Composite Resin Market Size, Share, Growth & Industry Analysis, By Resin Type (Thermoset, Thermoplastic), By Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, Other Fiber Composites), By Manufacturing Process (Lay-up, Filament Winding, Injection Molding, Pultrusion, Compression Molding, RTM, Others), By Application (Construction & Infrastructure, Transportation, Electrical & Electronics, Pipes & Tanks, Wind Energy, Marine, Aerospace & Defense, Others), and Regional Analysis, 2025-2032.

Market Definition

The global composite resin is the production, distribution and application of a wide range of polymer based materials reinforced with fibers to create composite structures. These resins, thermoset and thermoplastic, are the matrix that binds the fibers, glass, carbon or natural fibers, to give the final material high strength to weight ratio, durability and resistance to corrosion and chemical damage. These materials are key to many high performance industries, aerospace and defense, automotive, wind energy and construction. The market is dynamic with continuous innovation to develop lighter, stronger and more sustainable solutions to meet the changing demands of modern engineering and manufacturing.

Key Insights

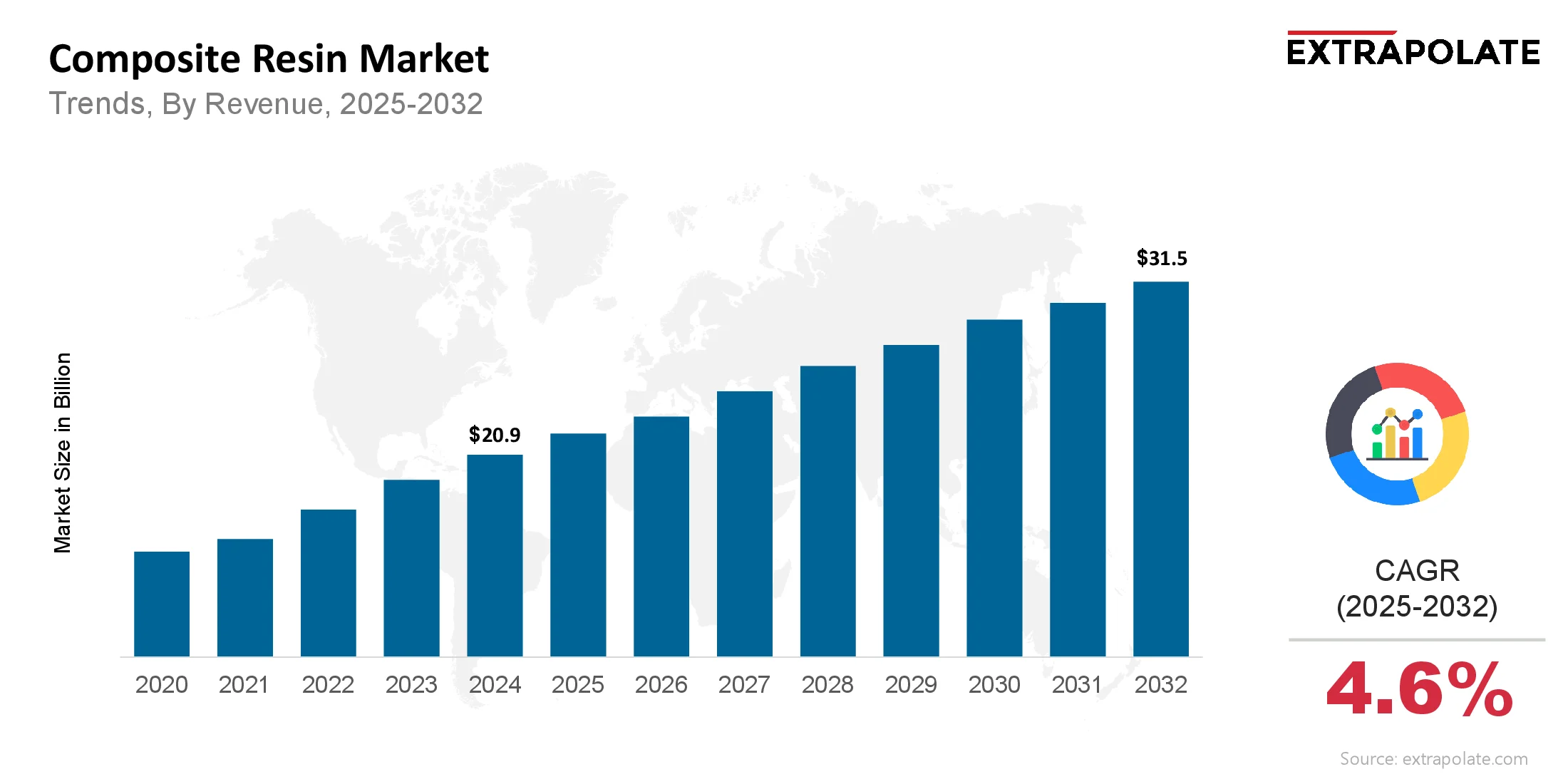

- Global composite resin market was valued at $20.9 billion in 2024.

- Market is expected to reach $31.5 billion by 2032, growing at a CAGR of 4.6% from 2025 to 2032.

- Asia-Pacific will be the largest region by 2032, driven by industrialization and infrastructure projects.

- Thermoset is the largest resin type, due to its durability, chemical resistance and inert composition.

- Automotive & Transportation is the largest application segment, driven by use of composites in lightweighting vehicles to improve fuel efficiency and performance.

- Growing demand for lightweight materials across industries, especially in automotive and aerospace, where composite resins offer better strength to weight ratio than traditional fasteners.

- A major trend is the focus on sustainable and bio-based composite materials due to environmental regulations and global push for sustainability.

Market Summary Financials

The global composite resin market has been growing steadily as it is an essential part of modern industrial processes. In 2024 the market was valued at $20.9 billion. It is expected to grow significantly to $31.5 billion by 2032. The growth is backed by a 4.6% CAGR from 2025 to 2032 showing the continuous demand and increasing applications of composite resins across various industries.

Detailed Analysis Content

Key Market Trends

Several major trends are driving both product and application of global composite resin market. High strength, lightweight materials is the new trend. Composite resins are being used in wind energy, automotive and aerospace to create lighter, stronger and more fuel efficient components. Eco friendly solutions and sustainability is another major trend. Research on recycled composites, bio based polymers and more efficient production techniques is being driven by this. Also the market is seeing an increase in smart composites that uses sensors and Internet of Things devices to continuously monitor structural integrity and performance. This is especially important in high risk applications like civil infrastructure and aerospace.

Major Players

The global composite resin market is characterized by a strong presence of key players, including:

- Huntsman Corporation

- Hexcel Corporation

- Mitsubishi Chemical Holdings Corporation

- Solvay

- BASF SE

- Hexion

- Owens Corning

- Teijin Ltd.

- Toray Industries, Inc.

- Arkema

- SGL Carbon

- AOC, LLC

- Ashland Inc.

- Gurit Holding AG

These companies are constantly innovating and expanding their capacities to meet the rising demand across various end-use industries.

Consumer Behavior Insights

Business value and functionality drive consumer behavior in the B2B composite resin market. Important considerations for industrial clients while making decisions are:

- Performance and Durability: In order to lower maintenance costs and increase the lifespan of their products, customers need composite resins with superior strength to weight ratios, corrosion resistance, and long-term durability.

- Cost: Although composites may initially cost more than traditional materials, consumers weigh the benefits from improved fuel economy, lower maintenance, and longer service life when calculating the overall cost of ownership.

- Sustainability: In order to satisfy their own corporate sustainability objectives and legal obligations, an increasing number of industrial clients are searching for suppliers who can offer ecologically friendly and sustainable composite solutions.

- Technology: The ability of composite resins to be used with advanced manufacturing processes like injection molding and pultrusion is a key decision making factor.

Pricing Trends

The cost of raw materials, the complexity of manufacturing, and the dynamics of supply and demand all affect composite resin prices. The market is challenged by the high cost of raw materials and capital-intensive apparatus, which might restrict adoption, particularly in applications where costs are a concern. Nonetheless, big businesses are spending money on research and development to create more affordable composite grades that nonetheless perform well. Prices are rising as a result of the growing demand for composites, particularly in rapidly expanding industries like wind energy and aerospace. Nonetheless, advancements in manufacturing techniques are contributing to increased productivity and decreased production costs, which over time may stable or decrease the price of the finished product.

Growth Drivers

Several factors are driving the growth of global composite resin market:

- Lightweight Materials: The need for fuel efficiency and reduced carbon emissions in transportation and aerospace is the primary driver. Composite resins being lighter than metals are ideal for manufacturing lighter vehicles and aircraft.

- Renewable Energy: The rapid growth of wind energy is a major growth driver. Composite resins are essential for manufacturing large, durable and lightweight wind turbine blades.

- Construction and Infrastructure: The increasing use of durable, corrosion resistant materials for modern construction projects including bridges, facades and pipes is driving the market growth.

- Technology: Continuous R&D in composite materials is leading to new applications and improvements in performance making them more attractive to wider range of industries.

Regulatory Landscape

The composite resin market is affected by regulations and standards, especially around environmental impact and safety. The EU’s “Fit for 55” package is pushing for renewable energy and sustainable materials, which benefits the composite resin market. But regulations can also be a restraint. For example, limited recycling infrastructure and end of life disposal of certain composite materials, especially thermoset based products, can hinder sustainability and regulatory compliance. Stricter regulations on emissions and safety in industries like aerospace and automotive is driving demand for high performance, lightweight composites that can help manufacturers meet compliance.

Recent Developments

The composite resin market is always innovating and expanding.

- New Facilities: In February 2022, Saertex opened a new facility in Mexico to produce multiaxial glass fiber noncrimp fabrics to support the growing wind power industry in the region.

- Technology: Hexcel Corporation used its HexPly carbon fiber pre-preg to create a lightweight camera drone, showing the material’s potential in new and emerging applications. The industry is also seeing rapid-cure resin technology and high-speed compression molding, which is making composite manufacturing more efficient and cost effective.

- Product Launches: In February 2020, INEOS Composites launched a new low profile resin for the recreational marine and vehicle markets in North America.

Demand-Supply Analysis

Demand for composite resins is growing strongly, driven by their use across many industries. On the demand side, the key sectors are automotive, aerospace, construction and wind energy all of which are growing and looking for high performance materials. On the supply side, the market is consolidated with many new entrants looking to get into this lucrative space. Existing players are partnering to expand their capacity and reach into new markets. Demand is strong but supply can be impacted by high raw material cost and the capital intensity of production. But the market is robust with both demand and supply aiding growth.

Gap Analysis

There is a big gap in the global composite resin market for easily accessible and validated data on the long term durability of fiber reinforced polymer (FRP) composites in civil infrastructure applications. While these materials are known to be durable, a “durability gap analysis” has identified a lack of well documented data on their performance under various environmental conditions such as moisture, alkalinity, fatigue and fire. The lack of accessible non-proprietary data is a barrier for designers and engineers who need reliable data to ensure the long term viability and safety of composite structures. Filling this gap through focused research and better data sharing is an opportunity for the industry to drive more adoption in infrastructure projects.

Segmentation and Growth Opportunities

The global composite resin market is highly segmented to address the diverse needs of its end-use industries. Key segmentation axes include:

Segmentation Category | Sub-Segments |

By Resin Type | Thermoset, Thermoplastic |

By Fiber Type | Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, Other Fiber Composites |

By Manufacturing Process | Lay-up, Filament Winding, Injection Molding, Pultrusion, Compression Molding, RTM, Others |

By Application | Construction & Infrastructure, Transportation, Electrical & Electronics, Pipes & Tanks, Wind Energy, Marine, Aerospace & Defense, Others |

By Region | North America, Europe, Asia Pacific, Rest of the World |

High Growth Segments

According to the market forecast two segments are expected to grow the most:

- Wind Energy: This segment will grow notably as the global wind turbine installations increase. Composite resins are critical for making the large, light and durable blades for these turbines.

- Carbon Fiber Composites: While Glass fiber composites have the largest market share, carbon fiber composites will be the fastest growing segment. This is driven by the increasing demand for high performance, light weight materials in aerospace, defense and electric vehicle applications.

Major Innovations

Innovations in composite resin are focused on performance, efficiency and sustainability.

- New Manufacturing Techniques: High-speed compression molding and rapid-cure resin technology is making composite production more efficient and cost effective.

- Bio-based and Recyclable Materials: The market is moving towards bio-resins and recycled materials, which are enabling composites with eco-friendly properties and reduced carbon emissions.

- Hybrid Composites: Hybrid composites which combine different fibers (e.g. glass and carbon) with various resin matrices are optimizing properties for specific applications.

Growth Opportunities

- Bio-based and Recyclable Resins: In a market where environmental concerns are driving demand, businesses that can create and market high-performance bio-based composite resins will have a significant competitive edge.

- Additive Manufacturing (3D Printing): Composite materials may now be printed using 3D technology. This method reduces waste and offers unprecedented design options for complex parts.

- Emerging Economies: Businesses can take advantage of the thriving manufacturing and construction industries in fast industrializing countries like Asia Pacific and Latin America by investing in production and distribution.

Extrapolate Says

The inherent significance of composite resin as a high-performance material in vital and growing industries is driving the market's unambiguous growth trajectory. Although traditional applications in the automotive and construction industries continue to be fundamental, our analysis shows that specialized, high-growth industry areas like wind energy and sophisticated aerospace and military hold the key to the market's future. With the need for sustainability and regulatory compliance driving the development of a new generation of bio-based and low-VOC formulations, the industry is at a turning point.

Long-term success is most likely for businesses that can successfully innovate in this field and create products that not only match but even surpass the performance of traditional resins while abiding by environmental regulations. The market also presents significant opportunities for companies that can address the current knowledge gaps, particularly in providing validated durability data for civil infrastructure applications, and for those who can establish a strong foothold in rapidly expanding emerging economies.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Composite Resin Market Size

- September-2025

- ���1���4���8

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021