Hernia Repair Devices Market Size, Share, Growth & Industry Analysis, By Product Type (Mesh, Fixation Devices, Laparoscopic Instruments), By Surgery Type (Open Hernia Repair, Laparoscopic Hernia Repair), By Hernia Type (Inguinal, Incisional, Femoral, Umbilical, Hiatal), By End-User (Hospitals, Ambulatory Surgical Centers, Clinics), and Regional Analysis, 2024-2031

Hernia Repair Devices Market: Global Share and Growth Trajectory

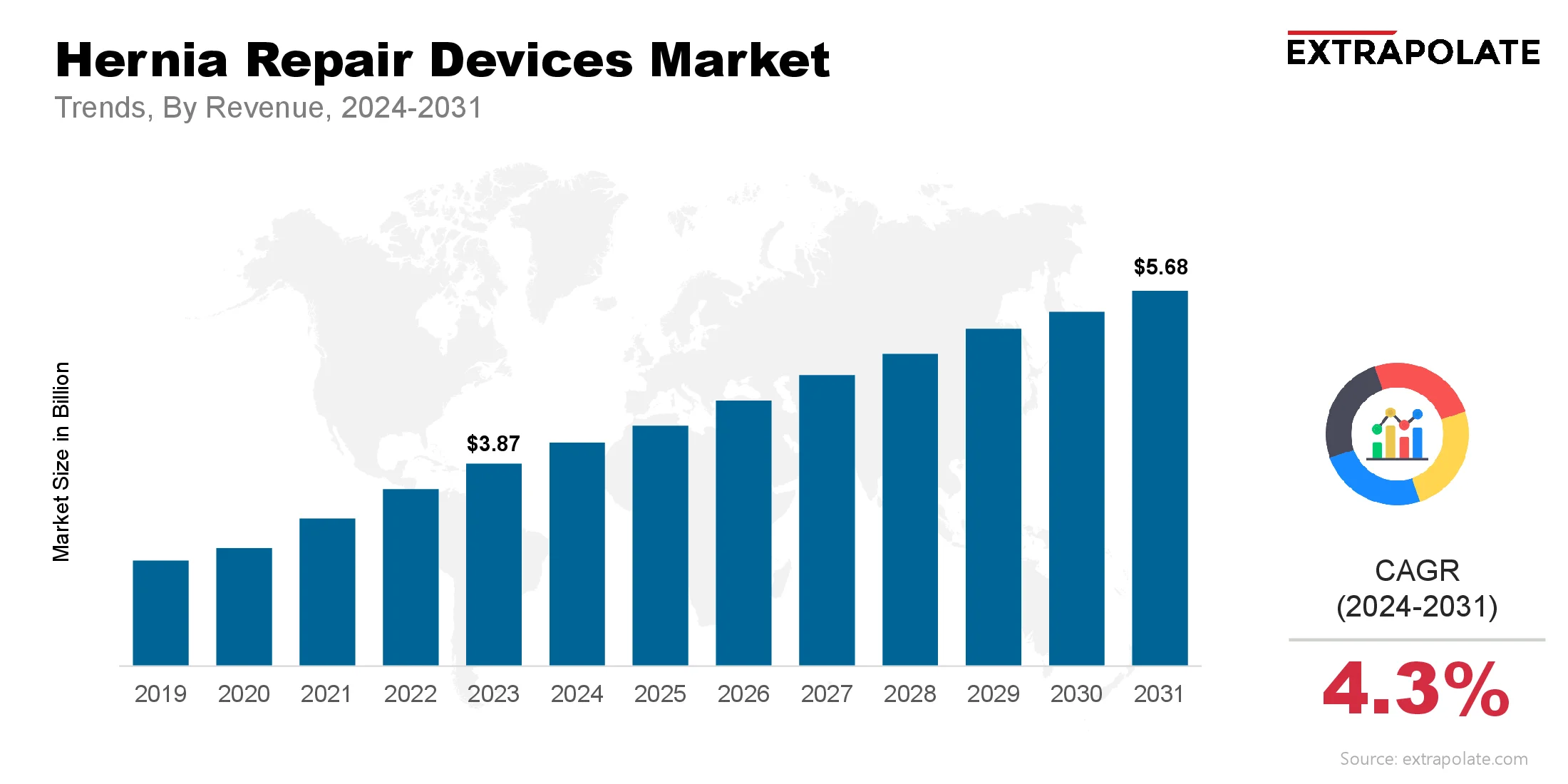

The global Hernia Repair Devices Market size was valued at USD 3.87 billion in 2023 and is projected to grow from USD 4.22 billion in 2024 to USD 5.68 billion by 2031, exhibiting a CAGR of 4.3 % during the forecast period.

The global market is making rapid expansion, fueled by growing hernia prevalence, rising preference for minimally invasive surgeries, and constant innovations in medical device technology. With hernia repair procedures performed worldwide each year, healthcare providers are investing in efficient, durable, and patient-friendly repair solutions. This has positioned the market critically within the broader surgical devices segment.

Hernias particularly inguinal, incisional, and umbilical types are common due to factors like aging populations, obesity, physical strain, and prior surgical complications. As a result, the need for reliable and safe repair methods has increased. Surgeons are opting for advanced meshes, fixation systems, and laparoscopic tools to cut-down recurrence rates, enhance patient comfort, and reduce recovery time.

This market’s growth is further encouraged by a remarkable shift toward robotic-assisted and laparoscopic hernia procedures. These approaches offer improved visualization, enhanced precision, and reduced trauma, aligning with patient and physician preferences for less invasive options. Consequently, demand for compatible mesh materials and instruments is on the rise.

In parallel, technological progress has introduced next-generation meshes, which include composite, self-gripping, and biologic options that improve tissue integration and minimize postoperative complications. Such innovations are expanding the scope for treatments, particularly in complex and high-risk cases.

Geographically, North America and Europe lead the market owing to strong healthcare infrastructure and early adoption of advanced surgical techniques. However, Asia-Pacific and Latin America are emerging rapidly, with a significant rise in procedure volumes and healthcare spending.

Key Market Trends Driving Product Adoption

Multiple vital trends are shaping the rising adoption of hernia repair devices:

Rising Demand for Minimally Invasive Surgery:

The move toward minimally invasive procedures is transforming hernia treatment. Techniques such as laparoscopic and robotic-assisted hernia repairs are becoming popular for their reduced postoperative pain, shorter hospital stays, and lower recurrence rates. As surgeons seek more patient-friendly approaches, minimally invasive hernia repair devices are witnessing strong growth worldwide.

Development of Next-Generation Mesh Products:

Mesh materials have undergone remarkable refinement. Manufacturers now offer lightweight, absorbable, and composite mesh devices that minimize complications like infection and inflammation. These next-generation products offer enhanced tissue integration, enhanced strength, and reduced post-surgical pain, boosting confidence among healthcare providers.

Rising Incidence of Hernia Cases Globally:

Lifestyle shifts, rising obesity rates, and an aging global population have led to a notable increase in hernia cases, specifically inguinal and incisional hernias. With millions of surgical procedures performed each year, there is an increasing need for safe and reliable hernia repair devices.

Shift Toward Robotic-Assisted Hernia Repairs:

Robotic surgery has found a stronghold in hernia repair, especially for complicated or recurrent hernias. With systems like the da Vinci Surgical System being incorporated into hospitals, surgeons are benefitting from enhanced precision, better visualization, and greater control. The shift toward robotic procedures is further fueling demand for compatible hernia repair tools and instruments.

Major Players and Their Competitive Positioning

The hernia repair devices market is classified by intense competition and the presence of global medical technology leaders. Companies are competing via innovation, mergers, strategic partnerships, and geographic expansion to bolster their position. Key players include are Becton, Dickinson and Company (BD), Medtronic plc, Johnson & Johnson (Ethicon Inc.), W. L. Gore & Associates, B. Braun Melsungen AG, Cook Medical Inc., Atrium Medical (part of Getinge Group), Herniamesh S.r.l., LifeCell Corporation, Cousin Biotech and others.

These companies offer a vast range of mesh products and fixation systems. Constant investment in research and development, along with a focus on surgeon and patient needs, helps them stay competitive and drive innovation in hernia repair.

Consumer Behavior Analysis

Consumer behavior in the hernia repair devices market reflects the rise in preference for enhanced surgical outcomes, safety, and recovery experiences:

- Demand for Better Postoperative Results: Patients and surgeons alike seek devices that ensure strong repairs with minimal complications. As a result, there is an increasing interest in mesh materials that reduce pain, shrinkage, and recurrence.

- Patient Preference for Minimally Invasive Options: A large number of patients now opt for laparoscopic or robotic hernia repairs. These techniques offer reduced scarring, quicker mobility, and fewer postoperative issues, which directly influence purchasing behavior at healthcare facilities.

- Focus on Long-Term Efficacy and Safety: Healthcare professionals are prioritizing durable and reliable devices that can withstand stress and minimize the likelihood of reoperation. The market is seeing increased demand for composite and biologic meshes that align with these expectations.

- Growing Familiarity Among Surgeons: Educational efforts, including workshops and training, have grown. This has enhanced understanding and use of advanced hernia repair solutions. Improved surgeon familiarity with new technologies is evident. As a result, usage rates are rising across various care settings.

Pricing Trends

Device costs vary depending on design and materials used. Brand recognition and local healthcare policies also impact pricing. Biologic meshes are derived from natural tissues and offer superior biocompatibility. This results in higher costs compared to synthetic alternatives.

Use of biologic meshes is rising in complex procedures. This is attributed to better integration and reduced complication risks, even at a premium cost. The use of tacks, sutures, and other laparoscopic instruments raises surgical costs. Cost-management is supported through strategic pricing and reimbursement frameworks.

To address growing competition, firms are shifting their commercial approach. Strategies include bundled pricing, multi-year agreements, and service-based models. Cost-effective procurement is achieved through these approaches. This facilitates integration of next-generation repair devices.

Growth Factors

Various drivers are contributing to the significant growth of the hernia repair devices market:

- Global Burden of Hernias: The global impact of inguinal hernias is substantial. Current estimates exceed 200 million affected individuals. Repair through surgery is commonly indicated to reduce complication risks. This continues to support strong demand for advanced treatment options.

- Technological Advancements in Mesh Design: New mesh types are being launched across the market. These offer reduced weight, anti-adhesion surfaces, and drug delivery capabilities. These innovations contribute to improved patient outcomes. They also influence hospitals to adopt next-generation devices.

- Improved Surgical Techniques and Tools: The use of laparoscopic and robotic systems is expanding. These technologies enable broader access to advanced surgical procedures. When combined with advanced meshes and fixation systems, these tools enhance procedural success. They contribute to more reliable clinical results.

- Rising Healthcare Investments: Healthcare access and infrastructure are expanding in emerging markets. This supports growth in surgeries and use of advanced technologies, including hernia repair devices.

- Supportive Reimbursement Policies: Government and insurance coverage is common in high-income regions. It promotes adoption of premium mesh products and instruments.

Regulatory Landscape

Strict oversight governs the safety and performance of hernia repair devices. The goal is to safeguard patient outcomes. Key aspects of the regulatory framework include:

- FDA Clearance in the United States: Hernia mesh and fixation devices must receive FDA clearance, under the 510(k) pathway. Demonstrating substantial equivalence is a key requirement. Supporting data must include both laboratory and clinical findings.

- CE Marking in the European Union: Marketing hernia repair devices in Europe demands strict MDR compliance. These rules govern device safety and clinical evaluation. Requirements include clinical performance data and ongoing monitoring. Proper labeling is also strictly enforced.

- ISO Standards Compliance: ISO 13485 outlines quality system requirements for manufacturers. They must also meet standards for labeling, sterilization, and biocompatibility.

- Regulatory agencies worldwide are strengthening oversight. This follows earlier reports of mesh-related complications. Stricter evaluations improve the safety and performance of approved devices. Such measures support long-term trust in the system.

Recent Developments

Recent milestones and innovations in the hernia repair devices market include:

- Launch of Hybrid Mesh Materials: Leading firms like BD and W. L. Gore are introducing hybrid meshes. The designs integrate both synthetic and biologic components. Strength and tissue compatibility are key features of these products. This makes them suitable for challenging repairs.

- Increased Focus on Robotic Compatibility: Device manufacturers are creating solutions for robotic-assisted surgery. These products are designed to enhance precision and compatibility. New tools feature extended trocars and meshes with self-fixation. Instruments now support articulation in robotic setups.

- Acquisitions and Collaborations: Major players like Johnson & Johnson and Medtronic are pursuing acquisitions. They collaborate with hospitals to enhance research and training programs.

- Surge in Biologic Mesh Usage: Use of biologic mesh is rising in U.S. and European hospitals. It is often selected for complex reconstructions and patients at higher risk.

- In April 2025, BD launched the Phasix ST Umbilical Hernia Patch, the first fully bioabsorbable mesh specifically designed for umbilical hernia repair. Cleared by the FDA, it combines P4HB mesh with a Sepra hydrogel barrier to support healing and is compatible with familiar surgical techniques.

- Digital Training Platforms: To accelerate adoption, several companies now offer virtual simulation and surgical skill platforms that train healthcare professionals in the latest repair techniques.

Current and Potential Growth Implications

Demand-Supply Analysis: In some regions, demand still exceeds supply. This is most evident where healthcare systems are still developing. Asia-Pacific and Latin America report growing surgical volumes. This is prompting global manufacturers to scale up production.

Gap Analysis: While the market exhibits consistent growth, access to premium devices remains constrained. This limitation is most evident in low-income regions. Cost constraints affect biologic mesh and robotic system use. Affordability remains a key market challenge. Firms are designing low-cost technologies for broader reach. Customized education programs support adoption in developing markets.

Top Companies in the Hernia Repair Devices Market

- Medtronic plc

- Becton, Dickinson and Company

- Johnson & Johnson (Ethicon Inc.)

- W. L. Gore & Associates

- B. Braun Melsungen AG

- Cook Medical Inc.

- Atrium Medical

- Herniamesh S.r.l.

- LifeCell Corporation

- Cousin Biotech

Hernia Repair Devices Market: Report Snapshot

Segmentation | Details |

By Product Type | Mesh, Fixation Devices, Laparoscopic Instruments |

By Surgery Type | Open Hernia Repair, Laparoscopic Hernia Repair |

By Hernia Type | Inguinal, Incisional, Femoral, Umbilical, Hiatal |

By End-User | Hospitals, Ambulatory Surgical Centers, Clinics |

By Region | North America, Europe, Asia-Pacific, Latin America, MEA |

High Growth Segments

- Laparoscopic Hernia Repair Devices: These devices are becoming more widely used. Faster recovery and fewer complications are key drivers. Surgeons now favor laparoscopic repair over open methods. It is often chosen for bilateral or recurrent hernias.

- Biologic Mesh Products: Use of biologic mesh is growing, especially in complex repairs. It offers improved tissue bonding and lowers infection risk.

Major Innovations

- Self-Adhering Mesh Technology: The design eliminates fixation. It helps shorten procedures and minimize recovery pain.

- Drug-Eluting Meshes: Anti-inflammatory or antibiotic agents are added to these products. They work to lower infection and inflammation.

- AI and Imaging Integration: Firms are testing image-based navigation systems. AI is also used to plan hernia repairs more precisely

Potential Growth Opportunities

- Expansion into Emerging Economies: Surgical volumes are rising in India, China, Brazil, and Indonesia. These countries are key to global market growth. This opens major opportunities for manufacturers. There is growing need for affordable and flexible hernia repair systems.

- Partnerships with Robotic Surgery Platforms: Robotic system partnerships are becoming more common. They support the development of high-precision surgical devices.

- Patient Education and Awareness Campaigns: Clear guidance on surgical options and mesh safety is critical. It encourages early care and supports growth in premium device use.

Extrapolate says:

The hernia device market is growing fast. Tech advances and less invasive care are driving global demand. In response, firms are creating safer, surgeon- and patient-friendly products.

The market is adopting robotic surgery, smart tools, and biologic meshes. Hernia repair is now a precise, tech-driven field. Strong results and clear rules support this market, and therefore, growth is expected to last over the long term.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Hernia Repair Devices Market Size

- July-2025

- ���1���4���0

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021