Ophthalmic Ultrasound Imaging System Market Size, Share, Growth & Industry Analysis, By Product Type (A-Scan Ultrasound, B-Scan Ultrasound, Combined A/B-Scan, Pachymeter, Ultrasound Biomicroscope (UBM)), By Application (Cataract Evaluation, Glaucoma, Retinal Detachment, Tumor Diagnosis, Others), By End-User (Hospitals, Eye Clinics, Ambulatory Surgical Centers, Academic & Research Institutes), By Industry Vertical (BFSI, Healthcare, Retail, IT and Telecommunications, Manufacturing, Others), and Regional Analysis, 2024-2031

Ophthalmic Ultrasound Imaging System Market: Global Share and Growth Trajectory

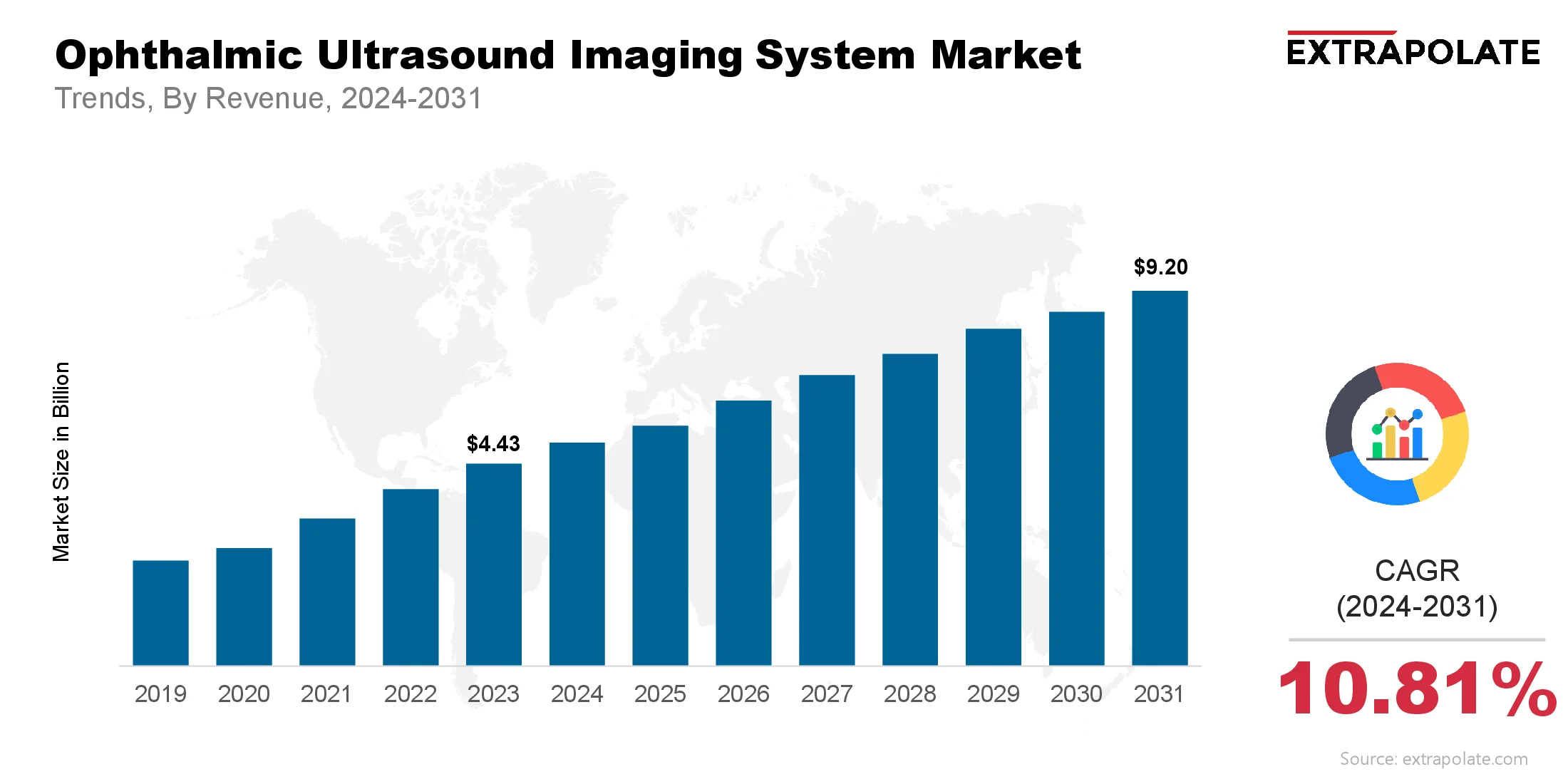

The global Ophthalmic Ultrasound Imaging System Market size was valued at USD 4.43 billion in 2023 and is projected to grow from USD 4.48 billion in 2024 to USD 9.20 billion by 2031, exhibiting a CAGR of 10.81% during the forecast period.

The ophthalmic ultrasound imaging system market is changing big time. As the demand for advanced diagnostic tools in ophthalmology increases, these systems are becoming essential in every clinical practice worldwide. Ophthalmic ultrasound imaging systems are used to image the back of the eye when direct visualization is blocked by ocular opacities. They are used to diagnose conditions like retinal detachment, vitreous hemorrhage and intraocular tumors.

The rise in prevalence of eye disorders, increasing geriatric population and technological advancements in ophthalmic diagnostic devices are driving the market. As practitioners look for non-invasive and accurate imaging techniques, ultrasound imaging systems offer clarity, efficiency and cost effectiveness. These systems are used in both preoperative and postoperative evaluations and have gained wide acceptance in ophthalmic clinics, hospitals and ambulatory surgical centers.

Advancements in imaging resolution, miniaturization of ultrasound probes and AI-assisted diagnostics are further enhancing the capabilities of these devices. The market will continue to grow as investments in healthcare infrastructure and portable and handheld imaging systems increase.

Key Market Trends Driving Product Adoption

Several key trends are shaping the ophthalmic ultrasound imaging system market:

- Rising Prevalence of Ophthalmic Diseases: More and more patients worldwide are suffering from eye diseases like cataracts, glaucoma, diabetic retinopathy and age related macular degeneration (AMD). These conditions often require precise diagnostic imaging to assess structural damage. Ophthalmic ultrasound systems, especially B-scan and A-scan devices are becoming essential tools for these diagnoses and are driving demand.

- Advancements in Ultrasound Technology: Continuous improvements in image resolution, real time imaging and user interface have significantly improved system efficiency. Hybrid ultrasound platforms which combine diagnostic and biometric capabilities are also expanding clinical use. Software algorithms now enable faster and more accurate measurements.

- Portable and Handheld Devices: Portability and ease of use is becoming more important especially in rural and resource limited settings. Manufacturers are making compact, battery operated ultrasound systems that have the functionality of traditional systems. This is increasing access to eye care in underserved populations and point of care diagnostics.

- AI and Tele-Ophthalmology: Artificial intelligence is changing image interpretation by helping ophthalmologists diagnose complex eye diseases better. Telemedicine platforms are using ophthalmic ultrasound systems for remote consultations and follow ups. This is more relevant in the post-COVID era where contactless diagnostic procedures are the norm.

Major Players and their Competitive Positioning

The ophthalmic ultrasound imaging system market is moderately competitive with several established players competing on innovation, pricing and geography: Include NIDEK Co., Ltd., Quantel Medical (Lumibird Group), Halma plc (Keeler Ltd.), Ellex Medical Lasers Ltd., Carl Zeiss Meditec AG, Optos plc (Nikon Corporation), Escalon Medical Corp., Sonomed Escalon, Tomey Corporation, and Appasamy Associates.

These companies invest in R&D to improve imaging, miniaturize equipment and user friendly software. Strategic partnerships, mergers and acquisitions are common as companies look to expand their market reach and technology expertise.

Consumer Behavior Analysis

Understanding the behavior of key end users ophthalmologists, optometrists and healthcare institutions gives insight into market dynamics:

- Focus on Diagnostic Accuracy: Doctors want high resolution imaging, fast data acquisition and reproducible results. A-scan and B-scan capable systems are gaining popularity as they are versatile.

- Minimally Invasive Solutions: Patients and providers want non-invasive, painless and minimal prep diagnostic methods. Ophthalmic ultrasound imaging fits the bill especially when OCT is not possible due to media opacities.

- More Training and Familiarity: More training and user friendly interfaces have increased adoption among medical staff. Educational institutions and professional associations are promoting the use of these systems during residency training making users more comfortable and proficient.

- Cost-Benefit Analysis: Although high end systems are capital intensive, healthcare providers recognize the value in improving diagnostic confidence, reducing repeat visits and surgical planning. More financing and leasing options are also influencing purchase decisions.

Pricing Trends

Pricing of ophthalmic ultrasound imaging systems varies widely depending on configuration, scanning capabilities, brand and software features. Systems with both A-scan (biometry) and B-scan (diagnostic imaging) are priced higher than single purpose devices.

- Entry-level Systems: $5,000 to $15,000. Used in small clinics or mobile settings.

- Mid-range Systems: $15,000 to $30,000. Better resolution and more integrated software.

- High-end Systems: Over $40,000. Comprehensive platforms used in hospitals and specialized eye centers.

Leasing models and bundled service contracts are becoming popular making the technology more accessible especially in emerging markets. Government subsidies and insurance reimbursements in some countries also help offset the cost.

Growth Factors

Several forces are contributing to the sustained expansion of the ophthalmic ultrasound imaging system market:

- Growing Prevalence of Eye Disorders: Eye conditions are increasing globally due to aging population, diabetes and lifestyle changes. Early and accurate diagnosis is key, hence continuous demand for imaging tools.

- Technological Advancements: AI powered analytics, wireless data transfer and 3D imaging is changing the game. Newer models have touchscreen interfaces and automated measurement tools making workflows simpler and reducing user dependency.

- Growing Healthcare Infrastructure in Emerging Economies: Countries in Asia-Pacific, Latin America and parts of Africa are investing heavily in diagnostic facilities. More eye care clinics and trained professionals means more demand for ophthalmic ultrasound systems.

- Rising Public Awareness and Eye Health Campaigns: Governments and NGOs are emphasizing the importance of regular eye checkups especially for older adults and diabetic patients. This awareness is translating into more use of diagnostic devices in routine care.

Regulatory Landscape

Ophthalmic ultrasound imaging systems are Class II or III medical devices depending on the features and intended use. Regulatory requirements vary by region:

- United States (FDA): Most ophthalmic ultrasound systems require 510(k) pre-market clearance to ensure safety and efficacy through performance data and clinical validation.

- European Union (CE Marking): Devices must comply with Medical Devices Regulation (MDR) and demonstrate conformity through technical documentation and post-market surveillance.

- International Standards (ISO 13485, IEC 60601): These cover quality management systems, electrical safety and performance standards. Compliance means global market access and consistency in manufacturing.

Manufacturers must also be transparent through regular audits, post-market monitoring and reporting of adverse events. Regulatory compliance is key to market reputation and customer trust.

Recent Developments

Several recent developments are changing the ophthalmic ultrasound imaging system market:

- Portable Ultrasound Platforms: New launches include handheld B-scan devices with wireless connectivity. Great for outreach programs and emergency care.

- AI-Driven Imaging Tools: AI is being added to help interpret, highlight anomalies and suggest diagnoses. Shortens diagnostic time and improves accuracy in busy clinics.

- Strategic Acquisitions: Big players are buying smaller tech companies to integrate innovative solutions and expand globally. Lumibird Group’s acquisition of Ellex has strengthened its diagnostic portfolio.

- Hybrid Imaging Systems: Some systems now combine optical and ultrasound imaging. Clinicians can have two imaging modalities in one platform.

These are exciting times for the industry to meet new clinical needs and technology.

Current and Potential Growth Implications

- Demand-Supply Analysis: With the global rise in ophthalmic cases, demand for ultrasound systems is outpacing supply in some regions. Manufacturers are increasing production and expanding distribution to meet demand.

- Gap Analysis: The biggest gap is accessibility, especially in low income and rural areas. High cost, lack of training and limited service infrastructure are the barriers. Addressing these gaps through cost effective models and telemedicine will be key to growth.

Top Companies in the Ophthalmic Ultrasound Imaging System Market

The leading companies in this market include:

- NIDEK Co., Ltd.

- Quantel Medical (Lumibird Group)

- Carl Zeiss Meditec AG

- Halma plc (Keeler Ltd.)

- Ellex Medical Lasers Ltd.

- Escalon Medical Corp.

- Sonomed Escalon

- Optos plc (Nikon Corporation)

- Tomey Corporation

- Appasamy Associates

These firms differentiate through product innovation, customer support, and global service networks.

Ophthalmic Ultrasound Imaging System Market: Report Snapshot

Segmentation | Details |

By Product Type | A-Scan Ultrasound, B-Scan Ultrasound, Combined A/B-Scan, Pachymeter, Ultrasound Biomicroscope (UBM) |

By Application | Cataract Evaluation, Glaucoma, Retinal Detachment, Tumor Diagnosis, Others |

By End-User | Hospitals, Eye Clinics, Ambulatory Surgical Centers, Academic & Research Institutes |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- B-Scan Devices: Most used for vitreous and retinal disorders, B-scan units lead the diagnostic segment.

- Ultrasound Biomicroscopy (UBM): High-frequency imaging is gaining traction in anterior segment imaging, especially for angle-closure glaucoma diagnosis.

- Eye Clinics and Ambulatory Centers: End-users are adopting portable and mid-range systems for daily ophthalmic exams.

Major Innovations

- Wireless Connectivity: Many systems now transmit images in real-time to EMR platforms.

- AI-Powered Diagnostic Assistance: Built-in AI flags abnormal findings and helps clinical decision-making.

- Ergonomic Designs: New models focus on user comfort with touchscreen displays and auto-focus.

Potential Growth Opportunities

- Emerging Markets: Government initiatives in India, China and Brazil to build eye care facilities are huge opportunities.

- AI with Tele-Ophthalmology: Leveraging AI and remote consultation platforms will increase access to expert diagnosis.

- Collaborations with Public Health Programs: Partnerships with non-profits and public health campaigns will drive broader adoption

Extrapolate Research says:

The ophthalmic ultrasound imaging system market is set to grow. With increasing prevalence of eye disorders, ongoing innovation and global push for better diagnostic infrastructure, this market is massive. As portable devices and AI-integrated platforms become the norm, ophthalmic care will get more accessible and accurate. Those who invest in affordability, training and global reach will lead the next wave of growth in this space.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Ophthalmic Ultrasound Imaging System Market Size

- July-2025

- ���1���4���0

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021