Picric acid Market Size, Share, Growth & Industry Analysis, By Product Type (Wet Picric Acid, Dry Picric Acid) By Application (Explosives Manufacturing, Metallurgical Etching, Laboratory Reagent, Forensic and Biomedical Research, Dye Intermediates) By End-User (Defense & Military, Research Laboratories, Metallurgical Industry, Academic Institutions, Specialty Chemical Manufacturers), and Regional Analysis, 2024-2031

Picric Acid Market: Global Share and Growth Trajectory

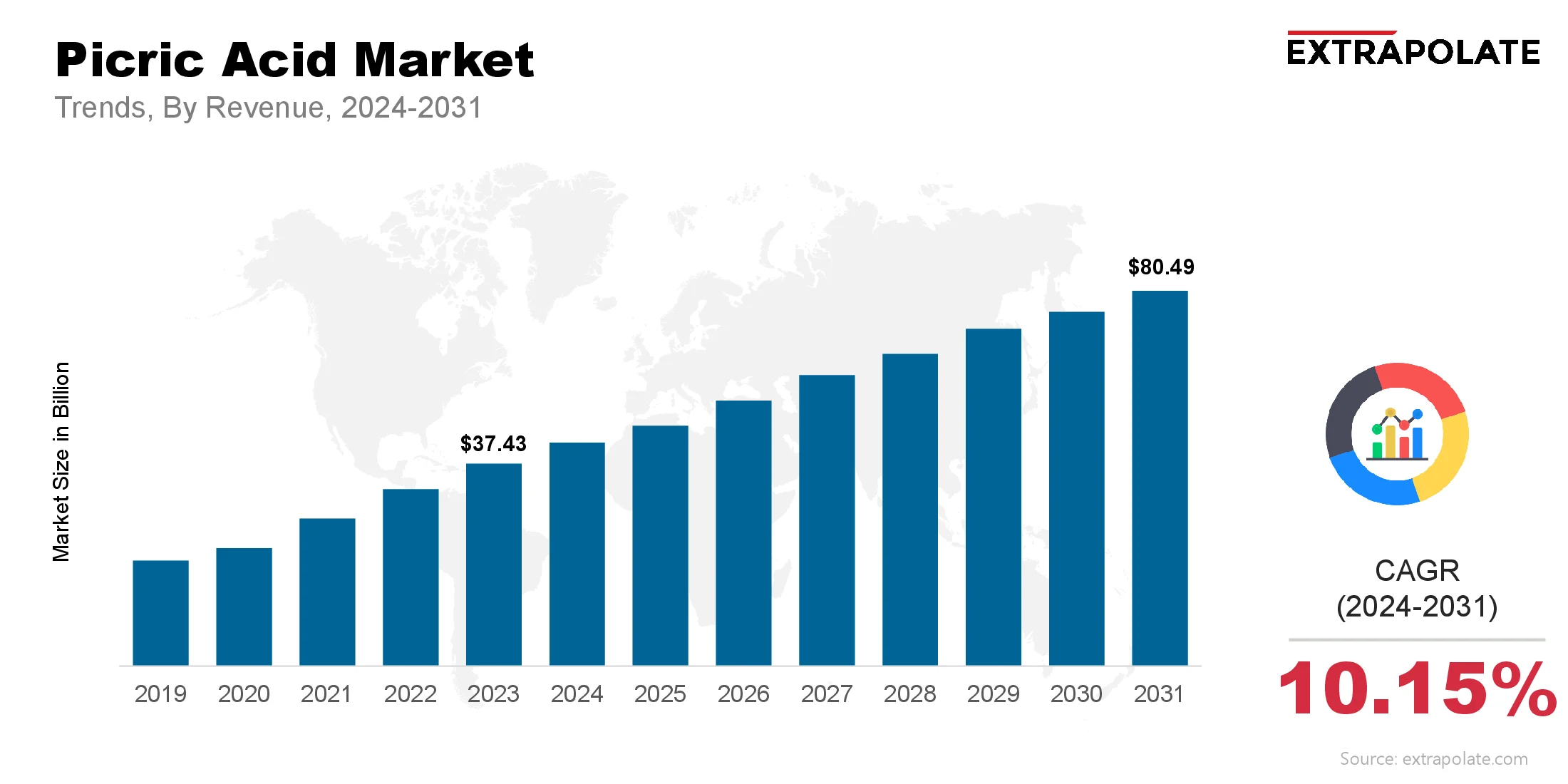

The global Picric Acid Market size was valued at USD 37.43 billion in 2023 and is projected to grow from USD 40.90 billion in 2024 to USD 80.49 billion by 2031, exhibiting a CAGR of 10.15% during the forecast period.

The global market is advancing steadily, driven by its relevance in niche industrial, research, and defense applications. Despite safety concerns and regulatory constraints, picric acid remains a vital compound in the synthesis of explosives, metallurgical analysis, and chemical reagents. Its sharp reactivity and chemical stability make it valuable in controlled environments, particularly in laboratories and defense manufacturing.

This market is shaped by evolving safety standards, ongoing military modernization efforts, and growing demand from the academic and industrial research community. Although newer and safer alternatives exist, the precision and performance of picric acid in critical applications ensure its continued presence in the global chemical supply chain.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Rising Use in Defense and Explosives Sectors

Picric acid's primary historical application has been in the manufacture of explosives, including boosters, detonators, and propellants. Military-grade explosives still rely on its powerful energetic properties in some formulations. As global defense budgets increase particularly in the Asia-Pacific and Middle Eastern regions demand for traditional and hybrid explosive materials, including picric acid, continues to persist.

Growth in Metallurgical and Industrial Applications

In metallurgy, picric acid plays a key role in etching processes for structural analysis of metal components. This is vital in quality control for aerospace, automotive, and heavy industries. The expanding use of high-performance metals and alloys has renewed the demand for precision etching agents, with picric acid offering effective results.

Continued Demand in Scientific Research

Despite being replaced in many standard laboratory applications, picric acid remains crucial in some analytical methods and biochemical assays. It’s used for protein precipitation and as a component in Bouin’s solution for tissue preservation in histology. With global investments in R&D rising, research institutions continue to utilize picric acid in controlled, small-scale settings.

Stability as a Specialty Chemical

As a specialty chemical, picric acid offers consistency and reliability for limited but essential uses. These include dye intermediate production, synthesis of picrate salts, and forensic analysis. While not used in mass-market applications, its role in specialized fields has secured a stable demand base.

Major Players and Their Competitive Positioning

The picric acid market comprises global chemical manufacturers and specialty reagent suppliers who cater to research, industrial, and military clients. Key players include: Merck KGaA, Thermo Fisher Scientific Inc., Loba Chemie Pvt. Ltd., CDH (Central Drug House), Santa Cruz Biotechnology, Finetech Industry Limited, Yongda Chemical Co., Ltd., Otto Chemie Pvt. Ltd., Indian Chemical Industries, and Spectrum Chemical Mfg. Corp.

These companies focus on consistent quality, safe packaging, and regulatory compliance. Many offer wet picric acid to minimize risks associated with storage and handling. Product development is largely centered on improving safety and ease of transportation rather than modifying the compound itself.

Consumer Behavior Analysis

- Preference for Safety in Handling: Consumers particularly in research and military procurement favor wet picric acid, which is stabilized with water to reduce sensitivity. Safety has become the defining purchasing criterion, with institutions investing in secure storage, detailed labeling, and stringent safety protocols.

- Limited But Specialized Usage: Picric acid’s usage is highly targeted. Institutions that purchase it often require small but high-purity quantities for niche uses. These include etching metal samples, preparing histological slides, or conducting specific explosives-related research. Buyers are typically well-informed about safety procedures and prefer suppliers with reliable compliance certifications.

- Cost vs. Risk Evaluation: The high cost of compliance in storage and disposal adds to the overall expense of using picric acid. However, organizations that require its unique properties often find few viable substitutes, justifying continued investment. Academic institutions, for example, may budget specifically for its acquisition under tightly controlled conditions.

- Education and Training Influence Demand: Institutions with trained personnel and appropriate infrastructure are more likely to use picric acid regularly. Demand is closely linked to personnel expertise, especially in laboratory and defense settings where improper handling can lead to hazardous incidents.

Pricing Trends

Picric acid is priced based on its form (wet or dry), purity, packaging, and transportation requirements. Laboratory-grade picric acid can range from USD 300 to USD 1000 per kilogram depending on specifications. Industrial-grade or bulk quantities may be lower, though still affected by international safety and shipping regulations.

Prices are also influenced by storage and disposal costs, which are significant due to the compound's classification as an explosive and hazardous substance. Suppliers often offer value-added services such as training manuals, compliant containers, and return policies for unused or expired material.

Growth Factors

Military Modernization Programs: With many countries upgrading their military infrastructure, there is a corresponding need for reliable energetic materials. Although its use in frontline explosives is declining, picric acid still plays a role in booster compositions and legacy munitions. This indirectly boosts demand from defense contractors and government labs.

- Expanding Research Activities: Chemical and material science research continues to evolve. Picric acid’s consistent behavior in controlled conditions makes it ideal for repeatable scientific studies. Whether in the study of picrate salts, colorimetric analysis, or nitration reactions, its use persists in advanced research.

- Industrial Applications in Metallurgy: Picric acid's application in etching for metallographic studies remains indispensable for examining grain structures and phase distributions in metals. As global infrastructure and manufacturing expand, demand for accurate material characterization supports continued usage.

- Forensic Science and Histology: In forensic pathology, picric acid remains a viable component in tissue preservatives. It helps preserve cell structure and is still used in legacy protocols. Though modern chemicals are emerging, some laboratories and procedures continue to prefer it due to its efficacy and familiarity.

- Regulatory Landscape: Regulation plays a significant role in the global picric acid market due to its classification as both a hazardous material and an explosive.

- United States (OSHA, DOT, EPA): In the U.S., agencies such as OSHA and the Department of Transportation impose strict rules on the storage, labeling, and transport of picric acid. EPA regulations also govern its disposal, classifying it as hazardous waste.

- Europe (REACH, CLP): Under EU REACH and CLP rules, picric acid is listed as Category 1 explosive. This classification dictates strict controls. Compliance involves chemical registration, hazard assessment, and sharing safety data. These steps apply across the entire supply chain.

- International Transport (UN Class 1.1D or 4.1): International transport of picric acid follows UN Model Regulations. These standards ensure safe handling of hazardous materials. The substance is identified by UN Codes 0154 and 1344. Packaging and handling vary based on its wet or dry state.

- ISO Standards: Compliance with ISO hazardous material guidelines is required for picric acid. This involves strict rules on labeling, packaging, and workforce education.

Recent Developments

- Stabilized Formulations Gaining Traction: To improve safety, suppliers offer picric acid with additives. These formulations reduce risks during transport and storage.

- Adoption of Safer Packaging: Advanced packaging methods aim to minimize sensitivity. They protect against shock and temperature fluctuations. Packaging advances feature vacuum-sealed pouches. Gel suspensions provide additional safety benefits.

- In July 2025, Niederwieser Group, Dow, and Kuraray launched a fully recyclable vacuum pouch made from polyethylene with an EVOH barrier. The pouch meets EU recycling standards while offering strong durability and extended food shelf life.

- India Boosts Domestic Production: India’s defense self-reliance initiative has boosted domestic chemical production. This includes explosive precursors such as picric acid.

- Research into Substitutes: Research into safer alternatives to picric acid is ongoing globally. Direct benefits to the picric acid market are limited at present. Substitutes frequently lack the required efficacy. Picric acid continues to provide reliable stability in critical applications.

Current and Potential Growth Implications

Demand-Supply Analysis

The supply chain for picric acid is steady. Limited producers cater to niche applications. Demand is focused on defense, metallurgy, and scientific research sectors. These areas represent the primary market for picric acid. Regulatory issues dominate supply constraints. Adhering to laws on hazardous material handling affects availability.

Gap Analysis

Despite stable demand, market expansion is limited by:

- Lack of awareness in emerging markets

- High cost of regulatory compliance

- Risk aversion among industries without established safety infrastructure

Gaps in safety can be reduced through safer chemical analogs. Packaging innovations may also ease handling for small-scale users.

Top Companies in the Picric Acid Market

- Merck KGaA

- Thermo Fisher Scientific

- CDH (Central Drug House)

- Loba Chemie

- Santa Cruz Biotechnology

- Finetech Industry Limited

- Otto Chemie

- Indian Chemical Industries

- Yongda Chemical Co., Ltd.

Picric Acid Market: Report Snapshot

Segmentation | Details |

By Product Type | Wet Picric Acid, Dry Picric Acid |

By Application | Explosives Manufacturing, Metallurgical Etching, Laboratory Reagent, Forensic and Biomedical Research, Dye Intermediates |

By End-User | Defense & Military, Research Laboratories, Metallurgical Industry, Academic Institutions, Specialty Chemical Manufacturers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Wet Picric Acid: Increasingly preferred due to reduced sensitivity and easier handling compliance.

- Metallurgical Etching: Driven by demand in quality control and materials science.

- Defense Sector: Persistent demand for legacy explosives and booster compositions.

Major Innovations

- Pre-Stabilized Solutions: Efforts are underway to develop lab-safe preparations. These aim to reduce shock sensitivity and simplify handling.

- New Packaging Formats: Tamper-proof and explosion-proof containers for global transport.

- Controlled Reactivity Additives: Studies are focused on improving dry picric acid storage. Chemical buffers are being developed to enhance stability.

Potential Growth Opportunities

- Expansion in Defense Contracts: Military budgets are rising in Asia and Eastern Europe. This trend may lead to higher government procurement.

- Chemical Research Growth: Increased investment in materials chemistry by universities and institutes may boost demand. Legacy reagents such as picric acid could see renewed use.

- Customized Industrial Applications: Emerging applications in specialty dyes and sensors could reopen dormant demand segments.

Extrapolate says:

The picric acid market is stable and highly specialized. It remains technically essential across specific industrial applications. Widespread adoption of newer chemicals has reduced usage in some areas. Yet, certain critical functions still depend on the unique properties of picric acid. Market strategies are increasingly shaped by compliance demands. Broader growth depends on innovation in safety standards. Despite industry changes, picric acid continues to play a vital role. It supports key functions across defense, metallurgy, and scientific research.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Picric acid Market Size

- July-2025

- ���1���4���0

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021