Transmission & Distribution Market Size, Share, Growth & Industry Analysis, By Component (Hardware (Transformers, Switchgear, Conductors, Cables), Software, Services), By Voltage Type (Low Voltage, Medium Voltage, High Voltage, Extra-High Voltage), By Installation Type (Overhead, Underground), By Application (Power Utilities, Industrial, Commercial, Residential), and Regional Analysis, 2024-2031

Transmission & Distribution Market: Global Share and Growth Trajectory

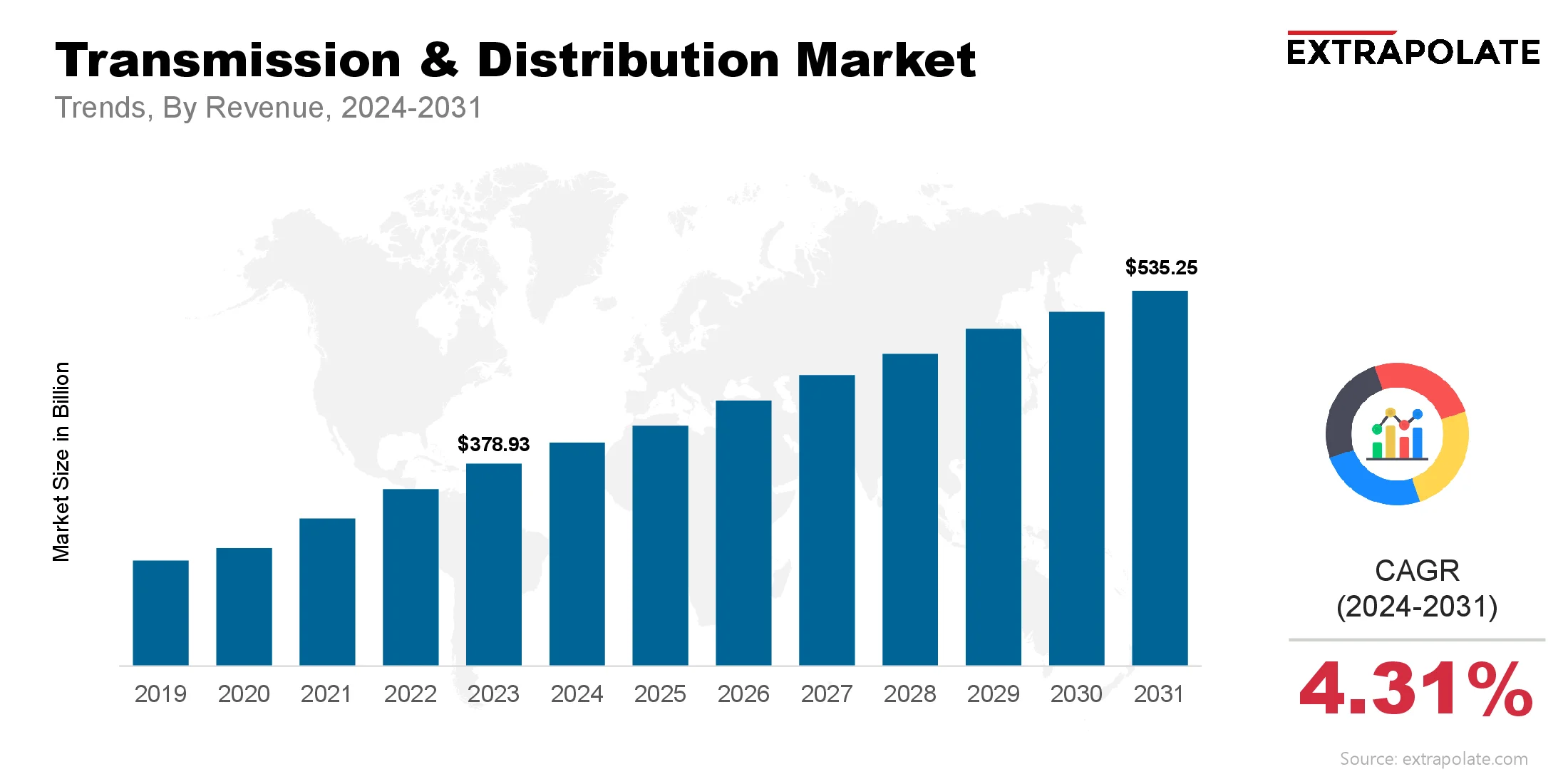

The global Transmission & Distribution Market size was valued at USD 378.93 billion in 2023 and is projected to grow from USD 398.18 billion in 2024 to USD 535.25 billion by 2031, exhibiting a CAGR of 4.31% during the forecast period.

The global Transmission & Distribution (T&D) market is growing fast. This growth is driven by rising electricity demand, urbanization, and the global shift to renewable energy. T&D systems are key infrastructure. They carry electricity from power plants to homes, businesses, and industries. As many countries upgrade old grids and add clean energy, investments in T&D technologies are increasing. This is true in both developed and emerging markets.

Electrification is growing in transport, homes, and industries. This puts pressure on utilities to expand grid capacity and improve reliability. To meet these needs, utilities are adopting smart grid solutions. Smart grids use automation, digital tools, and real-time data. They help reduce power losses, improve energy use, and manage demand quickly and efficiently.

Renewable energy is changing the way grids work. Sources like solar and wind are not always steady and are often spread out. This makes power flow harder to manage. Grids now need to be flexible and strong. They need to handle two-way power flows. Technologies like HVDC transmission, digital substations and energy storage help solve these challenges.

Asia-Pacific is leading the global T&D market. Large projects in China, India and Southeast Asia are driving growth. North America and Europe are investing in grid upgrades and clean energy systems. The market is supported by strong regulations, government funding and public-private partnerships. It’s all about energy security and sustainability.

Looking ahead the T&D market will grow steadily. Countries will continue to push for clean energy, better infrastructure and smarter technologies. With digitalization at its core the future of T&D will be smarter, more flexible and highly efficient.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Smart Grid: Smart grids are a major trend in the T&D sector. They use advanced sensors, communication networks, and real-time data to manage electricity more efficiently. Smart grids allow two-way communication between utilities and consumers. This helps balance supply and demand in real time. As countries focus on energy security and sustainability, smart grid investments are rising. For example, ABB unveiled the SACE Emax 3, the first cyber-security SL2-certified air circuit breaker in the world, in June 2025. It incorporates sophisticated algorithms, intelligence, and sensing to improve the energy security and resilience of critical infrastructure grids.

- Renewable Energy Integration: Decarbonization is pushing grids to accept more renewable sources. Solar and wind energy are variable, which makes balancing demand a challenge. Advanced T&D systems with smart controls and storage are essential. They help integrate renewables while keeping the grid stable. This trend is growing in Europe, North America, and parts of Asia-Pacific.

- Urbanization and Electrification: Cities are growing fast. At the same time, transport, heating, and industries are switching to electricity. This is increasing power demand. Utilities must expand and upgrade their T&D networks. Many developing countries are investing in grid projects to bring electricity to rural areas.

- Grid Resilience and Reliability: Extreme weather events, cyber threats and aging infrastructure are big risks to grid operations. Grid resilience is now top priority. Utilities are adopting automation, real time monitoring and fault detection technologies to minimize outages and improve restoration time.

- Digital Twin and Asset Management: Digital twin concept – creating a virtual replica of T&D systems – is gaining traction. It allows utilities to simulate operations, predict failures and optimize maintenance schedules. This digital transformation improves efficiency and extends life of aging infrastructure.

Major Players and their Positioning

T&D market is competitive and diverse with many global and regional players offering a wide range of solutions. Key players are investing in innovation, strategic partnerships and market expansion to stay ahead.

Major companies included are Siemens AG, Schneider Electric SE, ABB Ltd., General Electric Company (GE), Eaton Corporation, Mitsubishi Electric Corporation, Toshiba Corporation, Hitachi Energy, Nexans SA, Prysmian Group and others. These companies focus on high-voltage equipment, smart grid technologies, and control systems. They also offer cables, substations, and related services. Their strategies often involve mergers and acquisitions. They also form partnerships with utility companies, technology providers, and governments.

Consumer Behavior Analysis

- Reliability and Continuity of Supply: Consumers, from homes to industries, expect steady and reliable power. To meet this demand, utilities are upgrading grids. They invest in systems that can handle faults and use predictive maintenance to avoid outages.

- Demand for Green Power: More consumers now want clean and green energy. They support systems that allow more renewable power into the grid. Rooftop solar and other local sources are growing. This is driving investment in two-way T&D networks.

- Cost Sensitivity and Tariff Structures: Electricity users are more cost-aware, especially where prices change often. Utilities are improving systems to cut losses and boost efficiency. This helps keep user costs stable or lower over time.

- Participation in Demand Response Programs: Consumer interest in demand-side programs is growing. This is common in areas with smart grids. Such programs support grid upgrades and flexible energy systems.

Pricing Trends

The Transmission & Distribution (T&D) market has a wide range of prices. The geography, local laws, project size, and technology all have a role. High capital expenses are associated with high-voltage transformers, switchgear, cables, and substations.

- Upfront Capital and Long-Term Value: T&D projects need large upfront investments. However, they offer long-term value. Better efficiency and fewer outages help recover costs over time. Smart technologies also lower maintenance needs and give better control.

- Competitive Procurement: Many countries use tenders for T&D projects. This creates competition among vendors. It leads to lower prices and better technology. In public projects, governments often set pricing benchmarks.

- Modular and Scalable Pricing: Vendors now offer modular solutions. These can be scaled or upgraded later. This helps utilities stay within budget while planning for future growth.

Growth Factors

Several factors are driving growth in the Transmission & Distribution (T&D) market:

- Rising Electricity Demand: Electricity demand is going up. This is due to urban growth, economic development, and digital adoption. As a result, grid investments are increasing. Asia-Pacific, Latin America, and Africa are leading this trend.

- Renewable Energy Integration: Solar and wind power are growing fast. These sources need modern grids. The power supply is often unstable. Grids must handle this and support local generation.

- Government Support: Governments are backing T&D projects. They offer policies, funding, and programs. India’s RDSS and the U.S. GRIP are strong examples.

- Technology Advancements: New tech is changing the grid. Tools like IoT, AI, and energy storage help manage power better. They allow real-time data and improve efficiency.

- Regulatory Framework: The T&D sector follows strict rules. These rules focus on safety, reliability, and the environment.

Key Regulatory Requirements Include:

- National Grid Codes: Utilities must follow each country’s grid rules. These cover voltage, frequency, stability, and how systems connect.

- Environmental Regulations: New transmission lines must meet environmental rules. This is important when building near protected areas.

- Cybersecurity Standards: Grid operators need strong cybersecurity systems. They must follow global standards like NIST and ISO/IEC 27001.

- Market Deregulation: In some places, the T&D sector is now open to private players. This has brought more competition and better efficiency.

Recent Developments

Here are some key trends in the T&D industry:

- HVDC Growth: China, India, and Germany are building more HVDC networks. This helps carry power over long distances and adds more renewables to the grid.

- Smart Meters: Smart meters are being installed on a large scale. They make electricity use easier to track and manage.

- Digital Substations: New substations use digital sensors and smart devices. These help spot issues quickly and cut down costs. For instance, the SAM600 version 3.0 process interface unit, which Hitachi Energy presented in March 2024, combines merging and control unit capabilities into a single small device to improve cybersecurity and energy efficiency, expand flexibility, and hasten the implementation of digital substations.

- Strategic Partnerships: Companies like GE and Hitachi Energy are working with utilities. Together, they are building smart grid solutions and better services.

- Transport Electrification: EVs are putting pressure on the power grid. Utilities are adding fast chargers and local support to handle the load.

Current and Potential Growth Implications

- Demand-Supply Analysis: Global demand for T&D infrastructure is growing. Manufacturers are ramping up production of transformers, conductors, smart meters, and automation systems. However, supply chain constraints, particularly in raw materials like copper and aluminium, are affecting project timelines and increasing costs.

- Gap Analysis: Smart and resilient grids are becoming the norm. This is mainly prominent in developed nations. However, many emerging economies struggle with funding, rural electrification, and grid reliability. It will take multilateral funding, technological transfer, and capacity building to close this gap.

Top Companies in the Transmission & Distribution Market

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- General Electric Company (GE)

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hitachi Energy

- Toshiba Corporation

- Prysmian Group

- Nexans SA

Transmission & Distribution Market: Report Snapshot

Segmentation | Details |

By Component | Hardware (Transformers, Switchgear, Conductors, Cables), Software, Services |

By Voltage Type | Low Voltage, Medium Voltage, High Voltage, Extra-High Voltage |

By Installation Type | Overhead, Underground |

By Application | Power Utilities, Industrial, Commercial, Residential |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Smart Grids: This segment is witnessing exponential growth due to rising investments in real-time monitoring, demand-side management, and grid automation systems.

- HVDC Systems: High voltage direct current transmission is becoming crucial for long distance and cross border power transmission, especially from remote renewable energy sources.

Major Innovations

- Digital Twin: Simulate and track grid assets in real-time for proactive maintenance and decision making.

- AI Grid Management: Use machine learning for demand forecasting, fault detection and energy load balancing.

- Flexible AC Transmission Systems (FACTS): Improve grid stability, power quality and transmission capacity.

Growth Opportunities

- Growing Markets: India, Brazil and several African countries are growing as they invest in electrification especially in remote areas.

- Integration with Distributed Energy Resources (DER): As solar rooftops, microgrids and battery storage become mainstream, T&D networks need to adapt to these distributed power sources.

Extrapolate Research says:

The transmission & distribution market is experiencing major transformation. Smart tech, more electrification, and clean energy are pushing this shift. The power grid is getting smarter, faster, and more reliable. In the coming years, countries around the world, especially emerging ones, will keep investing in better T&D systems. New tech like HVDC systems and digital substations are changing the game. These updates are helping build a greener and more stable energy future. T&D isn’t just about moving power anymore. It’s now a key part of the world’s energy transformation.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Transmission Distribution Market Size

- July-2025

- 140

- Global

- Energy-and-Power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025