Application Security Market Size, Share, Growth & Industry Analysis, By Type (Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), Runtime Application Self-Protection (RASP), Software Composition Analysis (SCA)), By Deployment (Cloud-Based, On-Premises), By End-User Industry (BFSI, IT & Telecom, Healthcare, Government, Retail, Others), and Regional Analysis, 2024-2031

Application Security Market: Global Share and Growth Trajectory

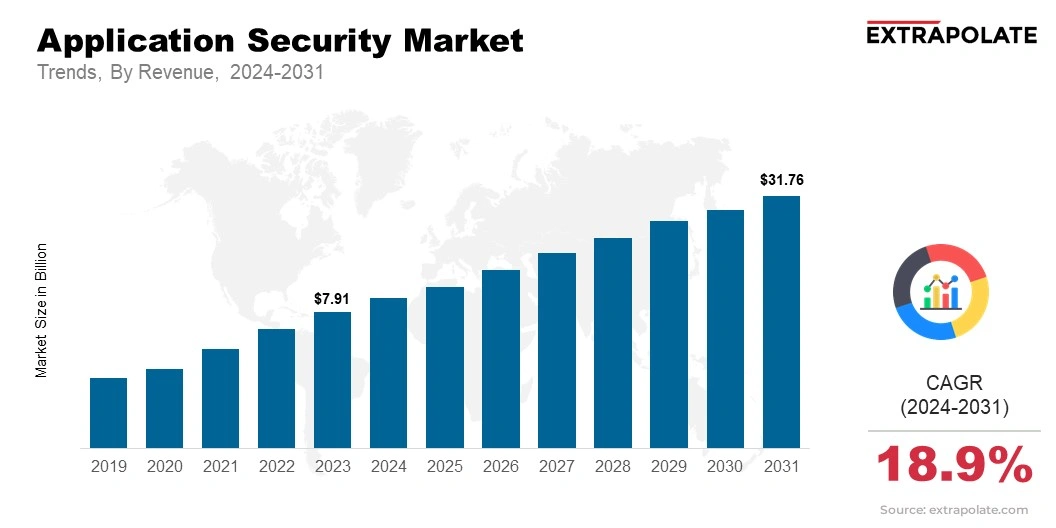

The global Application Security Market size was valued at USD 7.91 billion in 2023 and is projected to grow from USD 9.48 billion in 2024 to USD 31.76 billion by 2031, exhibiting a CAGR of 18.9% during the forecast period.

The global market is growing at a significant speed as organizations of every size are growing increasingly concerned with the protection of their applications from cyber-attacks due to potential vulnerabilities. The growth of sophisticated cyberattacks, standards for regulatory compliance, and the adoption of cloud-based applications are fueling the demand for application security solutions.

As organizations face increasing threats from cybercriminals, the need for strong application security measures, which include vulnerability scanning, encryption, and secure coding practices, is anticipated to keep growing, which in turn, put the market on a healthy growth trajectory.

Key Market Trends Driving Product Adoption

The application security market is defined by various key trends that highly contribute to the adoption of security solutions:

- Rising Cyber Threats and Attacks: With the rise in frequency and increasing complexity of cyberattacks, which include malware, ransomware, and data breaches, organizations are pursuing advanced application security solutions to protect their software applications and block unauthorized access to sensitive data.

- Shift to Cloud-Based Applications: The increase in the shift to cloud computing and the extensive use of Software-as-a-Service (SaaS) applications are propelling the demand for application security solutions to make sure that cloud-based applications are protected from possible vulnerabilities and risks.

- Regulatory and Compliance Pressures: The enactment of rigorous data protection regulations, like the GDPR and CCPA, is compelling businesses to implement application security measures to stay compliant and prevent substantial fines. This trend is driving the demand for solutions that assist organizations in fulfilling regulatory requirements.

- DevSecOps Adoption: The incorporation of security into the DevOps pipeline, referred to as DevSecOps, is gaining traction as organizations seek ways to make sure that security is integrated into applications from the start of the development process, rather than being added later.

Major Players and their Competitive Positioning

The application security market is intensely competitive, with various primary players taking the lead in offering creative and efficient solutions. Industry titans like IBM, Micro Focus, Veracode, and Checkmarx dominate the market. They wield strong security solutions and forge strategic collaborations.

Their focus on innovation fuels the constant improvement of product offerings. By making use of advanced technologies, these players aim to equip themselves to gain a considerable competitive leverage. AI, machine learning, and automated vulnerability detection helps these companies unlock new achievements in cybersecurity and ensure sustained growth.

Consumer Behavior Analysis

IT managers, security experts, and business leaders are placing a greater emphasis on security. They seek measures that protect every stage of the software development lifecycle.

Factors shaping consumer behavior include:

- Comprehensive Security Coverage: Businesses are looking for solutions that provide end-to-end security coverage, from the development phase to the deployment and maintenance, to identify exposures in applications before they are exploited.

- Ease of Integration: As organizations opt for diverse development tools and frameworks, they are progressively looking for application security solutions that can seamlessly merge with existing workflows and technologies without distorting the development process.

- Automated Security Testing: As applications become more complex, the need for automated security testing grows. These solutions quickly find risks and cut down on manual work. This helps speed up development cycles while keeping security intact.

- Cost-Effectiveness: Companies are also conscious about the cost involved in the implementation of application security solutions, looking for options that offer robust protection while being cost-effective and accommodate businesses of all sizes.

Pricing Trends

Application security solution prices differ greatly depending on the type of solution involved. SAST, DAST, and RASP solutions, for example, all have unique price points. Large corporations invest heavily in advanced, enterprise-grade solutions to safeguard their crucial digital assets. Smaller businesses, however, prioritize affordable security options that provide sufficient protection without excessive costs.

By adopting flexible, pay-as-you-go pricing structures, companies can now leverage high-end security tools while only paying for the features they actually need, making elite protection a viable option for businesses of all sizes.

Growth Factors

Factors that contributein the expansion of the application security market:

- Increasing Cybersecurity Threats: The increase in number of cyber threats, including advanced persistent threats (APTs) and application-layer attacks, is propelling the need for more robust application security solutions to protect sensitive data and intellectual property.

- Cloud and Mobile Application Adoption: The rise in dependence on cloud computing and mobile applications is expanding the attack surface for businesses, requiring stronger security measures for applications being used in these environments.

- Digital Transformation: As companies continue to embrace digital transformation, they are investing in application security solutions to protect their increasing digital assets and applications, ensuring the safety of important business operations and data of the customers.

- Regulatory Compliance: The rise in pressure from regulatory bodies is compelling organizations to implement security measures that guarantee compliance with data protection laws, thereby increasing demand for application security solutions.

Regulatory Landscape

The application security market is influenced by multiple rules and compliance standards, such as:

- General Data Protection Regulation (GDPR): This European Union regulation impose stringent data protection and privacy practices for businesses taking care of the personal information of EU citizens, influencing organizations to opt for security solutions that guarantee compliance.

- California Consumer Privacy Act (CCPA): The CCPA is a privacy regulation law in California requiring businesses to implement robust security measures to secure consumer data, thereby contributing to the growing demand for application security solutions in the region.

- Payment Card Industry Data Security Standard (PCI DSS): This standard defines security protocols for organizations that manage payment card information, influencing the widespread adoption of application security solutions within the financial services industry.

Recent Developments

Recent developments in the application security market:

- Fresh Releases: Multiple companies have launched new application security solutions, capitalizing on artificial intelligence and machine learning to amplify detection of vulnerability, automate threat response, and enhance overall security performance.

- Collaborations and Takeovers: Leading players are forming well planned alliances, collaborations, and acquisitions to strengthen their position in the market and diversify their line of products. For example, Veracode’s acquisition of a cloud-based security testing company helps in broadening its wide range of security solutions.

- Transition to DevSecOps: The growing adoption of DevSecOps practices is driving progress in application security tools. These tools are designed to integrate seamlessly with development and deployment processes. As a result, they provide continuous protection while maintaining speed.

Current and Potential Growth Implications

- Demand-Supply Analysis: The demand for application security solutions is projected to keep rising, especially in areas like finance, healthcare, and government, that handle confidential data and encounter increased security threats. The supply side is staying up-to-date with new advancements and scalability to meet the varying requirements of businesses from various industries.

- Gap Analysis: While many businesses are putting money into application security, a significant gap persists in the implementation of secure coding practices and advanced security testing tools, especially within smaller companies. Addressing this gap offers a chance of growth for vendors in the market.

Top Companies in the Application Security Market

- IBM Corporation

- Micro Focus International plc

- Veracode, Inc.

- Checkmarx

- Synopsys

- WhiteHat Security

- Rapid7

- Tenable

- Forcepoint

- Acunetix

Application Security Market: Report Snapshot

Segmentation | Details |

By Type | Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), Runtime Application Self-Protection (RASP), Software Composition Analysis (SCA) |

By Deployment | Cloud-Based, On-Premises |

By End-User Industry | BFSI, IT & Telecom, Healthcare, Government, Retail, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are anticipated to experience a substantial growth in the market:

- Cloud-Based Application Security: As more businesses are transitioning toward the cloud, the demand for cloud-native application security solutions is steadily increasing. This is especially evident for SaaS applications and multi-cloud environments.

- DevSecOps Integration: Unifying security into the DevOps pipeline is a key growth opportunity, as companies work for developing secure applications from the beginning and simplify security testing across the software development process.

Major Innovations

Innovations in the market:

- AI-Powered Threat Detection: AI and machine learning are playing a substantial role in the live detection of threats and weaknesses. This allows businesses to rapidly respond to increasing vulnerabilities.

- Automated Security Testing: Organizations aiming to accelerate development cycles without compromising security are increasingly favoring the latest solutions that automate security testing. These solutions reduce reliance on manual input, streamlining the testing process for greater efficiency.

Potential Growth Opportunities

Potential areas for expansion in the market involve:

- Expansion in Emerging Markets: The accelerating digital transformation in emerging markets offers considerable growth opportunities for application security vendors, as businesses in these regions look to safeguard their growing digital assets.

- Increasing Regulation: The growth in the worldwide focus on data protection laws and regulatory compliance creates numerous chances for companies offering solutions which help organizations meet security standards and avoid legal repercussions.

Extrapolate Research says:

The increasing demand for comprehensive cybersecurity solutions, the uptake of cloud-based apps, and compliance requirements are all driving the worldwide application security market's steady expansion. In the coming years, businesses that prioritize innovation, scalability, and smooth integration with contemporary development methodologies will be well-positioned to capitalize on the rising need for application security solutions.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Application Security Market Size

- February-2025

- 148

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021