ESports Organization Market Size, Share, Growth & Industry Analysis, By Revenue Stream (Sponsorships, Media Rights, Merchandise, Tournament Winnings, Content Creation) By Game Genre (MOBA, FPS, Battle Royale, Sports Simulation, Fighting, RTS) By Platform (PC, Console, Mobile) By Organization Type (Independent Teams, Sports Franchise-Owned, Entertainment Conglomerate-Owned) and Regional Analysis, 2024-2031

eSports Organization Market: Global Share and Growth Trajectory

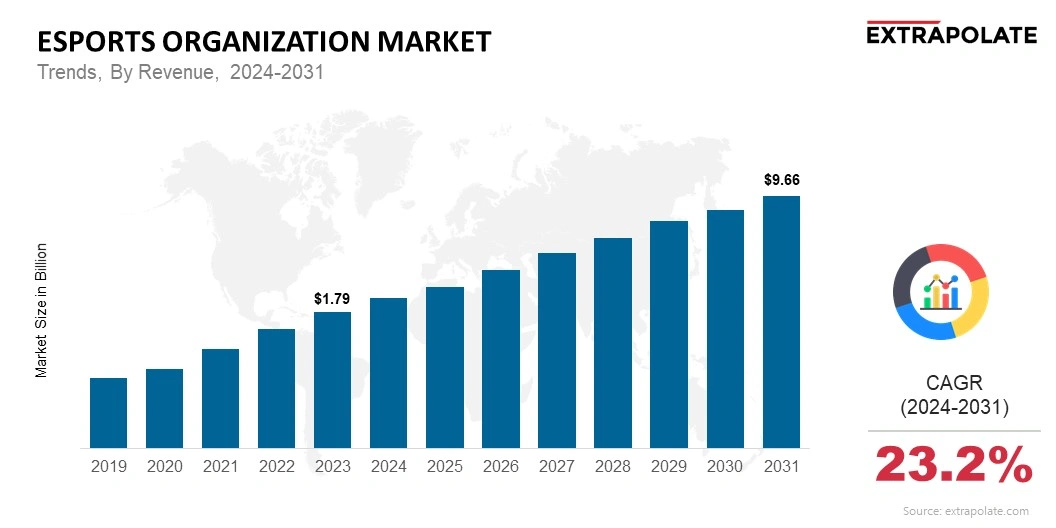

The global ESports Organization Market size was valued at USD 1.79 billion in 2023 and is projected to grow from USD 2.23 billion in 2024 to USD 9.66 billion by 2031, exhibiting a CAGR of 23.2% during the forecast period.

The global market is experiencing dynamic growth, driven by the surging popularity of competitive gaming, rising investments from major brands, and increasing viewership across digital platforms. eSports organizations function as professional teams that compete in global tournaments across various gaming titles such as League of Legends, Counter-Strike, Dota 2, and Call of Duty. These organizations are not only reshaping the entertainment landscape but are also becoming key players in the digital economy by building powerful fan communities and monetizing a variety of revenue streams.

eSports organizations are evolving beyond traditional team structures into full-fledged media and lifestyle brands. They generate revenue through tournament winnings, sponsorship deals, merchandise sales, content creation, streaming, and partnerships with game developers. As audiences continue to shift toward online and interactive platforms, eSports organizations are leveraging digital engagement strategies to enhance fan loyalty and drive global recognition.

One of the major growth drivers of this market is the expanding global viewership of eSports. With millions of fans tuning in to live-streamed tournaments and team-related content on platforms like Twitch, YouTube, and Facebook Gaming, the value of media rights and advertising opportunities is rising rapidly. This has attracted investments from traditional sports franchises, venture capital firms, and celebrities, fueling the professionalization and commercial growth of eSports organizations.

The increasing legitimacy of eSports as a mainstream entertainment and competitive discipline is also bolstering the market. Educational institutions are introducing eSports scholarships and programs, while governments in various regions are recognizing eSports as official sporting categories. These developments are encouraging structured team formation, better athlete management, and the adoption of long-term growth strategies by organizations.

Technology is playing a crucial role in the advancement of the eSports organization industry. Data analytics, AI-driven coaching tools, and player performance platforms are helping teams refine strategies and maximize their chances of success. Additionally, the rise of mobile eSports is opening new opportunities in emerging markets, expanding the reach of organizations beyond traditional PC and console gaming.

North America currently dominates the eSports organization due to its strong infrastructure, large player base, and high-value sponsorship deals. However, Asia-Pacific remains a powerhouse in terms of viewership, talent pool, and regional tournaments, offering vast potential for further expansion. Europe is also witnessing increasing activity with several prominent organizations gaining international traction.

As gaming, entertainment, and sports blur. eSports organizations are set to become major media influencers. With increasing monetization avenues. Strategic collaborations and cross-industry integration. The market is set to continue its upward trajectory. This will reshape the future of competitive digital entertainment.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The eSports Organization market is witnessing substantial transformation as the boundaries between sports, entertainment, and digital media continue to blur. Key trends include:

• Mainstream Acceptance of eSports: Growing media rights deals and TV broadcast integrations are pushing eSports organizations into the mainstream spotlight.

• Diverse Revenue Streams: Teams are expanding beyond prize money into merchandising, content creation, sponsorships, and licensing.

• Talent Development & Scouting: Organizations are investing in training facilities and player development programs, similar to traditional sports.

• Franchise-Based Leagues: Structured leagues like the League of Legends Championship Series (LCS) and Overwatch League are attracting investors and ensuring stability.

• Cross-Industry Collaborations: Partnerships with brands in fashion, automotive, and entertainment are diversifying exposure and fan engagement.

Major Players and their Competitive Positioning

The eSports Organization market features a mix of independently established teams and organizations backed by traditional sports clubs or entertainment conglomerates. Top players include Team SoloMid (TSM), FaZe Clan, Cloud9, Team Liquid, and G2 Esports, each known for fielding competitive teams across multiple game titles. Competitive edge stems from social media following, tournament success, content creation, and strategic sponsorships.

Consumer Behavior Analysis

Consumer behavior in the eSports Organization market is shaped by:

• Strong Digital Engagement: Fans follow organizations across platforms like Twitch, YouTube, Twitter, and TikTok.

• Brand Loyalty to Teams and Players: Emotional connection to rosters and influencers drives merchandise sales and streaming views.

• Preference for Authentic Content: Behind-the-scenes videos, live streams, and vlogs increase audience stickiness.

• Mobile eSports Growth: Especially strong in Asia, where mobile-first gaming opens new viewership channels.

• Younger Demographics: Gen Z and millennials dominate the audience base, influencing sponsorship targeting and content style.

Pricing Trends

Revenue for eSports organizations comes from multiple streams, with pricing models based on sponsorship tiering, media rights agreements, and content monetization. Sponsorship packages can range from USD 50,000 to over USD 1 million annually, depending on the size of the organization and its audience reach. Additionally, branded content partnerships, NFT drops, and in-game collaborations provide premium monetization opportunities.

Growth Factors

The eSports Organization market is accelerating due to:

• Rising Global Viewership: eSports audiences are expected to exceed 600 million globally by 2025.

• Investor Interest in Digital Sports Franchises: VC and private equity firms are pouring capital into scalable team brands.

• Enhanced Streaming Monetization: Platforms like Twitch and YouTube enable ad revenue, subscriptions, and fan donations.

• Corporate Sponsorship Growth: Non-endemic brands like Coca-Cola, BMW, and Nike are actively sponsoring teams.

• Increasing Collegiate and Grassroots eSports Programs: Creating feeder systems and long-term growth potential.

Regulatory Landscape

The regulatory environment for eSports Organizations varies by region and game publisher. Key concerns include player contracts, intellectual property rights, and visa and labor regulations. Betting restrictions are also a factor. Some countries are working on recognizing eSports as a legitimate sport. This could open access to subsidies and institutional support.

Recent Developments

The eSports Organization market is evolving rapidly, with recent developments including:

• FaZe Clan's Public Listing: One of the first major organizations to go public. This signals investor confidence.

• Celebrity Ownership & Endorsements: Involvement of celebrities and athletes is raising profile and reach.

• Expansion into Lifestyle Branding: Teams like 100 Thieves are integrating fashion, music, and gaming.

• AI and Analytics Integration: Use of data tools to enhance player performance and fan engagement.

• Metaverse Collaborations: Early experiments with virtual fan zones, NFT drops, and immersive experiences.

Current and Potential Growth Implications

Demand-Supply Analysis

The demand for competitive teams and content is rapidly rising, outpacing the supply of top-tier players and well-capitalized organizations. Investment is pouring in to support global expansion, content creation, and player acquisition.

Gap Analysis

Challenges in the market include:

• Monetization of Fan Base: While engagement is high, converting fans to paying users is still evolving.

• Sustainability of Business Models: Some teams rely heavily on VC funding and struggle to generate consistent profits.

• Talent Retention Issues: Player burnout, short career spans, and high turnover impact team stability.

• Regulatory Ambiguity: Lack of global standards on competition rules, player welfare, and contracts.

• Overreliance on Specific Titles: Risk exposure if game publishers shift strategies or titles lose relevance.

Top Companies in the eSports Organization Market

• Team SoloMid (TSM)

• FaZe Clan

• 100 Thieves

• Cloud9

• G2 Esports

• Team Liquid

• Evil Geniuses

• Natus Vincere (Na'Vi)

• OG Esports

• Fnatic

Report Snapshot

Segmentation | Details |

By Revenue Stream | Sponsorships, Media Rights, Merchandise, Tournament Winnings, Content Creation |

By Game Genre | MOBA, FPS, Battle Royale, Sports Simulation, Fighting, RTS |

By Platform | PC, Console, Mobile |

By Organization Type | Independent Teams, Sports Franchise-Owned, Entertainment Conglomerate-Owned |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

Key growth segments include:

• Mobile-Focused Organizations: Capturing markets in Southeast Asia, India, and LATAM.

• Content-Centric Teams: Expanding YouTube and TikTok followings for monetization.

• Lifestyle-Oriented Brands: Fusing gaming with streetwear, music, and celebrity culture.

• Women-Led Teams and Tournaments: Promoting inclusivity and unlocking new demographics.

• Collegiate and Amateur eSports Networks: Providing pipelines for talent and fan engagement.

Major Innovations

Innovative moves transforming the market include:

• Tokenized Fan Engagement Models: Using blockchain to let fans own parts of teams or vote on decisions.

• Virtual Reality (VR) and AR Integration: Enhancing spectator experiences.

• Smart Sponsorship Analytics: AI-driven valuation of logo placements, stream mentions, and fan sentiment.

• End-to-End Talent Academies: Structured pipelines from amateur to pro.

• Branded Experience Centers: Physical gaming houses and event spaces for fan interaction.

eSports Organization Market: Potential Growth Opportunities

Emerging growth areas include:

• Expansion into Non-Gaming Content: Creating Netflix-style documentaries, podcasts, and reality shows.

• New Market Entry in MENA and Africa: Unlocking untapped gamer demographics.

• Brand Licensing for Consumer Products: Toys, energy drinks, apparel, and accessories.

• Strategic M&A Among Teams: Consolidation for talent, reach, and operational efficiency.

• Cross-Promotional Deals with Traditional Sports Teams: Sharing audiences and revenue models.

Extrapolate Research says:

The eSports Organization market is redefining the future of digital entertainment and sports franchising. With strong fan loyalty, scalable content, and global accessibility, eSports teams are more than just competitive units — they’re becoming cultural powerhouses with long-term commercial value.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

ESports Organization Market Size

- May-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021