Non-Hodgkin Lymphoma Therapeutics Market Size, Share, Growth & Industry Analysis, By Therapy Type (Chemotherapy, Immunotherapy, Targeted Therapy, Radiation Therapy, Others), By Indication (Diffuse Large B-Cell Lymphoma (DLBCL), Follicular Lymphoma, Mantle Cell Lymphoma, Peripheral T-cell Lymphoma, Others), By Route of Administration (Oral, Injectable), By End-User (Hospitals, Specialty Clinics, Cancer Research Centers), and Regional Analysis, 2024-2031

Non-Hodgkin Lymphoma Therapeutics Market: Global Share and Growth Trajectory

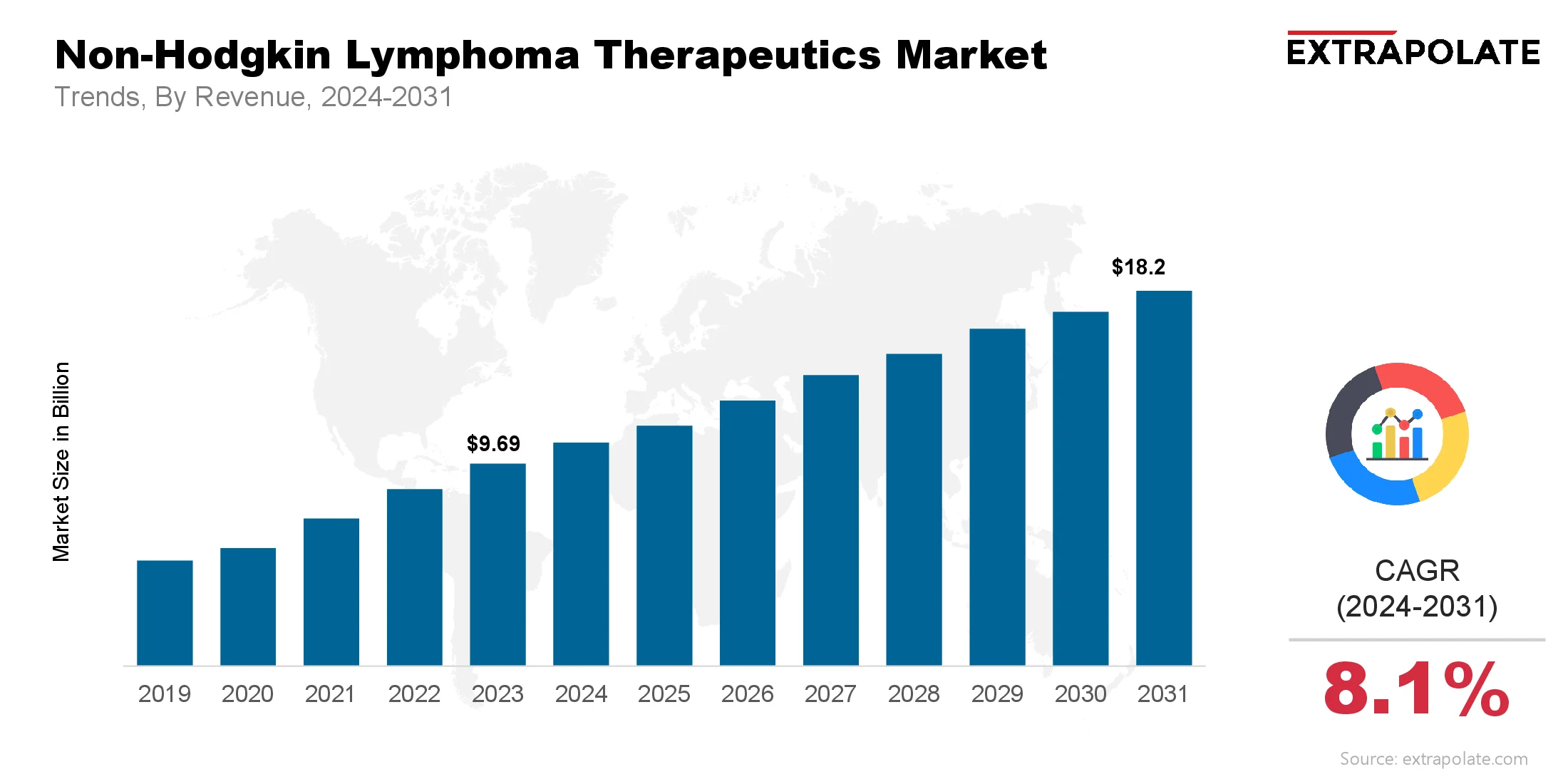

The global Non-Hodgkin Lymphoma Therapeutics Market size was valued at USD 9.69 billion in 2023 and is projected to grow from USD 10.50 billion in 2024 to USD 18.2 billion by 2031, exhibiting a CAGR of 8.1% during the forecast period.

The market is booming, driven by increasing incidence rates, changing treatment paradigms and R&D investment. NHL is a group of blood cancers that includes any lymphoma except Hodgkin’s lymphoma, that affects the lymphatic system and is on the rise globally. As diagnosis improves and new treatments emerge the NHL market is growing fast.

May factors are influencing the market. They are the growing burden of cancer, aging population and early cancer diagnosis awareness. Additionally, breakthroughs like targeted therapies, monoclonal antibodies and immunotherapy are becoming standard of care. These improve patient survival and quality of life and are driving the market growth exponentially.

NHL treatment has evolved from traditional chemotherapies to personalized treatment approaches. Combination therapies, new drug classes and cell and gene therapy are being adopted. With promising clinical trials ongoing the Non-Hodgkin Lymphoma market is set to grow for years to come.

Key Market Trends Driving Product Adoption

Targeted Therapy and Immunotherapy on the Rise:

One of the biggest trends in NHL treatment is the shift toward targeted therapy and immunotherapy. Treatments like rituximab (a monoclonal antibody) and CAR-T cell therapy are making a big impact. These focus on killing cancer cells while sparing healthy ones. That leads to better results and fewer side effects.

Increasing NHL Incidence and Early Detection:

NHL cases are rising worldwide. This is mainly due to aging populations and improved screening methods. In fact, the American Cancer Society says that 80,620 people in the US will be diagnosed with NHL in 2024. Since more cases are being caught early, the need for effective treatments is also growing.

Advances in Diagnostic Tools:

New imaging and molecular diagnostic tools are helping doctors catch NHL earlier. They also make it easier to identify the exact subtype of lymphoma. This helps doctors choose treatments that are more specific to each patient. That way, newer therapies can be used more effectively.

Personalized Medicine and Genomic Research:

Genomic research is pushing personalized medicine forward in NHL care. By studying the genes of a patient’s tumor, doctors can choose therapies that match the cancer’s molecular traits. This leads to better outcomes and fewer side effect

Major Players and Their Competitive Positioning

The NHL therapeutics market is fiercely competitive, characterized by major pharmaceutical and biotechnology players engaged in strategic partnerships, acquisitions, and new product launches. Key companies dominating the market include are Roche Holding AG, Novartis AG, Bristol-Myers Squibb Company, Gilead Sciences, Inc., Merck & Co., Inc., Pfizer Inc., AbbVie Inc., Johnson & Johnson (Janssen Pharmaceuticals), Amgen Inc., Seagen Inc.and others

These companies are investing heavily in clinical trials, pipeline development, and global market expansion. Roche’s Rituxan/MabThera, for instance, continues to be a cornerstone of NHL treatment, while Novartis’s Kymriah (CAR-T therapy) is gaining ground in relapsed/refractory settings.

Consumer Behavior Analysis

- Less Toxic and More Effective: Patients and doctors are choosing therapies that are more effective with less toxicity. Monoclonal antibodies and CAR-T cell therapies are preferred over chemo which has nasty side effects.

- Quality of Life: As survival improves patients want treatments that not only extend life but also quality of life. This is driving the shift to targeted treatments that are less invasive and have fewer side effects.

- Informed Patient: With all the medical info online and through advocacy groups patients are more informed about treatment options. This is driving demand for advanced therapies and clinical trials.

- Insurance and Reimbursement: Reimbursement has a big impact on treatment choices. Expensive but effective therapies like CAR-T may be slower to adopt in some markets due to cost but value based pricing and insurance coverage is helping to mitigate that.

Pricing

The pricing in the NHL therapeutics market reflects the innovation and complexity of the treatments. Monoclonal antibodies and immunotherapies are expensive, often over $10,000 per dose. CAR-T therapies can be over $400,000 per treatment. Despite the high upfront cost these therapies are justified by their efficacy and potential for long term remission.

Pharma companies are adopting differential pricing, tiered pricing for low and middle income countries. Value based pricing, where payers reimburse based on patient outcomes, is gaining traction especially in US and Europe.

Growth Factors

Several factors are driving the growth of the Non-Hodgkin Lymphoma therapeutics market:

- Immuno-Oncology Advancements: Immuno-oncology is driving innovation, new treatments are showing high success rates in relapsed or refractory patients. This includes checkpoint inhibitors and bispecific T-cell engagers. For example, in June 2025 FDA approved tafasitamab-cxix (Monjuvi), in combination with lenalidomide and rituximab, for adults with relapsed or refractory follicular lymphoma. It was approved based on the Phase 3 inMIND trial which showed better PFS than control

- Government Support and Funding: National cancer programs and public health initiatives are fueling the market. Governments across Europe and North America are investing in R&D, offering tax credits and grants to companies developing cancer therapeutics.

- Rising Geriatric Population: Aging is a major risk factor for NHL. The growing elderly population worldwide is directly correlated to higher incidence and thus more demand for treatment solutions.

- Expanding Pipeline and Approvals: FDA and EMA have approved several new treatments in the last few years and many promising candidates are in late stage clinical trials. This gives clinicians more tools and better patient outcomes.

Regulatory Landscape

The NHL therapeutics market is heavily regulated to ensure safety and efficacy. Key points:

- FDA Approval: Preclinical and clinical trials. Priority review and breakthrough therapy designation gets you to market faster for promising treatments.

- EMA and CE Certifications: In Europe the EMA approves drugs. CE mark for diagnostic tools.

- Post-Marketing Surveillance: Pharmacovigilance programs are crucial for long term safety especially for newly approved immunotherapies and gene therapies.

These regulations are now supporting fast track approvals and orphan drug designations for rare NHL subtypes.

Recent Developments

- CAR-T Therapy Expansion: Kymriah and Yescarta are getting approvals in more NHL subtypes. Their success is driving adoption. In January 2025, Immuneel Therapeutics launched Qartemi, a CD19-directed CAR-T cell therapy for relapsed or refractory B-cell Non-Hodgkin Lymphoma in India. It has an overall response rate of ~83.3% in Phase II trials and is much cheaper than global therapies.

- Bispecific Antibodies: Blincyto and others in development are recommended for patients who haven’t responded to standard treatment.

- Combination Therapies: Checkpoint inhibitors with chemo or targeted therapy are showing better response rates.

- Digital Health and Tele-oncology: COVID-19 has accelerated telehealth, remote patient monitoring and digital therapeutics are being added to NHL care.

Current and Potential Growth Implications

Demand-Supply Analysis: Growing patient population and rapid adoption of new treatments is driving demand. But manufacturing complexities especially in gene and cell therapies is straining supply chain.

Gap Analysis: While progress is being made, access is not equal. In low income and rural areas advanced diagnostics and high cost treatments are not available. This gap needs to be addressed for equitable healthcare.

Top Companies in the Non-Hodgkin Lymphoma Therapeutics Market

- Roche Holding AG

- Novartis AG

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- AbbVie Inc.

- Johnson & Johnson (Janssen Pharmaceuticals)

- Amgen Inc.

- Seagen Inc.

Non-Hodgkin Lymphoma Therapeutics Market: Report Snapshot

Segmentation | Details |

By Therapy Type | Chemotherapy, Immunotherapy, Targeted Therapy, Radiation Therapy, Others |

By Indication | Diffuse Large B-Cell Lymphoma (DLBCL), Follicular Lymphoma, Mantle Cell Lymphoma, Peripheral T-cell Lymphoma, Others |

By Route of Administration | Oral, Injectable |

By End-User | Hospitals, Specialty Clinics, Cancer Research Centers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Immunotherapy: Immunotherapies like CAR-T and monoclonal antibodies are hot because of their specificity and low side effects.

- Diffuse Large B-Cell Lymphoma (DLBCL): DLBCL is the most common NHL and gets the most research and treatment dollars so it’s a high growth segment.

- Injectable Route of Administration: Because of advanced therapies like CAR-T and monoclonal antibodies, injectables are the dominant share and growing.

Key Innovations

- Chimeric Antigen Receptor T-cell (CAR-T) Therapy:

CAR-T therapy uses a patient’s own T-cells and reprograms them to fight cancer. It has shown high remission rates in many cases. - Bispecific Antibodies:

These are newer treatments that connect cancer cells and T-cells. They help the immune system recognize and attack tumors. - Next-Generation Sequencing (NGS):

NGS helps doctors study the genetic makeup of lymphoma. It makes it easier to choose the best treatment for each patient.

Growth Opportunities

- Emerging Markets: With increased cancer rates, better infrastructure, and higher government spending on healthcare, Asia-Pacific and Latin America offer unrealized opportunity.

- Companion Diagnostics: The need for diagnostics that match patients with the appropriate treatment is being driven by personalized medicine.

- Joint R&D and Licensing Agreements: Pharma behemoths and biotech firms are accelerating market access and pipelines.

Extrapolate says:

The Non-Hodgkin Lymphoma Therapeutics Market is set to grow big and fast driven by new ideas and global cancer burden. Personalized medicine and immunotherapy are gaining traction and clinical pipelines are strong and regulatory support is in place. As awareness and early diagnosis improves, treatment outcomes will get better and NHL therapeutics will be the hot area of oncology research and investment in the next decade.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Non-Hodgkin Lymphoma Therapeutics Market Size

- July-2025

- ���1���4���0

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021