Automotive Plastics Exterior Parts Market Size, Share, Growth & Industry Analysis, By Product Type (Bumpers, Fenders, Grilles, Spoilers, Panels, Mirror Caps, Others) By Material (Polypropylene (PP), ABS, Polycarbonate, Polyamide, Polyurethane, Others) By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles)By End User (OEMs, Aftermarket), and Regional Analysis, 2024-2031

Automotive Plastics Exterior Parts Market: Global Share and Growth Trajectory

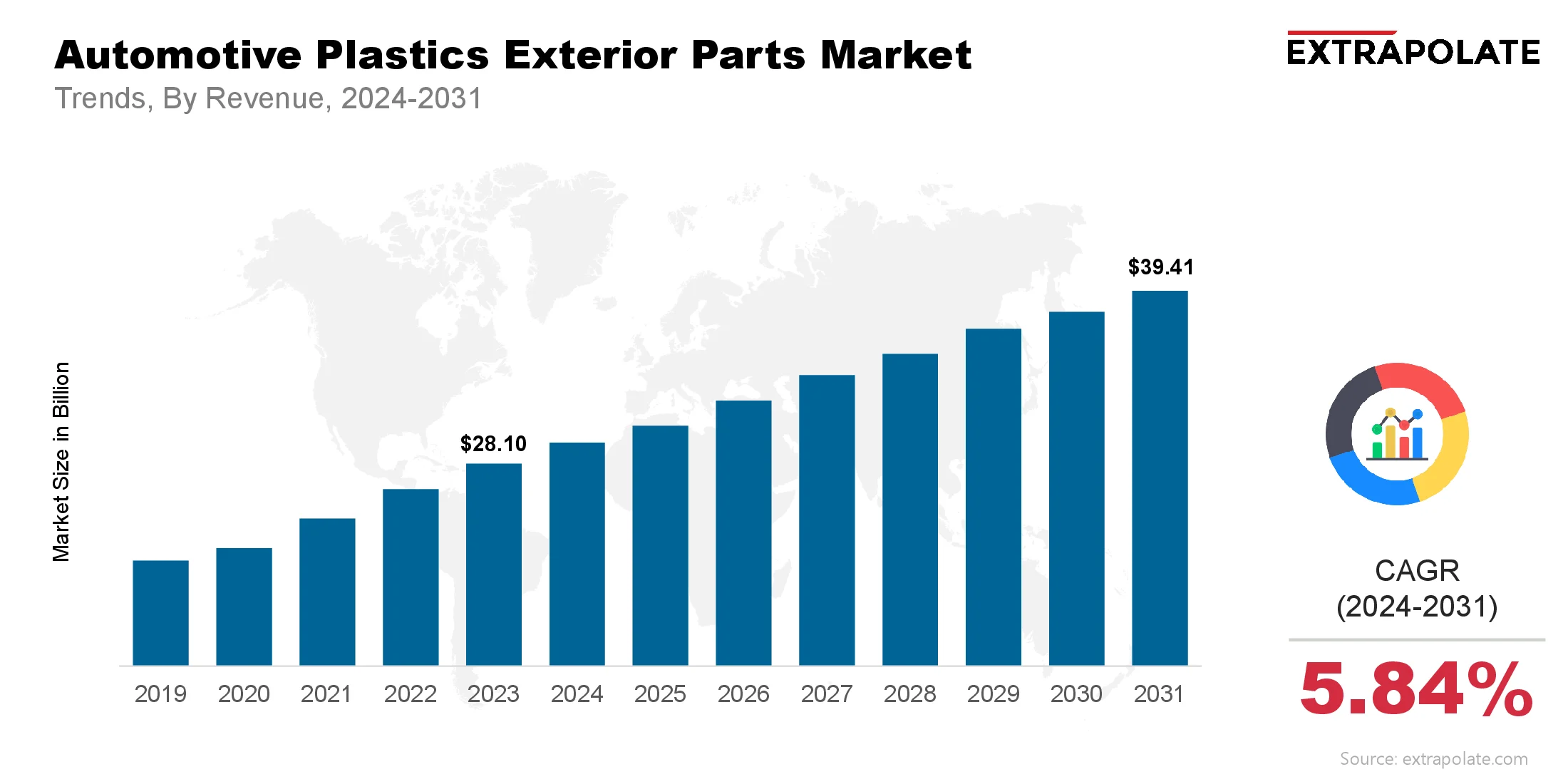

The global Automotive Plastics Exterior Parts Market size was valued at USD 28.10 billion in 2023 and is projected to grow from USD 26.48 billion in 2024 to USD 39.41 billion by 2031, exhibiting a CAGR of 5.84% during the forecast period.

The automotive plastics exterior parts market is booming. Automakers around the world are going plastic for better looks, lighter weight and better fuel efficiency. Plastic exterior parts like bumpers, fenders, grilles and panels are now the norm in modern vehicle design driven by environmental concerns and stricter emission norms.

Lightweight plastics are influencing the automotive industry. Unlike metal parts, plastics allow manufacturers to build vehicles that are not only lighter but also more corrosion resistant and cost effective to produce. With the use of advanced materials like polypropylene, ABS (acrylonitrile butadiene styrene), polycarbonate and polyamide the market is on a growth trajectory.

Sustainability, material science advancements and demand for fuel efficient and attractive vehicles is driving the shift towards plastic exterior parts. As automotive OEMs continue to focus on design flexibility, manufacturing efficiency and performance optimization plastic exterior parts will rule in the years to come.

Key Market Trends Driving Product Adoption

Several trends are driving the adoption of automotive plastic exterior parts:

Lightweighting for Fuel Efficiency and Emissions

The global drive towards vehicle lightweighting is the main reason for the increase in plastic exterior parts. Lighter vehicles use less fuel and produce less COâ‚‚ emissions, meeting global emission regulations. Plastics can be up to 50% lighter than metal and are being used to replace traditional materials without compromising structural integrity. OEMs are using thermoplastics and high-performance composites to meet fuel economy targets while improving vehicle performance.

Aesthetics and Design Freedom

Plastics offer more design freedom to create sleek, modern and aerodynamic vehicle exteriors. Design differentiation is a major selling point and the ability to mold complex shapes, integrate lighting systems and experiment with finishes and textures makes plastic exterior parts a design engineer’s dream.

Advanced Manufacturing Processes

New manufacturing processes like injection molding, blow molding and thermoforming are enabling mass production of durable, high quality plastic exterior parts with shorter cycle times and lower tooling costs. Additive manufacturing (3D printing) is also emerging as a way to prototype and customize exterior parts. These advancements are pushing the boundaries of what’s possible in automotive exterior design.

Electrification and EV Design Requirements

Electric vehicles (EVs) have different structural and aerodynamic requirements. Plastics in EV exteriors help to extend battery life by improving energy efficiency. EV makers are using plastics more and more for components like bumpers, side skirts and underbody shields where thermal insulation and corrosion resistance are key.

Major Players and Their Competitive Positioning

The automotive plastics exterior parts market has several big players, each trying to gain market share through innovation, partnerships and global expansion. The players are: Magna International Inc., Plastic Omnium, Faurecia, Compagnie Plastic Vallée, Toyota Boshoku Corporation, SABIC, Denso Corporation, Hanwha Group, Lear Corporation, Samvardhana Motherson Group.

These players are using material science and manufacturing expertise to develop next gen plastic parts for safety, durability and sustainability. Mergers, acquisitions and joint ventures are common strategies to strengthen product portfolio and enter new markets.

Consumer Behavior Analysis

Knowing the preferences and priorities of both end users and automakers is essential to comprehending customer behavior in this market:

- Sustainability and Efficiency: As the world becomes more aware of climate change, OEMs and consumers are focusing on sustainability. This is driving the adoption of recyclable and bio-based plastics for exterior applications. Automakers are sourcing materials that have minimal environmental impact across the product lifecycle to match customer expectations for eco-friendly mobility solutions.

- Affordable and Stylish Vehicles: Consumers still want vehicles that look good and are affordable. Plastic exterior parts help manufacturers meet this by offering design flexibility at a lower cost. Stylish bumpers, grilles and spoilers made from lightweight polymers look good without adding much to the production cost, so they are popular in both economy and premium segments.

- Customization and Personalization: The trend of vehicle customization is another driver for this market. Plastics allow for easy personalization of exterior components like trim pieces, diffusers and mirror caps. Automakers are tapping into this trend by offering exterior kits and finishes that can be customized to individual tastes, especially among younger consumers.

- Perception of Quality and Durability: Modern engineering and material technology has improved the durability and UV resistance of plastic exterior parts. Consumers today are more accepting of plastic exteriors if they know they will last long, look good and require low maintenance. So manufacturers are investing in coatings and surface treatments to extend product life.

Pricing Trends

Pricing in the automotive plastics exterior parts market is dependent on several factors such as material type, design complexity, volume and functional enhancements. Traditional polymers like polypropylene and ABS are cost effective but engineered plastics and composites like carbon-fiber-reinforced polymers (CFRP) are more expensive due to better performance.

Although tooling costs are high, scalability of production processes like injection molding makes it competitive especially in high volume manufacturing. Moreover, increasing adoption of recycled plastics and bio-composites is helping to reduce material cost over time. Suppliers are also looking at circular economy models to recover value from end of life plastic parts and that’s adding more efficiency to the pricing structure.

Growth Factors

The market for automotive plastic exterior parts is driven by several growth enablers:

- Regulatory Push for Emissions Reduction: Global emissions regulations like EU’s COâ‚‚ targets and CAFE standards in the US are forcing automakers to increase vehicle fuel efficiency. Plastics help reduce vehicle weight so play a key role in meeting these tough regulations. This regulatory pressure continues to drive investment in lightweight material technologies.

- Vehicle Production and Sales Growth: The global automotive production is rebounding especially in Asia-Pacific and Latin America and is driving demand for cost effective high performance exterior parts. Growth of middle class, urbanization and rising disposable income in emerging markets is further boosting vehicle ownership rates and supporting component demand.

- EV Segment Growth: The shift to electric mobility is redefining vehicle architecture and with it the materials used. EVs have fewer mechanical components but higher thermal management needs and benefit greatly from plastic parts. Plastics used in exterior body panels help manage weight distribution and thermal conductivity and improve the EV’s range and safety.

- Advances in Plastic Materials: New classes of plastics with enhanced strength, thermal resistance, and recyclability are being produced by ongoing research into materials engineering and polymer chemistry. Because of these advancements, plastic outside components can now be used in more crucial structural sections, replacing metal.

Regulatory Environment

Strict regulations centered on safety, environmental compliance, and recyclability oversee the market for automotive plastic exterior parts.

- The EU End-of-Life Vehicles (ELV) Directive is a key law that promotes the circular design of plastic parts and the reuse and recycling of vehicle components.

- UN ECE Safety Regulations require certain safety performance for parts. Among them, many of which are composed of plastic, such as lighting systems and bumpers.

- REACH and RoHS Directives verify the safety, non-toxicity, and environmental friendliness of the materials used in auto parts.

- The IATF 16949 and ISO 9001 standards regulate quality management systems for suppliers of automotive parts, including those that use plastic.

These rules have a big effect on supply chain sourcing and product development.

Recent Developments

The market is being shaped by recent events and calculated actions:

- Recycled and Bio-Based Plastics: To lessen their influence on the environment, major OEMs are utilizing recycled plastics in their grilles, bumpers, and trim pieces. Bio-based polymers made from renewable resources like sugarcane or maize starch are also being investigated by some.

- Smart Exterior Parts: Businesses are creating plastic parts with lighting and sensors to facilitate the transition to connected cars and provide useful features.

- Innovation Collaborations: To meet sustainability goals and enhance material performance, suppliers and automakers are working together on R&D projects. For instance, vehicle OEMs and resin suppliers are collaborating to create heat-resistant, high-strength plastics.

- Growth in Emerging Markets: Major companies are increasing production and distribution in areas like Southeast Asia, Latin America, and Africa in order to meet the rising demand for automobiles.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The demand for lightweight and affordable exterior parts is growing fast. This is pushing suppliers to expand production and invest more in R&D. But there are still challenges. It is difficult to keep a steady supply of some materials. These include high-quality recycled resins and bio-based plastics. Geopolitical issues and material shortages are also disrupting supply chains. These problems make it tough to meet rising demand.

b. Gap Analysis

Developed countries are adopting these parts quickly. But in many developing markets, progress is slower. They often lack access to advanced manufacturing tools and high-performance plastics. To close these gaps, there’s a need for local investments—in production, infrastructure, and skill-building.

Top Companies in the Automotive Plastics Exterior Parts Market

- Magna International Inc.

- Plastic Omnium

- Faurecia

- SABIC

- Hanwha Group

- Samvardhana Motherson Group

- Toyota Boshoku Corporation

- Lear Corporation

- Denso Corporation

- Flex-N-Gate Corporation

Automotive Plastics Exterior Parts Market: Report Snapshot

Segmentation | Details |

By Product Type | Bumpers, Fenders, Grilles, Spoilers, Panels, Mirror Caps, Others |

By Material | Polypropylene (PP), ABS, Polycarbonate, Polyamide, Polyurethane, Others |

By Vehicle Type | Passenger Cars, Commercial Vehicles, Electric Vehicles |

By End User | OEMs, Aftermarket |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Automotive Plastics Exterior Parts Market: High Growth Segments

- Electric Vehicles (EVs): As EV production picks up speed, there's a big need for plastic exterior parts. These parts help improve efficiency and driving range.

- Polypropylene-Based Components: Polypropylene is popular because it's affordable, lightweight, and performs well. It's expected to lead the way in material choices for exterior parts.

Major Innovations

- Co-injection Molding: This method lets manufacturers mix recycled and new materials in one part. It helps balance cost and performance.

- Self-Healing Plastics: These are being developed to make exterior parts last longer. They also help cut down on repair and maintenance costs.

- Aerodynamic Smart Panels: These panels boost fuel efficiency. They also work smoothly with vehicle sensors and lights.

Automotive Plastics Exterior Parts Market: Potential Growth Opportunities

- Circular Economy Efforts: More companies are using recycled plastics. Closed-loop recycling systems are also gaining traction. These steps help lower the environmental impact.

- Customization Trends: People now want more personalized and stylish vehicle exteriors. This is driving demand for design flexibility.

- Regional Growth: Markets in APAC, Latin America, and the Middle East are growing fast. This is because of higher vehicle demand and more spending on infrastructure.

Extrapolate says:

The automotive plastics exterior parts market is stepping into a new phase of growth and innovation. This change is mainly driven by the industry’s push for sustainability, better design options, and fuel efficiency. Plastic parts are changing how vehicles are made and how people see them. With new materials, supportive regulations, and more use in EVs and next-gen vehicles, the market is full of opportunities. Both big companies and newcomers can benefit from this. The mix of smart design and eco-friendly ideas means plastic exterior parts will keep playing a big role in the future of mobility.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Automotive Plastics Exterior Parts Market Size

- July-2025

- 140

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021