Radar Absorbing Materials Market Size, Share, Growth & Industry Analysis, By Material Type (Carbon-Based RAMs, Conducting Polymers, Dielectric RAMs, Magnetic RAMs, Nanocomposite RAMs) By Technology (Coatings, Foams, Films, Textiles, Laminates) By Application (Military & Defense, Aerospace, Automotive, Electronics, Telecommunications) By End-User (Government Agencies, Defense Contractors, OEMs, Commercial Enterprises), and Regional Analysis, 2024-2031

Radar Absorbing Materials Market: Global Share and Growth Trajectory

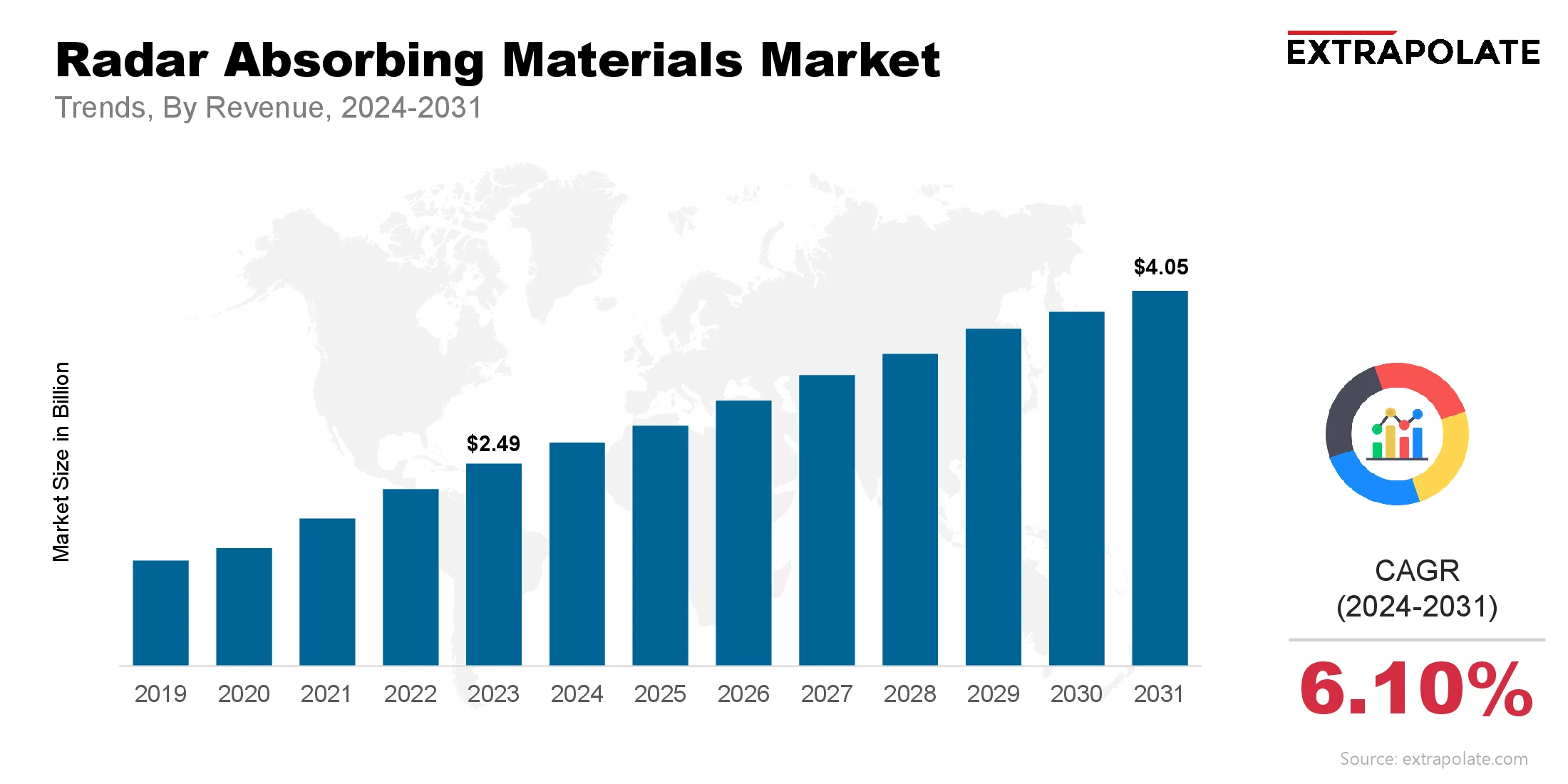

The global Radar Absorbing Materials Market size was valued at USD 2.49 billion in 2023 and is projected to grow from USD 2.67 billion in 2024 to USD 4.05 billion by 2031, exhibiting a CAGR of 6.10% during the forecast period.

The global radar absorbing materials (RAM) market is growing rapidly. This growth is driven by the rising need for stealth technologies in military, aerospace, and defense sectors. RAMs are specialized materials that absorb radar waves. They help reduce the radar cross-section (RCS) of vehicles, equipment, and structures. With modern warfare becoming more advanced, stealth missions are increasing. Governments and defense contractors are now investing heavily in radar absorbing solutions. These investments aim to maintain a strategic edge over adversaries.

The market is gaining strong momentum. New applications are appearing in both military and civilian fields. Innovations in electromagnetic wave absorption are pushing the market forward. Advances in miniaturization and multifunctional materials are also expanding RAM use. These materials are now used in combat aircraft, naval vessels, and drones. Civilian vehicles are also beginning to adopt RAM technologies. Radar absorbing materials are becoming essential for stealth and electronic warfare. The global modernization of armed forces is continuing at a fast pace. At the same time, radar systems are becoming more advanced. Together, these trends are driving RAM demand to new heights.

Key Market Trends Driving Product Adoption

Rise in Stealth Technology Demand

Stealth capabilities are now vital in modern defense. Reducing radar visibility for aircraft, ships, and ground vehicles is a key goal. This is driving the use of radar absorbing materials (RAM).

Governments are investing in stealth fighters, submarines, and UAVs. These platforms rely heavily on RAM for better concealment. As global tensions grow, defense budgets are rising. This is leading to record-high demand for RAM solutions.

Technological Advancements in RAM Design

New advances in nanotechnology and material science are transforming RAM design. Materials like carbon nanotubes, graphene, and magnetic composites offer better absorption and wider frequency coverage.

The use of metamaterials and multi-layer composites is also growing. These enhance RAM's ability to absorb high-frequency radar signals. Such improvements boost stealth capabilities in both military and commercial settings.

Growth of Unmanned Aerial Vehicles (UAVs)

UAVs are now widely used for surveillance, reconnaissance, and combat missions. To avoid radar detection, many UAVs are coated with RAM.

As UAVs become more common in defense and border security, the need for lightweight and effective RAMs is rising fast.

Electromagnetic Interference (EMI) Shielding in Civil Applications

Defense remains the main market for RAMs, but civilian use is increasing. These materials are being used in automotive radar, telecom, and electronics.

The spread of 5G and IoT devices has caused a rise in electromagnetic interference. This creates a strong need for shielding solutions.

RAM-based materials are now used in consumer electronics, antennas, and satellites. They help reduce signal reflection and improve performance.

Major Players and Their Competitive Positioning

The radar absorbing materials market is characterized by a mix of established defense contractors, specialty chemical firms, and emerging tech startups. These players are focused on R&D to enhance material performance and widen product portfolios. Leading players include: Laird Performance Materials, Huntsman Corporation, Parker Hannifin Corp., Rogers Corporation, Soliani EMC S.r.l., BAE Systems plc, Lockheed Martin Corporation, Stealth Coatings Inc., Lyncole XIT Grounding, and MAST Technologies.

These companies are actively pursuing strategic partnerships with defense agencies, conducting joint ventures, and acquiring innovative startups to strengthen their market positioning. The ability to offer customizable, frequency-selective, and multi-functional RAM products is becoming a key competitive advantage.

Consumer Behavior Analysis

- Defense Procurement Priorities: Government defense agencies are the primary customers in the RAM market. Their procurement decisions are based on performance benchmarks such as absorption bandwidth, weight, thermal stability, and environmental resistance. Preference is given to suppliers offering proven field-tested materials, supported by compliance with military standards and global defense certifications.

- Shift Towards Lightweight and Flexible Materials: With the proliferation of agile combat platforms and UAVs, there is growing demand for RAMs that are lightweight and flexible. Consumers now prioritize products that do not compromise vehicle agility or payload capacity. Manufacturers responding with aerodynamically stable and form-fitting coatings are gaining traction among high-value clients.

- Cost and Performance Balance: Cost plays a crucial role in material selection, especially in large-scale projects. While traditional RAMs such as iron ball paints and ferrite-based composites are cheaper, modern carbon-based and nanomaterial-infused variants offer superior performance at a higher price. Decision-makers are increasingly evaluating lifecycle costs, balancing initial investments against long-term operational advantages.

- Environmental and Regulatory Compliance: Military and industrial buyers are also placing greater emphasis on environmental sustainability and safety standards. Non-toxic, RoHS-compliant RAMs with reduced volatile organic compounds (VOCs) are favored in regions with stringent environmental regulations, such as the European Union and North America.

Pricing Trends

The pricing of radar absorbing materials is highly variable, influenced by factors such as material type, frequency range, thickness, and customization needs. Traditional materials like ferrite tiles and carbon-loaded foams are relatively affordable and widely used in fixed installations. However, advanced RAMs using nanomaterials, dielectric polymers, and metamaterials command premium prices due to their performance and complexity.

Bulk pricing is common in government defense procurement, with economies of scale reducing unit costs significantly. On the other hand, tailored RAM solutions for UAVs or space applications involve custom R&D, driving prices higher. Leasing models and integrated supply contracts are emerging to address budget constraints, particularly in developing economies.

Growth Factors

- Escalating Global Defense Spending: The increase in global military expenditure, particularly in Asia-Pacific, North America, and the Middle East, is a major catalyst for RAM demand. Countries like the U.S., China, India, and Saudi Arabia are investing in advanced defense systems, which require radar stealth capabilities. RAMs are essential components in the design of next-gen stealth fighters, frigates, and land-based weapon systems.

- Integration of RAMs in Space Technologies: As commercial space launches multiply, the need to manage radar signatures and EMI interference in satellites and spacecraft is growing. RAMs are increasingly being used in satellite enclosures, shielding systems, and payload bays to ensure signal clarity and reduce detection. This space-driven demand is unlocking a promising frontier for RAM suppliers.

- Modernization of Military Platforms: Upgrades to legacy military systems often include retrofitting with radar absorbing materials. From tanks to helicopters, radar stealth retrofits extend platform life and improve battlefield survivability. Nations seeking to modernize rather than replace fleets are generating new growth avenues for RAM providers.

Surge in Electronic Warfare Threats: As radar systems grow more sophisticated, so do the threats. Countries are investing in countermeasure technologies that reduce RCS and evade detection. Radar absorbing materials are key to neutralizing active and passive radar systems, enhancing tactical superiority in electronic warfare environments.

Regulatory Landscape

The radar absorbing materials market is heavily regulated due to national security, performance specs and material safety. Key regulations include:

- ITAR and EAR (U.S. Export Controls): Many RAMs are military grade and subject to strict export controls under ITAR and EAR.

- NATO Standards: RAMs used in NATO countries must meet specific performance and material specs to ensure interoperability and commonality across the military.

- REACH and RoHS: In Europe, RAM manufacturers must comply with REACH and RoHS for civil applications.

- MIL-STD Compliance: Products must meet military specs for flame resistance, impact resistance, electromagnetic attenuation and durability in harsh environments.

Recent Developments/Market Highlights

- Graphene RAMs on the Rise: Researchers and companies are turning to graphene for its incredible electrical conductivity and light weight. These materials are performing well across the entire electromagnetic spectrum and are in production now.

- US Defense Contracts for Stealth Aircraft: The US Department of Defense has awarded multi-million dollar contracts for next gen stealth platforms with advanced RAMs. This shows immense government backing.

- 3D Printed RAMs Emerges: Additive manufacturing is being used to create custom RAM components with complex geometries. Reduces lead times and enables field ready solutions for rapid deployment.

- Asia-Pacific Goes Domestic: China, India and South Korea are investing in domestic RAM production, looking for self sufficiency and reduced imports as tensions rise.

The development of a next-generation radar-absorbing fiber-reinforced composite, a broadband, flexible material that offers up to -40 dB reflection loss (≈ 99.99 % absorption), was announced by FibreCoat GmbH (Germany) in July 2025. It outperforms current RAM solutions by up to 100× and is scheduled for field testing later in 2025. It retains performance across curved and sloped surfaces.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Supply of high performance RAMs is limited by complex manufacturing processes and material availability. As demand outstrips supply, especially in aerospace and defense segments, manufacturers are ramping up and investing in new production lines. Nanocomposites and scalable synthesis will bridge the gap over time.

b. Gap Analysis

Demand is growing but affordability is a challenge. Developing nations and mid-tier defense systems can’t afford advanced RAMs. Lack of standardization across applications is a barrier to interoperability and efficiency. There is a big opportunity for suppliers who can offer cost effective, modular RAMs that balance performance with price.

Top Companies in the Radar Absorbing Materials Market

- Laird Performance Materials

- Huntsman Corporation

- Lockheed Martin Corporation

- BAE Systems

- Rogers Corporation

- Soliani EMC S.r.l.

- Stealth Coatings Inc.

- MAST Technologies

- Parker Hannifin Corp.

- Raytheon Technologies

Radar Absorbing Materials Market: Report Snapshot

Segmentation | Details |

By Material Type | Carbon-Based RAMs, Conducting Polymers, Dielectric RAMs, Magnetic RAMs, Nanocomposite RAMs |

By Technology | Coatings, Foams, Films, Textiles, Laminates |

By Application | Military & Defense, Aerospace, Automotive, Electronics, Telecommunications |

By End-User | Government Agencies, Defense Contractors, OEMs, Commercial Enterprises |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Fastest Growing Segments

- Carbon-Based RAMs: Lightweight and efficient across wide radar frequencies, these are gaining popularity. UAVs and stealth drones are driving segment growth.

- Military & Defense: This is the largest RAM market with continuous demand from armed forces for aircraft, naval vessels and land vehicles.

- Asia-Pacific: Military modernization programs, indigenous manufacturing and increasing defense budgets make Asia-Pacific the fastest growing market.

Innovations

- Frequency-Selective RAMs: Materials that absorb specific frequencies to match threat profiles are being developed, making platforms more versatile.

- Smart RAMs: Sensors integrated within RAM layers allow real-time monitoring of structural integrity and electromagnetic performance.

- Transparent RAMs: Optical materials innovations enable stealth without compromising visibility, essential for cockpits and sensors.

Radar Absorbing Materials Market: Growth Opportunities

- Civil Applications: EMI shielding in automotive electronics, telecom equipment and consumer electronics is an untapped opportunity for RAM solutions.

- Low Cost RAM for Emerging Markets: Simplified manufacturing and cost optimization can make RAM technology accessible to smaller defense budgets.

- Space Exploration and Satellite Shielding: As satellite deployment increases, RAM for EMI shielding and radar stealth will grow big time.

Extrapolate Research Says

The radar absorbing materials (RAM) market is set for strong growth. This growth is driven by rising investments in stealth technologies. Advanced material innovations are also playing a key role. Evolving electronic warfare strategies are further boosting demand. Defense forces around the world are focusing on radar evasion. They are aiming for better operational superiority. As a result, the need for high-performance and cost-effective RAM solutions is increasing.

New applications are also emerging. These include aerospace, space exploration, and commercial EMI shielding. Such uses are expanding the market’s overall potential. Extrapolate highlights a major shift in technology. The use of nanomaterials is gaining ground. AI-driven design is making RAM smarter. 3D-printed RAM is adding flexibility and speed to development.

For clients, this creates a strong investment opportunity. Scalable and high-frequency absorption technologies are in high demand. There is also a chance to build strategic partnerships. These apply to both developed and emerging markets. The future of radar stealth goes beyond invisibility. It is about smart, adaptive, and mission-critical materials. These materials will boost performance across multiple domains.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Radar Absorbing Materials Market Size

- August-2025

- ���1���4���0

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021