Waterproofing Chemicals Market Size, Share, Growth & Industry Analysis, By Product Type (Bitumen, Acrylic, Polyurethane, Epoxy, Silicone, Others), By Application (Roofing, Walls, Floors & Basements, Tunnels, Water & Wastewater Management, Others), By End-User (Residential, Commercial, Industrial, Infrastructure), and Regional Analysis, 2024-2031

Waterproofing Chemicals Market: Global Share and Growth Trajectory

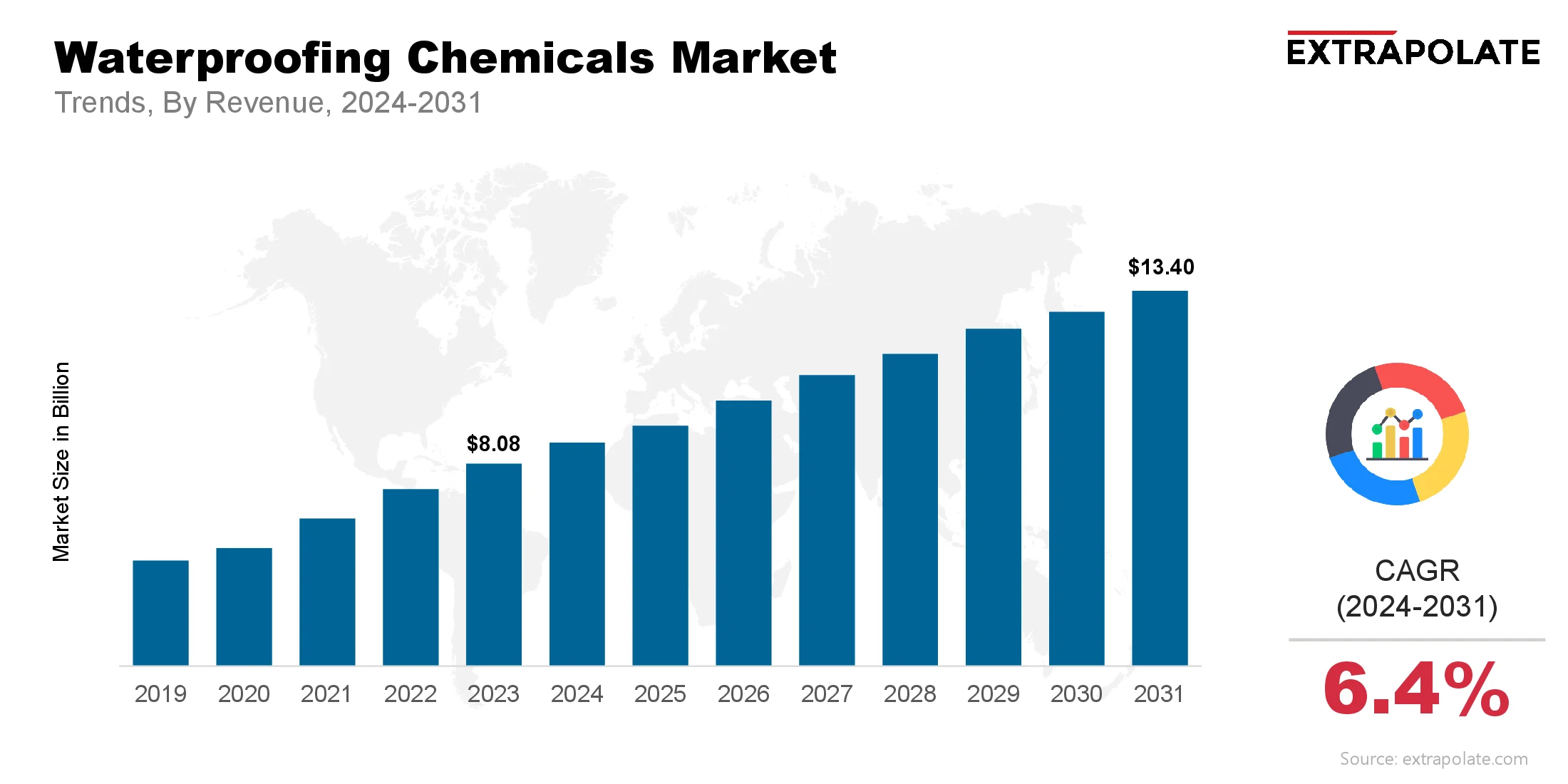

The global Waterproofing Chemicals Market size was valued at USD 8.08 billion in 2023 and is projected to grow from USD 8.65 billion in 2024 to USD 13.40 billion by 2031, exhibiting a CAGR of 6.4% during the forecast period.

The global market is experiencing steady and promising growth, driven by expanding construction activities and increasing demand for long-lasting, water-resistant infrastructure. Waterproofing chemicals are essential components in protecting structures from water infiltration, which can cause damage to foundations, reduce durability, and result in costly repairs. These chemicals are widely used in roofing, basements, walls, and tunnels, as well as in water management systems.

The market is witnessing significant traction in both developed and emerging economies. Rapid urbanization, population growth, and government initiatives for infrastructure development are boosting construction projects across Asia-Pacific, the Middle East, and Latin America. Consequently, the demand for effective waterproofing solutions has grown substantially. Moreover, the increasing awareness among builders and contractors about the long-term benefits of waterproofing—such as enhanced structural integrity and reduced maintenance costs—is further fueling market expansion.

Technological advancements have played a pivotal role in shaping the market landscape. Innovations such as polyurethane membranes, crystalline waterproofing, and bio-based chemicals are gaining popularity due to their improved performance, sustainability, and ease of application. As green building standards and environmental regulations become more stringent, the shift toward eco-friendly and VOC-compliant waterproofing chemicals is also accelerating.

The market's growth trajectory is further supported by the rise in extreme weather events caused by climate change, which has heightened the need for reliable waterproofing systems in flood-prone and coastal regions. In addition, increased investment in smart cities and large-scale infrastructure projects presents lucrative opportunities for manufacturers and suppliers.

With global players focusing on product innovation, strategic collaborations, and regional expansions, the waterproofing chemicals is poised to achieve substantial growth in the coming years, becoming an integral part of sustainable construction practices worldwide.

Key Market Trends Driving Product Adoption

Several dynamic trends are accelerating the adoption of waterproofing chemicals across the globe:

Rise in Infrastructure Development:

Massive investments in infrastructure projects, particularly in emerging economies, are driving demand for waterproofing solutions. Large-scale urban development projects—such as smart cities, highways, rail networks, and water treatment facilities—require advanced waterproofing applications to ensure durability and reduce long-term maintenance costs.

Shift Toward Sustainable Construction:

There is a growing global push toward green buildings and environmentally friendly construction practices. Waterproofing chemicals that are non-toxic, VOC-compliant, and recyclable are gaining traction. As builders strive to meet LEED and other environmental standards, the adoption of sustainable waterproofing solutions is accelerating.

Climate Change and Extreme Weather:

With the increasing frequency of floods, hurricanes, and other extreme weather events due to climate change, waterproofing has become a critical component in building design. Chemicals that offer superior resistance to water ingress are becoming a staple in disaster-prone zones, providing enhanced resilience to infrastructure.

Technological Advancements:

New formulations are being developed that enhance the chemical, thermal, and UV resistance of waterproofing materials. Nanotechnology, hybrid membranes, and polymer-modified bitumen are examples of innovations delivering improved performance. These advancements ensure the effective sealing of complex architectural elements.

Major Players and Their Competitive Positioning

The waterproofing chemicals market is highly competitive, with a diverse mix of multinational corporations and regional players vying for market share. Companies are focused on product innovation, strategic partnerships, mergers and acquisitions, and geographic expansion to maintain competitive advantage.

Prominent players include are BASF SE, Sika AG, Dow Chemical Company, GCP Applied Technologies Inc., Henkel AG & Co. KGaA, Pidilite Industries Limited, RPM International Inc., Fosroc International Ltd., Carlisle Companies Incorporated, Mapei S.p.A. and others.

These companies invest heavily in R&D to develop next-generation waterproofing products that cater to various end-use applications such as residential construction, commercial buildings, and civil engineering projects.

Consumer Behavior Analysis

Consumer demand in the waterproofing chemicals market is shaped by various economic, environmental, and technical factors:

- Demand for Long-Term Cost Efficiency: Consumers, especially institutional buyers and contractors, are increasingly focused on long-term savings. Waterproofing chemicals reduce the need for future repairs and maintenance, thus offering higher return on investment. This cost-efficiency over the lifecycle of a building is a key decision-making factor.

- Preference for Eco-Friendly Products: Green buildings and sustainability are major influencers of purchasing decisions. Consumers are actively seeking waterproofing products that are free from harmful chemicals, reduce carbon footprint, and conform to green certification standards.

- Increasing DIY and Retail Sales: In the residential segment, do-it-yourself waterproofing kits are gaining popularity. Homeowners are investing in waterproof coatings and sealants for rooftops, terraces, and bathrooms. This trend is particularly evident in developed markets with a strong culture of home maintenance.

- Awareness of Water Damage Risks: Water damage is a growing concern. So, more buyers want strong waterproofing solutions. Leaks bring mold, damage, and electric danger. These risks make buyers choose strong sealing systems.

Pricing Trends

Price changes with formula, use method, and strength. Supply in each area also impacts cost. Common types differ in price and use. Bitumen is basic, while others like PU suit advance jobs.

Old materials like bitumen stay popular for low cost. Advanced ones like crystalline compounds cost more but last longer.

Construction firms and project developers buy in large amounts. This helps them get better prices over time. Higher material and transport costs are raising prices. Makers now improve supply chains and try green options.

Growth Factors

Several critical factors are propelling the growth of the waterproofing chemicals market:

- Expanding Construction Sector: More projects are coming up across the world. This boosts the need for related products. With more people and new projects, better buildings are needed. Waterproofing plays a key role in every step.

- In March 2025, Eternity Waterproofing announced a strategic partnership with MAPEI Far East to enhance the quality and performance of waterproofing solutions in Southeast Asia. The collaboration aims to leverage MAPEI’s advanced materials and Eternity’s local expertise to meet growing regional infrastructure demands.

- Regulatory Compliance: New codes and laws are in place for buildings. They make waterproofing a must in many cases. Following these rules leads to safer and stronger buildings. This raises the need for approved chemicals.

- Advancements in Chemical Engineering: Continued research has boosted product features. Modern solutions now protect from water, fire, heat, and UV. Multifunctional traits raise demand. These products now serve wide areas and uses.

- Urban Flooding and Water Infiltration: Urban areas often suffer from floods and blocked drains. Waterproofing is the smart way to reduce damage. Tunnels and basements are prone to leaks. This has led to more use of top-grade sealing solutions.

Regulatory Landscape

Many laws guide the waterproofing chemicals market. They focus on safety, the environment, and how well products work.

- Environmental Regulations: Strict environmental rules now limit the use of VOCs. These rules are forcing changes in how products are made. In Europe, the REACH regulation restricts the use of harmful substances, while the U.S. EPA enforces air quality standards that affect product chemistry.

- Certification Standards: Products used in waterproofing must meet various industry-specific certification standards such as ASTM (USA), EN (Europe), and BIS (India). Waterproofing materials must pass tests on water leaks, stretchiness, and chemical hold-up. Certifications show they meet these checks.

- Building Codes: Governments are tightening rules on construction safety. Many now make waterproofing a design must-have. They guard buildings against leaks and cracks. At the same time, they promote sustainable methods.

Recent Developments

Several recent developments highlight the evolving dynamics of the waterproofing chemicals market:

- Sustainable Innovations: Sustainability needs are shaping product design. Sika and BASF now use plant-based or renewable materials in waterproofing.

- Smart Coatings: Waterproofing is getting smarter with nanotechnology. These nano-coatings fix small damage and adapt to changes like heat or moisture.

- Expansion into Emerging Economies: Firms are expanding where demand is rising. Asia-Pacific, Latin America, and Africa lead this growth. Infrastructural growth boosts demand in these regions. Government support makes expansion easier for companies.

- Strategic Acquisitions: Pidilite added Nina Waterproofing to expand its presence in construction chemicals. This shows how firms are joining forces in the sector.

- Digital Tools for Application Monitoring: Contractors are adopting digital solutions and mobile apps to ensure correct application of waterproofing chemicals, thereby improving performance and compliance.

Current and Potential Growth Implications

a. Demand-Supply Analysis:

More demand is pushing makers to boost output. At the same time, they must keep product quality high. Volatile costs of raw materials, like oil-based ones, cause issues. They affect how steadily products can be made. Due to price spikes and lack of supply in some zones, companies changed plans. They now use wider, more flexible supply chains.

b. Gap Analysis:

The surge in waterproofing needs strong, expert handling on-site. Yet, not enough skilled applicators are available to meet this demand. More buildings and structures now require advanced waterproofing. Still, many regions face a gap in trained labor for correct application. To improve how products are used, companies offer training. They teach both builders and end-users through certified modules.

Top Companies in the Waterproofing Chemicals Market

- BASF SE

- Sika AG

- Dow Chemical Company

- Pidilite Industries Limited

- GCP Applied Technologies Inc.

- Mapei S.p.A.

- Fosroc International Ltd.

- Carlisle Companies Inc.

- Henkel AG & Co. KGaA

- RPM International Inc.

Waterproofing Chemicals Market: Report Snapshot

Segmentation | Details |

By Product Type | Bitumen, Acrylic, Polyurethane, Epoxy, Silicone, Others |

By Application | Roofing, Walls, Floors & Basements, Tunnels, Water & Wastewater Management, Others |

By End-User | Residential, Commercial, Industrial, Infrastructure |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are poised for substantial growth:

- Polyurethane-Based Products: These coatings work on many surfaces. Their strength and flexibility boost demand. Flat roofs benefit from these coatings due to their strong seal. Below ground, they prevent moisture from entering walls and slabs.

- Infrastructure Applications: Use of waterproofing is rising in large structures. It keeps tunnels and bridges safe from leaks. Strong waterproofing keeps large sites safe. It guards against leaks and wear.

Major Innovations

Recent innovations in the waterproofing chemicals market include:

- Crystalline Waterproofing: The mix reacts to wet spots by forming crystals. These crystals fix small cracks rapidly.

- Bio-Based Waterproofing: These materials come from clean, green sources. Their use helps reduce harmful impact on the planet. They match the strength and quality of older methods.

- Hybrid Membranes: Adding polymers to bitumen improves how the membrane moves and lasts. It bonds tight and resists UV rays in rough spots.

Potential Growth Opportunities

The market presents promising growth avenues such as:

- Expansion into Rural and Semi-Urban Areas: Governments are driving affordable housing programs to meet growing demand. They are also promoting infrastructure upgrades in rural areas. Waterproofing brands can use this platform to roll out budget-friendly options. They can also showcase products designed for fast and easy use.

- Integration with Smart Construction Materials: Waterproofing chemicals that can integrate with smart sensors to detect leakage or stress conditions represent an exciting frontier in construction technology.

Extrapolate says:

Waterproofing products are seeing more use. This will drive strong market growth. Better waterproofing is in demand. Growth comes from tech, eco rules, and new buildings. Firms now focus on tech and the planet. This brings better and longer-lasting structures.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Waterproofing Chemicals Market Size

- July-2025

- 140

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021