Commercial Building Automation Equipment Market Size, Share, Growth & Industry Analysis, By System (Heating, Ventilation, and Air Conditioning (HVAC) Systems; Lighting Control Systems; Security & Access Control Systems; Building Energy Management Systems (BEMS); Fire Control Systems; Building Management Systems (BMS)) By Application (Office Buildings; Retail and Public Assembly Buildings; Healthcare Facilities (Hospitals); Airports; Hospitality Sector; Educational Institutions; Industrial) By Component (Hardware (sensors, controllers, field devices); Software; Services (installation, maintenance, support)), and Regional Analysis, 2025-2032

Market Definition

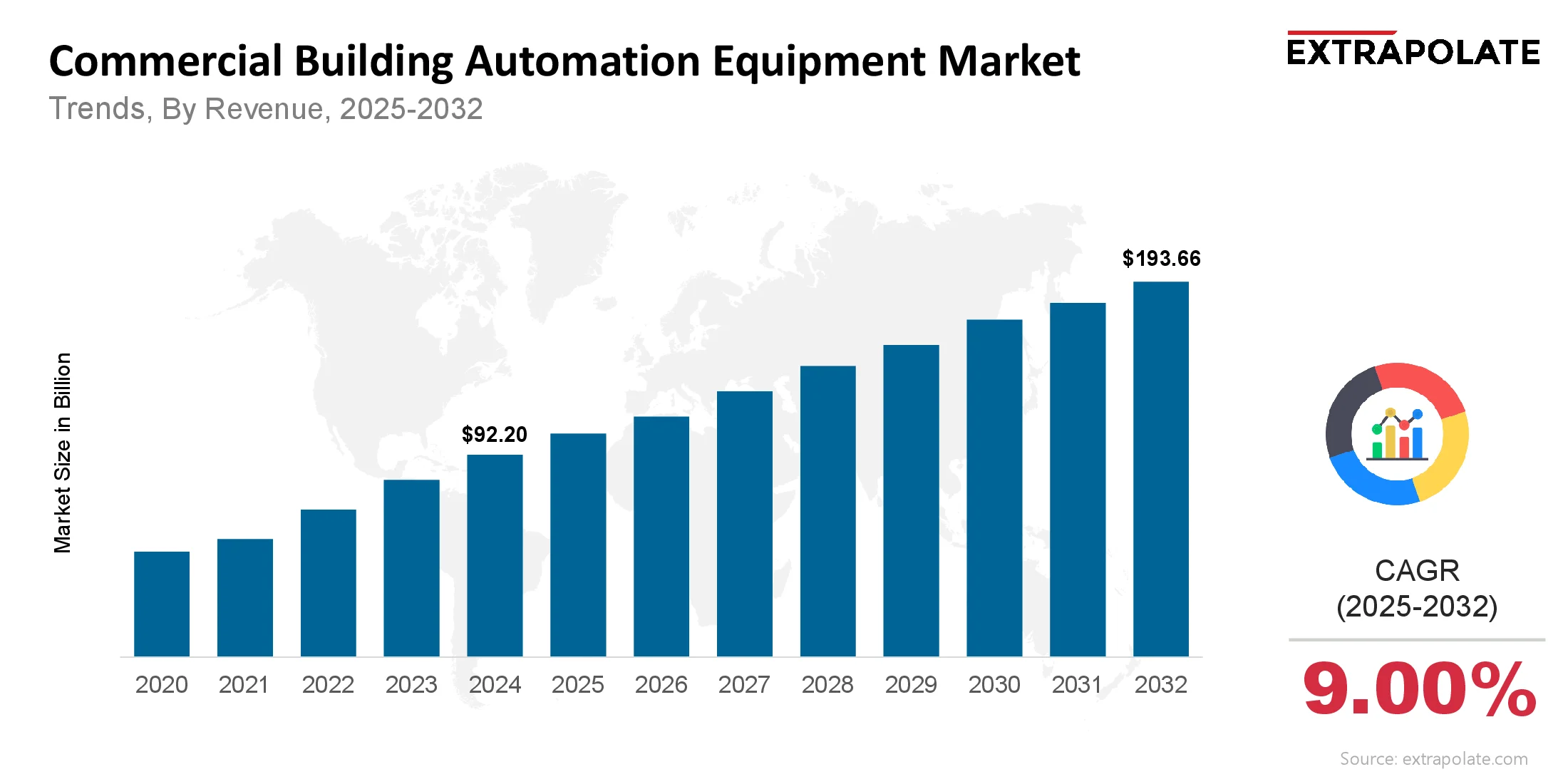

The global Commercial Building Automation Equipment Market size was valued at is projected to grow from USD 92.20 billion in 2024 to USD 193.66 billion by 2032, exhibiting a CAGR of 9.0% during the forecast period.

The global market is a complex ecosystem of hardware, software and services that centralizes control and management of a building’s operational systems including heating, ventilation and air conditioning (HVAC), lighting, security and fire safety. These systems are often referred to as Building Automation Systems (BAS) a computerized, intelligent network of electronic devices that monitor and control a building’s mechanical and electrical equipment to improve energy efficiency, performance and occupant comfort and safety. The market is evolving from simple, single purpose controls to highly integrated, data driven platforms that use the latest technologies like the Internet of Things (IoT), artificial intelligence (AI) and cloud computing to create smarter, more responsive and sustainable commercial spaces. The aim of these systems is to have a building’s installed systems working efficiently while reducing operational costs.

Key Insights

- The global commercial building automation equipment market was valued at $92.20 billion in 2024.

- It will reach $193.66 billion by 2032, growing at a significant rate.

- CAGR of around 9.0% from 2025 to 2032.

- North America will be the largest region by 2032, driven by advanced infrastructure and smart building investments.

- HVAC will be the largest system segment. It’s the backbone of energy consumption and indoor comfort.

- Commercial will be the largest application segment. Energy efficiency and occupant comfort.

- The biggest driver is energy efficient solutions.

- One of the trends is IoT and data analytics integration into building automation systems, which allows remote monitoring and control.

Market Summary Financials

The Global Commercial Building Automation Equipment Market is growing fast, driven by the global push for energy efficiency and sustainable infrastructure. Estimated to be $92.20 billion in 2024, it’s expected to grow to around $193.66 billion by 2032, which is a 9.0% CAGR from 2025 to 2032.

The market is being driven by several factors, including the adoption of smart building technologies, government initiatives for sustainable urban development and reducing operational costs. The demand for systems that can do real-time monitoring, predictive maintenance and remote control is driving investments in new builds and retrofits. While the upfront cost of advanced automation systems can be high, the long term savings from energy consumption and operational efficiency make the case for adoption, especially for large commercial properties.

Detailed Analysis Content

Key Market Trends

The commercial building automation market is being transformed by several big trends:

- IoT Everywhere: IoT devices, sensors and actuators are making it possible to have a whole building view and real-time data collection. This allows for predictive maintenance and intelligent resource allocation.

- AI and Predictive Analytics: AI and machine learning are being added to BAS to provide predictive analytics, allowing facility managers to anticipate maintenance needs and optimize energy usage based on historical data and real-time conditions. This moves from reactive maintenance to proactive management.

- Cloud Based Platforms: Cloud solutions are on the rise, allowing remote monitoring and control of building systems from a central platform or mobile app. This provides more flexibility and scalability and less on-site infrastructure.

- Health and Wellness: After global health events, there is a bigger emphasis on indoor air quality (IAQ) and occupant comfort. Automation systems are being used to manage ventilation, filtration and humidity to create healthier, more productive environments.

- Open Standards and Interoperability: The industry is moving towards open standards and interoperability, facilitating communication between different systems from different vendors. This reduces vendor lock-in and gives building owners more flexibility and scalability.

Major Players

The global commercial building automation equipment market is a competitive landscape with a mix of established industry giants and innovative startups. Key players include:

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Johnson Controls International plc

- Delta Controls

- ABB Ltd.

- Cisco Systems, Inc.

- Carrier Global Corporation

- Lutron Electronics Co., Inc.

- Trane Technologies plc

Consumer Behavior Insights

The decision making process for commercial building automation systems is all about long term benefits and operational efficiency. Building owners and facility managers are driven by the need to reduce energy consumption and costs. To enhance occupant comfort, safety and productivity is also a big factor. As sustainability becomes more important, businesses are looking for solutions to help them achieve green building certifications and reduce their carbon footprint. Other key factors that influence the buying decision are the system’s reliability, scalability, ease of integration with existing infrastructure and strong after sales support. With the complexity of modern buildings and the need for a data driven approach to management, automation systems are no longer an option for new and retrofitted commercial properties.

Pricing Trends

Pricing for commercial building automation systems is a big issue, with many variables, including size and complexity of the building, level of integration and what functions you want to implement. While initial install costs can be steep – $2 to $7 per sq ft for light commercial and $10 to $15 per sq ft for big systems – the market is moving towards the long term return on investment (ROI). The upfront cost is seen as a capital expenditure to get big savings on utility bills which can be 30-50% with smart HVAC upgrades. The move to wireless and modular systems is helping to simplify some of the install complexities and costs but the high initial cost is still a barrier for many small to medium sized businesses.

Growth Factors

The commercial building automation market is driven by:

- Energy Efficiency: As energy costs rise and environmental concerns grow, there’s an increasing need for solutions that can monitor and control energy usage in real-time. Building automation is a part of this solution, saving energy and reducing carbon footprint.

- IoT and AI: Continuous advancements and integration of IoT, AI and cloud is making systems more sophisticated and efficient. These technologies provide real-time data, predictive maintenance and remote management making automation more attractive and effective.

- Government Initiatives and Regulations: Many governments worldwide are implementing strict building codes and providing incentives to build green and smart buildings. These regulations like Energy Conservation Building Code in India are driving demand for automation solutions that can meet energy usage benchmarks.

- Smart Cities: The smart cities concept globally, especially in countries like China and India is creating a huge demand for building automation as a foundation for sustainable urban infrastructure.

Regulatory Landscape

The regulatory environment for commercial building automation is all about energy efficiency and sustainability. Governments and regulatory bodies are:

- Setting Green Building Standards: LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) certifications are pushing the adoption of energy efficient technologies including BAS.

- Enforcing Energy Efficiency Codes: Mandatory building codes that set energy consumption benchmarks are a big driver. These regulations force building owners to invest in automation systems to meet compliance.

- Offering Incentives: Some governments offer tax credits, grants and subsidies to encourage the installation of energy efficient and smart building technologies making the initial investment more attractive for businesses.

Recent Developments

The market is full of innovation and partnerships:

- Tech Integration: The latest solutions are using AI and machine learning for predictive analytics and real-time monitoring. Digital twins are being used to create virtual copies of buildings for simulation and performance optimization.

- Partnerships: To improve operational efficiency and sustainability companies are forming key partnerships. For example, Schneider Electric partnered with Noida International Airport in India to deploy building and energy management solutions.

- Product Launches and Upgrades: Major players are launching and upgrading their products to offer more integrated, scalable and user friendly solutions that can be controlled remotely via cloud based platforms and mobile apps.

- Interoperability: To address the issue of disparate systems there is a growing focus on solutions that use open protocols so that devices and systems from different manufacturers can communicate and integrate seamlessly.

Demand-Supply Analysis

The demand for commercial building automation equipment is high and growing. The main drivers are energy efficiency, security and operational performance in commercial buildings. The supply side is strong with many international and local players offering a wide range of products and services from full building management systems to specialized solutions for lighting or HVAC control. The supply chain is getting more complex with the addition of IoT sensors, software and cloud services to create a more connected ecosystem. But there is a big gap in the supply of skilled technicians to install, maintain and program these complex systems which sometimes hinders the growth of the market.

Gap Analysis

While the commercial building automation market is mature, there are still gaps and challenges:

- High Upfront Cost: The big upfront capital cost is a major hurdle for smaller businesses and new builds, despite the long term savings.

- Lack of Skilled People: There’s a shortage of skilled technicians and engineers to install, integrate and maintain these complex systems, leading to implementation delays and operational issues.

- Interoperability: Despite the push for open standards, many legacy systems and even new products from different vendors find it difficult for seamless communication, creating integration problems and vendor engagement.

- Data Security: With more devices and cloud based platforms, data security and privacy is a big gap that needs to be addressed to get mass adoption.

Segmentation and Growth Opportunities

Segmentation | Details |

By System | Heating, Ventilation, and Air Conditioning (HVAC) Systems; Lighting Control Systems; Security & Access Control Systems; Building Energy Management Systems (BEMS); Fire Control Systems; Building Management Systems (BMS) |

By Application | Office Buildings; Retail and Public Assembly Buildings; Healthcare Facilities (Hospitals); Airports; Hospitality Sector; Educational Institutions; Industrial |

By Component | Hardware (sensors, controllers, field devices); Software; Services (installation, maintenance, support) |

By Region | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

High Growth Segments

The commercial building automation market is growing across all segments but some stand out as hotspots:

- Building Energy Management Systems (BEMS): This is growing fast as businesses focus on energy efficiency and sustainability. As they look to reduce their environmental impact and operational costs BEMS are top of the list.

- Security and Access Control Systems: With safety and security on everyone’s mind this segment is in high demand. The integration of advanced security technologies like biometrics, video surveillance and facial recognition is driving innovation and growth.

New Developments

Recent developments are changing the game for building automation systems:

- AI and Machine Learning for Optimization: AI is being used to analyses real-time data from building systems to predict energy usage, identify maintenance needs and automatically adjust settings for optimal performance and comfort.

- Digital Twin Technology: This involves creating a virtual replica of a physical building so facility managers can simulate different scenarios, test new systems and optimize performance in a risk free environment.

- IoT Enabled Smart Sensors: Low cost, wireless and highly accurate IoT sensors for temperature, occupancy and air quality are enabling more granular control and data collection.

- Cloud Based Control and Mobile Apps: The move to the cloud and the development of intuitive mobile apps is making it easier for facility managers to monitor and control their buildings from anywhere, at any time.

Potential Growth Opportunities

For companies operating in or looking to enter this market, several key opportunities exist:

- Retrofitting Existing Buildings: The vast majority of commercial buildings are not fully automated. The opportunity to retrofit these existing structures with modern, smart systems represents a massive, largely untapped market.

- Developing Interoperable Platforms: Companies that can develop and market open-protocol platforms that seamlessly integrate with a wide range of hardware and software from different vendors will have a significant competitive advantage.

- Focusing on Small and Medium-Sized Enterprises (SMEs): While the market is dominated by large-scale projects, there is a growing demand from SMEs for cost-effective and scalable automation solutions.

- Providing Integrated Solutions: There is a strong demand for "holistic" solutions that combine HVAC, lighting, security, and other systems into a single, unified platform, rather than offering siloed products.

Extrapolate Says

The commercial building automation equipment market is on an upward trajectory driven by the economic efficiency and environmental responsibility. Our research shows that while traditional applications in HVAC and security will always be the foundation, the future of the market lies in the specialized high growth areas like building energy management systems.

The industry is at a crossroads with the push for sustainability and stricter regulations bringing a new generation of connected, AI enabled solutions. Companies that can innovate in this space and develop platforms that not only meet but exceed performance expectations while addressing the challenges of interoperability and high upfront costs will be the ones that will succeed in the long term.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Commercial Building Automation Equipment Market Size

- September-2025

- ���1���4���8

- Global

- Machinery-Equipment

Related Research

0-Global Market Status and Trend Report 2015-2026

November-2020

2 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

3 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020