E-waste Management Market Size, Share, Growth & Industry Analysis, By Waste Type (Consumer Electronics, Household Appliances, IT & Telecom Equipment, Others), By Material Recovery (Metal, Plastic, Glass, Others), By Source (Residential, Commercial, Industrial), and Regional Analysis, 2024-2031

E-waste Management Market: Global Share and Growth Trajectory

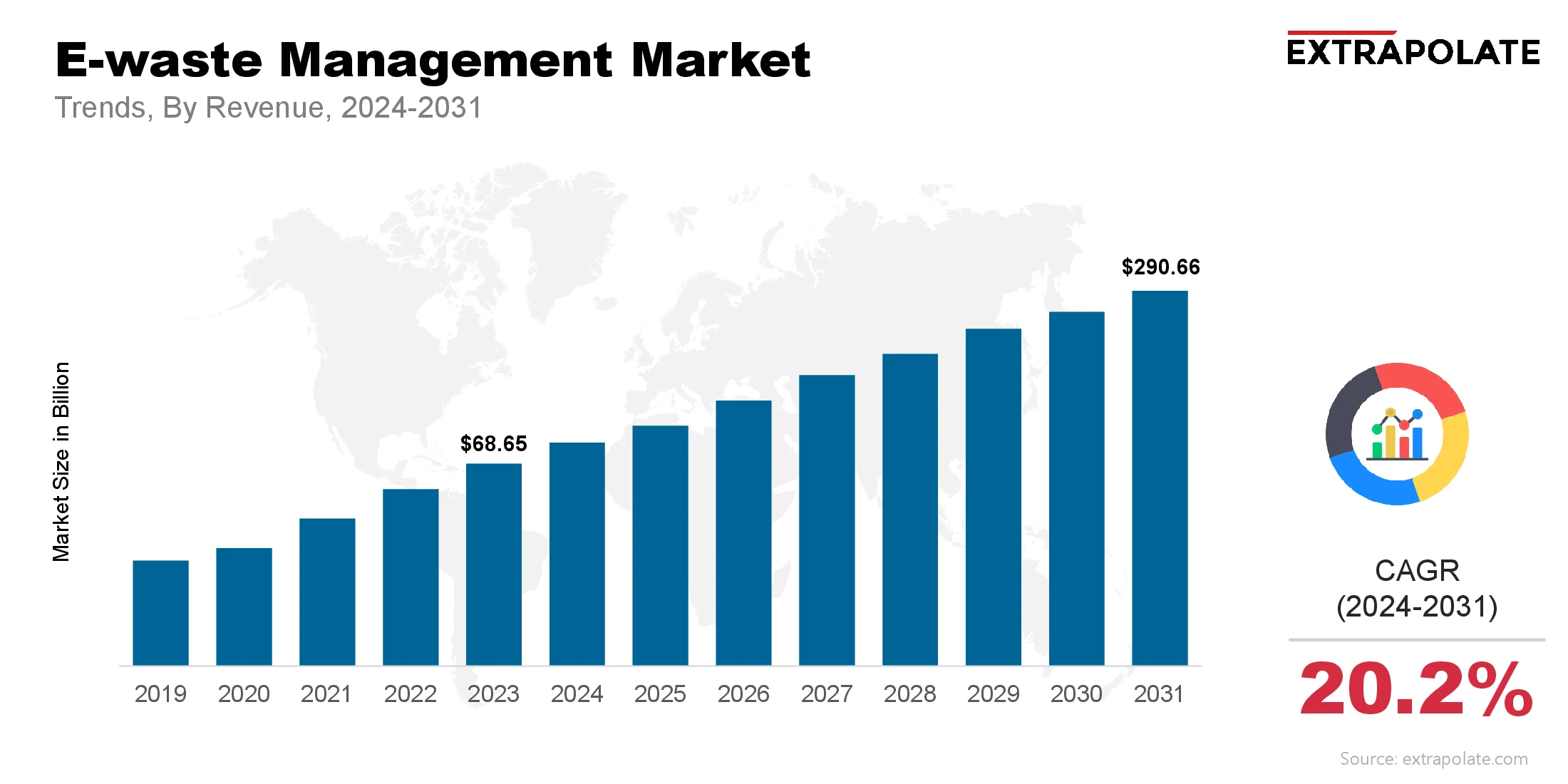

The global E-waste Management Market size was valued at USD 68.65 billion in 2023 and is projected to grow from USD 79.93 billion in 2024 to USD 290.66 billion by 2031, exhibiting a CAGR of 20.2% during the forecast period.

The global market is undergoing significant expansion, fueled by the increase in generation of electronic waste and increasing regulatory focus on environmental sustainability. With the proliferation of electronic devices and shortening product life cycles, vast quantities of e-waste comprising old computers, mobile phones, televisions, refrigerators, and other electronic appliances are generated globally. This surge has prompted significant demand for effective e-waste handling solutions, as environmental and health concerns take center stage.

Governments and corporations are increasingly recognizing the need for sustainable disposal and recycling mechanisms. Advanced e-waste management systems enable the recovery of valuable materials like gold, copper, and rare earth metals, while ensuring safe handling of hazardous substances like lead, mercury, and cadmium. With technological developments and circular economy principles becoming popular, the market is poised for remarkable expansion across all regions.

A crucial shift is occurring in how electronic waste is treated transitioning from landfill-based disposal to integrated recycling and reuse processes. Advancements in automation, robotics, and material recovery are transforming this sector. As awareness increases and regulatory frameworks get strict, the market is expected to grow rapidly, becoming a cornerstone of global sustainability efforts.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Rise in Electronic Consumption and Obsolescence

Consumer behavior and business practices have driven a rapid turnover of electronic products. From smartphones to smart TVs, modern devices have shorter life spans, encouraging frequent upgrades. This phenomenon is dramatically increasing the volume of e-waste generated each year, necessitating advanced waste management infrastructure to prevent environmental degradation.

Regulatory Push for Sustainable Waste Management

Governments across the world are implementing strict rules and policies to promote responsible e-waste disposal. Initiatives such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive and India's E-Waste Management Rules mandate manufacturers to adopt Extended Producer Responsibility (EPR), driving the growth of collection, recycling, and disposal networks.

Technological Advancements in Recycling Processes

Modern recycling technologies are enabling more efficient sorting, dismantling, and extraction of materials from e-waste. Innovations like AI-driven sorting robots, hydrometallurgical and pyrometallurgical methods, and chemical recycling are improving recovery rates and reducing environmental impact. These innovations are crucial for creating scalable and sustainable e-waste management systems.

Growth of Circular Economy Practices

Companies and governments are increasingly aligning with circular economy models that focus on reusing, refurbishing, and recycling materials. This paradigm shift is prompting the development of business models that extend the life cycle of electronics, creating new value chains and job opportunities while reducing the pressure on natural resources.\

Major Players and Their Competitive Positioning

Many players compete in the global e-waste market. They provide a range of solutions, from pickup to resale. Leading players are upgrading their tech and building strong networks. These steps help them expand globally and improve how they operate.

Leading companies in the market include are Sims Limited,Aurubis AG,Enviro-Hub Holdings Ltd,Umicore,Veolia Environnement S.A.,Ewaste+,Tetronics Technologies Ltd,Electronic Recyclers International (ERI),Stena Metall Group,EnviroServe and others.

Mergers, partnerships, and joint ventures are key strategies being employed by companies to solidify their presence in rapidly expanding markets. Businesses are adopting new digital tools for better tracking. These tools also support compliance with legal and safety norms.

Consumer Behavior Analysis

- Heightened Awareness of Environmental Impact: Rising environmental consciousness is prompting consumers to prioritize ethical and sustainable methods of electronic waste disposal. Through education, corporate responsibility, and government support, awareness efforts are successfully encouraging consumers to engage in responsible e-waste recycling.

- Preference for Convenient and Transparent Services: Consumers are more likely to engage when recycling options are readily available. Accessibility significantly impacts behavior. The demand for e-waste management is rising for services that provide pickup at home, process transparency, and real-time status updates. Providing digital receipts and disposal certifications helps build trust among tech-aware consumers seeking transparency and accountability.

- Growing Market for Refurbished Electronics: Consumers focused on cost and sustainability show rising demand for refurbished devices. This trend supports circular economy goals. Refurbishment demand rises as fewer devices reach landfills. The market expands due to increased professional service needs.

- Role of Producer Responsibility: Consumers are playing a larger role in ensuring manufacturers take responsibility. This influences corporate behavior. Offering buyback and trade-in options boosts brand loyalty. Free recycling programs also enhance customer retention. Growing demands require manufacturers to adopt sustainable design practices. Lifecycle planning increasingly reflects these goals.

Pricing Trends

Costs vary based on service offered, amount of waste, local regulations, and how much material is recovered. Extended Producer Responsibility programs offer free or subsidized recycling services. Yet, safe disposal of hazardous and bulk waste often incurs charges.

The value in e-waste lies in extracting metals such as gold, silver, and copper. Palladium and rare earth elements contribute to revenue. Shifts in metal prices impact revenue stability. Fluctuating markets challenge e-waste profitability. The rise in metal prices enhances recycling economics. This trend fuels growth in funding and technological advances.

Emerging leasing and service-based approaches offer comprehensive solutions. They cover collection, secure data destruction, and resource recovery at stable prices. Certified, sustainable disposal commands higher fees due to compliance costs. Enterprise customers increasingly accept these premiums.

Growth Factors

- Digitalization and Smart Device Proliferation: The surge in connected devices, smart homes, and IoT systems leads to more electronic waste. Cloud computing infrastructure growth further contributes. The rise of new device types adds complexity to e-waste. Effective management requires innovative solutions.

- Urbanization and Infrastructure Expansion: As cities expand and modernize, local governments create specific e-waste initiatives. These programs aim to handle growing electronic waste. Digital waste tracking, when linked to smart city programs, improves how e-waste is managed. Efficiency and traceability benefit from this integration.

- Supportive Policies and Incentives: Financial support from public and environmental bodies boosts e-waste management systems. Technology adoption benefits from these programs. Initiatives include backing for new companies, recycling innovation, and technology-driven waste management solutions.

- ESG and Corporate Sustainability Goals: Environmental, social, and governance objectives are becoming central to business operations. Firms focus more on responsible and ethical practices. Handling electronic waste responsibly is a growing measure of business sustainability. It signals environmental and social responsibility. Collaboration between electronics producers and recycling companies is growing. It helps advance responsible waste handling.

Regulatory Landscape

International, national, and regional rules oversee e-waste handling. Their goals include environmental protection, resource recovery, and public health.

Key regulatory highlights include:

- Basel Convention: Cross-border hazardous waste transport is managed under this law. It advances responsible electronic waste practices.

- EU WEEE Directive: Electronic waste management rules enforce collection and processing in all member countries. Recycling and recovery are key components.

- India’s E-Waste Management Rules (2022): Producer obligations are expanded under the framework. Collection targets are set, and formal recycling infrastructure is encouraged.

- U.S. State Laws: National legislation on e-waste is absent in the U.S. Many states, including California and New York, have adopted recycling and device return programs.

Meeting regulatory standards requires thorough licensing and oversight. Aligning with these frameworks provides legal security and market trust.

Recent Developments

- AI and Robotics in Recycling: Advanced machine vision systems boost sorting accuracy. AI helps process complex waste streams more efficiently.

- Urban Mining Initiatives: Innovators are focusing on recovering valuable metals from discarded electronics. This supports sustainable mining practices.

- Global Take-back Programs: Companies such as Apple, Dell, and Samsung expand programs to reclaim old devices. This supports sustainability and brand accountability.

- Digital Platforms: Integrating blockchain and IoT enhances waste monitoring. This supports clear reporting and meets legal requirements.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The need for e-waste disposal outstrips available services. Developing economies experience this imbalance most acutely. This imbalance presents chances for startups to enter the market. Innovation in technology is also accelerated. Supply constraints stem from weak collection networks. Recycling facilities often cannot handle growing volumes.

b. Gap Analysis

Informal e-waste processing remains prevalent in regions like South Asia and Africa. This poses challenges and gaps in the market. Unsafe techniques are common among informal recyclers. This results in significant environmental and health risks. Effective solutions involve enforcing regulations and building skills. Integrating informal recyclers into formal sectors is key.

Top Companies in the E-waste Management Market

- Sims Limited

- Veolia Environnement S.A.

- Umicore

- Aurubis AG

- EnviroServe

- Stena Metall Group

- Tetronics Technologies Ltd

- Electronic Recyclers International (ERI)

- Ewaste+

- Enviro-Hub Holdings Ltd

E-waste Management Market: Report Snapshot

Segmentation | Details |

By Waste Type | Consumer Electronics, Household Appliances, IT & Telecom Equipment, Others |

By Material Recovery | Metal, Plastic, Glass, Others |

By Source | Residential, Commercial, Industrial |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- IT & Telecom Equipment: Accumulating obsolete networking and computing gear increases e-waste volumes. This drives strong demand for secure, efficient recycling solutions.

- Metal Recovery: Valuable metals found in wires and circuit boards support lucrative recycling markets. Their recovery fuels industry growth.

- Commercial Source Segment: Corporate sectors like data centers create considerable e-waste. They require disposal practices that meet regulatory standards.

Major Innovations

- AI-Powered Sorting Systems: Advanced AI systems quickly identify and separate recyclables. As a result, processing speed improves significantly.

- Chemical Recycling: Valuable metals are recovered through chemical processes. Solvents and catalysts play a key role in this method. They eliminate the need for thermal methods.

- Blockchain for Compliance: Using distributed ledger technology strengthens tracking of waste. This ensures transparent audits in recycling operations.

Potential Growth Opportunities

- Emerging Markets Expansion: E-waste management is developing rapidly in Africa and Southeast Asia. Policies prioritize structured collection and eco-friendly recycling.

- Tech-Driven EPR Platforms: Technology supports smoother Extended Producer Responsibility compliance. Digital platforms enhance transparency and control. These platforms support efficient management of obligations.

- Green Certifications and Carbon Credits: Sustainable waste services qualify for environmental credits. These perks make eco-friendly options more attractive.

Extrapolate says:

As electronics use increases, so does discarded waste. The global e-waste sector is set to expand sharply. Device adoption is expanding rapidly worldwide. Consequently, electronic waste volumes are increasing. Changing environmental rules demand better waste handling. Sustainable methods help businesses stay compliant. Environmental care and innovation shape the market. Corporate focus on these areas sustains growth.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

E-waste Management Market Size

- July-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021