Medical Documents Management Systems Market Size, Share, Growth & Industry Analysis, By Product Type (Solutions, Services), By Application (Patient Medical Records Management, Admission and Registration Documents Management, Patient Billing Documents Management, Others), By End-User (Hospitals and Clinics, Nursing Homes/Assisted Living Facilities, Insurance Providers, Other Healthcare Institutions), By Deployment Mode (Cloud-based, On-premise, Web-based), and Regional Analysis, 2025-2032

Market Definition

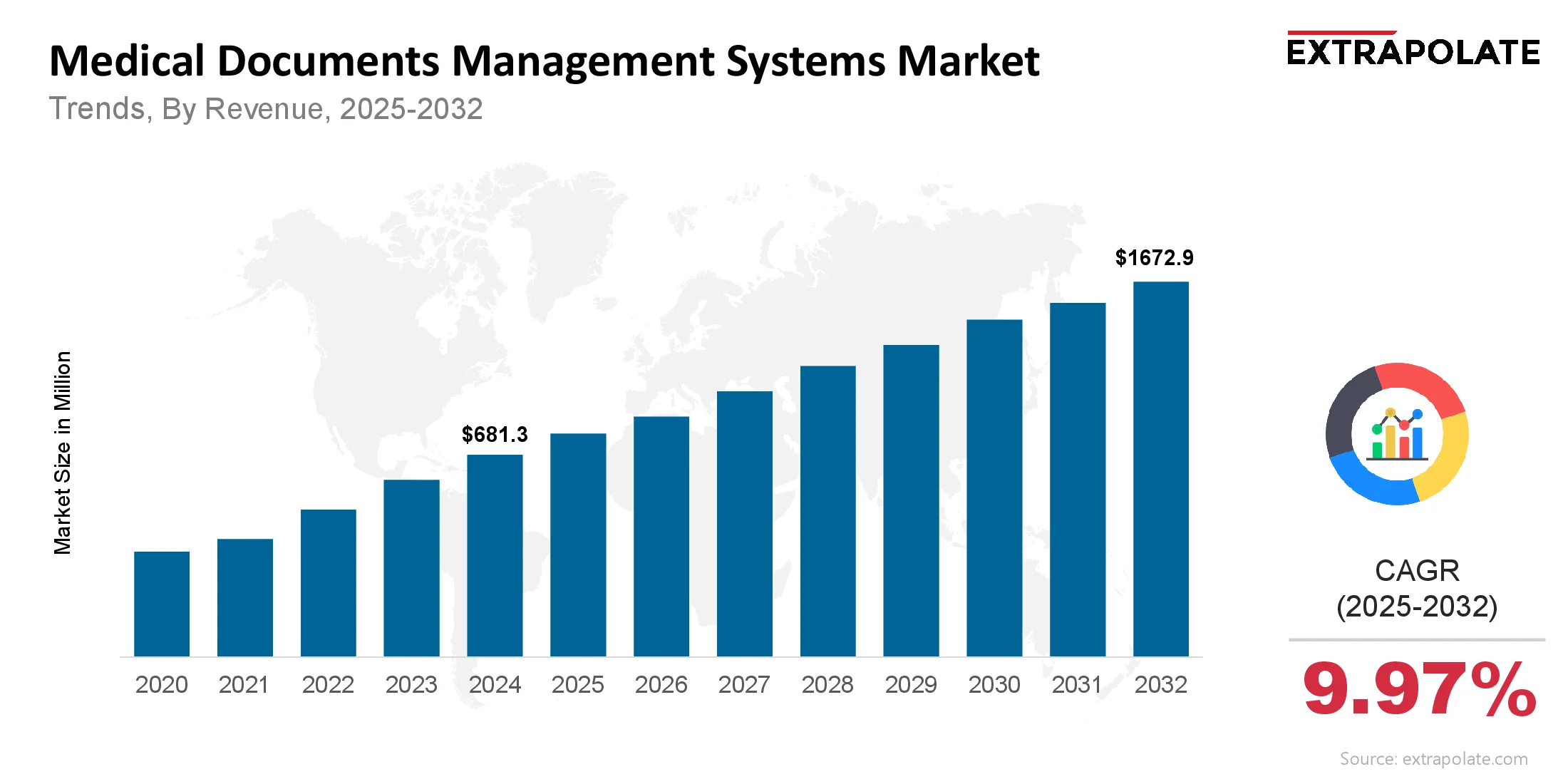

The global Medical Documents Management Systems Market size was valued at USD 660 million in 2023 and is projected to grow from USD 681.3 million in 2024 to USD 1672.9 million by 2032, exhibiting a CAGR of 9.97% during the forecast period.

The creation, implementation, and marketing of software programs and services intended to digitize, organize, and safeguard medical records are all included in the worldwide market for medical documents management systems. Healthcare firms must use these systems to move away from ineffective paper-based procedures and handle patient medical data, billing paperwork, and other administrative files electronically.

The market is characterized by its crucial role in boosting operational efficiency, guaranteeing regulatory compliance, and enhancing data security within the healthcare ecosystem. It is made up of a variety of components, such as solutions for document capture, indexing, storage, and retrieval, as well as related services like implementation and support. The market is changing to provide more integrated, scalable, and intelligent solutions that are essential for contemporary patient care and administrative excellence as healthcare providers around the world continue to implement Electronic Health Records (EHRs) and other digital workflows.

Key Insights

Key Insights

- The global medical documents management systems market was valued at $681.3 million in 2024.

- Medical documents management systems market is projected to reach $1,672.9 million by 2032

- A CAGR of around 9.97% is expected from 2025 to 2032

- North America will have the largest market size by 2032 due to strong regulations and healthcare IT investments.

- Solutions is the largest market segment by product type due to demand for core functionalities like document capture, indexing and sharing.

- Patient medical records management is the largest segment by application as there is a huge demand for organized clinical data.

- The need for operational efficiency and digital transformation of healthcare is a major driver as organizations move from paper to electronic records to improve accuracy and compliance.

- Integration of AI, ML and blockchain is a trend in the industry as it’s being used to automate document handling, improve search and enhance data security.

Market Summary Financials

The Medical Document Management Systems Market has been growing steadily as the world is pushing for healthcare digitalization. The market was $660 million in 2023 and grew to $681.3 million in 2024. Looking ahead, the market is expected to grow big time with projections of $1672.9 million by 2032 which is a CAGR of 9.97% from 2025 to 2032. This is a big deal for the market and its role in modernizing healthcare infrastructure.

Detailed Analysis Content

Key Market Trends

The market for medical documents management systems is being shaped by several transformative trends:

- Integration with Electronic Health Records (EHRs): There is a growing trend towards seamless integration of medical document management systems with existing EHR platforms. This allows for a more centralized and comprehensive view of patient information, facilitating better care coordination.

- Shift to Cloud-Based Platforms: Healthcare organizations are increasingly adopting cloud-based solutions for their flexibility, scalability, and cost-effectiveness. Cloud systems offer secure storage and remote access, which is crucial for modern, distributed healthcare workflows.

- Adoption of AI and Automation: Artificial Intelligence (AI) and Machine Learning (ML) are being integrated to automate tasks like data extraction, document indexing, and workflow routing. This reduces manual errors and administrative burdens, allowing staff to focus more on patient care.

- Heightened Focus on Data Security: With the increasing digitalization of patient data, there is a strong emphasis on robust security features. Modern systems are incorporating end-to-end encryption, multi-factor authentication, and automated audit trails to ensure compliance with strict data protection regulations.

Major Players

The market is characterized by a mix of large, established technology companies and specialized healthcare IT firms. The competition is driven by innovation in areas like AI integration, cloud-based offerings, and enhanced security. A list of key companies includes:

- 3M Company

- Allscripts Healthcare Solutions Inc.

- athenahealth Inc.

- Cerner Corporation (Oracle Health)

- Epic Systems Corporation

- Hyland Software Inc.

- Kofax Inc.

- McKesson Corporation

- Nextgen Healthcare Inc. (NXGN Management, LLC)

- Siemens Healthineers AG

- Laserfiche

- IBM Corporation

- OpenText Corporation

- Tungsten Automation Corporation

Consumer Behavior Insights

The purchasing decisions of healthcare providers are influenced by several critical factors:

- Need for Efficiency: The primary driver is the desire to reduce administrative costs and improve operational efficiency by moving away from paper-based systems.

- Regulatory Compliance: Adherence to data privacy laws, such as HIPAA, is a major concern, compelling providers to invest in systems with strong security features and audit trails.

- Interoperability: Organizations are looking for solutions that can easily integrate with their existing EHR, billing, and other digital health platforms.

- Remote Accessibility: The rise of telehealth and remote work has increased the demand for systems that allow secure, real-time access to patient records from anywhere.

- Scalability: Providers, especially smaller clinics, prefer systems that are scalable and can be easily adjusted to handle growing data volumes without a large initial investment.

Pricing Trends

The degree of customization needed, the size of the healthcare organization, and the deployment mode all have a significant impact on the pricing model for medical document management systems. Smaller practices or those with tighter IT budgets may find cloud-based solutions more appealing because they often provide a more flexible subscription-based pricing structure. Despite providing more control, on-premise solutions may have higher upfront infrastructure and licensing expenses. Pricing is also impacted by the incorporation of cutting-edge features like automation and artificial intelligence, with more complex systems fetching higher prices.

Growth Factors

The market is propelled by a confluence of factors, including:

- Digital Transformation of Healthcare: The global shift from traditional paper-based systems to digital workflows is a foundational driver.

- Government Initiatives and EHR Mandates: Government programs and incentives, like the HITECH Act in the U.S., encourage the adoption of EHRs and other digital health tools, accelerating the demand for document management systems.

- Growing Volume of Patient Data: The increasing prevalence of chronic diseases and the rising number of hospital visits are generating vast amounts of patient data, necessitating robust and efficient management systems.

- Telehealth Expansion: The rapid growth of telehealth has created a strong need for integrated and accessible electronic document management to ensure seamless care delivery.

- Need for Cost Optimization: Healthcare providers are under pressure to reduce administrative costs and improve efficiency, which document management systems can help achieve through automation and streamlined processes.

Regulatory Landscape

The regulatory environment is a big driver. Data privacy and security regulations like HIPAA in the US and GDPR in Europe require sensitive patient information to be handled securely. This has created a big demand for solutions that have robust security, audit trails and compliance monitoring. A gap analysis which compares an organisation’s current documentation and processes against regulatory requirements is a first step for many providers to ensure they meet these standards.

Recent Developments

The market is seeing continuous innovation and partnerships. Recent news includes:

- AI Integration: Companies are embedding AI and machine learning to automate tasks, improve search functionality and user experience. For example Oracle Health has added generative AI and conversational voice to Cerner HER.

- Partnerships: Partnerships between healthcare IT companies and providers are common. For example Athenahealth Inc partnered with Cardiovascular Associates of America to improve clinical and financial outcomes for independent cardiology practices.

- Product Releases: New products are being released to meet industry needs. The “Dox and Box” system uses AI driven Optical Character Recognition (OCR) to convert paper records to digital formats, showing a focus on the conversion process.

Demand-Supply Analysis

The demand for medical document management systems is growing fast, driven by the need for better record-keeping. On the supply side, there are many providers, from big tech companies to specialized startups. The supply is responding to the demand for cloud, AI and security. The market is favorable, with a clear and accelerating demand for solutions that can streamline workflows and be compliant.

Gap Analysis

Although the market is mature, there are still gaps and areas for improvement. A key gap is lack of interoperability between systems which hinders information sharing across departments and organizations. Despite the push for digitalization, there is still resistance to change among some healthcare staff. The market needs solutions that are cost effective and highly secure, as many providers, especially smaller clinics, struggle with high implementation costs and complexity of integrating new systems. The supply side gap is in creating user friendly interfaces to overcome adoption resistance and comprehensive training and support services.

Segmentation and Growth Opportunities

Segmentation | Details |

By Product Type | Solutions, Services |

By Application | Patient Medical Records Management, Admission and Registration Documents Management, Patient Billing Documents Management, Others |

By End-User | Hospitals and Clinics, Nursing Homes/Assisted Living Facilities, Insurance Providers, Other Healthcare Institutions |

By Deployment Mode | Cloud-based, On-premise, Web-based |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growing Segments

- Cloud: Cloud is expected to be the fastest growing segment as more and more people prefer flexible, scalable and cost effective solutions that can be accessed remotely.

- Solutions: Solutions will continue to be the largest segment and will grow fast as people need core functionalities to automate and streamline workflows.

- Patient Billing Documents Management: This application segment will grow as healthcare providers and insurers use these systems to validate claims, reduce denial rates and improve financial compliance.

Major Innovations

Recent innovations are all about integrating new technologies to enhance the system. Key innovations are:

- AI Automation: AI for automated data extraction, intelligent search and workflow routing is the biggest innovation that is changing document handling.

- Blockchain: Blockchain is emerging as a way to create secure, immutable audit trails for medical documents, to ensure data integrity and security.

- Predictive Analytics: AI systems can now analyze large datasets to identify trends and predict patient needs, moving beyond document management to a more proactive approach to care.

Potential Growth Opportunities

- Bio-based and Recyclable Adhesives: This is not relevant to medical document management systems.

- Interoperability: Big opportunity to build solutions that work with all the legacy systems and digital health platforms, a big pain point for providers.

- Vertical Solutions: Focus on niche areas like clinical research or long term care facilities with tailored solutions can be a big opportunity.

- Emerging Markets: Rapidly modernizing healthcare infrastructure and government investments in digital health in APAC region is a major growth opportunity.

- Cybersecurity: As cyber threats increase, there is a growing market for solutions that offer advanced security features like threat detection and data loss prevention to help organizations meet compliance requirements.

Extrapolate Says

The Global Medical Documents Management Systems Market is growing fast and our research shows that while the foundation of operational efficiency and regulatory compliance is still the core driver, the future of the market is in specialized intelligent solutions.

With AI, machine learning, and cloud-based platforms requiring a new generation of systems that handle documents as well as workflow, security, and analytics, the industry is at a turning point. Long-term success will go to businesses who can innovate in this field and create extremely safe solutions that work with current health IT systems.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Medical Documents Management Systems Market Size

- September-2025

- 140

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021