Medical Display Market Size, Share, Growth & Industry Analysis, By Product Type (Diagnostic Displays, Surgical Displays, Clinical Review Displays, Dental Displays, Others) By Technology (LED-Backlit LCD, OLED, CCFL-Backlit LCD) By Application (Radiology, Mammography, Surgery, Pathology, Dentistry, Others) By End-User (Hospitals, Diagnostic Centers, Clinics, Ambulatory Surgical Centers), and Regional Analysis, 2024-2031

Medical Display Market: Global Share and Growth Trajectory

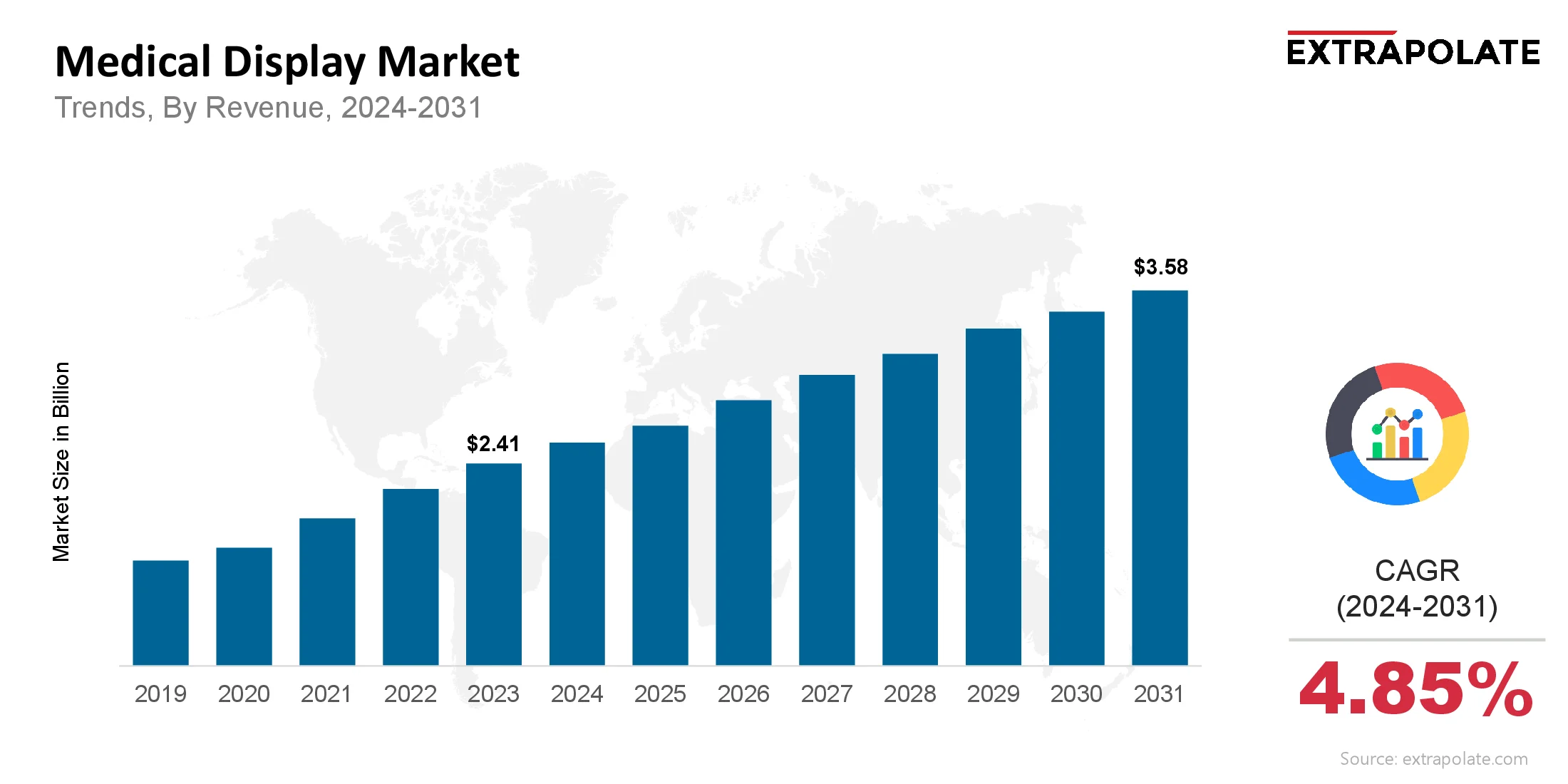

The global Medical Display Market size was valued at USD 2.41 billion in 2023 and is projected to grow from USD 2.57 billion in 2024 to USD 3.58 billion by 2031, exhibiting a CAGR of 4.85% during the forecast period.

The medical display market is growing fast, driven by the increasing digitization in healthcare and the rising demand for advanced diagnostic imaging. Medical displays are specialized monitors that show patient data, diagnostic images and surgical procedures with high clarity, resolution and accuracy. These displays are used in applications like radiology, mammography, endoscopy, surgery and multi-modality imaging where image quality and compliance to medical standards like DICOM is critical.

As hospitals modernize, the demand for precise, real-time and high-resolution imaging has gone up. Medical displays with their ability to maintain uniform luminance, show detailed grayscale imaging and facilitate accurate diagnostics have become essential. Integration of artificial intelligence (AI) and 3D imaging in diagnostics has further raised the bar, pushing the demand for technologically advanced display solutions.

Minimally invasive surgeries, increasing health awareness and rapid adoption of digital healthcare systems globally are driving the growth of the medical display market. Moreover, expansion of telemedicine, mobile imaging systems and hybrid operating rooms is providing additional growth opportunities. As the market advances, medical display technologies are becoming more compact, ergonomic and energy efficient while delivering exceptional performance under critical clinical conditions.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several trends are driving the adoption and growth of medical displays:

- More Accurate Diagnostics: The move to evidence-based diagnosis and personalized medicine has made accurate imaging more critical. Medical displays provide high resolution images with consistent luminance so radiologists and physicians can see tiny details and increase diagnostic confidence and patient outcomes.

- Digitalization of Healthcare: With electronic health records (EHRs), cloud-based imaging and AI, digitalization is transforming the healthcare landscape. Medical displays are getting smarter and more connected, enabling seamless connectivity, faster image access and improved workflow across departments.

- More Surgical and Interventional Procedures: Minimally invasive procedures are on the rise and require surgical displays that can provide clear real-time imaging with low latency. 4K and 8K medical displays are being adopted in hybrid ORs and cath labs for complex procedures like cardiac surgery and endoscopy.

- Telemedicine and Remote Diagnostics: The COVID-19 pandemic has accelerated telehealth adoption. Medical grade displays are playing a key role in remote consultations and teleradiology by ensuring image quality even over digital platforms. This trend will continue to grow.

Major Players and Their Competitive Positioning

The medical display market is a competitive space with global tech giants and specialized medical imaging companies. Leading players are innovating, partnering and expanding geographically to strengthen their presence. Prominent companies in this market include: Barco NV, Eizo Corporation, Siemens Healthineers, LG Display Co., Ltd., Sony Corporation, BenQ Medical Technology, FSN Medical Technologies, Jusha Medical, Novanta Inc., Advantech Co., Ltd.

These companies are launching advanced medical displays with higher resolution, better color fidelity and calibration. Partnerships with hospitals, regulatory approvals and R&D investments are key strategies to stay ahead.

In July 2024, LG Electronics launched the 21HQ613D‑B 5MP diagnostic monitor for breast imaging. This 21.3″ IPS display, cleared by the FDA, delivers 2,048 × 2,560 resolution with 1,100 cd/m² brightness and built‑in front calibration, enhancing accuracy and workflow efficiency in mammography and tomosynthesis.

Consumer Behavior Analysis

Consumer behavior in medical display market is driven by a mix of technology literacy, clinical needs and institutional priorities.

- Focus on Diagnostic Efficacy: Healthcare providers want displays that deliver better image quality and enable precise diagnosis. Institutions are moving towards displays that are DICOM compliant and have automated calibration tools for long term consistency.

- Preference for Integrated Systems: Hospitals and diagnostic centers are moving towards integrated systems that combine PACS, HIS (Hospital Information Systems) and medical displays into one solution. This reduces operational bottlenecks and enhances clinician productivity.

- Shift towards Preventive Care: As patient awareness increases, there is a growing preference for preventive diagnosis. This leads to more imaging studies and hence more demand for medical grade displays that can support large scale operations.

- Budget Constraints and ROI Focus: While high end displays are expensive, institutions are looking at long term ROI such as faster diagnosis, reduced errors and better clinical outcomes. Leasing models and bundled service agreements are also making these technologies more accessible.

Pricing Trends

- Pricing in medical display market varies by resolution (HD, 4K, 8K), size, panel technology (LCD, OLED) and medical imaging standards. Entry level clinical review displays are priced lower, high end diagnostic and surgical displays, especially those that support 3D visualization and AI integration are priced higher.

- Market is seeing downward pressure on prices due to competition but innovation and value added features are still justifying higher price points. Many manufacturers are now offering calibration software, remote monitoring and long term warranty making total cost of ownership more favorable.

- Also, trend of multi display configurations in radiology and surgery is increasing per institution spend while regional disparities in healthcare infrastructure is influencing pricing in developing market.

Growth Factors

Several factors are driving the growth of medical display market:

- Technology: 4K/8K ultra high definition, OLED panels, multi modality imaging and AI integration have significantly improved display performance and user experience.

- Rising Imaging Procedures: Surge in chronic diseases like cancer, cardiovascular disorders and neurological conditions is leading to increase in diagnostic imaging procedures like MRI, CT scans and mammography hence more demand for high resolution displays.

- Aging Population: As the global population ages, age related diseases are on the rise. This is driving demand for diagnostic imaging and hence medical displays for geriatric care and preventive diagnosis.

- Hospital Digitization: Hospitals and diagnostic centers are upgrading by replacing old display technology with medical grade solutions especially in radiology and surgery. Digitization is most prominent in North America and parts of Asia-Pacific.

Regulatory Landscape

Medical displays, like all medical devices, are subject to strict regulations to ensure safety, reliability and performance in clinical environments. Regulatory oversight includes:

- FDA Approval (U.S.): Medical displays used for diagnostic purposes must be 510(k) or PMA approved by the U.S. Food and Drug Administration to meet required standards.

- CE Marking (Europe): Products sold in Europe must meet EU Medical Device Regulations (MDR) for safety and DICOM compliance.

- ISO Certifications: Manufacturers follow ISO 13485 for quality management and ISO 9241-307 for visual performance evaluation in medical displays.

Manufacturers also need to perform periodic calibration and maintenance testing to ensure image consistency which is critical for accurate diagnostics.

Recent Developments

Notable developments in the medical display market include:

- Introduction of AI-Enabled Displays: Some companies have introduced AI tools in displays for automated image quality control, anomaly detection and real-time analytics to improve workflow.

In May 2025, Becton Dickinson introduced the HemoSphere Alta surgical monitor. Featuring AI‑driven forecasting of hypotension events to alert anesthesiologists in advance, this system improved predictive accuracy by over 30% compared to conventional monitors in early trials.

- Rising Popularity of OLED Technology: OLED displays are gaining traction due to their better contrast, faster response time and thinner form factor especially in surgical and diagnostic applications.

- Emerging Markets: As healthcare infrastructure improves in regions like Latin America and Southeast Asia, companies are focusing on product customization and cost-effective solutions for these geographies.

- Remote Display Management: New technologies now allow hospitals to manage and calibrate displays remotely to ensure consistent performance across departments and locations.

Current and Potential Growth Implications

Demand-Supply Analysis:

As demand for advanced diagnostic and surgical imaging grows, display manufacturers are ramping up production and expanding their product portfolios. Supply chain challenges especially related to semiconductor components are still a concern but are stabilizing.

Gap Analysis:

While major hospitals in developed countries have state-of-the-art displays, rural and underfunded institutions still use outdated or lower-grade equipment. Addressing this technology gap is a big opportunity for growth through scalable and modular display solutions.

Top Companies in the Medical Display Market

- Barco NV

- Eizo Corporation

- Sony Corporation

- LG Display Co., Ltd.

- Siemens Healthineers

- BenQ Medical Technology

- FSN Medical Technologies

- Jusha Medical

- Advantech Co., Ltd.

- Novanta Inc.

Medical Display Market: Report Snapshot

Segmentation | Details |

By Product Type | Diagnostic Displays, Surgical Displays, Clinical Review Displays, Dental Displays, Others |

By Technology | LED-Backlit LCD, OLED, CCFL-Backlit LCD |

By Application | Radiology, Mammography, Surgery, Pathology, Dentistry, Others |

By End-User | Hospitals, Diagnostic Centers, Clinics, Ambulatory Surgical Centers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Medical Display Market: High Growth Segments

- Diagnostic Displays: As imaging volumes increase, high-res diagnostic monitors are flying off the shelves.

- Surgical Displays: Minimally invasive and robotic surgeries are driving demand for real-time HD surgical displays.

- OLED Displays: Superior color and faster response times in surgical environments are increasing adoption.

Major Innovations

- 4K/8K Ultra HD Displays: More precision and clarity for complex surgical and diagnostic tasks.

- Touchscreen Integration: Better interactivity and control during surgeries and image analysis.

- DICOM Self-Calibration Tools: No more manual recalibration.

Medical Display Market: Potential Growth Opportunities

- Emerging Markets: Asia-Pacific, Latin America and parts of Africa where healthcare investment is growing.

- AI-Powered Displays: Integration with AI and big data will make imaging more personalized and accurate.

- Remote Diagnostics and Telemedicine: Medical displays will be key to telehealth expansion and underserved areas.

Extrapolate Research says:

The medical display market is going to grow steadily and sustainably as digitization, imaging volumes and diagnostic and surgical procedures advance. As healthcare systems around the world modernize, high-quality medical displays will be essential to clinical decision making and patient outcomes.

With more innovation, AI and global health equity, the future of the medical display market looks good. R&D, emerging market penetration and collaboration across the healthcare ecosystem will be the drivers of the next phase of growth.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Medical Display Market Size

- July-2025

- 140

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021