Automotive Start-Stop Device Market Size, Share, Growth & Industry Analysis, By Technology (Engine Start-Stop, Automatic Start-Stop) By Vehicle Type (Passenger Cars, Commercial Vehicles) By Component Battery, (Alternator, Starter Motor, ECU, Sensors), and Regional Analysis, 2024-2031

Automotive Start-Stop Device Market: Global Share and Growth Trajectory

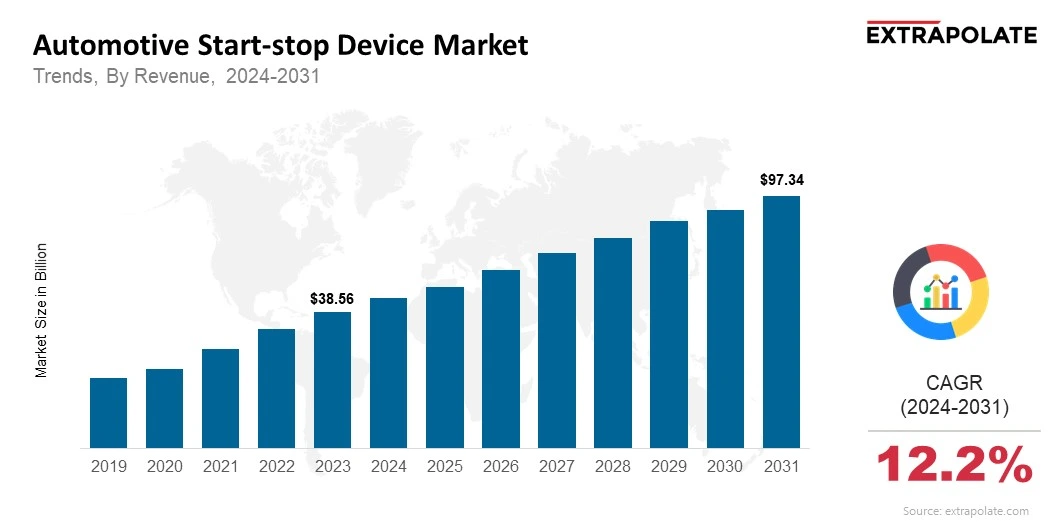

The global Automotive Start-Stop Device Market size was valued at USD 38.56 billion in 2023 and is projected to grow from USD 43.61 billion in 2024 to USD 97.34 billion by 2031, exhibiting a CAGR of 12.2% during the forecast period.

The global market is witnessing significant growth, fueled by technological advancements, stringent fuel efficiency regulations, and growing environmental awareness among consumers. Automotive start-stop systems, which automatically turn off the engine when the vehicle is idle and restart it when the accelerator is pressed, are becoming an essential feature in modern vehicles.

These devices contribute to reducing fuel consumption and emissions, making them highly attractive in the context of sustainable transportation solutions. As automakers focus on enhancing fuel economy and meeting global emission standards, the demand for start-stop systems is on the rise, particularly in passenger vehicles.

The increasing focus on electric mobility, along with the push for energy-efficient solutions in the automotive sector, is also driving the growth of the automotive start-stop device industry. Advanced technologies, such as smart sensors, electronic control units, and high-performance batteries, have played a pivotal role in improving the efficiency and reliability of start-stop systems.

The integration of these devices is also helping manufacturers comply with environmental regulations by lowering carbon emissions. The market is further supported by the rising consumer preference for eco-friendly vehicles and a growing number of government initiatives promoting the adoption of green technologies.

In addition, the automotive industry’s continuous efforts to innovate and enhance driving experience have resulted in the incorporation of start-stop technology into a broader range of vehicles, including electric vehicles (EVs) and hybrid vehicles. The market is also witnessing an increase in the installation of start-stop systems in vehicles across various regions, particularly in Europe and North America, where regulatory pressure for reducing emissions is more prominent. As the demand for more sustainable and fuel-efficient vehicles grows, the market is expected to maintain its growth trajectory, positioning itself as a key player in the transition toward greener transportation solutions.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The automotive start-stop device market is witnessing rapid growth, driven by several key trends that are reshaping the industry:

- Environmental Concerns: With the growing focus on reducing CO2 emissions and enhancing fuel efficiency, governments and consumers are increasingly adopting start-stop technology as a key solution.

- Regulatory Compliance: Stringent regulations, such as the Corporate Average Fuel Economy (CAFE) standards and the European Union’s CO2 emission targets, are pushing automakers to incorporate start-stop devices to meet environmental goals.

- Increased Vehicle Electrification: The integration of hybrid and electric vehicle technologies is enhancing the effectiveness and efficiency of start-stop systems, making them more common in the automotive industry.

- Consumer Demand for Fuel Efficiency: Rising fuel prices and growing awareness about environmental sustainability are driving consumers toward vehicles with start-stop systems that offer improved fuel economy and reduced environmental impact.

Major Players and their Competitive Positioning

The automotive start-stop device market is highly competitive, with several established players leading the innovation race. Key players include Bosch, Continental AG, Denso Corporation, and Valeo. These companies are engaged in continuous product development and strategic partnerships to maintain their competitive edge. Additionally, smaller players are emerging with innovative solutions targeting specific vehicle segments.

Consumer Behavior Analysis

Consumers are increasingly opting for vehicles equipped with start-stop systems due to their significant advantages in fuel efficiency and reduced emissions. Key factors influencing consumer behavior include:

- Fuel Savings: Consumers are leaning toward vehicles with start-stop tech. It helps reduce fuel use, especially in city driving with lots of stops and starts.

- Environmental Impact: Consumer knowledge about the environment is on the rise. This causes people to favor automobiles with smaller carbon footprints. Start-stop systems have become a desirable characteristic for this type of automobile.

- Cost-Effectiveness: Start-stop devices offer long-term fuel savings. This makes them more attractive to budget-conscious buyers.

Pricing Trends

Pricing for start-stop devices varies. Factors like vehicle type, manufacturer, and system complexity affect costs. Premium vehicles usually have advanced start-stop systems. These systems offer extra features, which raise their prices. The entry-level segment is expanding. More automakers are adding basic start-stop systems to affordable models.

Growth Factors

Several factors are driving the growth of the automotive start-stop device market:

- Technological Advancements: Better sensor tech, engine management systems, and longer battery life are improving start-stop device performance. These upgrades make the systems more reliable.

- Government Incentives and Regulations: Strict emission rules are pushing automakers to adopt fuel-saving tech. Start-stop devices help meet these compliance standards.

- Vehicle Electrification: The growth of electric and hybrid vehicles is boosting start-stop system efficiency. This is leading to wider adoption across more vehicle segments.

- Consumer Awareness: Fuel use plus the environment are concerns. Because of that interest in vehicles with start-stop technology increases.

Regulatory Landscape

Regulations for start-stop devices are changing. Governments are pushing for lower vehicle emissions, driving these changes. Stricter fuel efficiency and emission rules are being introduced globally. These regulations are speeding up the adoption of start-stop technologies. Manufacturers must comply with these rules to stay competitive. Meeting regulations is crucial for market success.

Recent Developments

Recent developments in the automotive start-stop device market include:

- Integration with Hybrid Vehicles: Start-stop technology is now common in hybrid and electric vehicles. It further improves fuel efficiency in these models.

- Improved Battery Technology: Battery technology advances are boosting start-stop systems. Stronger batteries that handle frequent starts and stops make these systems more effective.

- Expansion in Emerging Markets: With growing demand for fuel-efficient cars in emerging markets, automakers are adding start-stop systems to affordable models. This meets market needs effectively.

Current and Potential Growth Implications

Demand-Supply Analysis

Demand for start-stop devices is growing. This is driven by the need for better fuel efficiency and lower emissions. The supply of advanced systems may face issues. Key components, like high-performance batteries and sensors, are needed for proper operation.

Gap Analysis

While the automotive start-stop device market is growing rapidly, there are areas that still require improvement:

- Battery Durability: Frequent engine stops and starts stress vehicle batteries. This calls for more durable and reliable battery solutions.

- Consumer Perception: Some buyers see start-stop systems as inconvenient or harmful to engines. Educating them on the benefits can change this perception.

- Cost Challenges: Start-stop devices raise vehicle costs upfront. This can slow adoption in price-sensitive market segments.

Top Companies in the Automotive Start-Stop Device Market

- Bosch

- Continental AG

- Denso Corporation

- Valeo

- Delphi Technologies

- ZF Friedrichshafen

- Hitachi Automotive Systems

- Aisin Seiki Co. Ltd.

- Hyundai Mobis

Report Snapshot

Segmentation | Details |

By Technology | Engine Start-Stop, Automatic Start-Stop |

By Vehicle Type | Passenger Cars, Commercial Vehicles |

By Component | Battery, Alternator, Starter Motor, ECU, Sensors |

By Region | North America, Europe, Asia-Pacific, MEA, South America |

High-Growth Segments

The following segments are expected to experience high growth in the coming years:

- Passenger Cars: Rising demand for fuel-efficient, green cars is boosting start-stop tech use. It's a key feature for saving fuel and cutting emissions.

- Commercial Vehicles: Start-stop systems are now used in commercial vehicles. They save fuel in city traffic and cut running costs.

Major Innovations

Innovation plays a crucial role in maintaining competitiveness in the automotive start-stop device market. Key innovations include:

- Advanced Battery Technologies: Better battery design and performance are raising start-stop system efficiency. These upgrades support smoother operation.

- Smart Engine Control Systems: New engine control tech is making start-stop systems more precise and reliable. This helps boost overall performance.

- Integration with Hybrid and Electric Vehicles: Pairing start-stop systems with hybrid and electric powertrains boosts efficiency. It also makes vehicles more eco-friendly.

Automotive Start-Stop Device Market: Potential Growth Opportunities

The automotive start-stop device market is facing several challenges, including:

- Technological Hurdles: Frequent engine starts and stops create wear. This drives the need for tougher parts and systems.

- Market Competition: Tough global competition demands constant innovation. Staying ahead means always improving.

- Consumer Perceptions: To overcome consumer doubt, clear info on start-stop tech is key. Educating buyers on fuel savings and lower emissions can boost acceptance.

Extrapolate Research says:

The automotive start-stop device market is expected to grow consistently. This growth comes from rules, new technologies along with customer desire for vehicles that use less fuel. Businesses that solve problems with things such as long battery life and how customers view start-stop systems will do well in this changing business area.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Automotive Start-Stop Device Market Size

- May-2025

- 148

- Global

- Automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021