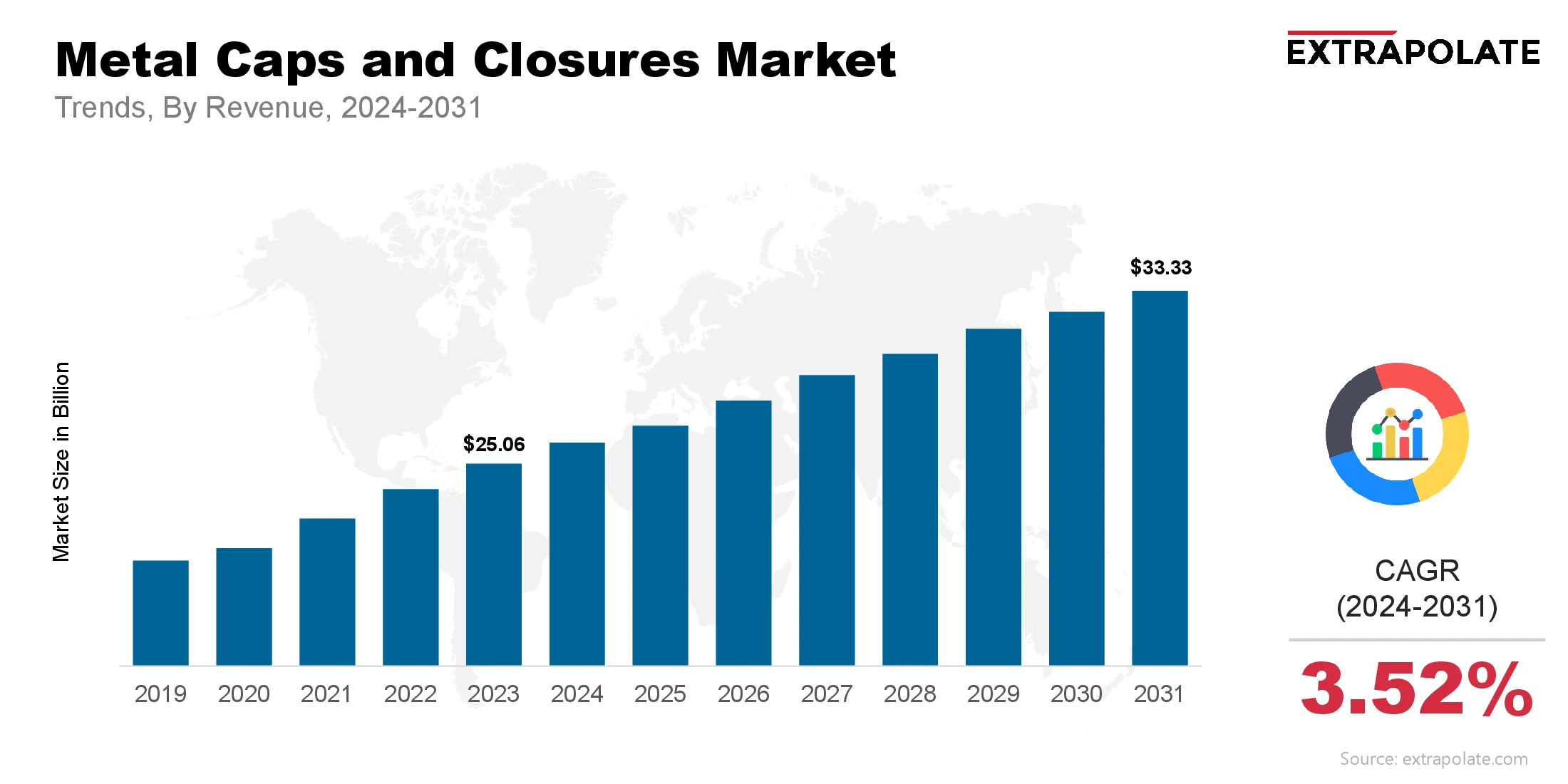

The global Metal Caps and Closures Market size was valued at USD 25.06 billion in 2023 and is projected to grow from USD 26.16 billion in 2024 to USD 33.33 billion by 2031, exhibiting a CAGR of 3.52% during the forecast period.

The global metal caps and closures market is witnessing steady growth, driven by the increasing demand for secure, sustainable, and visually appealing packaging solutions. These closures play a crucial role across industries such as food and beverage, pharmaceuticals, cosmetics, and personal care by offering product protection, tamper evidence, and extended shelf life.

Metal caps—commonly made from aluminum, steel, or tinplate—are favored for their strength, barrier properties, and recyclability. As global concerns around plastic waste intensify, metal closures are emerging as a preferred alternative due to their eco-friendly nature and alignment with circular economy goals. Brands are leveraging the aesthetic and functional benefits of metal caps to create premium packaging that appeals to conscious consumers.

The beverage sector, particularly alcoholic drinks and bottled water, continues to be a major driver of demand for screw caps, crown caps, and ROPP closures. Additionally, rising consumption of packaged foods and the expansion of the pharmaceutical industry have increased the need for reliable and tamper-proof sealing solutions.

Technological advancements such as digital printing, lightweighting, and smart features (e.g., QR codes or NFC-enabled caps) are further reshaping the market landscape. Manufacturers are investing in sustainable innovations and expanding production capacities to meet the growing global demand.

Asia-Pacific dominates the market due to rapid industrialization, population growth, and rising consumer awareness, while North America and Europe continue to lead in terms of sustainability adoption and premium product packaging.

As industries continue to prioritize safety, sustainability, and product differentiation, the metal caps and closures market is projected to experience robust growth in the coming years. Innovations and emerging market opportunities are expected to further enhance the global market trajectory.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Rise in Premium Packaging Demand: The surge in premium and luxury packaging—especially in alcoholic beverages, cosmetics, and personal care—has significantly boosted the demand for aesthetically appealing metal caps. Brands aim to create a distinguished look and feel with high-end packaging, and metal closures provide that visual appeal along with functional integrity.

- Sustainability and Circular Economy Focus: Environmental awareness and government regulations are pushing industries to adopt sustainable packaging solutions. Metal closures, being infinitely recyclable, align with circular economy principles. The use of aluminum closures, in particular, is on the rise due to their light weight, corrosion resistance, and eco-friendliness. Many major players are reengineering their product lines to increase post-consumer recycled (PCR) content.

- Technological Advancements in Manufacturing: Modern manufacturing methods like digital printing, embossing, and multi-color lithography have enhanced the aesthetic and functional value of metal closures. Additionally, precision-engineered sealing techniques have improved tamper-evidence and resealability. The integration of advanced automation and robotics in capping lines has also boosted operational efficiency and consistency.

- Growing Demand for Safety and Tamper Evidence: Food safety and pharmaceutical regulations have made tamper-evident and hermetically sealed closures an industry standard. Metal caps, particularly roll-on pilfer-proof (ROPP) closures, ensure product safety and prevent contamination. With consumers more concerned about authenticity and hygiene, tamper-evident metal caps are increasingly favored.

- Surge in Beverage and Bottled Water Consumption: Rising consumption of bottled water, carbonated drinks, ready-to-drink (RTD) beverages, and alcohol across the globe has greatly influenced metal cap demand. Beer and wine segments, which often rely on crown caps and screw closures, have expanded rapidly—particularly in emerging markets.

Major Players and their Competitive Positioning

The metal caps and closures market is highly competitive and fragmented, with major players continuously focusing on innovation, sustainability, and expansion. Key participants included are Crown Holdings, Inc., Silgan Holdings Inc., Berry Global Inc., Guala Closures Group, Closure Systems International, Inc., Amcor Plc, Technocap Group, Alcopack Group, PELLICONI & C. S.p.A., Massilly Group and others.

These companies are actively investing in R&D, strategic acquisitions, and regional expansion. Many are also partnering with beverage and pharmaceutical brands to provide custom solutions with anti-counterfeit features and aesthetic customization.

Consumer Behavior Analysis

- Increased Preference for Convenience and Resealability: Modern consumers favor convenience. Metal closures like twist-off and lug caps provide easy opening and resealing, a significant driver for home-use food and beverage products. Ease of use, combined with hygienic assurance, makes these closures popular among both younger and elderly demographics.

- Health and Safety Concerns Drive Purchase Decisions: Increased awareness of hygiene, contamination risks, and the need for tamper-proof solutions drives consumers to choose metal-sealed packaging, especially in food and pharmaceuticals. The perception of metal closures as more secure than plastic ones reinforces this behavior.

- Rising Inclination Toward Sustainability: Consumers today are more informed and environmentally conscious. As a result, they prefer packaging that supports recycling and reduces landfill burden. This trend is prompting companies to prominently advertise their use of recyclable metal closures as part of their sustainability branding.

Pricing Trends

Metal caps and closures span a wide range of price points, depending on material, application, and customization. Aluminum closures are typically more expensive than steel ones but are preferred for their light weight and corrosion resistance. Decorative features such as embossing, printing, and matte or glossy finishes also add to the cost.

Raw material price fluctuations—especially in aluminum and tinplate—directly affect closure pricing. However, bulk production and economies of scale enable competitive pricing for standard products. Manufacturers are also adopting lightweighting and design optimization to manage material usage and costs.

Leasing and contract manufacturing services are becoming common, especially for small to mid-sized FMCG companies that need high-quality metal closures without significant capital investment.

Growth Factors

- Expanding Beverage Industry: The global beverage sector—especially alcoholic drinks, carbonated beverages, and flavored water—continues to expand, creating sustained demand for metal caps like crown, screw, and press-on closures. Innovations in bottle design and branding are also supporting this trend.

- Rising Urbanization and Packaged Food Consumption: Urbanization has led to busier lifestyles, increasing demand for ready-to-consume packaged foods. Metal caps and closures provide long shelf life and reliability, making them suitable for sauces, condiments, canned goods, and jarred products.

- Boom in Pharmaceutical and Nutraceutical Packaging: The pharmaceutical sector’s emphasis on product integrity and contamination prevention has created a favorable landscape for metal closures. Child-resistant, tamper-evident, and airtight caps are being used increasingly across tablets, syrups, and dietary supplements packaging.

- Supportive Regulatory Environment: Global regulations favor tamper-evident and food-grade closures. Governments are promoting metal packaging through recycling incentives and extended producer responsibility (EPR) mandates, encouraging adoption of metal caps over plastic ones.

Regulatory Landscape

Compliance with safety, food contact, and recycling standards is critical in the metal caps and closures market.

- FDA (U.S.): All closures for consumable goods must comply with FDA regulations related to food contact materials, sealing integrity, and migration levels.

- EU Regulations: European packaging standards require closures to comply with the EU Framework Regulation (EC) No. 1935/2004 and REACH guidelines, ensuring safety and recyclability.

- ISO Certifications: Quality management systems like ISO 9001 and environmental management under ISO 14001 are widely adopted. Standards also exist for specific types of closures like ROPP and CRC (child-resistant closures).

Recent Developments

- Rise in Recyclable Aluminum Closures: Companies like Guala Closures and Crown Holdings have introduced aluminum closures made from up to 80% recycled content. These innovations aim to reduce carbon footprints while maintaining product integrity. In March 2025, BERICAP Aluminium partnered with VDP to launch exclusive aluminum roll-on closures for over 200 German wineries, focusing on premium design, sealing quality, and sustainability. The collaboration also incorporates advanced digital printing and customizable features to enhance packaging aesthetics and support German wine branding.

- Smart Closures Enter the Scene: The integration of QR codes, NFC chips, and tamper-detection sensors is transforming closures into smart packaging tools. These features allow consumers to verify authenticity, access product info, and engage with brands digitally.

- Mergers and Acquisitions: Recent M&A activity includes Silgan Holdings acquiring Cobra Plastics and Technocap expanding its metal closure production footprint in Europe. These moves aim to enhance technological capabilities and regional market share.

- Lightweighting Initiatives: Lightweight metal closures with the same performance metrics are being developed to cut material usage and shipping costs. These designs contribute to overall sustainability without compromising functionality.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Global demand for metal closures is on the rise, especially in emerging economies. However, supply-side constraints such as raw material shortages and high energy prices can pose challenges. Still, technological advancements and growing capacities are helping manufacturers meet the increasing demand.

b. Gap Analysis

While metal closures offer superior performance, their cost is a barrier for small-scale producers and in regions with limited packaging infrastructure. The industry is focused on developing cost-effective solutions and educating stakeholders about long-term benefits.

Top Companies in the Metal Caps and Closures Market

- Crown Holdings, Inc.

- Silgan Holdings Inc.

- Berry Global Inc.

- Guala Closures Group

- Closure Systems International, Inc.

- Amcor Plc

- Technocap Group

- Alcopack Group

- PELLICONI & C. S.p.A.

- Massilly Group

Metal Caps and Closures Market: Report Snapshot

Segmentation | Details |

By Product Type | Screw Caps, Crown Caps, Lug Caps, ROPP Caps, Flip-Top Caps, Others |

By Material | Aluminum, Steel, Tinplate, Others |

By End-User | Food & Beverages, Pharmaceuticals, Personal Care, Industrial, Household, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Aluminum Closures: Due to their lightweight and corrosion-resistant properties, aluminum closures are increasingly used in beverages and cosmetics.

- Pharmaceutical Closures: Tamper-evident, child-resistant metal caps are gaining traction for syrups, supplements, and OTC drugs.

- Food Sector Closures: Vacuum-sealed and lug caps are in high demand for sauces, jams, and baby food.

Major Innovations

- Decorative and Custom Closures: Closures are now a branding tool. Embossed logos, textured surfaces, and multi-color finishes offer differentiation.

- Sustainable Coatings: New BPA-free, food-safe coatings extend product shelf life without compromising recyclability.

- Digital Integration: Embedded digital identifiers help fight counterfeiting and improve traceability throughout the supply chain.

Potential Growth Opportunities

- Emerging Markets Expansion: City growth and income gains are changing consumption patterns. This helps create space for market expansion. These trends support demand for upgraded packaging options.

- Premiumization in Beverage Packaging: Shifting consumer tastes push brands to upgrade packaging. This raises demand for sleek, high-end metal closures.

- Partnerships with Eco-Conscious Brands: Working with eco-focused brands boosts metal cap use. This is key in organic and natural product lines.

Extrapolate Research Says:

The industry is gaining momentum. Food, drink, and healthcare sectors are fueling demand. In response, closures are evolving to offer safety, style, and ease of use.

Metal closures now offer smart functions and eco designs. This makes them ideal for firms focused on safety and greener packaging. New markets are driving expansion. The industry remains strong and ready for long-term success.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Metal Caps and Closures Market Size

- July-2025

- 140

- Global

- Retail

Related Research

Activewear Market Size, Share, Growth & Industry Analysis, By Product Type (Athletic Shoes, Sports B

March-2025

Agrobacterium tumefaciens Competent Cells Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Aluminium Composite Panels (ACP) Market Insights 2022, Global Analysis and Forecast to 2030

July-2021