Welding Consumables Market Size, Share, Growth & Industry Analysis, By Product Type (Stick Electrodes, Solid Wires, Flux-Cored Wires, SAW Wires and Fluxes), By Welding Technique (SMAW, GMAW, FCAW, SAW, TIG), By Application (Construction, Automotive, Oil & Gas, Shipbuilding, Manufacturing, Aerospace), By End-User (Industrial, Commercial, Infrastructure), and Regional Analysis, 2024-2031

Welding Consumables Market: Global Share and Growth Trajectory

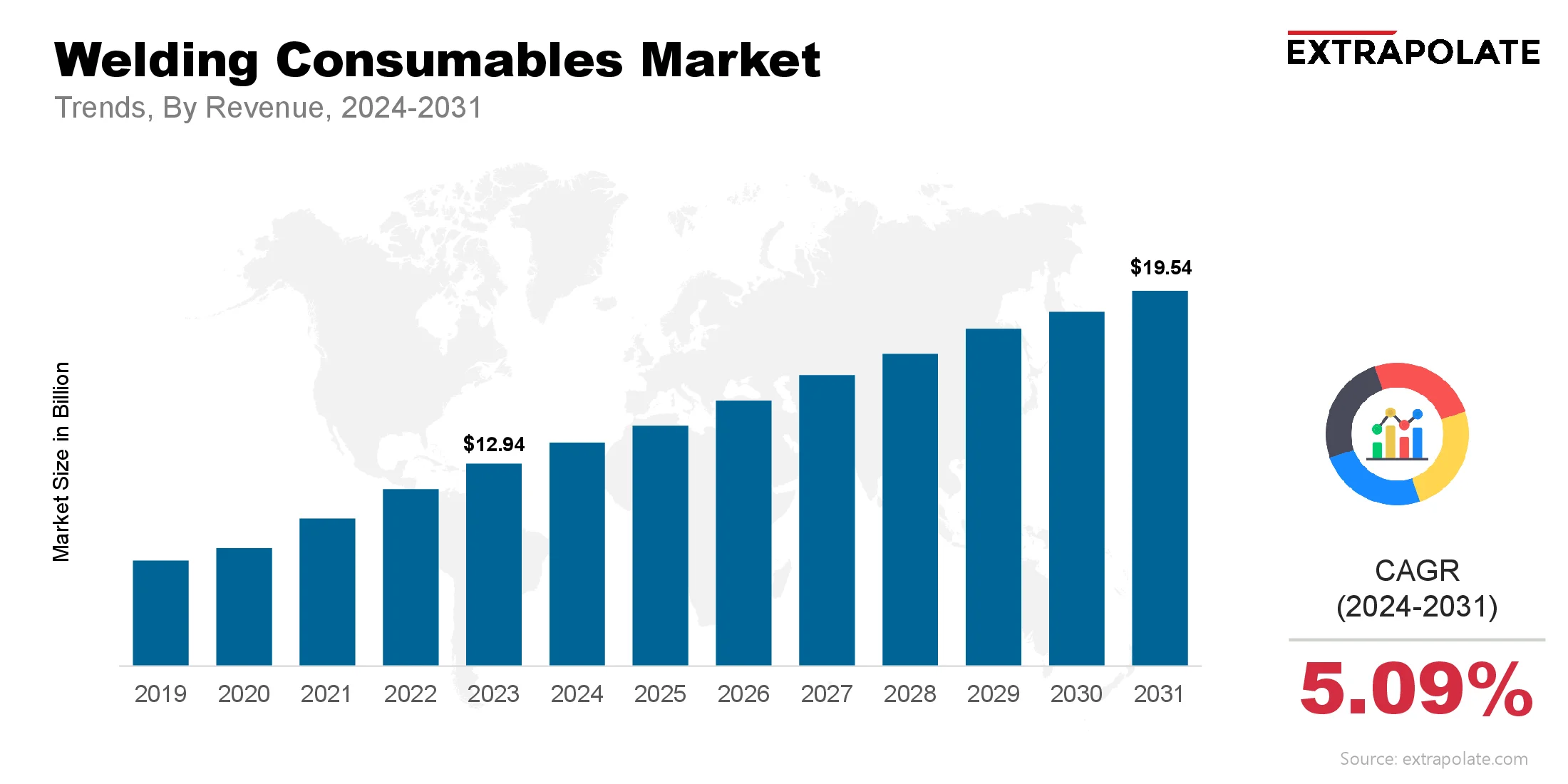

The global Welding Consumables Market size was valued at USD 12.94 billion in 2023 and is projected to grow from USD 13.8 billion in 2024 to USD 19.54 billion by 2031, exhibiting a CAGR of 5.09% during the forecast period.

The global welding consumables market is experiencing steady and transformative growth, driven by the expansion of construction, manufacturing, and automotive sectors. Welding consumables, which include electrodes, filler metals, fluxes, and shielding gases, are essential materials used in welding processes to ensure the integrity, strength, and longevity of welded joints. With industries focusing on infrastructure modernization, industrial automation, and lightweight vehicle design, the demand for welding consumables is expected to rise significantly in the coming years.

This market's growth trajectory is bolstered by rapid industrialization in developing economies and the adoption of advanced welding technologies such as robotic welding and laser welding. Increasing awareness of welding quality, operational safety, and efficiency across various sectors is encouraging the uptake of innovative consumables that offer enhanced arc stability, slag removal, and corrosion resistance. As technological innovations continue to evolve, the welding consumables market is poised to scale new heights in both value and volume terms.

One of the major transformations in the market is the shift from traditional manual welding to automated and semi-automated processes, especially in developed economies. This shift is driving demand for high-performance consumables that can withstand rigorous production cycles while offering consistent weld quality. With the integration of robotics, artificial intelligence, and Internet of Things (IoT) in welding applications, consumable manufacturers are investing in product R&D to support future-ready welding solutions.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Rise in Infrastructure and Construction Projects: The growing number of infrastructure development projects worldwide is significantly contributing to the demand for welding consumables. Mega-projects in bridges, railways, high-rise buildings, and industrial plants require extensive welding operations. As countries invest in urban expansion and smart city initiatives, the need for reliable and high-performance welding consumables is expanding rapidly.

- Automation and Industry 4.0 in Manufacturing: The global shift towards automation and Industry 4.0 is reshaping welding practices. Advanced manufacturing units are adopting robotic and automated welding systems, which require precision-engineered consumables that support consistent weld performance. This trend is particularly prominent in the automotive, aerospace, and heavy machinery industries, where uniformity and speed are critical.

- Growing Popularity of Environment-Friendly Products: Environmental regulations and increasing awareness around sustainability are promoting the adoption of eco-friendly welding consumables. Lead-free solders, low-fume welding rods, and water-based fluxes are gaining popularity. Manufacturers are investing in sustainable product lines that align with regulatory guidelines and corporate ESG (Environmental, Social, and Governance) goals.

- Technological Advancements in Welding Techniques: The evolution of welding methods, including laser welding, friction stir welding, and hybrid welding, is boosting the demand for consumables tailored for these advanced techniques. These methods offer increased efficiency, reduced distortion, and higher strength joints, prompting the development of specialized consumables that can perform under high thermal and mechanical stress.

Major Players and their Competitive Positioning

The welding consumables market is moderately consolidated, with a mix of global giants and regional manufacturers competing based on innovation, quality, and pricing. Key players are continuously expanding their production capacities, investing in R&D, and engaging in mergers and acquisitions to strengthen their market position.

Leading companies in the market included are Lincoln Electric Holdings, Inc., ESAB Corporation, voestalpine Böhler Welding GmbH, Air Liquide S.A., Fronius International GmbH, Hyundai Welding Co., Ltd., Magmaweld, WeldWire Company, Inc., Ador Welding Limited, Illinois Tool Works Inc. and others. These companies offer a wide array of consumables for shielded metal arc welding (SMAW), gas metal arc welding (GMAW), submerged arc welding (SAW), and flux-cored arc welding (FCAW), among others. Strategic collaborations and the expansion into emerging markets are common tactics to gain market share.

Consumer Behavior Analysis

- Shift Toward Quality and Performance: Consumers, particularly from high-end manufacturing industries, prioritize welding consumables that deliver consistent performance, minimal spatter, and strong joint integrity. This demand is encouraging suppliers to develop premium products tailored to critical applications such as aerospace and shipbuilding.

- Emphasis on Safety and Compliance: End-users are increasingly focused on workplace safety and environmental compliance. Consumables that reduce fume emissions, enhance arc stability, and meet safety standards are gaining traction, especially in North America and Europe.

- Cost Efficiency and Lifecycle Value: In Southeast Asia and Latin America, buyers remain price sensitive. Still, they increasingly value long-term lifecycle benefits. Quality consumables lower the need for rework and minimize downtime. This leads to better productivity and lasting value.

- Rise in Customized Solutions: Customized consumables are expected by manufacturers. These target particular metals, welding angles, and work conditions. The focus on tailored welding is strong in niche markets. High precision is essential in these fields.

Pricing Trends

Cost differences arise from product type, quality, packaging, and materials used. These factors impact pricing widely. Higher prices apply to flux-cored wires and specialty electrodes. They offer better performance for specialized tasks. The cost structure is influenced by higher prices for nickel, molybdenum, and copper. Raw material price rises are a key factor.

Price volatility pushes suppliers to add value. Services like training and bundled welding gear help customers. Cost control strategies include bulk purchases and long-term contracts. Strong supply chain partnerships support these efforts.

Growth Factors

- Industrial Growth in Emerging Markets: Rapid industrial growth is seen in India, China, Brazil, and Indonesia. These markets are expanding manufacturing capabilities. Expansion of factories and infrastructure projects raises welding consumable needs. This supports industrial growth. Government-led programs like “Make in India” and “Belt and Road” speed up sector demand. These initiatives enhance trade and development.

- Expanding Automotive Sector: Shifts in automotive focus demand lighter parts and EVs. Innovative welding methods are needed to keep up. Welding consumables compatible with lightweight metals and high-strength steels are sought after. This supports modern manufacturing needs. High-speed automated welding increases consumable use in automotive plants. Wires and fluxes are designed to meet these demands.

- Oil & Gas and Shipbuilding Demand: Rising oil and gas work offshore drives demand for tough welding consumables. These must resist corrosion and offer high strength. In shipbuilding, consumables must withstand extreme environments. They should comply with tight classification rules.

- Focus on Welding Education and Certification: Skilled workers and certified welders are increasingly valued. They ensure proper use and choice of consumables. Manufacturers join with training centers to educate workers. This creates informed users who value quality and compliance.

Regulatory Landscape

The welding consumables industry is governed by international standards to ensure quality, safety, and environmental compliance. Key regulatory bodies and standards include:

- American Welding Society (AWS): The standards set rules worldwide for welding consumables. These include how they are classified and tested.

- ISO 14344 and EN Standards: Consumables in Europe must comply with labeling, packaging, and quality rules. These ensure safety and reliability.

- OSHA Regulations: Workplace safety depends on proper handling. Controlling fumes is especially critical in factories.

Compliance with local environmental standards is required. Key areas include fumes, lead use, and waste handling.

Recent Developments

- Innovation in Flux-Cored and Metal-Cored Wires: Weld materials are being enhanced for performance. They save time and improve finish quality.

- Digitalization in Welding Operations: Advanced welding uses sensors and data tools. This promotes traceable and efficient consumables.

In July 2025, TRUMPF introduced a new laser welding system with integrated quality control, combining AI-based VisionLine Inspect and OCT (optical coherence tomography) sensors to monitor weld seam integrity and penetration depth in real time. The all-in‑one solution, showcased at the LASER, World of Photonics fair, aims to enhance manufacturing efficiency by enabling inline defect detection without the need for external interfaces or multiple suppliers.

- Sustainability-Focused Product Lines: Firms like ESAB and Lincoln Electric launch eco-friendly products. This aligns with sustainability targets.

- Strategic Acquisitions: Global players are expanding through regional acquisitions. These deals offer cost-efficient manufacturing and local market reach.

Current and Potential Growth Implications

a. Demand-Supply Analysis: The need for welding consumables is accelerating in expanding markets. Legacy supply systems are unable to match this growth. Raw material scarcity and political instability are disrupting supply. This is prompting shifts in how companies source materials globally.

b. Gap Analysis: Developed markets benefit from broad access to advanced welding consumables. Meanwhile, developing nations struggle with knowledge gaps, financial barriers, and a shortage of skilled labor. The existing gap presents a market for mid-tier solutions. Such offerings provide a practical compromise between technical capability and affordability.

Top Companies in the Welding Consumables Market

- Lincoln Electric Holdings, Inc.

- ESAB Corporation

- voestalpine Böhler Welding GmbH

- Air Liquide S.A.

- Illinois Tool Works Inc.

- Fronius International GmbH

- Hyundai Welding Co., Ltd.

- Ador Welding Limited

- WeldWire Company, Inc.

- Kobe Steel, Ltd.

Welding Consumables Market: Report Snapshot

Segmentation | Details |

By Product Type | Stick Electrodes, Solid Wires, Flux-Cored Wires, SAW Wires and Fluxes |

By Welding Technique | SMAW, GMAW, FCAW, SAW, TIG |

By Application | Construction, Automotive, Oil & Gas, Shipbuilding, Manufacturing, Aerospace |

By End-User | Industrial, Commercial, Infrastructure |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Flux-Cored Wires: These products are favored in high-load applications. They combine fast weld buildup with operational simplicity.

- Automotive Welding Consumables: As EVs gain market share, welding needs shift. Consumables must now match lighter, modern materials.

- Construction Applications: Strong urban infrastructure growth is driving demand. This is increasing the need for electrodes and solid wires.

Major Innovations

- Smart Welding Consumables: Consumables with RFID can be traced in use. They show data on wear, output, and shelf life.

- Nano-Coated Electrodes: Precise arc stability enhances welding accuracy. Minimizing spatter supports better surface finish and efficiency.

- Environmentally Compliant Fluxes: Low-hydrogen materials improve air quality during welding. Lead-free solutions further support health and environmental goals.

Potential Growth Opportunities

- Expansion into Emerging Markets: Cost drops with local manufacturing. Value lines match the needs of price-conscious areas.

- Integration with Digital Welding Platforms: Real-time feedback helps spot issues fast. AI systems ensure better quality checks.

- Product Customization Services: Catering to niche applications with bespoke formulations and packaging.

Extrapolate Research Says:

Demand for welding consumables is rising steadily. The market is likely to see lasting expansion. More firms now use automated welding systems. So, demand for precise and strong consumables is growing. New materials and eco rules are driving change. Digital tools add more value for end-users. Welding consumables serve more than basic needs. They now support better work and faster progress in major industries. Sustainability and customer knowledge are now key. Players who invest in both will benefit most.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Welding Consumables Market Size

- July-2025

- 140

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021