Cosmetics OEM Market Size, Share, Growth & Industry Analysis, By Product Type (Skincare, Haircare, Makeup, Fragrance, Personal Hygiene) By Service Type (OEM, ODM (Original Design Manufacturing), Custom Formulation) By Packaging (Bottles, Tubes, Jars, Pumps & Dispensers, Sachets) By Distribution Channel (Online, Offline (Retail, Professional Stores, Brand Outlets)), and Regional Analysis, 2024-2031

Cosmetics OEM Market: Global Share and Growth Trajectory

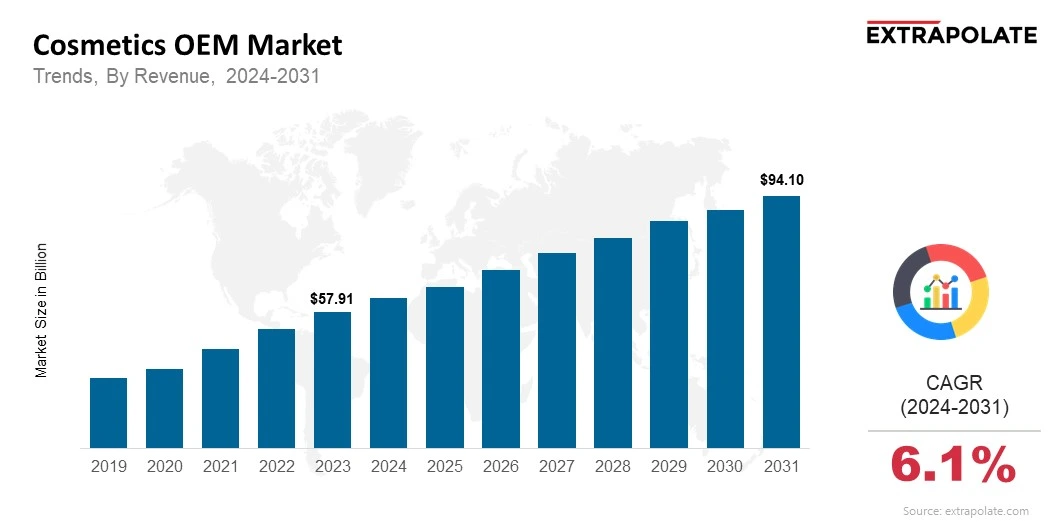

The global Cosmetics OEM Market size was valued at USD 57.91 Billion in 2023 and is projected to grow from USD 61.98 Billion in 2024 to USD 94.10 Billion by 2031, exhibiting a CAGR of 6.1% during the forecast period.

The global cosmetics OEM (Original Equipment Manufacturer) market is observing steady growth, fueled by the rise in demand for customized beauty products, the globalization of cosmetic brands, and the increasing focus on product innovation and cost-efficiency.

Cosmetics OEM refers to the outsourcing of product development and manufacturing to third-party specialists, allowing cosmetic brands to focus on marketing, distribution, and branding. This business model is becoming popular among startups, indie brands, and even established cosmetic giants aiming to streamline production and launch new products faster.

The OEM model in the cosmetics industry covers a wide range of products which include skincare, haircare, makeup, fragrances, and personal care solutions. Manufacturers are offering end-to-end services, from research and formulation development to packaging and regulatory compliance.

This support allows brands to tap into expert knowledge and access advanced technologies without the need to invest in in-house production facilities. As a result, the cosmetics OEM market is becoming a cornerstone for brand scalability and agility in an increasingly competitive environment.

One of the main drivers of growth of the market is the growing consumer preference for niche and personalized beauty products. OEM manufacturers are responding to this trend by developing customizable formulations, natural and organic options, and clean beauty solutions that align with evolving consumer values.

The surge in e-commerce and digital marketing has also enabled smaller brands to reach global audiences, further boosting demand for OEM services that can accommodate quick turnarounds and vast range of products.

Technological developments are reshaping the capabilities of OEM manufacturers. Automation, AI-driven formulation, and smart manufacturing processes are improving efficiency, quality control, and production scalability. Additionally, many OEMs are opting for sustainable practices, using eco-friendly ingredients and recyclable packaging, which adds value for brands looking to appeal to eco-conscious consumers.

Regionally, the Asia-Pacific market controls the global cosmetics OEM landscape, with countries such as South Korea, Japan, and China leading in innovation, manufacturing expertise, and export capabilities.

These countries have become preferred hubs for global brands that seek trustworthy and high-quality production partners. Meanwhile, North America and Europe are also observing a rise in OEM activity, driven by the growth of indie brands and the increasing demand for private-label cosmetics.

As consumer demand transitions toward ethical, clean, and personalized beauty solutions, the role of OEM manufacturers will be increasingly crucial. The global cosmetics OEM market is set for for substantial growth, underpinned by its ability to adapt to emerging trends, deliver high-quality products effectively, and support the rapid pace of brand innovation in the beauty industry.

The cosmetics OEM market is driven by innovation and customization. Evolving consumer expectations are shaping key trends in the market:

• Rise of Clean Beauty and Natural Formulations: Brands work with OEMs to make vegan and organic goods. This meets the high need for clean-label cosmetics.

• Growth of Indie and DTC Brands: OEMs help small brands launch with low MOQs (Minimum Order Quantity) and save on costs. They also offer full support, from making to packing the product.

• Product Customization and Private Label Expansion: Brands are using OEM partnerships to create custom formulas. They also design unique packaging and exclusive product lines.

• Technological Integration in Formulation: Advances in cosmetic science are boosting product performance. OEMs are now creating skincare and makeup with better efficacy.

• Globalization of Beauty Trends: Regional preferences influence OEM abilities. Global brands are tailoring products to suit local markets.

Major Players and their Competitive Positioning

The cosmetics OEM market is highly competitive with players such as COSMAX, Kolmar Korea, Intercos, Nihon Kolmar, and BioTruly dominating global manufacturing services. These companies are enhancing their influence through R&D investments, collaborations with major beauty brands, and geographic expansion. In addition to this, regional OEMs are gaining traction by offering flexible production models and niche product expertise.

Consumer Behavior Analysis

Brands are forming partnerships with OEM providers to support:

• Faster Product Launches: Accelerating time-to-market to capitalize on seasonal and trend-based demand.

• Brand Differentiation: Offering unique textures, active ingredients, and packaging to stand out in a saturated market.

• Operational Efficiency: Outsourcing to OEMs helps reduce capital expenditure and focus on branding and distribution.

• Sustainability Goals: Collaborating with manufacturers who follow eco-conscious production practices and sustainable sourcing.

Pricing Trends

OEM pricing is determined by the complexity of the formulation, packaging customization, order volume, and certifications (e.g., cruelty-free, organic). While premium product development commands higher prices, affordable options for emerging brands are extensively available. Demand for flexible manufacturing and shorter lead times is also impacting pricing models.

Growth Factors

Key elements driving the growth of the market:

• Rising Beauty Consciousness: Growing global awareness about skincare and grooming, especially among millennials and Gen Z.

• E-commerce and DTC Boom: The rise in number of online-first brands that depend on OEM support.

• Regulatory Simplification: Streamlined procedures for cosmetic certification in multiple regions, enhancing OEM export capabilities.

• Focus on R&D and Innovation: OEMs investing in research labs to offer clients cutting-edge formulations.

• Customization and Flexibility: Ability to tailor products to brand vision and target demographics.

Regulatory Landscape

The cosmetics OEM market operates under several international regulatory frameworks, which include the EU Cosmetics Regulation, FDA guidelines, and ISO certifications. OEM providers must comply with ingredient safety, labelling norms, and testing protocols to ensure regulatory approval in different geographies.

Recent Developments

The industry is seeing continuous innovation and strategic moves such as:

• AI in Product Development: Formulas are shaped by real data. They match what buyers want and need.

• Eco-Friendly Packaging: OEMs now use recyclable and biodegradable materials. This helps brands meet green goals.

• Multi-Functional Products: Demand for hybrid cosmetics, such as skincare-infused makeup.

• Global Expansion of OEM Facilities: Acquisitions and joint ventures are boosting production. They also help expand global reach.

Current and Potential Growth Implications

Demand-Supply Analysis

The demand for OEM services is rising as beauty brands seek agility and innovation. Supply is keeping pace, with manufacturers investing in automation and expanding capacity to support both mass-market and premium brands.

Gap Analysis

Despite strong growth, the market faces a few challenges:

• IP Protection Concerns: Ensuring confidentiality and exclusivity in formula development.

• Minimum Order Constraints: Smaller brands may struggle with MOQs and limited customization.

• Ingredient Compliance: Navigating regulatory restrictions for certain active ingredients across different markets.

• Packaging Lead Times: Custom packaging options may extend product launch timelines.

Top Companies in the Cosmetics OEM Market

• COSMAX Co., Ltd.

• Kolmar Korea Co., Ltd.

• Intercos Group

• Nihon Kolmar Co., Ltd.

• Chromavis Fareva

• Ancorotti Cosmetics

• Biotecnol S.A.

• Biotiful Co., Ltd.

• Know Cosmetics Inc.

• PT. Cedefindo

Cosmetics OEM Market: Report Snapshot

Segmentation | Details |

By Product Type | Skincare, Haircare, Makeup, Fragrance, Personal Hygiene |

By Service Type | OEM, ODM (Original Design Manufacturing), Custom Formulation |

By Packaging | Bottles, Tubes, Jars, Pumps & Dispensers, Sachets |

By Distribution Channel | Online, Offline (Retail, Professional Stores, Brand Outlets) |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Cosmetics OEM Market: High-Growth Segments

Key segments witnessing accelerated demand include:

• Skincare: High growth in anti-aging, hydrating, and clean formulations.

• Makeup: Custom shades and hybrid cosmetics gaining traction.

• Haircare: Growing demand for sulfate-free and scalp-care focused products.

Major Innovations

Innovation is central to OEM differentiation. Emerging advancements include:

• Waterless Cosmetics: Concentrated, eco-conscious formulations reducing environmental footprint.

• Smart Cosmetics: Skin-adaptive products using biomimetic technologies.

• Biotech Ingredients: Lab-grown actives with high purity and performance.

Cosmetics OEM Market: Potential Growth Opportunities

Market players can unlock new avenues by addressing:

• Formulation Innovation: Skin-safe formulas are a top focus. Products also last long and serve more than one use.

• Sustainability Integration: Materials are sourced in fair, ethical ways. Plastic use is reduced, and green methods are used in production.

• Inclusive Beauty Lines: The brand offers shades for all skin tones. It also makes products for different hair types and cultural needs.

• Digital Product Visualization: Brands can design the packaging with the company. They can preview the final look online before it goes to market.

• Regulatory Readiness: Supporting brands in navigating multi-country product registrations.

Extrapolate Research says:

The global cosmetics OEM market is experiencing high-speed development, fueled by changing consumer preferences, private labels, and the rise in need for agile manufacturing solutions. Companies are giving priority to advancements, compliance, and client collaborations are expected to sustain in this evolving beauty ecosystem.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Cosmetics OEM Market Size

- May-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021