Gasification Market Size, Share, Growth & Industry Analysis, By Technology (Fixed Bed, Fluidized Bed, Entrained Flow, Plasma, Supercritical Water) By Feedstock (Coal, Biomass, Municipal Solid Waste, Petroleum Residues) By End-Use (Power Generation, Chemicals, Hydrogen, Liquid Fuels, Fertilizers), and Regional Analysis, 2024-2031

Gasification Market: Global Share and Growth Trajectory

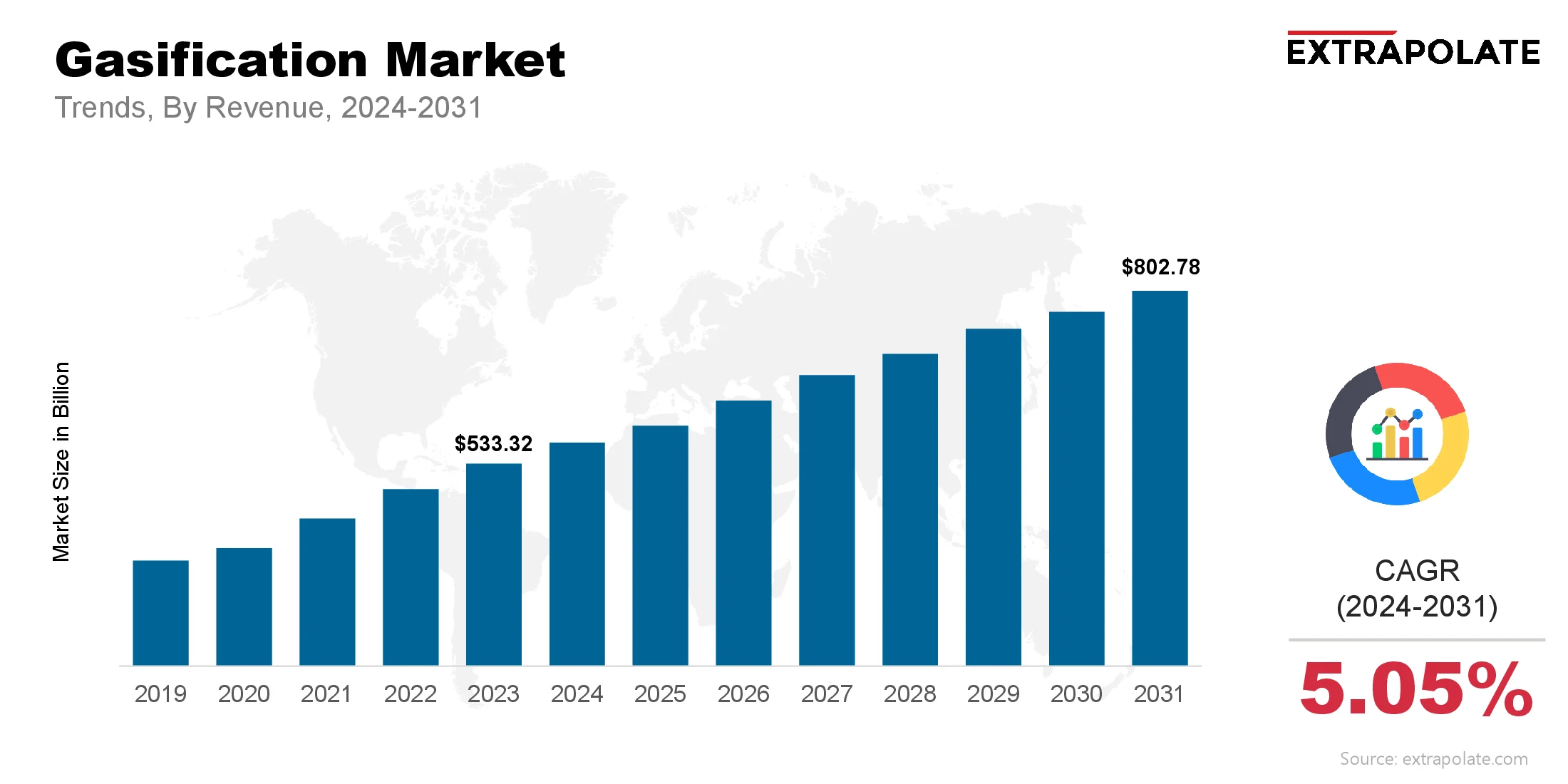

The global Gasification Market size was valued at USD 533.32 billion in 2023 and is projected to grow from USD 568.47 billion in 2024 to USD 802.78 billion by 2031, exhibiting a CAGR of 5.05% during the forecast period.

The global market is witnessing a major shift. This change is driven by the rising need for cleaner and more efficient energy solutions. Gasification is a flexible and advanced process. It converts carbon-rich materials like coal, biomass, petroleum residues, and municipal waste into synthesis gas or "syngas."

Syngas is mainly made of hydrogen and carbon monoxide. It can be used to generate electricity, produce fuels, make chemicals, and create fertilizers. This makes gasification a cleaner alternative to traditional combustion methods.

The move toward circular economies is also boosting gasification. Municipal waste and biomass, once seen as waste, are now seen as energy sources. Waste-to-energy (WTE) systems, including plasma and biomass gasification, help reduce landfill use. They also produce energy and lower greenhouse gas emissions.

New technologies are pushing the market forward. Modern gasification systems now handle a wider range of feedstocks. They also offer better thermal efficiency and improved gas cleaning.

Innovations in reactor designs, like fluidized bed and entrained flow gasifiers, have made operations more efficient. These designs also allow for more types of input materials. Digital tools and AI are also being used for real-time monitoring and predictive maintenance. This helps cut costs and increases plant reliability.

In terms of regions, Asia-Pacific leads the market. This is due to its large supply of coal and biomass, rising energy needs, and strong clean energy policies. Europe and North America are focusing more on biomass and waste-based gasification to meet their sustainability targets.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Renewable and Waste-Derived Feedstocks: Gasification is no longer just about coal. A big trend in the market is the use of renewable and waste derived feedstocks like municipal solid waste, agricultural residues and forest biomass. This is in line with the circular economy and reduces landfill and produces syngas that can be refined into biofuels, electricity or chemicals.

Hydrogen Economy and Clean Energy Transition: Hydrogen production from gasification is gaining traction especially with countries planning for a hydrogen economy. Gasification of biomass or waste with carbon capture technology is a route to low carbon or even negative carbon hydrogen making it a key enabler of decarbonization across industries.

Integrated Gasification Combined Cycle (IGCC) Deployment: IGCC systems are more efficient and emit less pollutants than traditional power generation. Although capital intensive, the ability to produce electricity and capture carbon at the same time is attracting attention especially in developed countries where emission regulations are strict.

Plasma and Supercritical Water Gasification: Advanced gasification technologies like plasma gasification can treat hazardous and mixed wastes effectively. Supercritical water gasification is also gaining ground for wet biomass as it is efficient and doesn’t require drying of feedstocks.

Major Players and Their Competitive Positioning

The global gasification market is characterized by the presence of several key players developing cutting-edge gasification systems. These companies are innovating across feedstock flexibility, energy conversion efficiency, and system scalability. The leading companies include: Air Liquide S.A., Mitsubishi Heavy Industries, Ltd., General Electric Company, Shell Plc, Siemens Energy AG, Thyssenkrupp AG, Synthesis Energy Systems, Inc., Enerkem Inc., CHOREN Industries GmbH, EQTEC Plc

These players are investing heavily in R&D, forming strategic partnerships, and expanding their global footprints through pilot plants and commercial-scale deployments. Their focus lies in both industrial gasification and emerging waste-to-energy markets.

Consumer Behavior Analysis

- Sustainability and Resource Efficiency: Industrial consumers and municipalities are looking at gasification as a way to reduce waste and optimize resource use. This is particularly true in regions with landfill capacity constraints and high waste disposal costs.

- Hydrogen and Green Ammonia: Chemical manufacturers and utilities are becoming big users of gasification derived hydrogen and ammonia. These applications are critical for fertilizer production, fuel cell technologies and energy storage systems, driving demand for modular and scalable gasifiers.

- Off-Grid and Remote Applications: Consumers in off-grid areas, especially in developing countries, are looking at small scale biomass gasifiers for decentralized energy generation. These systems enable local power generation using agricultural waste, reducing dependence on diesel generators. In October 2024, Aries Clean Technologies launched full integrated operations at its Linden, New Jersey biosolids gasification facility. The fluidized-bed system converts municipal wastewater sludge into energy, processing 400 tons per day, making it the world’s largest biosolids gasifier

- Awareness and Technical Knowledge: While gasification has been around for decades, new users, especially municipal governments and independent power producers, are becoming more aware of its technical maturity, feedstock flexibility and environmental benefits.

Pricing Trends

Gasification system pricing depends on the technology type (fixed bed, fluidized bed, entrained flow, plasma, etc.), scale, feedstock handling capability and end-use applications. Traditional coal gasifiers are mature and lower cost, advanced systems like plasma and supercritical water gasifiers are higher cost due to complexity and component cost.

But landfill fees, carbon taxes and regulatory incentives are making gasification more competitive. And integrating gasifiers into combined heat and power (CHP) systems or as hydrogen generation units improves the ROI. Modular systems and mobile gasifiers are entering the market especially for agricultural and industrial waste applications, for distributed energy generation.

Growth Factors

- Global Decarbonization Focus: The gasification market will grow as countries implement carbon reduction targets and net zero commitments. Unlike incineration, gasification allows CO2 capture and reduces methane emissions from landfill waste so it’s the environmentally preferred option.

- Feedstock Availability: There are many types of feedstocks—coal, municipal waste, biomass, and farm residues. This wide choice is helping gasification grow in both rural and industrial areas.

- Industrial Demand for Syngas: Syngas is used to make ammonia, methanol, synthetic natural gas, and special fuels. Refineries, chemical plants, and clean fuel makers need more of it. This is boosting the use of gasification.

- Government Support and Policy Incentives: Governments are offering subsidies and tax breaks. They are also setting clean energy and waste rules. This support is leading to more gasification projects in the US, EU, China, and India.

Regulatory Landscape

Gasification projects must meet a whole host of environmental, safety and performance regulations. These include:

- Emissions Compliance: Regulators have strict limits on NOx, SOx, CO2, dioxins and particulate matter. Gasifiers, especially when combined with carbon capture, are often easier to comply with than incinerators or traditional power plants.

- Feedstock Handling and Waste Classification: Regulations may restrict the type of waste that can be gasified, especially hazardous or radioactive materials. Approval is required for feedstock sourcing and handling methods.

- Plant Safety Standards: High temperature and high pressure operations require rigorous design, inspection and operational protocols. OSHA, ATEX and ISO standards must be met for system certification and operation.

- Permitting and Land Use: Gasification facilities, especially waste-to-energy plants, must get permits for air quality, water use and land use before construction and operation.

Recent Developments

- Plasma Gasification Pilots Moving Forward: Hitachi Zosen Inova and InEnTec are commissioning plasma gasification plants to handle municipal and hazardous waste with near zero emissions.

- Hydrogen from Waste Growing: Enerkem and EQTEC are producing hydrogen from municipal solid waste through gasification. This supports clean hydrogen roadmaps in North America and Europe.

- China Building Biomass Gasification Plants: China is investing in biomass gasification for rural electrification and district heating. New plants powered by crop residues are bringing energy to remote areas. In June 2024, NEXTCHEM (via MyRechemical, a MAIRE S.p.A. subsidiary) signed a licensing agreement with DG Fuels Louisiana for its NX Circular gasification technology. The system will be used in a sustainable aviation fuel (SAF) plant, producing up to 450 million liters per year from biomass and municipal waste by 2028

- Refinery and Chemical Company Partnerships: Several gasification companies have partnered with petrochemical and refining companies to convert low value feedstocks into syngas for fuels and chemicals, including methanol and green ammonia.

Current and Potential Growth Implications

a. Demand-Supply Analysis: There is a growing demand for clean and flexible energy systems, as well as chemicals. This is pushing supply chains to adapt quickly. Equipment manufacturers are increasing production of modular and utility-scale gasifiers. But in some regions, supply is still limited. The main reasons are a shortage of skilled workers and challenges in feedstock logistics.

b. Gap Analysis: Gasification has clear technological and environmental benefits. However, it’s not yet widely adopted. High capital costs, regulatory delays, and low awareness are major barriers. To overcome these, we need better financing options, standardized technology platforms, and stronger community outreach.

Top Companies in the Gasification Market

- Air Liquide S.A.

- General Electric Company

- Shell Plc

- Siemens Energy AG

- Thyssenkrupp AG

- Mitsubishi Heavy Industries, Ltd.

- Synthesis Energy Systems, Inc.

- EQTEC Plc

- Enerkem Inc.

- CHOREN Industries GmbH

Gasification Market: Report Snapshot

Segmentation | Details |

By Technology | Fixed Bed, Fluidized Bed, Entrained Flow, Plasma, Supercritical Water |

By Feedstock | Coal, Biomass, Municipal Solid Waste, Petroleum Residues |

By End-Use | Power Generation, Chemicals, Hydrogen, Liquid Fuels, Fertilizers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Plasma Gasification: Plasma gasification is the perfect solution for complex and hazardous waste Nearly complete feedstock conversion means clean syngas and inert slag.

- Biomass Gasification: Agricultural economies and off-grid electrification needs are driving biomass gasification growth, especially in Asia and Africa.

- Hydrogen from Gasification: Municipal solid waste and biomass gasification for hydrogen is going to be a big segment as global demand for low-carbon hydrogen solutions grows.

Innovations

- Carbon Capture and Utilization (CCU): New gasification plants are incorporating carbon capture systems to reduce or eliminate CO2 emissions. Some are even converting captured CO2 into building materials or methanol.

- AI-Powered Process Optimization: Artificial intelligence and digital twin technologies are improving gasification plant efficiency, safety and feedstock flexibility. Real-time analytics reduce downtime and increase output.

- Modular Micro-Gasifiers: Small, portable gasifiers are revolutionizing rural energy access and industrial process heating by providing local syngas production at low operating costs.

Growth Opportunities

- Decentralized Energy Systems: Gasification can power microgrids in remote areas using local biomass or waste. Suited for rural electrification in Africa and Southeast Asia.

- Green Hydrogen and Ammonia Projects: Governments are prioritizing hydrogen strategies and gasification is a main part of green hydrogen and ammonia roadmaps. Funding opportunities for pilot and demo projects.

- Industrial Decarbonization: Hard-to-abate sectors like steel, cement and chemicals are looking at gasification for cleaner process heat and synthesis gas. These are new growth areas.

Extrapolate Research Says:

The gasification market is set to bloom as the world needs cleaner energy and better waste management. As governments prioritize carbon neutral and green hydrogen, gasification is the versatile and scalable solution.

With plasma, biomass and modular gasification technologies advancing and regulations in place globally, the industry is set to play a big role in the future energy mix. Synergies between gasification, carbon capture and hydrogen production will unlock long term growth.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Gasification Market Size

- August-2025

- 148

- Global

- Energy-and-Power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025