Hematology Analyzers and Reagents Market Size, Share, Growth & Industry Analysis, By Product Type (Hematology Analyzers (3-part, 5-part, Others), Reagents (Stains, Diluents, Others)) By Application (Anemia, Blood Cancer, Infection-related Testing, Immune Disorders, Others) By End-User (Hospitals, Clinical Laboratories, Research Institutes, Point-of-Care Settings), and Regional Analysis, 2024-2031

Hematology Analyzers and Reagents Market: Global Share and Growth Trajectory

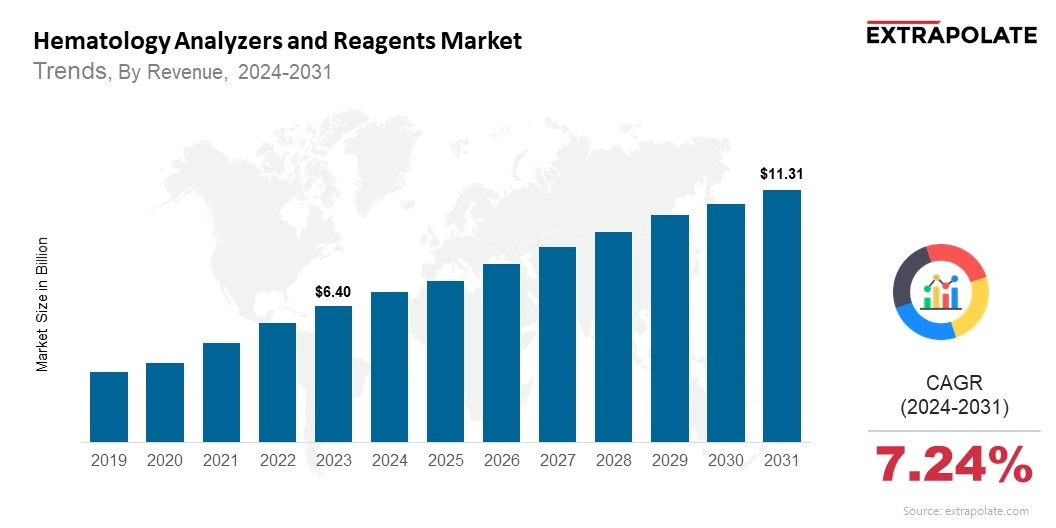

Global Hematology Analyzers and Reagents Market size was recorded at USD 6.40 billion in 2023, which is estimated to be valued at USD 6.93 billion in 2024 and reach USD 11.31 billion by 2031, growing at a CAGR of 7.24% during the forecast period.

The hematology analyzers and reagents market is booming as demand for advanced diagnostics increases, hematologic disorders rise and technology advances. Hematology analyzers, the workhorses of clinical diagnostics, automate the process of analyzing blood samples to get fast and accurate results. With specialized reagents, these instruments are key to diagnosing anemia, leukemia, infections and immune disorders.

The market is driven by a shift to preventive healthcare, increased awareness of early disease detection and the need for accurate testing. With healthcare systems under pressure to deliver high volume, cost effective services fully automated hematology analyzers are becoming more popular in hospitals, diagnostic labs and point of care.

Technology is playing a big role in shaping the market. Modern hematology analyzers now have AI, machine learning algorithms and data analytics to improve diagnostic accuracy, streamline workflows and provide real time decision support. Compact and portable models are also expanding access to remote and underserved populations, driving growth globally.

Emerging markets in Asia-Pacific, Latin America and Africa are also seeing growth as healthcare infrastructure improves and healthcare expenditure increases. But high cost of analyzers and need for skilled technicians are the challenges.

Despite these hurdles the hematology analyzers and reagents market will continue to grow strongly over the next few years. Continuous R&D investments, expanding application areas and supportive government policies will further fuel the market growth, hematology diagnostics will remain the backbone of modern healthcare.

Key Market Trends Driving Product Adoption

Automation in Diagnostics

Automation is changing clinical diagnostics. Hematology analyzers now have fully automated sample processing, advanced algorithms and smart interfaces, making the lab more efficient and reducing human error. Labs get more throughput, faster turnaround times and lower operational costs. Automation also allows labs to handle high sample volumes with consistency which is critical in big hospitals and remote diagnostic centers.

AI and Data Analytics

Integration of AI and data analytics in hematology analyzers is the biggest trend in the market. These smart systems can flag abnormalities, detect rare blood disorders and suggest diagnostic pathways based on historical data. AI application improves decision making, reduces diagnostic errors and shortens diagnosis time, improves clinical outcomes.

Point-of-Care Testing (POCT)

There is growing demand for point-of-care hematology analyzers especially in resource limited or decentralized healthcare settings. Compact, portable and user friendly analyzers with quick turnaround time are revolutionizing diagnostics in emergency rooms, ICUs and outpatient clinics. POCT devices also support disease monitoring in rural and home settings, better disease control and patient convenience.

Rising Hematologic Disorders

Anemia, leukemia, lymphoma and infections like malaria is driving up the need for hematology testing. Hematology analyzers are key tools for early detection, monitoring and treatment response assessment. This surge in disease burden is compelling hospitals and labs to invest in advanced diagnostic solutions for better healthcare delivery.

Major Players and Their Competitive Positioning

Hematology analyzers and reagents market is highly competitive with global players investing in R&D, strategic partnerships and product innovation to maintain their leadership. Key players are: Sysmex Corporation, Beckman Coulter (a Danaher company), Siemens Healthineers, Abbott Laboratories, HORIBA Ltd., Mindray Medical International Ltd., Nihon Kohden Corporation, Boule Diagnostics AB, Drew Scientific Inc., Diatron MI Zrt.

They are focusing on expanding their product portfolio, software capabilities and integrated diagnostic platforms. Mergers and acquisitions especially in emerging markets help them to strengthen their distribution network and offer cost effective diagnostic solutions.

In June 2023, Abbott launched the i‑STAT Alinity point-of-care hematology analyzer. This portable, cloud-connected blood testing device delivers lab-quality results at the bedside and integrates seamlessly with EMR and LIS systems to enable remote result monitoring and real-time clinical decision-making.

Consumer Behavior Analysis

Accurate and Early Diagnosis

Consumers and healthcare professionals are looking for early diagnosis and continuous health monitoring. Hematology analyzers with detailed blood cell counts and morphology meet this need. Accurate results enable quick treatment decisions, patient satisfaction and better clinical outcomes.

Shift To Preventive Care

The healthcare industry is moving from reactive to preventive care. Consumers are getting blood tests as part of health checkups even without symptoms. This preventive approach is driving more use of hematology analyzers in diagnostics and wellness programs.

Awareness and Education

With increasing awareness about hematological diseases and diagnostic tools, both patients and providers are more open to new technologies. Campaigns by healthcare agencies and NGOs are educating the public about early detection, supporting wider adoption of hematology tests.

Accessibility in Developing Nations

In many emerging markets, affordability and accessibility are key. Portable and low cost analyzers are gaining traction in small diagnostic labs and community clinics where budget constraints limit high end equipment adoption. Flexible pricing models and local manufacturing help companies to address these cost sensitive markets.

Pricing Trends

Pricing of hematology analyzers and reagents varies based on complexity, throughput, brand and level of automation. High end 5 part differential analyzers with advanced software integration can be much more expensive than basic 3 part analyzers used in small clinics. While capital investment is a concern, several factors are helping to offset the cost:

- Leasing and Rental Models: Many companies are offering flexible financing options, including equipment leasing, making advanced systems more accessible.

- Bundled Reagent Contracts: Analyzers are often provided at subsidized cost under reagent rental agreements, encouraging long term partnerships between labs and manufacturers.

- Operational Cost Savings: Automated analyzers reduce labor costs, turnaround time and error rates, offering significant long term savings that justify the investment.

Growth Factors

Several factors are propelling the hematology analyzers and reagents market:

Rising Incidence of Blood Disorders

Chronic conditions like anemia, leukemia, thrombocytopenia and hemophilia are on the rise globally. Accurate hematology diagnostics is critical for disease management, making analyzers an essential part of clinical workflow.

Technological Innovations

Advancements in hematology analyzers – digital imaging, microfluidics and AI based cell classification – are improving the accuracy of diagnostics. These innovations are enabling faster analysis with less sample volume and better user interface.

Global Expansion of Healthcare Infrastructure

Governments and private sectors are investing heavily in healthcare infrastructure especially in emerging markets. New diagnostic labs, hospitals and research centers are driving demand for hematology analyzers and reagents.

Regulatory Support and Healthcare Reforms

Favorable regulatory environment, government subsidies and reimbursement policies are encouraging healthcare facilities to invest in diagnostic equipment. Standardized testing protocols and international certification guidelines are supporting market growth.

Regulatory Landscape

Hematology analyzers and reagents are heavily regulated to ensure patient safety, test accuracy and manufacturing quality. Regulatory bodies across regions govern market entry and product usage:

- United States (FDA): Hematology analyzers are IVD medical devices and require premarket approval or clearance.

- Europe (CE Marking): Products must meet IVDR standards for safety, clinical efficacy and manufacturing compliance.

- International (ISO 13485): Certification ensures compliance to global quality management standards for medical devices including design, development and manufacturing.

Companies invest heavily in documentation, validation and post-market surveillance to meet compliance standards and maintain brand trust.

Recent Developments

- AI Integration: Leading manufacturers are launching hematology analyzers with AI for data interpretation, diagnostic suggestions and real-time monitoring.

In March 2023, Sysmex Corporation launched the XN-330 hematology analyzer for mid-volume labs. This system has AI-assisted flagging for better result accuracy and consumes 22% less reagent per sample for clinical precision and cost-efficiency.

- Portable Analyzer Launches: Compact and mobile analyzers are being launched to support remote healthcare programs and mobile clinics especially in rural and underserved areas.

- Partnerships and Expansions: Sysmex and Mindray have expanded their manufacturing and distribution presence in Southeast Asia, Africa and Latin America through strategic partnerships.

- Customized Reagents: Disease specific and analyzer specific reagents are being developed for precision, compatibility and cost-efficiency.

Current and Potential Growth Implications

Demand-Supply Analysis

Growing diagnostic needs are driving demand for hematology analyzers across all healthcare settings. However, supply chain is challenged by high R&D cost, complex regulatory process and supply disruption of reagent raw materials. Companies are now investing in local production facilities to bridge the gap.

Gap Analysis

Developed countries have broad access to high-end analyzers but there is a huge gap in diagnostic capabilities in low-income countries. Lack of infrastructure, trained personnel and financial resources limit access to high-end systems. Addressing this gap through cost-effective technologies and training programs is a big opportunity for market players.

Top Companies in the Hematology Analyzers and Reagents Market

- Sysmex Corporation

- Beckman Coulter Inc.

- Siemens Healthineers

- Abbott Laboratories

- Mindray Medical International Limited

- HORIBA Ltd.

- Nihon Kohden Corporation

- Diatron MI Zrt.

- Boule Diagnostics AB

- Ortho Clinical Diagnostics

Hematology Analyzers and Reagents Market: Report Snapshot

Segmentation | Segments |

By Product Type | Hematology Analyzers (3-part, 5-part, Others), Reagents (Stains, Diluents, Others) |

By Application | Anemia, Blood Cancer, Infection-related Testing, Immune Disorders, Others |

By End-User | Hospitals, Clinical Laboratories, Research Institutes, Point-of-Care Settings |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Hematology Analyzers and Reagents Market: High-Growth Segments

Five-Part Differential Hematology Analyzers

These are gaining popularity due to their high accuracy in white blood cell typing. Hospitals and diagnostic labs prefer five-part analyzers for complex disease diagnosis.

Reagents for Automated Systems

As automation becomes standard, demand for compatible reagents tailored to specific analyzer models is rising. Customized reagents improve test reliability and reduce system downtime.

Major Innovations

- Cloud-Based Data Integration: Analyzers connected to the cloud allow for centralized monitoring and instant access to diagnostic data.

- Microfluidic-Based Platforms: These platforms use smaller sample volumes and enable faster processing.

- Advanced Image Analysis: Enhancements in microscopy and imaging software provide better differentiation of abnormal cells.

Hematology Analyzers and Reagents Market: Potential Growth Opportunities

Emerging Markets

With healthcare investments rising in countries like India, Brazil, Indonesia and South Africa, hematology analyzer manufacturers have a big opportunity to expand their market presence.

Telehealth and Remote Diagnostics

Integration of hematology systems with telemedicine platforms can support remote patient monitoring and diagnosis especially in rural or underserved areas.

Extrapolate Research says:

The hematology analyzers and reagents market will grow steadily over the forecast period. With the global burden of hematologic disorders increasing and the shift towards preventive healthcare, the demand for automated testing is rising.

Innovations, accessibility and policy support are making hematology analyzers and reagents an essential part of modern diagnostics. As labs move to more advanced, high-throughput systems and AI-powered solutions, the market is poised for long term growth across developed and developing regions.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Hematology Analyzers and Reagents Market Size

- July-2025

- 140

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021