Biochar Market Size, Share, Growth & Industry Analysis, By Product Type (Wood Source Biochar, Agricultural Waste Biochar, Animal Manure Biochar, Others) By Technology (Slow Pyrolysis, Fast Pyrolysis, Gasification) By Application (Agriculture, Water & Wastewater Treatment, Construction, Energy, Others) By End-User (Farmers, Municipal Authorities, Industrial Users, Research Institutions), and Regional Analysis, 2024-2031

Biochar Market: Global Share and Growth Trajectory

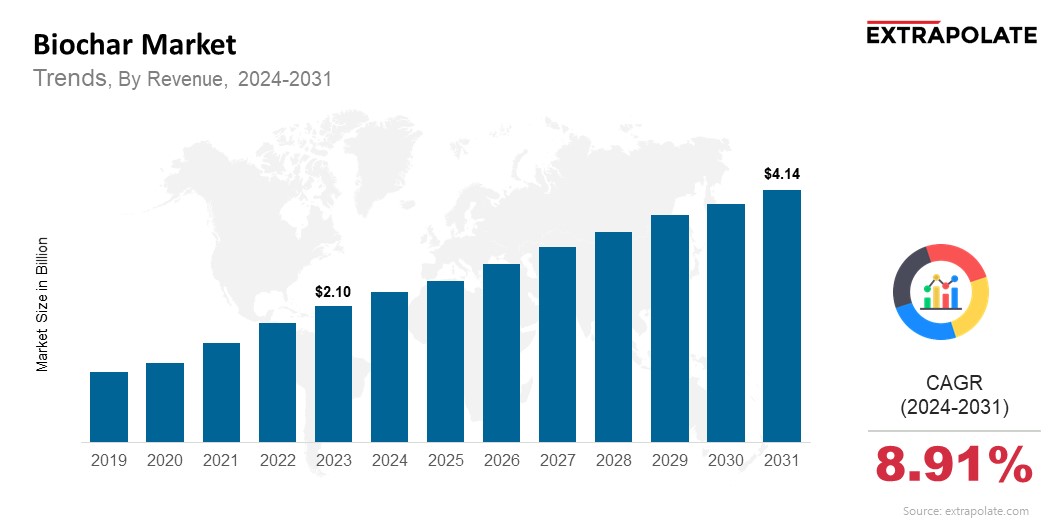

Global Biochar Market size was recorded at USD 2.10 billion in 2023, which is estimated to be valued at USD 2.28 billion in 2024 and reach USD 4.14 billion by 2031, growing at a CAGR of 8.91% during the forecast period.

The global biochar market is undergoing substantial growth, driven by the increasing demand for sustainable agricultural practices and rising concerns regarding climate change. Biochar is a carbon-rich product derived from the pyrolysis of organic biomass and has attracted attention for its dual benefits of improving soil fertility and sequestering carbon. It is being integrated into several farming systems, environmental management, and renewable energy sectors.

As the world is increasingly seeking sustainable solutions for waste management and agricultural productivity, biochar’s multifunctional characteristics offer a compelling case. Farmers, environmentalists, and policymakers are adopting biochar as it can restore degraded soils, reduce greenhouse gas emissions, and substantially grow crop yields. With constant innovations and a deeper understanding of its applications, the biochar market is poised for significant growth in the years to come.

One of the most transformative aspects of biochar is its role in sustainable agriculture. When applied to soil, biochar enhances water retention, nutrient availability, and microbial activity, which results in healthier crops and more resilient farming systems. Moreover, biochar plays a crucial role in carbon sequestration, locking away carbon for centuries and helps in combatting global warming.

Key Market Trends Driving Product Adoption

Various trends are shaping the global biochar market and driving its widespread adoption:

Sustainable Agriculture and Soil Health: The rising demand for natural and organic farming solutions is reshaping agricultural practices. Farmers and agronomists are increasingly turning to biochar as a sustainable soil amendment. The ability to improve fertility, adjust soil pH, and promote microbes makes biochar highly effective. Its importance is rising as soil degradation threatens global agriculture.

Waste Management and Circular Economy: The rise of circular economy initiatives has brought renewed focus to waste reuse. Repurposing agricultural and forestry waste is now seen as a key sustainability goal. Biochar systems improve organic waste management. They transform biomass into a stable product with multiple environmental and economic benefits. By diverting organic waste from landfills and incinerators, biochar production supports sustainability targets. It contributes to cleaner, more circular waste systems.

Climate Change Mitigation: Biochar is becoming popular as a tool for carbon sequestration. Governments and organizations are recognizing its potential to trap carbon dioxide in soil for hundreds to thousands of years. This property makes biochar a crucial part of climate action strategies.

Emerging Industrial Applications: With agriculture being the largest consumer, biochar’s potential in other sectors like water treatment, construction materials, and energy storage increasing. Researchers are exploring biochar in supercapacitors, insulation, and as a filtration medium, opening up new revenue streams.

Major Players and their Competitive Positioning

The biochar market is moderately fragmented, with multiple companies competing on the basis of production methods, raw material sourcing, and value-added services. Major players in the global market include: Pacific Biochar Benefit Corporation, Biochar Supreme, LLC, Cool Planet Energy Systems, Carbo Culture, The Biochar Company, Carbon Gold Ltd., ArSta Eco Pvt. Ltd., Genesis Industries, Farm2Energy, and Bioforcetech Corporation.

These companies are actively investing in research and development to improve the efficiency and scalability of biochar production. Partnerships with agricultural cooperatives, universities, and governmental bodies are also helping market players in expanding their geographical footprint and improve customer education.

Consumer Behavior Analysis

Consumer behavior in the biochar market is propelled by a combination of environmental awareness, cost considerations, and regulatory incentives:

Environmental Stewardship: Farmers and businesses that give priority to sustainability are more likely to opt for biochar. The product aligns with their goals of minimizing emissions, improving biodiversity, and restoring soil health. Consumers in this segment are also fueled by the desire to contribute to environmental conservation.

Economic Viability and Return on Investment: While the upfront cost of biochar can be higher than conventional fertilizers, long-term benefits like limited need for irrigation and fertilizers, improved crop yields, and soil resilience offer compelling returns. Farmers who assess inputs on a lifecycle cost basis are increasingly making the switch.

Awareness and Education: The adoption of biochar is closely linked to consumer awareness. Regions with strong agricultural extension services or targeted awareness campaigns report higher levels of usage. As governments and NGOs increase biochar education, adoption is expected to grow.

Preference for Organic Products: The rising consumer demand for organic and chemical-free produce is indirectly influencing the usage of biochar. Farmers that seek organic certification often adopt biochar as a soil conditioner that fits within the regulatory framework for organic farming.

Pricing Trends

Pricing in the biochar market is driven by feedstock, technology, grade and location. High grade biochar from hardwood or agricultural residues and produced under controlled pyrolysis conditions commands a premium.

The price of biochar can range from $300 to $1,200 per ton depending on the properties and application. Small scale producers struggle with price competitiveness, while large scale producers benefit from economies of scale. Government subsidies and carbon credits are starting to play a role in price rationalization making biochar more accessible to end users.

Growth Factors

Several macro and microeconomic factors are driving the biochar market:

Growing Global Focus on Sustainability: Governments, corporations and consumers are adopting sustainable practices like never before. This is the driving demand for green technologies and biochar fits right in.

Supportive Government Policies: Governments in Europe, North America and parts of Asia are offering grants, subsidies and carbon offset programs for biochar. Biochar is also being included in carbon markets which is an additional revenue stream for producers.

Technological Advancements in Pyrolysis: Innovations in pyrolysis technology are improving efficiency, scalability and environmental performance of biochar production. Modular and mobile units are now available for local and decentralized production.

Soaring Agricultural Demands: With a growing global population and shrinking arable land, the pressure on agriculture is immense. Biochar’s ability to increase productivity especially in degraded soils is driving its adoption in commercial farming.

Regulatory Landscape

The regulatory landscape for biochar is changing fast especially in carbon neutral and sustainable agriculture regions:

- In the U.S., the Environmental Protection Agency (EPA) and the USDA have guidelines and support for biochar in farming.

- In the EU, biochar producers must comply with European Biochar Certificate (EBC) for quality and environmental safety.

- ISO standards for biochar (e.g., ISO 16855) are being developed to standardize testing, classification, and labeling of biochar products globally.

While regulations are still emerging in many countries, the growing awareness of biochar’s environmental benefits is pushing governments to formalize standards and incentivize adoption.

Recent Developments

Key developments shaping the biochar market:

- Carbon Credit Integration: Biochar’s long-term carbon storage capacity is gaining recognition. Key market players are using this to register projects under carbon credit schemes. The ability to monetize carbon storage enhances project returns. As a result, investor interest in biochar is steadily rising.

In May 2025, Carbonfuture registered over 100,000 tonnes of biochar carbon credits on its platform with European biochar producers. It is one of the largest verified biochar carbon credit leveraging European Biochar Certificate (EBC) and Puro.earth protocols.

- Strategic Partnerships: To validate biochar’s effectiveness, firms such as Carbon Gold and Pacific Biochar are working with research groups and farm agencies. Field trials play a key role in this effort.

- New Applications in Construction: Researchers are exploring biochar for use in construction materials. Its ability to regulate moisture and provide insulation supports sustainable building practices.

- Mobile Biochar Units: Portable pyrolysis technology enables farmers to convert agricultural waste into biochar on-site. This is particularly effective in rural and hard-to-reach areas.

Current and Potential Growth Implications

Demand-Supply Analysis: The rising demand for biochar is leading producers to expand their production capacities. But constrained knowledge and the absence of distribution and logistics on a larger scale represents some significant roadblock. Good logistics, decentralized production, and well-defined market linkages will combine to meet market demand.

Gap Analysis: The biochar market has strong potential for climate and soil solutions. Lack of standard rules, limited government support, and low awareness are slowing the biochar market's progress. Giving farmers clear, trusted information can speed up adoption. Better supply chains will support large-scale growth.

Top Companies in the Biochar Market

- Pacific Biochar Benefit Corporation

- Biochar Supreme, LLC

- Cool Planet Energy Systems

- The Biochar Company

- Carbon Gold Ltd.

- Carbo Culture

- Bioforcetech Corporation

- ArSta Eco Pvt. Ltd.

- Genesis Industries

- Farm2Energy

Biochar Market: Report Snapshot

Segmentation | Details |

By Product Type | Wood Source Biochar, Agricultural Waste Biochar, Animal Manure Biochar, Others |

By Technology | Slow Pyrolysis, Fast Pyrolysis, Gasification |

By Application | Agriculture, Water & Wastewater Treatment, Construction, Energy, Others |

By End-User | Farmers, Municipal Authorities, Industrial Users, Research Institutions |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Biochar Market: High-Growth Segments

The following segments are composed for significant development:

Agricultural Biochar: Farmers aiming for long-term crop success now choose sustainable soil inputs. These products help protect and restore soil over time. Stronger soil, better moisture, and higher harvests are key biochar benefits. These gains support long-term farm success.

Water Treatment Applications: Biochar’s porous structure and strong adsorption help trap heavy metals and organic pollutants. This opens up use in city and industrial water treatment.

Slow Pyrolysis Technology: Using this method leads to more biochar per batch. The final product is cleaner and more effective. The preferred technique for producing biochar at scale is now pyrolysis. Agricultural sectors are leading this shift due to growing demand.

Major Innovations

Recent innovations propelling the biochar market include:

Carbon-Negative Certification: Lifecycle assessments track emissions across the entire value chain. This helps companies understand the full carbon footprint of their products. They prove carbon-negative potential and increase confidence among regulators and customers. Certifications from trusted third parties build trust in the product. This boosts market value and supports wider adoption.

Smart Biochar Blends: Biochar blends now include compost, microbes, or added nutrients. These mixes help enrich soil and boost yields. These advanced blends offer better support for plant and soil systems. These mixes are gaining traction for offering many benefits in one use.

Energy Co-Generation: To increase efficiency, producers are reworking setups to recover syngas and bio-oil. These by-products can be used as clean energy sources. It boosts value and gives a sustainable energy output.

Biochar Market: Potential Growth Opportunities

Emerging Economies: Parts of Africa, Southeast Asia, and Latin America are experiencing serious soil degradation. This decline threatens agricultural productivity and food security. Poor soil health is now a major threat to farming and food systems. This adds to rising food insecurity. Governments now support early biochar trials in these regions. They aim to grow its use as a working solution.

Carbon Market Participation: Global carbon trade is becoming more clear and set. This gives biochar firms a way to earn billions through carbon offsets.

Integration with Precision Agriculture: Using biochar with tools like soil sensors and satellite images boosts its impact. This mix may attract tech-savvy farmers.

Extrapolate Research says:

The global biochar market is set to grow fast. Climate goals, soil health, and carbon cuts now drive plans and business moves. Sectors like farming, waste, and energy now focus on sustainability. Biochar acts as a linchpin technology tying them together. Better production methods are driving biochar forward. With demand and policy support, it's no longer a niche but a main eco solution. Players focused on growth, awareness, and fresh products will stay ahead. They can tap into value across many sectors.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Biochar Market Size

- July-2025

- 140

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021