Limb/Leg Lengthening Surgery Market Size, Share, Growth & Industry Analysis, By Product Type (Intramedullary Nails, External Fixators, Bone Lengthening Stimulators), By Application (Congenital Defect Correction, Post-Traumatic Repair, Cosmetic Height Increase), By End-User (Hospitals, Specialty Orthopedic Clinics, Ambulatory Surgical Centers), and Regional Analysis, 2024-2031

Limb/Leg Lengthening Surgery Market: Global Share and Growth Trajectory

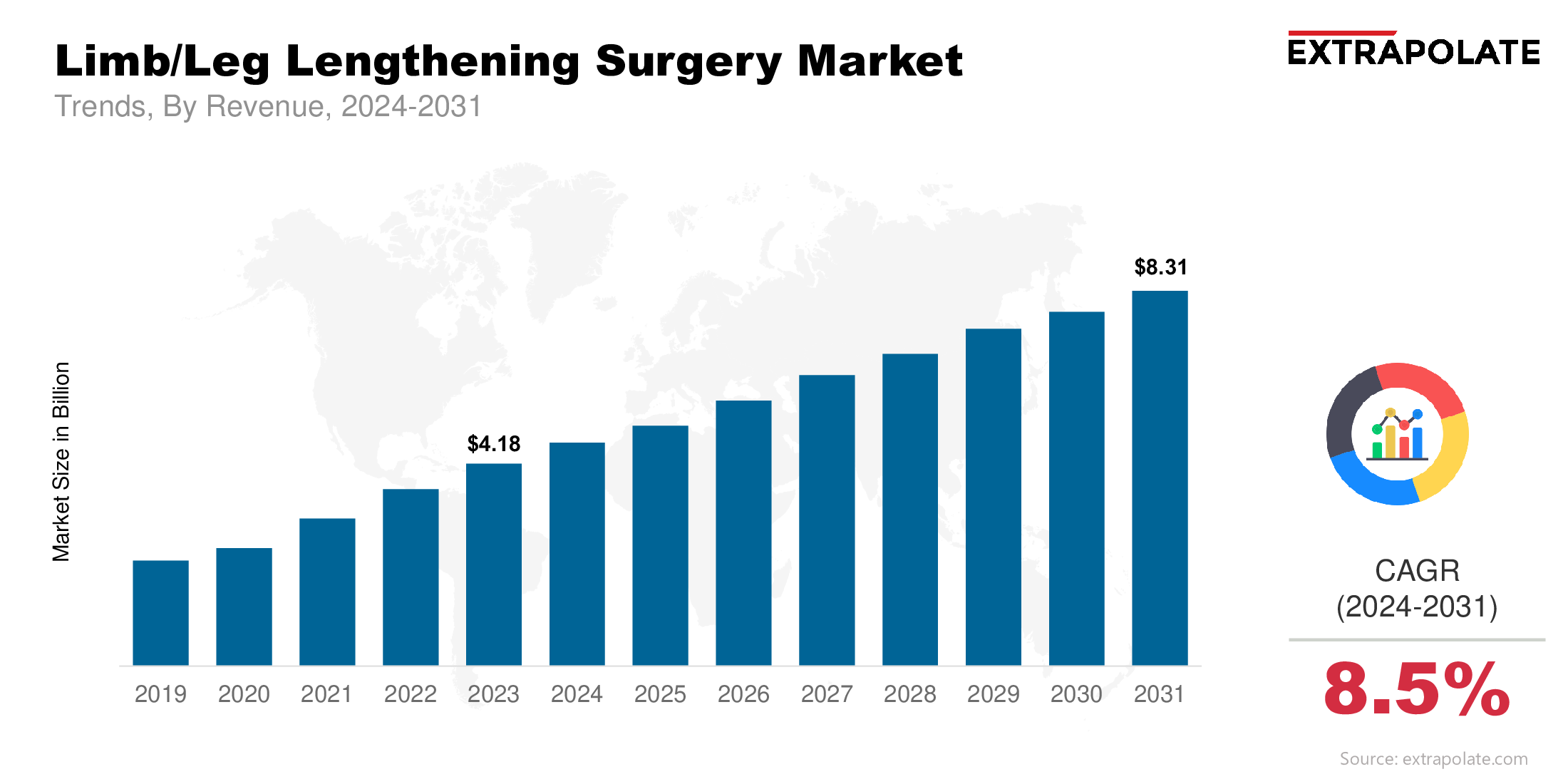

The global Limb/Leg Lengthening Surgery Market size was valued at USD 4.18 billion in 2023 and is projected to grow from USD 4.59 billion in 2024 to USD 8.31 billion by 2031, exhibiting a CAGR of 8.5% during the forecast period.

The global market is advancing steadily, supported by medical innovation and growing demand for corrective and cosmetic orthopedic procedures. This specialized field focuses on procedures that lengthen bones in the legs, typically to address congenital deformities, growth abnormalities, trauma-related discrepancies, or elective cosmetic height increases. Technological breakthroughs in external and internal fixation systems, alongside minimally invasive surgical techniques, are significantly enhancing patient outcomes and expanding accessibility.

The rising prevalence of limb length discrepancies (LLDs), coupled with increasing social acceptance of cosmetic leg lengthening, is fueling demand. Additionally, the integration of advanced orthopedic devices—such as motorized intramedullary lengthening nails—offers patients more effective, less painful, and quicker recovery options. With orthopedic clinics, specialty hospitals, and ambulatory surgical centers increasing their adoption of these solutions, the market is poised for a notable growth trajectory.

North America currently dominates the global market due to its robust healthcare infrastructure, high patient awareness, and adoption of innovative surgical devices. However, markets in Asia-Pacific and Europe are rapidly catching up, especially as medical tourism surges in countries like India, South Korea, and Turkey. The global limb/leg lengthening surgery industry is anticipated to witness steady expansion over the coming years, driven by improved surgical techniques and greater patient acceptance.

Key Market Trends Driving Product Adoption

- Rising Demand for Cosmetic Height Increase: A notable trend is the increasing use of limb lengthening surgeries for cosmetic reasons. Patients seek to enhance their stature through surgical intervention, particularly in markets like the U.S., China, and South Korea. This demand is transforming the surgery from a purely reconstructive practice to one serving elective aesthetic goals, contributing significantly to market growth.

- Technological Advancements in Orthopedic Devices: Technological innovation is reshaping limb lengthening surgery. Modern internal devices like the PRECICE and STRYDE nail systems enable precise, motorized, and minimally invasive bone elongation. These devices reduce external scarring, minimize pain, and shorten hospital stays, leading to improved patient satisfaction. Advanced imaging and surgical navigation systems also enhance procedural accuracy.

- Greater Patient Awareness and Accessibility: Patients are becoming more aware of available surgical options to correct limb length discrepancies and improve stature. Online consultations, transparent cost structures, and educational platforms run by hospitals and surgeons are making this specialized procedure more accessible, encouraging people to consider it as a viable solution.

- Rise in Trauma and Congenital Conditions: Accidents and congenital deformities are common causes of limb length discrepancies. Advances in pediatric orthopedic care and the early diagnosis of such conditions are increasing the number of surgical interventions in younger patients. Additionally, recovery protocols and bone healing stimulators are improving outcomes across age groups.

Major Players and Their Competitive Positioning

The limb/leg lengthening surgery industry is moderately consolidated, with a few key players dominating the global landscape. Companies are competing on technology, product portfolio, pricing models, and global reach. The most influential companies include NuVasive Inc., Orthofix Medical Inc., Smith & Nephew PLC, DePuy Synthes (Johnson & Johnson), and Stryker Corporation.

These companies are investing in R&D to create innovative lengthening systems, such as magnetically driven intramedullary nails. Strategic collaborations with orthopedic clinics, academic institutions, and rehabilitation centers are also common, aiming to expand market presence and improve procedural outcomes.

NuVasive’s PRECICE nail system, in particular, is widely considered a breakthrough, allowing surgeons to control bone distraction through an external magnetic remote. Meanwhile, Orthofix has developed devices that support both adult and pediatric orthopedic applications. The competitive landscape is expected to intensify as more players enter the market with cost-effective and minimally invasive solutions.

Consumer Behavior Analysis

- Moving Towards Minimally Invasive: Patients are opting for limb lengthening procedures with minimal discomfort and quick recovery. This is driving demand towards internal lengthening systems that don’t require external fixation devices. Patients also prefer procedures with fewer post op hospital visits and minimal scarring.

- Elective and Cosmetic on the Rise: A growing segment of patients are getting limb lengthening for cosmetic reasons rather than medical necessity. This is more pronounced among younger adults who see increased height as a confidence booster and professional asset. In response, clinics are now offering customised surgical packages and concierge care for elective patients.

- Cost vs Benefit: The cost of limb lengthening surgery can range from $70,000 to over $150,000 in developed countries. Patients are weighing long term benefits like quality of life and mobility against high upfront costs. Insurance coverage varies greatly and is usually limited to medically necessary procedures so patients are looking for financing options or traveling abroad for more affordable care.

- Influence of Social Media and Patient Testimonials: The market is being shaped by more digital engagement. YouTube, Instagram and online forums are giving patients firsthand accounts of people who have gone through the procedure. These testimonials are playing a big role in patient decision making and often where and how they choose to have surgery.

Pricing Trends

The cost of limb lengthening varies based on several factors. These include the complexity of the surgery, the type of device used, hospital stay duration, and post-operative care. Internal lengthening systems are more advanced but are also much more expensive than external fixators.

Pricing differs across regions. In the U.S., the procedure usually costs over $100,000. In countries like Turkey and India, it ranges from $20,000 to $40,000. This is due to lower labor costs and a strong focus on medical tourism. Some providers offer bundled packages. These may include surgery, hospital stay, physical therapy, and travel. With rising competition, pricing is expected to become clearer. Tiered options may also be introduced to attract more patients.

Growth Factors

- Technological Innovation in Surgical Devices:

Smart orthopedic implants now include sensors and motorized systems. These features, along with better biocompatibility, improve surgical outcomes. They help lower the risk of infection, joint stiffness, and nonunion. This makes limb lengthening safer and more effective.

- Increased Availability of Specialized Surgical Centers:

More orthopedic centers are now offering limb lengthening surgeries. This is common in regions with strong medical tourism. These centers focus on specialized care. They also have advanced tools for diagnosis and rehabilitation. This encourages more patients to undergo the procedure.

- Demographic Trends and Rising Patient Acceptance:

Urbanization and rising incomes are driving demand for elective surgeries. People are also more aware of healthcare options. As a result, more are open to procedures like limb lengthening. The growing number of children with birth defects or trauma-related issues is also increasing demand.

- Supportive Rehabilitation and Post-Operative Infrastructure:

Rehabilitation is now seen as essential to recovery. Many hospitals offer physical therapy as part of the treatment. Post-surgery recovery is also improving. New tools like exoskeletons and bone healing devices support faster healing. These changes are boosting patient confidence and acceptance.

Regulatory Landscape

Limb or leg lengthening surgeries use orthopedic implants. These implants must meet strict regulatory standards in major markets. Following these rules helps ensure the implants are safe, work well, and are compatible with the body.

In the U.S., the FDA checks and approves these devices. They're reviewed under Class II or III regulations for safety and effectiveness. In Europe, the CE mark is required. This shows the product meets safety and performance rules set by the European Medicines Agency. ISO 13485 certification also plays a role. It ensures that the manufacturing process follows proper quality standards.

Regulators are now also focusing on how safe the procedure itself is. Surgical centers must follow strict rules on sterilization, post-op care, and patient monitoring. As cosmetic leg lengthening becomes more common, authorities are trying to strike a balance. They want to keep patients safe while also meeting growing demand.

Recent Developments

- Launch of PRECICE STRYDE System:

NuVasive launched the STRYDE version of the PRECICE system. It now allows patients to bear weight during the lengthening process. This makes recovery more comfortable and helps improve mobility. - Rise of Cosmetic Limb Lengthening Clinics:

Specialized clinics have opened in countries like the U.S., Germany, India, and South Korea. These clinics focus only on cosmetic limb lengthening. They offer full services, including pre-surgery counseling, personalized aesthetic planning, and physiotherapy after the surgery. - AI in Surgical Planning:

AI is now being used to create personalized surgical plans. It also helps simulate how the results will look after surgery. This makes the process more precise and gives patients a clearer idea of their outcome. - New Partnerships for Better Devices:

Companies like Orthofix and Smith & Nephew are teaming up with research institutes. Together, they’re working on advanced implants. This is to help bones grow faster and reduce the risk of complications.

Current and Potential Growth Implications

- Demand-Supply Analysis: Rising patient demand for safe, effective, and minimally invasive procedures is pressuring manufacturers to innovate. However, limited production capacity and high costs of implant development remain supply-side constraints.

- Gap Analysis: Technologically advanced systems are available in developed countries. However, in low-income and rural areas, access is limited. This is mainly due to high costs and a shortage of skilled surgical experts. It opens up opportunities for telemedicine-based consultations and training programs to help close this gap.

Top Companies in the Limb/Leg Lengthening Surgery Market

- NuVasive Inc.

- Orthofix Medical Inc.

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Smith & Nephew PLC

- Orthopaedic Implant Company

- WishBone Medical Inc.

- Auxein Medical

- Pega Medical

- Wittenstein Intens

Limb/Leg Lengthening Surgery Market: Report Snapshot

Segmentation | Details |

By Product Type | Intramedullary Nails, External Fixators, Bone Lengthening Stimulators |

By Application | Congenital Defect Correction, Post-Traumatic Repair, Cosmetic Height Increase |

By End-User | Hospitals, Specialty Orthopedic Clinics, Ambulatory Surgical Centers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Intramedullary Nail Systems are becoming more popular than traditional external fixators. They offer better comfort for patients and fewer complications.

- Cosmetic Surgery, especially for height enhancement, is growing fast. Young adults and medical tourists are driving this trend.

Major Innovations

- Magnetically Controlled Lengthening Nails: Systems like PRECICE enable non-invasive bone lengthening. A handheld remote controls the adjustment, reducing hospital visits and improving safety.

- AI and 3D Imaging Integration: These technologies support accurate pre-operative planning. They also offer real-time guidance during surgery, enhancing precision.

Potential Growth Opportunities

- Medical Tourism: Countries like India, Turkey, and South Korea are becoming popular for affordable limb lengthening surgeries. They also offer good quality care after surgery.

- Expanded Pediatric Applications: Better diagnostic tools and safer surgery methods now help doctors treat children with limb issues at an earlier stage.

- Next-Gen Implants and Biologics: New implants are being designed to help bones heal faster. When used with bone graft substitutes, they might even cut down recovery time.

Extrapolate Research says:

The limb/leg lengthening surgery market is growing steadily. This growth is driven by both medical needs and cosmetic demand. Surgical methods are becoming more advanced. Technologies like motorized implants and AI planning are improving results. Patients now recover faster and with better outcomes.

The market is expanding in emerging economies. Medical tourism and lower-cost treatments are fueling this growth. Extrapolate Research sees strong potential ahead. Minimally invasive surgeries and better rehab support are key drivers. Body customization is also becoming more popular. Companies that focus on access, innovation, and education will lead. They are best placed to grow in this changing orthopedic market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Limb Leg Lengthening Surgery Market Size

- June-2025

- ���1���4���0

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021