Data Monetization Market Size, Share, Growth & Industry Analysis, By Component (Tools, Services), By Deployment Mode (On-Premise, Cloud), By Application (Sales and Marketing, Finance, Operations, Customer Experience, Others), By Industry Vertical (BFSI, Retail, IT & Telecom, Healthcare, Manufacturing, Media & Entertainment), and Regional Analysis, 2024-2031

Data Monetization Market: Global Share and Growth Trajectory

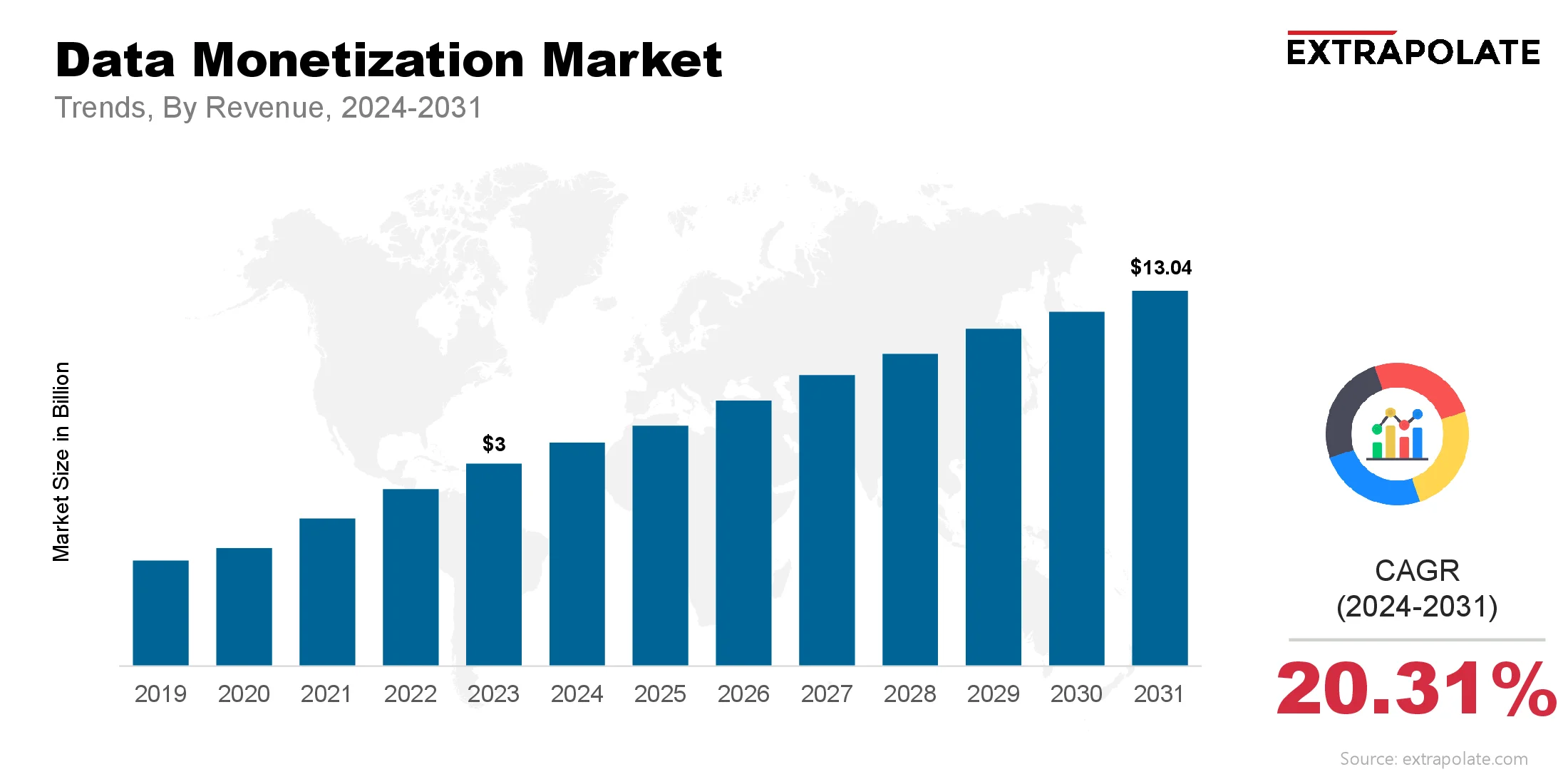

The global Data Monetization Market size was valued at USD 3 billion in 2023 and is projected to grow from USD 3.57 billion in 2024 to USD 13.04 billion by 2031, exhibiting a CAGR of 20.31% during the forecast period.

The data monetization market is growing like never before as organizations across industries are realizing the value of data as a strategic asset. As digital transformation deepens, businesses are moving from data collection to data capitalization, using data for internal optimization and external revenue generation. From telecom to banking, healthcare and retail, companies are tapping into this lucrative opportunity to turn data into business outcomes.

The rise of the digital economy, proliferation of IoT devices, increasing use of cloud platforms and rapid advancements in AI are fuelling the adoption of data monetization strategies. Organizations are using big data analytics, APIs, data marketplaces and subscription based models to convert raw data into actionable insights or sell to third parties.

Data monetization gets amplified when combined with AI, ML and blockchain. These technologies enhance data value by enabling real-time analytics, secure sharing and better contextualization. As awareness of data’s revenue potential grows, the global data monetization market is poised to undergo a massive transformation and exponential growth in the next few years.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Shift Toward Data-as-a-Service (DaaS)

One of the key trends shaping the data monetization landscape is the shift to Data-as-a-Service (DaaS) models. DaaS allows businesses to package and distribute data in a scalable on-demand manner through cloud based platforms. This model enables real-time data access and seamless integration with business intelligence tools. Companies are moving to DaaS to streamline operations, reduce infrastructure costs and improve data accessibility and usability.

Integration of AI and Predictive Analytics

Data monetization strategies are being enhanced by AI and predictive analytics. These technologies allow processing of large datasets in real-time to generate actionable insights. AI driven models are now used for targeted advertising, dynamic pricing, fraud detection and customer segmentation. Companies are using these models not just to get internal value but to offer data based services externally and generate new revenue streams.

Rise of Data Marketplaces

The emergence of data marketplaces – centralized platforms that facilitate buying and selling of data – is another key trend driving the data monetization market. These platforms offer standardized formats, enhanced data security and transparency. Organizations can now license datasets to external stakeholders or trade anonymized consumer insights. This trend is democratizing data access and enabling monetization across industries.

Increasing Regulatory Awareness and Compliance Tools

While regulatory compliance used to hinder data monetization, it’s now driving more structured and secure monetization. The implementation of GDPR, CCPA and similar laws globally has forced companies to build robust governance frameworks. And that’s led to the creation of tools for privacy aware data sharing and monetization. This focus on ethical data is driving more adoption.

Major Players and Their Competitive Positioning

The data monetization market features a diverse mix of established technology firms and innovative startups. Leading players are offering comprehensive platforms that combine data analytics, storage, and monetization capabilities.

Key companies in the competitive landscape included are IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, Salesforce, Inc., Google LLC, Amazon Web Services (AWS), Accenture PLC, Cisco Systems Inc., Infosys Limited and others. They are forming partnerships, launching cloud-native monetization platforms and acquiring niche data startups to expand their capabilities. For example, AWS and Microsoft have introduced data lakes and APIs to simplify external data sharing, while SAP is adding monetization to their ERP systems.

Consumer Behavior Analysis

- Increased Demand for Data-Driven Solutions: Enterprises and consumers are demanding more personalized, real-time solutions. Businesses are monetizing behavioral and transactional data to optimize customer experiences and offer more. From banks to streaming services, data monetization is part of the customer engagement strategy.

- Willingness to Exchange Data for Value: Modern consumers are willing to share personal data for tangible value - discounts, recommendations or customized experiences. This has enabled businesses to collect first-party data ethically and monetize it directly or indirectly.

- Privacy Concerns Impacting Adoption: Despite the willingness to share data, privacy concerns are a key factor in user behavior. Transparent data practices, opt-in policies and clear value exchanges are becoming critical for customer trust. Companies that use data ethically are seeing higher adoption of their data-driven services and solutions.

- Data Literacy and Internal Adoption: Organizations are investing heavily in data literacy training for all employees. This cultural shift is making internal data monetization happen - using data to inform strategy, operations and product development. As more employees are data-literate, enterprises are finding new use cases for data monetization.

Pricing Trends

Pricing for data monetization solutions varies widely depending on the delivery model, data complexity, volume and use case. Cloud-based platforms offering DaaS and analytics solutions follow subscription pricing models.

These range from pay-as-you-go for small datasets to enterprise licenses for large deployments.Transactional pricing is also common on data marketplaces where datasets are priced by quality, freshness, granularity and demand. For example, highly segmented customer behavior data is premium priced in finance and retail. Companies are also trying tiered pricing models based on the level of insight - from raw data to enriched, actionable intelligence.

Growth Factors

- Explosion of Data Generation: With the explosion of data from IoT devices, social media, mobile apps and enterprise systems, businesses have an abundance of untapped information. The sheer volume and variety of data is driving demand for tools and strategies to turn this raw asset into business value.

- Advances in Cloud and Edge Computing: Cloud and edge computing has made data collection, storage and processing faster and more cost effective. This enables real-time data analysis and delivery which is essential for dynamic data monetization models. Cloud infrastructure scalability allows companies of all sizes to participate in data monetization.

- Competitive Differentiation: In a crowded market, businesses are using data monetization as a differentiator. Offering unique insights or data based services can set companies apart from competition, increase customer loyalty and open up new revenue streams.

- Strategic Partnerships and Ecosystems: Ecosystem driven monetization is gaining traction. Companies are partnering with vendors, affiliates and even competitors to exchange or co-monetize data. For example, automotive manufacturers are partnering with insurers to share vehicle data in exchange for lower premiums, creating mutual value.

Regulatory Landscape

The data monetization market is governed by an increasing number of regulations to protect consumer privacy and ensure ethical use of information. These include:

- General Data Protection Regulation (GDPR) in Europe: Requires organizations to get explicit consent before collecting and using personal data and to be transparent on data usage.

- California Consumer Privacy Act (CCPA): Requires businesses to disclose what personal data is being collected and allows consumers to opt out of its sale.

- Personal Data Protection Bill (India) and similar frameworks in Brazil, Canada and Australia are influencing global practices.

To comply with these regulations companies are investing in privacy enhancing technologies (PETs), data anonymization techniques and governance platforms. Regulatory alignment is now seen as not just a legal requirement but a competitive advantage in the market.

Recent Developments

- Launch of Industry-Specific Data Exchanges: Major tech firms are launching industry specific data exchanges – for example healthcare and automotive marketplaces – making it easier to monetize sector specific data.

- M&A Activity and Venture Capital: Companies like Salesforce and Snowflake are acquiring startups specializing in data cataloging and monetization while VC firms are investing heavily in DaaS and API based data startups.

- Embedded Monetization Features in ERP and CRM Platforms: New enterprise platforms are now including data monetization modules so businesses can commercialize internal data without major IT overhauls.

- Blockchain for Secure Monetization: Blockchain is being used to enable secure, transparent and traceable data transactions particularly in healthcare and finance.

In May 2025, Datavault AI, in partnership with Kove IO, launched a secure, real-time tokenized data vending solution at IBM Think 2025 in Boston. The platform combines Datavault’s AI powered valuation tools (DataScore, DataValue, Data Vault Bank) with Kove’s SDM Memory Tower 39i so enterprises can transact data value without moving raw data ensuring encryption, privacy and compliance.

Current and Potential Growth Implications

Demand-Supply Analysis

Demand for monetizable data is through the roof but data quality, completeness and interoperability are supply side challenges. Organizations are now building robust data pipelines and cleaning tools to increase value of their datasets.

Gap Analysis

There is a huge gap in monetization maturity across industries. While tech, telco and banking are leading the way, education, manufacturing and public services are lagging behind due to data privacy and infrastructure concerns. Bridging this gap is a massive opportunity for tech vendors and consulting firms.

Top Companies in the Data Monetization Market

Prominent players shaping the global data monetization landscape include:

- IBM Corporation

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Salesforce, Inc.

- Amazon Web Services (AWS)

- Google LLC

- Cisco Systems Inc.

- Accenture PLC

- Infosys Limited

Data Monetization Market: Report Snapshot

Segmentation | Details |

By Component | Tools, Services |

By Deployment Mode | On-Premise, Cloud |

By Application | Sales and Marketing, Finance, Operations, Customer Experience, Others |

By Industry Vertical | BFSI, Retail, IT & Telecom, Healthcare, Manufacturing, Media & Entertainment |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Tools Segment: Data monetization tools including analytics engines, APIs and data catalogs are in high demand. These tools help extract actionable insights and package data for resale.

- Cloud Deployment: Cloud deployment is expected to witness rapid growth due to its scalability, cost-effectiveness, and remote accessibility.

- BFSI and Retail Sectors: Banks and retail companies are leveraging data monetization for customer insights, personalized marketing, and fraud prevention—driving demand in these sectors.

Major Innovations

- Self-Service Data Monetization Platforms: Businesses are now offering platforms where customers can analyze and buy data insights independently.

- AI-Driven Data Valuation Engines: These tools value datasets based on quality, usage and relevance.

- Tokenized Data Models: Blockchain based tokenization allows individuals to own and monetize their data directly – creating decentralized ecosystems.

Potential Growth Opportunities

- Expansion in Emerging Economies: As data infrastructure improves in regions like Southeast Asia, Africa and Latin America, there is a huge untapped opportunity for data monetization.

- Cross-Industry Data Partnerships: Collaborative monetization between sectors (e.g. automotive and insurance, retail and logistics) can create new high value data products.

- Ethical Monetization Models: Innovations in consent management, user compensation and anonymization are creating ethical user-centric monetization methods.

Extrapolate says:

The data monetization market compelling growth trajectory, as data is being recognized as a revenue generating asset. As businesses are looking to gain competitive advantage through insights, the shift from passive data storage to active monetization is changing the strategic priorities across industries. The convergence of AI, cloud and real-time analytics is opening up new opportunities for internal efficiency and external revenue. Despite regulatory hurdles and data quality challenges, organizations are moving fast by investing in governance frameworks, new tools and cross-industry partnerships. With demand from BFSI, retail and telecom and growth in emerging markets – data monetization is moving from an innovation led concept to a core of the digital economy. Extrapolate believes that companies that adopt scalable, ethical and customer centric data monetization will be the winners in this space.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Data Monetization Market Size

- July-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021